MRC Global (MRC) ($920MM market cap) is a global distributor of pipes, valves, fittings ("PVF") and other maintenance products to gas utilities, industrials and energy end markets. The market appreciates the MRO/distributor business model as many pure-play industrial distributors trade anywhere from 10-15x EBITDA, however MRC Global historically focused on the cyclical oil and gas drillers and has mostly traded at a significant discount to other industrial distributors (currently, about 6x EBITDA). In the past decade, since the oil market broke in the mid-2010s, MRC Global has focused on diversifying out to adjacent but less cyclical markets like gas utilities, refineries (turnarounds/maintenance can only be deferred for so long) and energy transition projects (big beneficiary of the Inflation Reduction Act). But credit for this mix shift has been hard to come by in public markets as they continue to trade inline with more upstream focused NOW Inc (DNOW) (although NOW is debt free).

Historically, MRC Global has battled being overleveraged, after a couple strong years they've finally gotten that under control with debt/EBITDA roughly at 1x (if you count the convertible preferred as equity). This past spring, the company started the process to refinance their term loan that comes due in September 2024, however, a management described "business disagreement" with their convertible preferred shareholder (who filed a lawsuit attempting to block the refinancing) led them to pull the deal. The company does have ABL capacity to redeem the term loan when it comes due next year, although that wouldn't be an ideal balance sheet outcome (interestingly, because of their liquidity, management has decided to account for the term loan as long term debt even though it matures in less than a year).

The convertible preferred is perpetual, pays a currently below market rate of 6.5% and has a conversion price of $17.88 (versus a current price of $10.88). The preferred holder is Cornell Capital, the namesake Henry Cornell was an original architect in rolling up distributors to what would become MRC Global while he was managing Goldman's private equity business. From their amended 13D following the lawsuit, it is clear that Cornell wants to be cashed out:

The Lawsuit seeks, among other things, (i) a declaration that the Issuer’s contemplated refinancing transaction violates the Issuer’s corporate charter and (ii) an order to enjoin the Issuer from signing or executing any definitive documentation with respect to, or otherwise consummating, the Refinancing. While MI objects to the Refinancing as contravening MI’s rights pursuant to the Certificate of Designations, MI has indicated to the Issuer that it desires to negotiate a resolution acceptable to all parties. Such a resolution could, for example, involve the Issuer repurchasing the preferred stock held by MI in whole or in part for cash or potentially other forms of consideration. However, there can be no assurance that any such transaction will occur, or the terms of any such transaction.

With that in mind, in appears the activist fund Engine Capital which owns approximately 4% of the shares outstanding, in their quarterly letter, they outlined thoughts that MRC Global could be sold for between $14-$18/share. Now management is facing pressure from an upcoming loan maturity, a grumpy preferred shareholder and an activist common stock investor. On Halloween eve, news comes out from Bloomberg News that MRC Global is exploring a sale after receiving interest from private equity firms. A buyout would come with a new term loan in place, liquidity for Cornell Capital, appease Engine and potentially achieve an equity valuation that MRC Global won't in public markets.

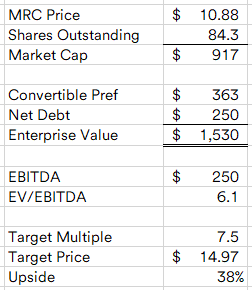

Again, the closest peer is DNOW, although they're far more exposed to upstream oil and gas, there's a wide gap between where MRC and DNOW trade and other distributors. Given the leverage here through the preferred shares, a buyer only has to give MRC a little multiple expansion credit for the improved business mix shift for equity shareholders to do well.

At 7.5x EBITDA (forward estimate from Tikr.com), which admittedly is a multiple grabbed slightly out of thin air, you're looking at about a $15/share target price, a nice premium to the current price. If a deal doesn't happen, there's not much, if any, premium really baked into the price. MRC Global is facing some covid hangover headwinds in their fast growing (and the best segment) gas utilities business as their customers are destocking like many others after supply chain issues caused utilities to overorder in 2021-2022. But that segment has grown at a 10+% CAGR for a decade and should return to growth shortly. MRC has been a favorite pitch of those wanting to be long oil and gas, but in a more sensible way than owning the producers, if energy does rally, MRC should benefit along with it. In a way, it's the perfect hated small cap value stock.Disclosure: I own shares of MRC

My main issue with MRC and other distributors is their actual cash flow generation. They've had low or negative cash flow from operations all of the last 6 years except in 2020 and 2019 when they sold off inventory. They also operate at a pretty low EBITDA margin - I have concern regarding pipe pricing vs HRC. They are somewhat insulated because their suppliers will lower prices but their inventory will likely get written down a bit.

ReplyDeleteThat's a fair criticism, while it is low on capex, it is a working capital intensive business.

DeleteWhy do you think MRC has held back on making an official strategic review announcement?

ReplyDeleteDon't think they need to. A debt maturity doesn't exactly warrant a full-on "strategic review" of an already profitable business pulling in $3.5B in ttm revenue. This isn't a broken biotech.

DeleteFourth quarter press release says: "We intend to pay off our Term Loan B on or before its maturity in September of 2024 with a combination of our asset-based lending facility and cash."

ReplyDeleteIs this play dead?

No, not at all. They have to say that, need to reassure lenders/the market that they will be paying off the loan. But it is still not an ideal situation to be in with their preferred stock shareholder holding the company semi-hostage, the "is this play dead?" scenario would be if they refinanced the loan and paid off the preferred stock.

DeleteWhy is using the ABL to repay the term loan suboptimal?

ReplyDeleteIt doesn't fix the preferred stock holder problem. They're preventing the company from taking on additional debt in future for any acquisitions or growth capex, etc.

DeleteMDC have you looked at BOOM intriguing business with 2 crappy companies attached and a strategic review announced. Could use that to delever and bring some shareholder value.

ReplyDeleteAlso interested in AIRG seems like it’s performed terribly for years but could be some forced pressure to exit.

BNED would be another but also not much confidence thesis there is tied to DOE policy changes.

Thanks - appreciate the ideas, BOOM looks interesting. Which of the 2 are the crappy ones? All seem average on the face, but only spent the last 20 minutes looking at them. Seems really cheap.

DeleteI'll look at AIRG and BNED too, thanks again.

DynaEnergetics which is under strategic review is usually considered the premier asset. I think in this case you have a company who just refinanced a bunch of debt, has a newer CEO (been with the company a decade), is generally cheap and wants to simplify the story. To me looks like a classic play on freeing up cash with a sale to focus on certain business lines.

DeleteAnother name that I forgot to mention is RYAM which is in a similair position except they have a weird debt finance restructure that might force a sale of assets to lower debt.

SYBX is another broken biotech that laid off 90% of the staff.

SYBX would fit your broken b

Thanks for the color on BOOM. I started looking at SYBX a couple weeks back, forgot why I put it down, I'll take another look.

DeleteThey just published this which to me doesnt necessarily mean they want to sell https://www.globenewswire.com/news-release/2024/02/20/2832143/0/en/Synlogic-Adopts-Limited-Duration-Stockholders-Rights-Plan.html

DeleteNot sure you have dug into BOOM more, but now Radoff is involved in this one too. https://www.globenewswire.com/news-release/2024/03/15/2846948/0/en/DMC-Global-Enters-into-Cooperation-Agreement-with-Bradley-L-Radoff.html

Deletehttps://www.sec.gov/Archives/edgar/data/1439095/000119380524000394/prec14a09488047_03182024.htm

ReplyDeleteEngine Capital with a contested proxy, wants 2 board seats. Ramping up the pressure.

Bought before the 10K in Feb, exited here. Think this was a good call, but r/r from here seems less attractive.

ReplyDeleteThat's fair. My current plan is to hold through some kind of resolution with the preferred shareholder, some go forward capital structure that makes sense.

DeleteLoved reading this thaanks

ReplyDeleteFiled 20mil share shelf

ReplyDeletehttps://www.sec.gov/Archives/edgar/data/1439095/000119312524237209/d889639dex991.htm

ReplyDeleteFixing up the balance sheet, taking out a Term Loan B to repurchase the disputed preferred shares. This is likely the end of the special situation at this point, doesn't appear that a deal is going to materialize in the near term, but I'll continue to hold at least a bit longer for LTCG and possibly longer than that as the stock is still fairly cheap.

The prefs are now being eliminated:

ReplyDeletehttps://finance.yahoo.com/news/mrc-global-announces-actions-strengthen-111900811.html

https://www.sec.gov/Archives/edgar/data/1439095/000119312525149152/d75113dex991.htm

ReplyDeleteA deal did happen here, with DNOW.