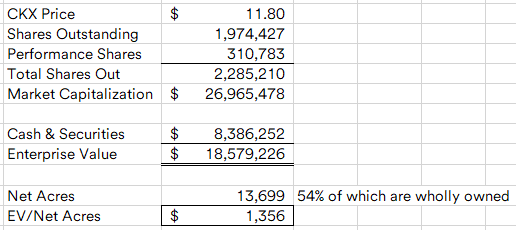

Banc of California (BANC) and PacWest's (PACW) merger is a bit old news at this point, but initial excitement has worn off and shares are now priced below $12.30/share, where PE firms Warburg Pincus and Centerbridge are making their PIPE investment (originally at a 20% discount, it will close with the merger). This is less of a short-term special situation trade and more a medium-to-long term investment as we wait for the skies to clear in the regional bank industry and bet on the merged bank extracting a massive amount of synergies. The merger is a complicated transaction, the basic terms are below, all of this is designed to clean up the larger distressed PacWest:

PacWest was one of the rumored next dominos to fall in this past spring's banking crisis. Their strategy was to use low cost California deposits (including a venture capital deposit clientele) and then lend those deposits out across the country to CRE and commercial borrowers. When their depositors fled, PacWest was forced to load up on expensive wholesale funding to plug the hole. Part of the problem was their customers (both depositors and borrowers) didn't see them as their primary bank, borrowers weren't depositors and depositors weren't borrowers. Banc of California contrastly operates more like a large community bank, they gather deposits and lend in the same geographic area, southern California.The accounting here will be a bit quirky, in an acquisition or a merger, a bank needs to mark-to-market the assets of the acquired bank on their balance sheet. As everyone is well aware, where current rates are, banks have large unrealized losses that aren't included on their balance sheet in both the loans held for investment and securities held-to-maturity portfolios. Since Banc of California is in relatively better shape, PacWest will be the acquirer here so that BANC's assets are marked-to-market rather than PACW's. There's a lot of moving pieces here (BANC is selling their residential mortgage and multi-family portfolios among other asset sales to plug the wholesale funding problem), but in the interest of brevity, Warburg Pincus and Centerbridge's investment was designed to plug the capital ratio hole created by this mark-to-market merger accounting, keeping the merged bank's capital ratios in the healthy 10+% CET1 range.

My high level core thesis here is mainly two fold:

- Pre-regional bank crisis, bank mergers were highly scrutinized. Back in the summer of 2021, President Biden released an executive order that "encourages DOJ and the agencies responsible for banking (the Federal Reserve, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency) to update guidelines on banking mergers to provide more robust scrutiny of mergers." What this meant in practice, banks had to convince regulators/politicians to approve a merger by limiting branch closures and job cuts, make grants into the community, etc. That's not the case here, regulators are rolling out the red carpet to ensure that the contagion doesn't spread. The two parties are guiding to only a six month merger timeline as they've already previewed this deal with regulators. While they'll be careful not to explicitly say it, but the two banks have a ton of geographical overlap that will get rationalized in the coming year or two post closing, likely blowing past their projected synergies.

- Banc of California previously had a reputation as a bit of a renegade fast growing bank under Steven Sugarman (brother of SAFE's Jay Sugarman), they entered a lot of risky lines of business and even plastered their name on a new soccer stadium in LA for $15MM/year, quite the marketing expense for a small regional bank. However, four plus years ago Sugarman was pushed aside, in came Jared Wolff to lead the bank, he grew up at PacWest (with a stop in between at City National, another LA bank) and knows it and its management team very well. Wolff shed many of the risky lines of business, ditched the stadium licensing deal, instead focused on being a community commercial bank. BANC has performed reasonably well since, trading between 1.1-1.4x book value. This is a bit of a jockey bet that he can draw on both his experience turning around BANC and being the former president of PACW to merge these two organizations optimally.

- This deal doesn't solve two issues the market has been worried about, geographic concentration and deposit concentration risk, the combined bank will still be commercial focused (lacking significant retail deposits) and in California. But maybe neither should be a concern going forward? Market could be fighting the last war, but something I've been thinking about and don't have a strong rebuttal.

- One of BANC's pitches is there is a void to fill because many of the largest California headquartered banks have either failed or been merged away in recent years. I don't entirely buy that as the money center banks have a large presence in California, banking is a relative commodity, while relationship community banking can be a good profitable niche, I struggle thinking there's massive growth opportunity here. This is a merger execution story, not a growth one.

- Proforma, 80% of deposits will be insured, like to see that a bit higher, but this is a commercial focused bank. They'll still be a pretty small bank with only 3% deposit share in southern California.

- Outside of the current bank environment risks, this situation does carry a fair amount of execution risk. I've been apart of a few acquisitions before, things always take longer and are hairier than it appears to outsiders, need to have some patience.

Disclosure: I own shares of BANC and PACW