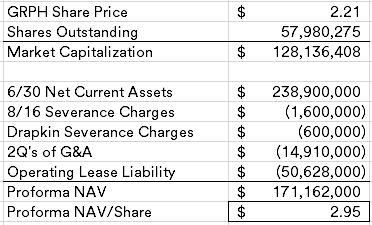

Graphite Bio (GRPH) (~$130MM market cap) is a clinical-stage gene editing biotech that paused development in January for their lead asset, nulabeglogene (a treatment for sickle cell disease), following a serious adverse event in the first patient dosed. About a month later, Graphite Bio made the determination to explore strategic alternatives and did a large reduction in workforce. In the months since, the company sold their IP in a couple transactions for nominal amounts, the CEO resigned to pursue other opportunities and they did a further layoff.

In August, the company brought in Kim Drapkin as the CEO (plus just about every other relevant executive function) to lead the strategic alternatives process. Drapkin was previously the CFO of Jounce Therapeutics (JNCE), a similarly situated broken biotech, which accepted a cash bid plus a CVR from Kevin Tang's Concentra Biosciences (Tang does own ~4% of GRPH). Interestingly, as part of Drapkin's compensation package, she receives an additional $200k in severance if a definitive agreement is reached within 3 months of her 8/21/23 start date:

The Company entered into a letter agreement, dated August 21, 2023 (the “Start Date”), with Ms. Drapkin (the “Offer Letter”). Pursuant to the terms of the Offer Letter, Ms. Drapkin will be entitled to a base salary of $550,000 per year. In addition, Ms. Drapkin will be entitled to cash severance payments in the amount of (i) $400,000 in the event of a termination of her employment other than for cause or death upon or within 12 months after the closing of a strategic transaction, plus an additional $200,000 if the definitive agreement for such strategic transaction is executed within three (3) months after the Start Date or (ii) $350,000 in the event of a termination of her employment other than for cause or death upon or within 12 months after the Board’s approval of a plan of dissolution of the Company under Delaware law, in each case subject to Ms. Drapkin’s execution and non-revocation of a separation agreement and release, as further provided in the Offer Letter.

While that's not enough to ensure a deal is reached in that timeframe, it certainly points to the expectation of a quick deal when she was brought on board. Another attractive quality to GRPH, their net cash position (after deducting current liabilities) is well over $200MM, that's a meaningful amount of money to many potential bidders which should increase the quality of any deal counterparty compared to some of these true micro/nano cap broken biotechs.

The one large red flag here is their operating lease liability; near the top of the recent craziness, GRPH entered into a 120 month lease for some office and laboratory space in San Francisco (which only started after they raised the white flag).

On December 16, 2021, the Company entered into a lease agreement with Bayside Area Development, LLC (“Bayside”) for 85,165 square feet of office and laboratory space in South San Francisco, CA. The lease for the office and laboratory space commenced in April 2023. The term of the lease is 120 months with the option to extend the term up to an additional ten years. This option to extend the lease term was not determined to be reasonably certain and therefore has not been included in the Company’s calculation of the associated operating lease liability under ASC 842. During the three and six months ended June 30, 2023, the Company took possession of the Bayside lease and recognized a $32.0 million right-of-use asset and corresponding lease liability upon the lease commencement date. In addition, the Company recognized $27.2 million in leasehold improvements. Bayside provided a tenant improvement allowance of up to $14.9 million, of which $14.7 million was utilized and recorded in lease liability.

In connection with the Restructuring Plan, the Company has determined that it will not utilize this facility for purposes of its own operations, and as a result, intends to sublease the vacant space to recover a portion of the total cost upon recognition of the lease.

They've yet to sublease the space or negotiate a termination payment with their landlord. Given the state of Bay Area office space, it might be advisable to assume the entire long term operating lease liability against the NAV.

I'm going to assume only two quarters of G&A versus my normal four, to account for the time it has already taken since the original announcement plus the three month incentive fee, it doesn't appear this one should take too long once the operating lease is neutralized in one way or another. Although the default expectation with these should be a reverse-merger, the odds of a simpler cash deal should be higher given Drapkin's experience at JNCE.Disclosure: I own shares of GRPH