** Note, I'm a little late in posting my mid-year review as I was unplugged a bit for the last couple weeks. Back dating the post to its usual spot.**

My blog portfolio is essentially flat year-to-date with a gain of 2.99%, well behind the S&P 500 with a gain of 15.29%. The broken biotech basket performed well but was generally offset by declines in a lot of my legacy holdings and just malaise in my speculative M&A ideas (crossing my fingers that M&A picks up in the second half). Long term performance remains solid at a 21.75% pre-tax IRR.

Closed Positions:

- Quite a bit of churn happened in the broken biotech basket, I sold Eliem Therapeutics (ELYM), Homology Medicines (FIXX), Graphite Bio (GRPH), Kinnate Biopharma (KNTE), Reneo Pharmaceuticals (RPHM), Cyteir Therapeutics (CYT), AVROBIO (AVRO) and Theseus Pharmaceuticals (THRX) as each of these had some sort of buyout or reverse merger transaction. If there was a CVR component, I held through the merger and sold shortly after. Some of these rallied significantly post reverse merger, but in attempt to stick to the original thesis, I generally sold after the shareholder base turned over a bit.

- I got spooked out of both Instil Bio (TIL) and Aclaris Therapeutics (ACRS) -- although I made a nice profit on ACRS -- as both management teams don't appear to be following the reverse merger and/or buyout with a CVR strategy. Instil Bio has yet to sell their new manufacturing facility and I don't have confidence in the property valuation, plus TIL included the line of their intention of "Exploring opportunities to in-license/acquire and develop novel therapeutic candidates in diseases with significant unmet medical need." Aclaris announced alongside their Q1 results "we have decided to progress ATI-2138 into a proof-of-concept Phase 2a trial in patients with moderate to severe atopic dermatitis", however this one might be worth looking at as BML Capital Management has accumulated a significant stake and could push ACRS to revisit their go-forward strategy.

- Sio Gene Therapies (SIOX) made their liquidating distribution and is now pushed into the non-traded bucket. Similarly, Merrimack Pharmaceuticals (MACK) made its liquidating distribution, the remaining penny or two is now in a non-traded liquidating trust.

- Pieris Pharmaceuticals (PIRS) announced they are pursuing a similar strategy as MACK did, minimizing corporate expenses in an effort to extend their cash runway long enough to capture any milestone payments among their disparate portfolio of development partnerships. I sold to capture a tax loss, but will continue to monitor this one for a re-entry, if any of their milestones do hit, the return could be a multiple of the current market cap.

- MariaDB (MRDB) and Asensus Surgical (ASXC) were similar situations, cash burning companies with potentially valuable IP that was subject to a non-binding tender offer, if the tender fell through, both could be worthless. Luckily for me, both deals went to a definitive agreement and I sold each as the spread tightened to a normal range.

- First Horizon (FHN) was added shortly after their transaction with TD Bank broke in middle of the short lived bank crisis last year, this spring FHN passed over the long-term capital gains mark for me and I booked the profit. I could see FHN being an acquisition target for one of the super regional banks trying to use an acquisition as a springboard into a higher regulatory tier category.

- I should probably leave the traditional merger arbitrage trades to the experts, I exited Spirit Airlines (SAVE) after the judged ruled against the merger on anti-trust grounds, Albertsons (ACI) hasn't gone to court yet, but under the current administration, likely faces a similar result. Unlike Spirit, Albertsons is cheap on a standalone basis and their PE sponsor Cerberus is likely to seek liquidity in other ways if their merger with Kroger (KR) fails.

- NexPoint Diversified Real Estate Trust (NXDT) and Transcontinental Realty Investors (TCI) both fall into a similar bucket for me, real estate companies trading at very wide discounts to their NAV, but with management in no hurry to close those gaps (or simply unable to in the current interest rate regime / real estate market). NXDT has seen some recent insider buying that improves the story, but it has been several years since the old closed end fund converted to a REIT and little has been done to simplify the portfolio or tell the story.

Previously Undisclosed Positions:

- I've initiated a small position in DMC Global (BOOM) which owns three separate and distinct industrial businesses. The company has announced a strategic review to sell two of the three businesses, leaving behind a multi-family residential building products business (Arcadia). I didn't buy earlier in the story because it is unclear to me why Arcadia is chosen one to remain in the public shell, but the situation changed when Steel Partners (savvy, NOL maximizing conglomerate) lobbed in a $16.50/share offer (shares currently trade sub $14). BOOM has acknowledged the offer and stated they'll consider it as part of their greater strategic alternatives process.

Current Portfolio:

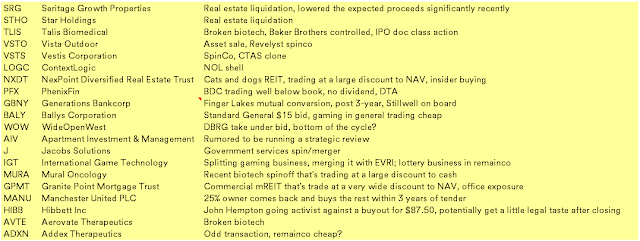

I will be doing some reshuffling of my personal balance sheet, likely withdrawing cash from this account in the near future so keep that in mind when I post the year end results.Since this is a pretty brief update, thought I'd include my current watchlist with a little blurb on each, as always, feel free to share any ideas or provide any pushback.

Sorry if you've already discussed, but is there any reason that you don't favor Net Lease (NLOP)?

ReplyDeleteI'll take another look at it, clearly missed it at the spin (I got burned a bit by ONL). Net lease office has always been a bit of a crappy asset class, they're not mission critical like other net lease properties and you risk the entire property going dark at once. But I do like the REIT spin liquidation theme, done well on those in the past.

DeleteThis comment has been removed by the author.

DeleteWhat reservations do you have with AVTE? Seems to fit the standard playbook with strategic alts 8k yesterday and RA Capital at 32%.

ReplyDeleteI agree, nothing holding me back, just going to blame the being unplugged for a bit. I like the setup.

DeleteSimon Bates, a Radoff appointee, was put on the board recently - the price at the time of their co-op agreement is higher than Steel Partners’ bid, so there seems to be a good chance for the bid to be rejected. Perhaps there will be higher bids soon? What a strange company…

ReplyDeleteAny view on ALVR timeline/price levels from here after lease disposal?

ReplyDeleteI think its pretty attractive. Usually things start to move quicker after the lease is terminated. I'm guessing we'll hear some transaction in the next 30-60 days.

DeleteThank you as always for sharing your thoughts. How are you feeling about the recent sell-off in PARR?

ReplyDeleteI don't have any intelligent thoughts on where crack spreads are going, but my thinking is PARR has done a pretty great job of allocating capital over time, other than injecting additional equity into Laramie many years back, hard to really point to a bad deal or investment they've made. The NOL is getting chipped away at. Will Monteleone taking over the big chair isn't a big issue for me, he's been there from beginning, have a sense that he's the deal guy anyway, sort of a golden child coming out of Zell's shop.

DeleteI'm sure you were hoping for some better (short-term) results but the underlying process seems very solid to me. Love your blog, enjoy interacting with you, keep on doing what you do!

ReplyDeleteI also sold TCI / ARL. Very cheap but management seems intent on keeping it that way. I'm afraid the VNDA story is going to end in a similar way.

AVTE seemed like something you would have bought if you had the time to look at it. I still own it but after a decent run-up it doesn't look as attractive anymore as it did a few weeks ago, before it was published on SSI and the likes.

What is SSI?

DeleteSecret Society of Investors (SSI), a close-knit, strongly guarded community of only the best and the most elite retail investors.

DeleteWould love to see a more detailed analysis of VSTO from the watchlist if you ever get to it.

ReplyDeleteI second this. Would also love to see your thoughts on VSTS and STHO!!!

DeleteI'm pretty close to VSTO, happy to share thoughts or answer any Q's. I think shareholders are about to do something really dumb bc MNC doesn't have the money

DeletePlease share! Just saw that GAMCO came out against management and for the MNC deal.

DeleteI've been in this since about $26. I think MNC should have just tendered for as much as they can get their hands on at $40. They would end up with a significant % and likely could then bump it to $42 to clear the rest / replace the board. VSTO mgmt are incredibly entrenched here & making decisions that appear to clearly go against what investors want ($42). I think the CSG transaction will be (would have been) voted down which would be embarrassing. VSTO have now proved they have the cash after providing funding letters.

DeleteHave you taken a look at Solventum (SOLV)? It's a recent partial spinoff of 3M. Trades at 20% + free cash flow yield and a mid teens earnings yield; it's a very slow growing, but stable business. Seems like a typical Joel Greenblatt spinoff as institutions owned a majority of 3M, then sold of SOLV once the shares were distributed.

ReplyDeleteAs far as "vanilla" merger arb goes I think CTLT is worth taking a look at, I like it a lot. It's a ~10% gross spread for a deal that should close in 3-4 months (almost certainly by the end of the year). Downside is high 40s-50, and has gotten a lot better since the deal was announced as their main customer SRPT got a full label expansion of their gene therapy. Antitrust is factually fine, it's a pure vertical deal and the main complainer LLY has significantly quieted down and gone out and acquired their own CDMO capacity

ReplyDelete$TIL and $EIGRQ are pretty interesting here.

ReplyDeleteI also like $RMLFF and $GDRZF though risky if something happens to scrap the CITGO auction.

I have bought out of the money calls and puts on $OMEX. To the extent the lawsuit fails I’ll make a small amount of money if the lawsuit succeeds I’ll make a lot of money.

Are you able to buy Eiger? It is trading on the Expert Market. I don't have a broker that allows buying on the Expert Market.

DeleteIt was trading on regular markets until a few days ago.

DeleteMade money on the puts as it turns out. I’ll make $25k-45k. If the lawsuit were successful to the tune of $1b+ I could have made a million+. But the strangle option play was a good strategy. I was mildly nervous that the company could basically receive what would amount to $3-6 per share and I would lose the ~$30k in premiums I paid. I bought ~50% more puts than calls but had a similar dollar exposure.

DeleteRE $OMEX

DeleteNice quarter guys !! Lol. Jokes aside - really enjoy your blog & how engaging you are with us mere mortals. Looking forward to many more posts in the future ! Did you look at RCM ? Played out somewhat as expected with a few bumps along the way (excuse the pun). Thought it would be right up your alley.

ReplyDeleteNXDT just hosted a conference call with a very different tone. They say they're going to 1/ start hosting quarterly conference calls starting in 4Q and 2/ liquidate $175-$250mm worth of non core assets. With NXDT hard to give them a lot of credibility, but this conference call sounded very different. There's a slide deck online. https://s29.q4cdn.com/666248138/files/doc_financials/2024/q2/NXDT-Portfolio-Repositioning-Deck-9-10-2024-_vF.pdf

ReplyDelete$NXDT pretty interesting here, agree. If they can sell at the estimates they claim it’s an obvious bargain.

DeleteI think it could be the start of what people were hoping for two years ago, just off a way lower valuation. If they start doing conference calls with an actual story to tell - could be a significant re rating

DeleteIt would be nice if you could do an article on IGT

ReplyDeleteWhat's the trade ?

DeleteThought you would find this interesting, apologize if already posted re TCI/ARL: https://www.dmagazine.com/commercial-real-estate/2024/04/behind-the-22m-verdict-against-gene-phillips-company/ Do you make anything of Bradford Phillips resigning from the boards in July? It's probably just connected to this.

ReplyDeleteThanks for posting this, hadn't seen it. Not sure what to make of it but you're probably right on the connection.

DeleteDid you see the tender for IOR? Maybe it's finally happening!?! (Or at least it's going to happen in the next year or two :-) ) I think the 91% threshold is so they can do a short form merger, but I'm not sure. Would be curious if anybody has any other thoughts?

Delete