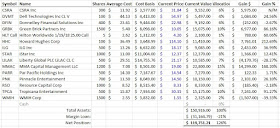

The big winners this year were Leidos Holdings, Tropicana Entertainment, MMA Capital, Nexpoint Residential Trust, Green Brick Partners and the big losers were Verso, Par Pacific Holdings, and LiLAC Group, breakdown of the attribution is below:

Closed Positions:

- I sold Crossroads Capital (XRDC) in October at $1.62 to book an early "tax loss" or so I told myself, more likely just me being impatient, which was before news was released that they had hired an investment bank to shop their assets and eventually ended up selling a couple positions. Today it trades for $2.13 and NAV is over $3, I'd guess the liquidation takes another year or so but it remains an interesting idea.

- Hawaii's Public Utility Commission blocked the merger between NextEra Energy and Hawaiian Electric (HE) which then cancelled the pending spinoff of their bank subsidiary, ASB Hawaii, which is the main reason I was interested in the first place (still want that bank!). There could be another buyer out there, but I moved on at a small loss.

- KCAP Financial (KCAP) was a small position I bought in the early spring as people were panicking, especially with risky credits in particular, but performance of bank loans that KCAP (and other BDCS) held were still chugging along just fine. The market was pricing in a crisis that never occurred, pair that with the news that KCAP was shopping their CLO manager, and it seemed like a good way to play the bounce when the market returned to normal. Markets returned to normal, the CLO manager sale didn't materialize (they actually just issued a new CLO), and with dividends I booked a nice gain. KCAP still looks cheap at 73% of NAV and bank loan marks have only gone up since 9/30 as people pile into floating rate debt.

- The Lockheed Martin exchange offer for Leidos Holdings (LDOS) turned out to be one for the ages. I don't normally post about exchange or tender offers, but I liked this one because I'm familiar enough with the government services sector and thought Leidos was cheap with or without the exchange offer discount. After the exchange offer ratio was finalized, LDOS stock price shot up, either because of a squeeze or possibly because it screened cheap after the deal due to extra leverage caused by the special dividend needed to qualify as a RMT. After I received my shares, I ended up booking the quick profit but I still like the government services sector in a era where infrastructure and fiscal spending will be in vogue.

- As hinted at in my mid-year post, I did end up selling the remainder of my Nexpoint Residential Trust (NXRT) holding around ~$20, still like the Class B apartment asset class but just don't trust management and it was close to fair value.

- I'm not entirely convinced that Verso (VRS) won't end up working out reasonably well, but I didn't have the initial patience, basically got caught being a little bored and impulsive, without having conviction to hold or add to it as the former senior creditors sold out of the stock. The other lesson here is to be more skeptical of management projections in disclosure statements, and of course most fairness opinions can be thrown out the window, investment banks just back into whatever valuation their clients want to hear.

- The Zais Financial Corp (ZFC) tender offer worked out pretty much as planned, I ended up selling the Sutherland Asset Management (SLD) stub shortly after the deal closed to book a high single digit return in a little more than a month. Sutherland is now back on my watchlist, they've announced a dividend, trade well below book value, and as former private REIT shareholders sell their shares it has created an opportunity.

My favorite ideas for 2017 are iStar Inc (STAR) and Resource Capital Corp (RSO), both are REITs that either don't pay a dividend, iStar, or pay an abnormally low dividend, Resource Capital, and have mixed portfolios that don't lend themselves to being valued properly by the public markets. As both continue to recycle their capital and make their portfolios easier to understand, the market should reward them with higher valuations. Two "buy complexity, sell simplicity" type ideas.

Disclosure: Table above is my blog/hobby portfolio, its a taxable account, and a relatively small slice of my overall asset allocation which follows a more diversified low-cost index approach. The use of margin debt/options/concentration doesn't represent my true risk tolerance.