Tax Attributes

At the time of the GLPI transaction, old Pinnacle had significant NOLs along with the standard D&A tax shield that made it an insignificant federal income tax payer. The NOLs were exhausted through the taxable spin of the OpCo and even though the D&A of the real estate will still flow through the GAAP financial statements, they can only depreciate the assets they own for income tax purposes. But due to the structure of the spinoff, Pinnacle Entertainment will continue to be a minimal income tax payer, below are explanations from both PNK and GLPI executives:

"However, we did receive a step-up basis in our assets. That step up just to give some shorthand for it. You look at the enterprise value of the company as a whole. We had a tax basis on what was spun of roughly about $1 billion and the difference between those two will be amortized over a 15 year period evenly. That will create a deduction going forward, main point being, that our effective tax rate will be materially lower than the statutory one by virtue of the deduction" - Anthony Sanfilippo, Pinnacle Entertainment CEO

"..and the reason we did it this way [spin the OpCo and merge the PropCo with GLPI], was obviously to help solve for some tax problems. It also, some people expressed some concern that the Pinnacle NOLs would be going away but the reality is, on the spin they will be getting a stepped-up basis of the NOLs as well as to the extent that we pay gain above and beyond the NOLs, their assets will get stepped up actually higher than their NOLs. So in the end they should be, from a tax perspective, in very good shape going forward with a higher asset level basis for depreciation." - William Clifford, GLPI CFOBack to the EBITDA to free cash flow bridge slide:

Pinnacle is projecting only $4MM in cash taxes annually on the current business (including the Meadows acquisition), gaming companies typically aren't significant tax payers due to their considerable fixed assets, but even with the sale of their real estate to GLPI, Pinnacle via the stepped up basis of their assets/goodwill that they'll be able to amortized over 15 years have maintained similar same tax efficiency. I'd be curious to hear anyone's thoughts on how much their tax attributes could be worth?

Real Estate Remaining at Pinnacle Entertainment (OpCo)

GLPI is a net lease REIT and thus uninterested in development assets, their investors want predictable cash flows and not excess land sitting around generating insufficient revenue for dividends. As part of GLPI's sweetened offer to buy Pinnacle's real estate they sent a letter to Pinnacle's shareholders outlining the increased value of the second offer, and specifically called out the property assets to be left behind at the operating company.

Belterra Park

In 2013, old Pinnacle began the redevelopment of the River Downs racetrack outside of Cincinnati to be refashioned as Belterra Park (to create an association with the Belterra Casino Resort across state lines in Indiana) a "racino" with video lottery machines and six full service restaurants. The all-in redevelopment price was approximately $300MM, it opened in the spring of 2014 and almost immediately began to under-perform expectations. By the time GLPI came knocking with an offer to buy Pinnacle's real estate on an earnings basis the Belterra Park property was generating almost nothing - making it a hard fit for a REIT - it would have to be valued at almost zero for it to make sense to GLPI shareholders who demand a current yield on their assets.William Clifford, CFO of GLPI said on a call discussing the deal:

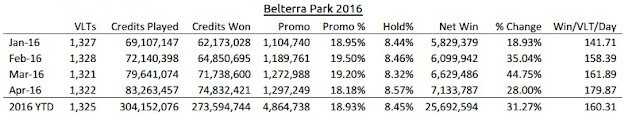

"The primary reason why we left off Belterra with the operating company is because on a historical basis it has fairly low levels of EBITDA which meant that we weren't really paying very much for it. And what we were able to do by leaving it behind, was to take the tax basis of the property and transfer that to OpCo which will eventually save us taxes on the gain relative to spend. That represented probably somewhere north of $50 million worth of tax savings. So even on a multiple basis, it seemed to make sense and quite candidly, we think it adds value for OpCo and will depreciate by the Pinnacle team."The decision to leave Belterra Park with the OpCo was made almost a year ago, since then the property has begun to turnaround its performance. Ohio built 4 casinos between 2012 and 2013, plus granted licenses to many similar racinos, all that development at once hurt the entire market in the state and is just now beginning to recover, Beltera Park included. Net win at the racino is up 31% year over year through April of this year.

GLPI valued it at $75MM in its letter, typically I would discount this valuation as GLPI was attempting to convince Pinnacle shareholders the deal was in their best interest. But if anything, $75MM seems low compared to the initial development costs even considering the properties initial struggles - but improving - and additionally new Pinnacle will benefit from the depreciation tax shield in addition to the step up basis on the sold assets discussed earlier. It's also clear that Pinnacle's management is willing to sell real estate and may look to do a sale-leaseback of Belterra Park once it fully stabilizes.

Excess Undeveloped Land - Lake Charles & Baton Rouge

Staying with Pinnacle Entertainment is roughly 500 acres of undeveloped land, about 50 of those acres are adjacent to their flagship L'Auberge Lake Charles resort which is positioned as a regional destination with non-gaming amenities (concerts, restaurants, golf course) and has an equally positioned Golden Nugget resort next door (which was supposed to be an Ameristar Casino, but Pinnacle had to divest it at the time of the Ameristar-Pinnacle merger). This land could potentially be valuable as an additional redevelopment asset for this growing market and could benefit from the Golden Nugget casino as well building up the overall market and land value around the two casinos.

The other 450 acres around the L'Auberge Baton Rouge resort looks a bit more uncertain given its size and isolated location (at least according to Google Maps). GLPI valued the excess land near both properties at $30MM or roughly $60,000 per acre which seems within reason.

Insider Buying

While the new Pinnacle Entertainment isn't your normal spinoff since all the employees came with the spinoff, it's still encouraging to see management has been buying shares in recent weeks (maybe with proceeds from GLPI shares?) giving more validity to their own thesis that the shares are undervalued.

In addition to the insider buying, the company also announced a $50MM share repurchase plan signaling both confidence in their free cash flow and again that their shares are undervalued.

Summary

Profroma for the Meadows acquisition that should be completed this fall, Pinnacle Entertainment trades for 6.5x EBITDA whereas its near identical peer in Penn National Gaming trades for 7.5x EBITDA. Yes, the structure is leveraged unconventionally and has some risk, but for a $700MM market cap company with almost no tax liability going forward and ~$105MM in real estate provides additional margin of safety at this valuation. Additionally, management and the company itself are significant buyers of the company's shares.

Disclosure: I own shares of PNK

What is the normalized EBITDA and FCF? What happens to the FCF of $130 mill in recession? Seems like many cyclicals are cheap especially the levered cyclicals on current EBITDA and earnings?

ReplyDeleteIt's a fair question, but in my opinion the regional gaming companies are less cyclical and less exposed to a major recession than the Las Vegas/Macau peers. Old Pinnacle Entertainment actually increased revenues every year going back to 2004, and EBITDA had two down years in 2007 and 2008 (went from $204MM in 2006 to $160MM in 2008) before regaining its old high again in 2010 and growing from there. Pinnacle currently doesn't have any speculative developments in the works, none of their markets have new competitors coming online in the near future, and their middle class customers are doing fairly well as far as I can tell. I don't have a clear "normalized" EBITDA and FCF as there are too many moving parts, casinos bought and sold over the cycle, but I'd argue we're not as close to a cyclical top in this sector than others believe. Once you start seeing new licenses and politicians outside of the east coast pushing casino development again, then I'll be a lot more cautious. Thanks for the comment.

DeleteThe revenues increased in 08 and 09! Then this is not cyclical. I cant imagine why would people continue to go to casinos when they were defaulting on other debts. What happened to revenues in recessions prior to the financial crisis? I also don't understand why would EBITDA decrease in 2008 when revenues had increased - high G&A - poor management?

DeleteThere was some new development during that period, it might not be an apples-to-apples comparison as new casinos were opening. I wouldn't say it's not cyclical, just less so the high end destination resort casinos.

DeleteI bought PNK mainly of the strength of the CEO's market purchases of stock plus his very articulated goals that his team understands. He delegates a lot. Ownership + engaged team + defined goals usually = improved operations. Looking for $17/share.

ReplyDeleteIt can be hard for a person who is looking to purchase a new bed to decide which type is the right choice. There are so many to choose from: a latex mattress, memory foam, inner-spring mattresses, water beds and many others. It is a good idea for anyone in this situation to educate themselves on the different types of mattresses and beds that are on the market today. Best mattress brand

ReplyDelete