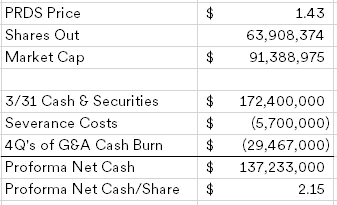

Pardes Biosciences (PRDS) ($90MM market cap) is another biotech for the basket, this morning the company announced poor clinical results, an 85% reduction in their workforce and the decision to pursue strategic alternatives. The company has a questionable history, it was founded shortly after the covid pandemic began in 2020 to pursue new treatments for viral diseases that lead to pandemics, they entered into a merger agreement with a SPAC in June 2021 and completed the deSPAC process in December 2021. Luckily for them, this was before we started seeing heavy trust redemptions, with almost all of the SPAC cash being delivered to Pardes plus a $75MM PIPE investment. Pardes has one asset, Pomotrelvier, a covid treatment that just failed to meet its Phase 2 primary endpoint, thus triggering the halt of their development program. Even if trial was successful, it seems like society has moved on from covid and the share price reflected the skepticism that this could be a commercial product.

What makes Pardes slightly more interesting is their limited history, unlike others, they haven't had time to build up significant NOLs (only have $66MM) that might be attractive to a reverse-merger partner. Pardes also doesn't have a significant lease or other major shutdown costs, so while a reverse-merger is likely still the first option, this one might be a strong candidate for a fairly clean liquidation. I do wonder when we see a shift towards more liquidations, as we get more and more of these pursuing strategic alternatives, there can't be enough reverse-merger deals to go around (we still have dozens of SPACs doing the same too).

Disclosure: I own shares of PRDS