Star Holdings (STHO) (~$225MM implied market cap) is the upcoming spinoff of the merger of iStar (STAR) and Safehold (SAFE) targeted to be completed on 3/31/23. Similar to other real estate spinoffs, STHO will be stuffed with legacy assets with a stated strategy to monetize the portfolio over time and return sale proceeds to shareholders.

iStar was a commercial mREIT prior to the great recession, during '08-'09 many of their commercial mortgage loans went bad and the company ended up foreclosing on various property types across the country. In the years since, they've run off much of that legacy portfolio (I previously owned it for the legacy assets) and then several years back launched a new ground lease strategy under the Safehold (SAFE) banner, a REIT that is externally managed by iStar. As the SAFE strategy succeeded in the low rate environment (a ground lease is typically 99 years, about the longest duration asset you'll find) and iStar's legacy portfolio ran off, there was little need to maintain two separate public companies with related party arrangements. iStar with its management contract and SAFE shares was basically an asset backed tracking stock of SAFE. Last August, iStar and SAFE announced a merger transaction where SAFE would internalize management and iStar would spinoff its non-ground lease assets into STHO. Similar to other real estate spins (SMTA, RVI, etc), the new combined SAFE will be the external manager of STHO.

As usual in spinoffs now, iStar will be receiving a dividend back from STHO, the use of funds is to pay down iStar's debt and leave primarily just SAFE shares to then swap for new SAFE. In order to facilitate that dividend, STHO is receiving $400MM in SAFE shares that they will then take a $140MM margin loan out against and send that, plus a $115MM term loan collateralized by all of STHO's assets back to iStar. The term loan will amortize down quickly as all cash above $50MM will sweep to pay down principal and the margin loan will be in place at least 9 months per a lockup agreement on STHO's SAFE shares. The proforma STHO looks something like this (note, the STHO share count will be approximately 13.3 million, or 0.153 shares for every STAR share):

The legacy portfolio is a mix of assets, the two largest ones that account for roughly half of the book value are smaller master plan communities, one is Asbury Park Waterfront (a collection of developed and pre-development mixed use properties) on the Jersey Shore and Magnolia Green (a golf course centered 1900 acre single family home community) just outside of Richmond. STHO will also have some legacy commercial real estate loans and a parcel of land in Coney Island NY, they anticipate it will take 3-4 years to monetize most of the legacy assets.The trickier, and possibly scarier part of STHO is the SAFE shares, as mentioned, its basically a perpetual bond masquerading as an operating company. But with the rate curve substantially inverted, the market is pricing in quite a few rate cuts that would be beneficial to SAFE shares.

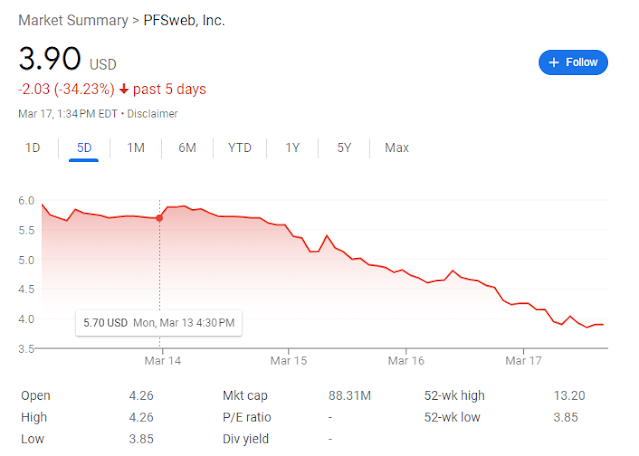

On March 17th, iStar put out a press release estimating the consolidation ratio with SAFE (it will be finalized immediately prior to the merger using a VWAP calculation) at 0.15 shares of SAFE for each share of STAR. Using that ratio we can back into the implied price of STHO:

At today's close, unless I made a dumb error (always possible), STHO shares are trading at roughly 40% of book value. Shares could potentially get even cheaper after the spinoff occurs, STAR is a REIT and included in REIT indices, STHO will be a c-corp and will likely get sold by any REIT index funds (although the largest ones like VNQ now include non-REIT real estate companies as well) and it won't pay a dividend. Owning real estate right now is a bit scary, but STHO's chunkier legacy assets are tied more to residential markets and we continue to have a shortage of housing in this country.Management Fees and Expense ReimbursementsWe do not maintain an office or employ personnel. Instead, we rely on the facilities and resources of our manager to conduct our day-to-day operations.We will pay our manager an annual management fee fixed at $25.0 million, $15.0 million, $10.0 million and $5.0 million in each of the first four annual terms of the agreement, and 2.0% of the gross book value of our assets thereafter, excluding the Safe Shares, as of the end of each fiscal quarter as reported in our SEC filings. The management fee is payable in cash quarterly, in arrears. If we do not have sufficient net cash proceeds on hand from sales of our assets or other available sources to pay the management fee in full by the original due date of the management fee, we will pay the maximum amount available to us by the original due date and the remaining shortfall will be carried forward and be paid within 10 days after sufficient net proceeds have been generated by subsequent asset sales to cover such shortfall in full; provided that in no event may such shortfall in respect of any fiscal quarter remain unpaid by the 12 month anniversary of the original due date.

Disclosure: I own shares of STAR and short shares of SAFE (synthetically long STHO)