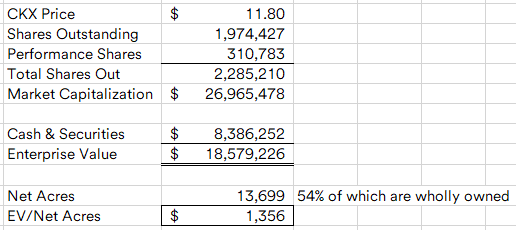

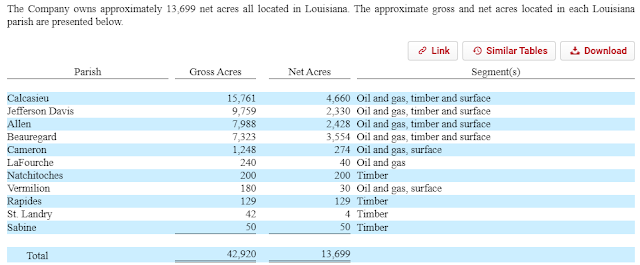

CKX Lands (CKX) (~$27MM market cap) is a sleepy micro-cap that goes back to 1930 when it was spun from a bank. CKX owns 13,699 net acres (about half is wholly owned, the other half is through a 16.67% interest in a JV) in southwest Louisiana which it earns royalties from oil and gas producers, timber sales and other surface rents it collects. Revenue skews towards oil and gas revenues, but the value of the land is likely more in its use as timberland (they don't give oil and gas reserve numbers).

On Monday, CKX put out the below press release:

CKX Lands, Inc. Announces Review of Strategic Alternatives

LAKE CHARLES, LA (August 21, 2023)—CKX Lands, Inc. (NYSE American: CKX) (“CKX”) today announced that its Board of Directors has determined to initiate a formal process to evaluate strategic alternatives for the company to enhance value for stockholders. The Board of Directors and the management team is considering a broad range of potential options, including continuing to operate CKX as a public, independent company or a sale of all or part of the company, among other potential alternatives.

The company has engaged TAP Securities LLC as financial advisor in connection with the review process. Fishman Haygood, L.L.P. is serving as legal advisor to the company.

There is no deadline or definitive timetable set for the completion of the review of strategic alternatives and there can be no assurance that this process will result in CKX pursuing a transaction or any other strategic outcome. CKX does not intend to make further public comment regarding the review of strategic alternatives until it has been completed or the company determines that a disclosure is required by law or otherwise deemed appropriate.

CKX Lands, Inc. is a land management company that earns revenue from royalty interests and mineral leases related to oil and gas production on its land, timber sales, and surface rents. Its shares trade on the NYSE American market under the symbol CKX.

TAP Securities is an affiliate of TAP Advisors, an investment bank providing financial advisory, mergers and acquisitions and capital-raising services. TAP Securities is located in New York City, phone number (212) 909-9034.

The company's disclosures lack much detail, it is challenging to value this asset from the outside. Management here has a significant informational edge over public market investors, but with this, they are signaling that CKX is likely worth considerably more than the current trading price. Having read a few of these announcements over time, if I had to guess, the highlighted part sounds like management wants to take it private.

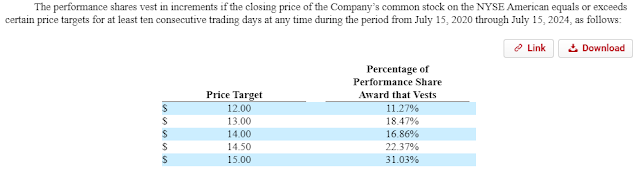

Additionally, management doesn't take any cash salary and instead the board granted them a generous stock incentive package that vests over time as CKX hits certain share price targets.

I don't really have a good sense of how much CKX is worth, other than I like the setup, I'd be interested in hearing more complete thoughts from others that have done more work on CKX, please feel free to comment below.

I've owned a bunch of CKX for many years - it's been a learning experience for me. Deep value plays need a catalyst to unlock that value.

ReplyDeleteOther additions to your initial notes: some of their acreage are subdivided for residential 'ranchettes' that have been selling for $13k/acre. If they can turn that into a real repeatable business, there's a lot of value to unlock.

G&A expenses incl. stock comp with the new employees are up a lot over the past few years as revenues have remained low. They were paying out some cash dividends up until a few years ago.

Anyway, your hunch that the management could take it private is plausible. (Check out the filings on the acquisition history of Michael White who joined the board eight or so years ago.) My feeling having talked to the new exec team, and having asked what the plan is to unlock value and would they please start selling off the parts, is that the board was more interested in maybe going bigger rather than shrinking and folding. Anyway, this should not be a public company at this market cap, and I hope I'm rewarded after years of patience!

Thanks, I appreciate your thoughts. Since you've owned/followed the company for a long time, do you have SOTP number pegged in your head for how much it's worth?

DeleteI had always had 20-22 as a target. I think the new target is prob 17 given the stock incentives to execs for reaching the price target thresholds.

DeleteThere’s a twtr thread on ckx suggesting that the ceo is looking at a mgmt buyout because of a related company contract. I donT think there’s enough of us pikers or a third patty to have enough stock and or make a competing bid against mgmt with a shady agenda.

So my gut says 17 in 10-12 months. Which I’ll be pleased enough with though overall a bad hold over many years in a strong market.

Thanks again, I hope your patience is paid off. $17 seems pretty reasonable to me.

DeleteThis blog has been a treat for years. I’ve gotten into some very good ones through you (and an occasional stinker but that’s how it goes) and hope you continue it. You should raise a fund!

DeleteDo you have any thoughts on this part of the sentence in the announcement "continuing to operate CKX as a public, independent company" I don't see how going private fits in...

ReplyDeleteMaybe I'm reading too much into it, but to me, that part of the sentence is highlighting how its not optimal to be a public, independent company for them.

DeleteThe same guys running this operation run CKX: https://www.wafb.com/2023/08/11/la-recieve-historic-600m-investment-infrastructure/

ReplyDeleteThere is minimal disclosure around it, but CKX leased some land to GCS for the project, there's a short note in the recent proxy regarding this.

Simplest explanation seems to be these guys don't want to keep operating this side project when they're all independently wealthy and just scored some serious money to do carbon capture. Question is - will CKX get significant value from whatever exposure they have to the project?

Interesting find, thanks. Is Stream Wetlands Services the same as GCS? I see that disclosure. If so, yeah might make sense for them to take it private before any serious revenue share is due.

DeleteI'm not sure it is, I haven't seen any connection between the two. Nevertheless, if it is, it makes tremendous sense. If it isn't, it still makes sense to buy out the revenue share.

DeleteAlso, CKX owns some land at the exact location where this sequestration plant is going to be built (https://cppj.totaland.com/# , parcel 00246557 and 00246565).

And the strategic review was launched 10 days after the DoE awarded this project to GCS. And note that the CFO of CKX is also the CFO of GCS and also the investment manager of the Stream family office. And note that he accepted the CKX job a year before the GCS consortium bid on the CO2 hub project, accepting no salary but a ton of performance shares.

Lots of coincidences.

Yeah - if you follow the timeline of the lease option being granted to SWS, exercise of the option, and the revenue share, it seems clear they're exposed to the project. I have no idea how you value that stake given the land is fairly worthless if this doesn't get off the ground. But makes sense to consolidate and sell of the other stuff to focus on making it a success.

Deletehttps://www.wired.com/story/big-business-burying-carbon-dioxide-capture-storage/

ReplyDeleteAnyone have the exact location of Project Cypress?

ReplyDeleteYou can see a photo of the location here: https://www.rigzone.com/news/louisiana_ccs_developer_seeks_federal_permit-14-oct-2020-163562-article/ . Pretty sure it matches this location, matches all other aspects too. Gray family owns a lot of land around there, CKX some parcels as well.

Deletehttps://www.google.com/maps/place/Gray's+Ranch/@30.1389077,-93.6048511,15.17z/data=!4m15!1m8!3m7!1s0x863bf755e47f593f:0xd9f858947906d3a8!2sVinton,+LA+70668,+USA!3b1!8m2!3d30.1911244!4d-93.5813576!16zL20vMHRrMWs!3m5!1s0x863bf831b84661a3:0xa7a4b19b05e61357!8m2!3d30.1413797!4d-93.5928441!16s%2Fg%2F1thzv546?entry=ttu

Here is the text from the proxy that gives info on the lease to Stream Wetlands: "CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

ReplyDeleteThe Company and Stream Wetlands Services, LLC (“Stream Wetlands”) were parties to an option to lease agreement dated April 17, 2017 (the “OTL”). The OTL provided Stream Wetlands an option to lease certain lands from the Company, subject to the negotiation and execution of a mutually acceptable lease form.

On February 28, 2022, the Company exercised the OTL and entered into a 25-year lease in exchange for a one-time payment by Stream Wetlands of $38,333. The terms of the lease provide for formulaic contingent payments to the Company based on the amount of revenue generated from activities on the subject property by a third party, with a guaranteed minimum payment of $500,000 in the event that revenue does not meet a minimum threshold. No minimum payment is due unless and until the third party engages in activity on the subject lands, and neither the Company nor Stream Wetlands is able to determine whether that will occur. William Gray Stream, the President and a director of the Company, is the president of Stream Wetlands.

The Company’s President is also the President of Matilda Stream Management, Inc. (“MSM”) and the Company’s Chief Financial Officer is the Chief Investment Officer of MSM. MSM provides administrative and accounting services to the Company for no compensation."

https://www.sec.gov/Archives/edgar/data/352955/000143774923008811/ckx20230331_def14a.htm

Interesting valuation done a few years back here: https://www.fnsyte.com/post/ckx-an-undervalued-land-holding-company. Company hired TAP Securities as its financial advisor. One of Taps senior advisors by the name of H C Bowen Smith is a long time industry veteran in the forest products paper and packaging industry. I think company will end up selling most of its timber land assets after which William Stream Gray and Michael B White of Ottley Properties will take company private. CKX lands owns property just south of Gray's Ranch which will be used to build the sequestration plant for project cypress. Great value here. I think they get about $3,000 per acre for timberland assets. I have a value of $18 per share.

ReplyDeleteThanks for the all comments, keep them coming as the situation evolves, appreciate having smarter readers than me.

ReplyDeletehttps://www.theadvocate.com/baton_rouge/news/business/developers-defend-calcasieu-parish-direct-air-capture-hub/article_ce8c40fc-87e5-11ee-8974-df01a769f23d.html

ReplyDeleteI've been thinking about why William Stream leased CKX lands property through his vehicle Stream Wetlands Services LLC. I now know why. "Anyone who plans to undertake commercial development on or near a wetland or stream can buy these mitigation credits to offset the negative effects of their project on the local ecosystem. " Stream Wetland Services more than likely owns plenty of mitigation a.k.a Stream credits. These credits will offset any negative effects on local ecosystem. SWS leasing CKX land confirms a commercial development will occur on CKX land. This commercial development will be the sequestrian plant for Project Cypress.

ReplyDeleteObvious question I guess, but has anyone straight up asked the company if Project Cypress is planned to be constructed on CKX property?

ReplyDeleteShares are starting to move here. The stock incentive plan for President and CFO expires July 15th, 2024. The last target price for performance shares is $15. Board has an incentive to get a deal done before July 15th which would be about 11 months into the strategic alternatives process. Could also get an announcement about signing of Project Cypress any day. Alot to look forward to with this one. $13.50 a share still looks undervalued here.

ReplyDeletehttps://www.sec.gov/Archives/edgar/data/352955/000143774922019969/ex_407230.htm

https://www.sec.gov/Archives/edgar/data/352955/000143774922019969/ex_407231.htm

We can get an idea on the progress of the Class VI Permit here for Gulf Coast Sequestration. Company prepares for draft permit May 2024 through June 2024. July 2024 is the public comment period. August 2024 through October 2024 is preparation for final permit decision. https://www.epa.gov/system/files/documents/2024-01/class-vi-permit-tracker_1-5-24.pdf.

ReplyDeleteHowever, the State of Louisiana was granted primacy over class VI wells meaning they will takeover approval of these permits. This is expected to expedite the approval process. https://www.jdsupra.com/legalnews/state-of-louisiana-granted-primacy-over-2271991/.

Interesting how dates line up for CKX lands shareholders with permit approval dates. The performance shares expire in July right before start of permit approval process in August. The company announced strategic alternatives in August 2023. We will reach a year of strategic alternatives in August 2024. I'd assume if CKX lands is exposed to Project Minerva, they'd want to get the company sold before the Class VI permit is approved and drilling could then begin on CKX's land.

I'm nervous about CKX's ownership of the land. They say that they own the land "indivision" [1]

ReplyDeleteIndivision appears to mean that there's at least two owners, either of which can sell or lease the land [2]

I worry that I don't know enough about their ownership to know how much they receive per dollar of revenue.

[1] https://www.ckxlands.com/lands/

[2] http://houmaestateplanningattorney.com/info-center/estate-planning-info-center/forms-of-property-ownership-in-louisiana/

Hopefully CKX lands can sell its undivided 1/6 interest acreage back to Walker Louisiana Properties if Walker Louisiana Properties is not interested in selling land to another party. I'd imagine they could sell the acreage they own 100% of, sell the undivided 1/6 interest acreage back to Walker Louisiana, and keep the acreage where the sequestration plant will be built. Since the plant will possibly be built on the undivided 1/6 interest acreage, maybe CKX will give Walker Louisiana Properties a percentage of the revenue share. Many options here.

DeleteFrom recent 10-K. This section was not included on last years 10-K and hints at companies desire to go private due to increased regulatory costs amongst other things. "The costs, time burden and risks associated with being a publicly traded company continue to increase.

ReplyDeleteBecause we are a public company filing reports with the SEC, we are subject to regulatory and public scrutiny and extensive and complex regulation. In addition, we are required to maintain financial accounting controls and comply with rules concerning the accuracy and completeness of our books and records. In addition to regulation by the SEC, we are subject to the listing fees and rules of the NYSE American stock exchange. The NYSE American rules contain requirements related to corporate governance, communications with shareholders, and various other matters. Compliance with these public company obligations requires significant time and expense. Other expenses associated with being a public company include auditing, accounting and legal fees and expenses, director and officer liability insurance costs, transfer agent fees and other expenses. The cost of being a publicly traded company is substantial, not only in absolute terms but, more importantly, in relation to the overall scope of the operations of a small company.

Changing laws, regulations and standards relating to corporate governance and public disclosure has created uncertainty for public companies and significantly increased the costs and risks associated with accessing the public markets and public reporting. Over time, as the SEC and NYSE American have adopted new rules, including rules requiring us to make additional public disclosures, the costs and time necessary for us to comply with public company rules has increased. Failure to comply with these requirements can have numerous adverse consequences, including, but not limited to, our inability to file required periodic reports on a timely basis, loss of market confidence, delisting of our securities and/or governmental or private actions against us. Our efforts to comply with new and changing regulations are likely to continue to result in increased general and administrative expenses and a diversion of management time and attention."

Update from the company. Sounds like a sale is in the works?

ReplyDeletehttps://www.sec.gov/ix?doc=/Archives/edgar/data/352955/000143774924012449/ckx20240418_8k.htm

Sounds promising, but also sounds like we're still several months off from the process being completed.

DeleteThoughts on recent 8K filed by CKX? Letting the employment agreement expire without another in place hints at imminent changes near. I think we are close to a deal.

ReplyDeleteYeah, I would agree too, something is likely happening in the short term.

DeleteAgreed. Had posted this in another forum..

DeleteIs anyone still following this ? Would appreciate any thoughts on this from the August 12, 2024 10-Q.

"Also on July 15, 2024, all 196,900 unvested performance shares awarded to employees under the Plan lapsed without the performance criteria being achieved and were forfeited by the grantees"

Also, is the below a positive ? / Indication that we are in the final innings.. ?

"On July 15, 2024, the First Amended and Restated Executive Employment Agreement between the Registrant and its President, William Gray Stream, and the Executive Employment Agreement between the Registrant and its Chief Financial Officer, Scott Stepp, expired in accordance with their terms. Messrs. Stream and Stepp mutually agreed with the Registrant’s board of directors to continue their employment in their respective offices with the Registrant without written agreements. The compensation committee of the board of directors expects to meet on or before August 8, 2024, to determine the officers’ compensation from and after July 15, 2024."

If the meeting occurred on or before August 8th, an 8-K would be required to be filed no later than yesterday August 14th. Since no 8-K was filed, either the meeting did not occur, a new agreement wasn't signed so nothing material to announce or the meeting was re-scheduled. Either way, the lack of urgency to get new employment agreements signed for CEO and CFO strongly hints at a change of control in the near term.

DeleteThe strategic alternatives process has been tracking very closely to the progress of Project Cypress as many have speculated CKX's land will be the site for the sequestration plant for the project. William Stream's Gulf Coast Sequestration Class VI well application was just declared administratively complete by Louisiana Department of Energy yesterday. https://www.dnr.louisiana.gov/index.cfm/page/1695

ReplyDeleteInteresting, do you know what the next steps are for it? Is there a DENR review?

ReplyDeleteDENR Technical Review is next.

Delete@MDC still holding? How long is too long here?

ReplyDeleteStill holding, it has been ~6 months since the 4/18 8-K, this isn't a super easy asset to sell, I'm willing to give it more time, maybe another 3-6 months. It is one of my larger positions.

DeleteI'd agree with your timeline as well. The company seems to be in advanced stage of negotiation. This is a good one to be patient with and wait for conclusion.

Deletehttps://carbonherald.com/capturepoint-selected-to-transport-and-store-project-cypress-co2-for-climeworks/

ReplyDeleteWith Heirlooms facilities in Shreveport and Climeworks signing carbon capture deal with CapturePoint, seems like Gulf Coast Sequestration has lost out on business with Project Cypress DAC facilities. With the initial strategic alternatives announcement being closely tied to this project, I wonder how this update will affect the process.

The Project Cypress DAC facility is poised to eventually capture megatons of carbon. CapturePoint may initially manage 300,000 tons, but Gulf Coast Sequestration’s Project Minerva will be essential for handling the larger volumes. Designed with a capacity to store over 80 million tons, Project Minerva aims to sequester up to 2.7 million tons annually.

Deletehttps://ccusmap.com/markers/project-detail/minerva

One of the largest carbon storage plants in the US and possibly world could be built on CKX's land.

I'm speculating CKX's land just south of Gray's Ranch will be used as a brine disposal well for nearby Co2 wells. This disposal well will be located on marshland hence the revenue share agreement with Stream Wetland Services. This proposed brine disposal well was laid out in an old 1978 document by Department of Energy. You can learn more about this brine disposal well by searching for "Vinton" in document.

ReplyDeletehttps://www.energy.gov/sites/prod/files/2015/06/f23/EIS-0029-FEIS-volume2.pdf

That's a very astute observation, thanks for sharing it.

ReplyDeleteThanks for the insight. That is interesting, I guess the counter would be that they wanted to lock in a higher rate on their idle cash before the fed cut rates. But I hope you're right, been a long slow road here.

ReplyDeleteNo problem. Moving cash to CD's could just be a change in cash management strategy. This has surely been a much longer process than I anticipated. If this goes beyond the end of year, I may need to rethink my position.

ReplyDeleteI just read a report by Project Cypress and it shows the land/ location where the sequestration plant etc is being built. I found the location on a map, it’s just south of Vinton, near the Port of Vinton, and I looked up the property records. The land is owned by Stream Family LP and some other Stream entities. So it does seem correct that CKX has lost out on Project Cypress.

ReplyDeleteIn the Project Cypress materials they released it’s not clear where they actually plan to store the captured CO2. They only show where the DAC plant is being built.

ReplyDeleteI emailed Gray Stream and got a response back on Thanksgiving day. "Thank you for your inquiry.

ReplyDeleteAs noted in our filings, in an effort to unlock shareholder value the company is still involved in discussions relative to strategic alternatives. Also as noted in our filings there is no guarantee that CKX will consummate a transaction, but those efforts and discussions are still ongoing in earnest. We hope to have a material update very soon.

CKX Lands is not involved in Project Cypress.

Thank you again.

Gray Stream"

VIC writeup from December just became publicly available:

ReplyDeletehttps://valueinvestorsclub.com/idea/CKX_LANDS_INC/6688114082

I'd love to see any sort of update from the company. this process is getting painfully long now.

ReplyDeletehttps://x.com/VincePagano/status/1899468051680006304

DeleteApparently an update is coming on 3/21

10K dropped (during market hours?) and contains this segment that wasn't there before:

Delete"Since the April 18, 2024 update, management and the Board subcommittee, together with the Company’s financial advisors, have continued working with interested parties and have advanced discussions with a potential counterparty. "

and

"As part of management’s desire to maximize value for shareholders through this process, the Company expects to seek to partition, in kind or by sale, ownership of its undivided interests in lands co-owned with others. There can be no assurance that the Company will be successful in reaching a negotiated partition of its co-owned acreage that would avoid the need to seek partition in court."

I think the shared ownership of these plots is what is causing the delays / headaches. They're trying to sell parcels in which they only have a ~17% interest. It's taking way too long and I am not too optimistic at this point, but we'll see. Small position.

Agreed. The co-owned land is the hold up. Sounds like "We’ll try to work this out peacefully, but if we can’t, we’re ready to fight in court" Breaking up ownership could get messy fast. If courts get involved could take years to solve partition issue.

DeleteAdvanced discussions with a potential counterparty sounds promising, but still a ways away, a bit frustrating, would have assumed they could have cleaned up the partial ownership parcels earlier in the process.

DeleteDeal as been made: https://www.sec.gov/ix?doc=/Archives/edgar/data/0000352955/000143774925027061/ckx20250814_8k.htm

ReplyDeleteSo only $1316 per acre? Seems to be currently trading at fair value

ReplyDeleteYes, agree. Disappointing that management wasn't the buyer.

DeleteFor those still in this. 13G filed by a Shao Fan Zhang & Liu Yi Ming & their co. 2757129 Ontario Incorporated. (5.1%).

ReplyDelete"We anticipate using the proceeds to strengthen our balance sheet and evaluate strategic opportunities.".

ReplyDeleteIt's not like the balance sheet needed strengthening in the first place .. This has been a train wreck so far. Not a huge loss of capital fortunately, but a massive opportunity cost over the space of a few years.

Fundamentally it still looks cheap, with ~$19m in cash and the remaining land vs a ~$21m mcap. But no update on the remaining (divided) plots, that's probably still a difficult undertaking. And the excess cash on the balance sheet should have been distributed about a decade ago .. Can't say I'm very enthusiastic.

Of course you can't win them all but despite the loss being limited (this was a small position) this one stings a bit because I feel I was suckered in with the nice story about the co2 sequestration, the insiders with no salary but a juicy stock incentive package, etc.

DeleteCKX is interesting as a value play but I am concerned with the possibility of a delisting.

ReplyDeleteThe company is listed on the NYSE American which seems to require a minimum of at least 300 shareholders of record (Section 1003(b)(i)(B) of the NYSE American Company Guide found at https://nyseamericanguide.srorules.com/company-guide/09013e2c853aa97f ).

Per the last 10-K, CKX only had 265 stockholders of record. Is delisting an important potential risk to consider here?