The dumpster diving continues, this one is a bit messier and riskier.

Pieris Pharmaceuticals (PIRS) is a clinical stage biotechnology company targeting treatments for respiratory diseases and cancer indications. In late June, the company announced that their partner, AstraZeneca (AZN), in their lead product candidate, elarekibep, discontinued its Phase 2a trial and this week we found out that AstraZeneca also terminated their R&D collaboration agreement with Pieris. Getting a read out on elarekibep's Phase 2a trial was the company's top strategic priority, so much so that they limited investment in their other assets, now without that partnership, the company is left in a difficult position where they are burning cash and can't raise capital in the current environment.

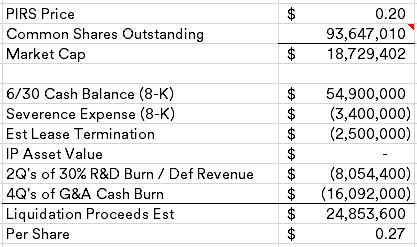

In comes the strategic alternatives announcement where they disclosed a 6/30 cash balance of $54.9MM and a reduction in workforce of 70%. The CEO's (4.8% owner) comments were rather specific:

"We are pursuing strategic options across three main areas following the recent developments that have impacted our ability to independently advance our respiratory programs," commented President and CEO Stephen Yoder. "One track is accelerating partnering discussions of PRS-220 and PRS-400. A second focal area is diligently selecting the best possible development partner and deal structure to re-initiate clinical development of cinrebafusp alfa, our former lead immuno-oncology asset, which has shown 100% ORR in five patients in a HER2+ gastric cancer trial that was discontinued for strategic reasons. Third, we will explore whether our balance sheet, position as a public company, and other assets are of strategic value to a range of third parties.” Mr. Yoder continued, "While the challenges we recently experienced across our respiratory franchise have forced us to make very difficult personnel decisions, I cannot express enough gratitude to our departing colleagues for their dedication, collaborative spirit and integrity."

I appreciate the honesty of "position as a public company" being of strategic value, that points to a reverse merger being high on the list, which isn't ideal.

Pieris has a lot of partnerships, in addition to AstraZeneca, Pieris has current collaboration deals with Genentech (now part of Roche), Seagen, Boston Pharmaceuticals and Servier. These are in addition to the assets mentioned in the above quote. PRS-220 and PRS-400 are wholly owned and controlled, PRS-220 is currently in a Phase 1 trial in Australia and PRS-400 is still pre-clinical. Plus they have cinrebafusp alfa (don't ask me to pronounce that) which previously had a successful Phase 1 study, they were initiating a Phase 2, but stopped to redirect corporate resources to the failed AstraZeneca program. In PIRS's own words in the latest 10-Q, before the strategic alternatives announcement:

In July 2022, we received fast track designation from FDA for cinrebafusp alfa. In August 2022, we announced the decision to cease further enrollment in the two-arm, multicenter, open-label phase 2 study of cinrebafusp alfa as part of a strategic pipeline prioritization to focus our resources. Cinrebafusp alfa has demonstrated clinical benefit in phase 1 studies, including single agent activity in a monotherapy setting, and in the phase 2 study in HER2-expressing gastric cancer, giving the Company confidence in its broader 4-1BB franchise. In April 2023, clinical data showing an unconfirmed 100% objective response rate and promising emerging durability profile was presented at the American Association of Cancer research annual meeting. These data provided encouraging evidence of clinical activity for this program and we are considering a range of transaction to facilitate the continuation of cinrebafusp alfa, including an immuno-oncology focused spinout to traditional partnering transactions.

Between the strategic alternatives press release and the language in the 10-Q, it doesn't appear Pieris is just beginning the process, but rather they've been looking for ways to raise capital all along by selling these three assets (because they needed cash to get to their previous mid-2024 AstraZeneca readout timeline), here there might be quicker asset sale catalyst than others in the broken biotech basket.

But as usual, I have no real thoughts on the science behind any of this, but among the partnerships and the wholly owned programs, there might be some value nuggets above and beyond the cash on the balance sheet.

The partnerships do create some quirky accounting. Pieris has received upfront payments in each of these deals for the licensing rights and some R&D collaboration on future development, they account for the upfront payment by creating a deferred revenue line item for the revenue received but where services haven't been performed (like R&D spend). While this shows up as a liability, as you read through the lengthy description of each partnership, it appears (feel free to push back on this) like their partners can't claw back funds and its not a true debt or liability.

One could probably figure out the margin on this deferred revenue over time by doing some data mining, but with the 70% reduction in workforce, likely over indexed to the R&D team, it doesn't appear the company is too concerned about not being able to recognize this revenue or having it clawed back.