In a recent post I mentioned there are some interesting spins on the horizon, one of those is La Quinta Holdings (LQ) doing an OpCo/PropCo split sometime in Q2 2018. Their plans changed a little last week with the announcement that Wyndham Worldwide (WYN) - also doing an interesting spin - is buying La Quinta's asset-lite management company business for $1.71B in cash (after backing out $240MM Wyndham is reserving for potential taxes La Quinta will owe in the spinoff) or roughly 15.1x EBITDA.

Since Wyndham is paying cash, it's fairly easy to back into what value the market is assigning to La Quinta's PropCo spinoff, to be named CorePoint Lodging (CPLG). Today, La Quinta's enterprise value is roughly $3.83B and combined company has an estimated $331MM in EBITDA for 2017. Wyndham is paying $1.71B for the management company that will do $113MM in EBITDA, leaving an EV of $2.12B and $218MM in EBITDA behind in the REIT spinoff, for a 9.7x EBITDA multiple.

CorePoint is a hotel REIT, I've discussed the disadvantages of those in previous posts, but in summary they're more an operating company/franchisees than true REIT models, they're taking the majority of the business risk rather than acting as a landlord charging rent. La Quinta's model is a mid-market select service hotel, historically they've been concentrated in the south (particularly Texas) but have expanded and diversified in recent years after being hit hard in the oil downturn. Their hotels typically tend to be situated in suburban, airport and interstate locations that might be less susceptible to AirBnB but more at risk for overbuilding/supply risk.

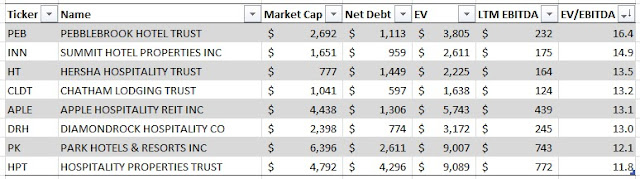

There are a lot of hotel REITs, here's a small sample of internally managed ones I pulled, they might not all be perfect comparable companies but as you can see, none of them trade below 10x EBITDA:

If CorePoint is worth 12x EBITDA, my math gets me to about a $14/share price for the spinoff (might move around a little depending on the eventual net debt on the spin) + $8.40/share from Wyndham for the management business for a total of $22.40 versus a $19.60 stock price today, or about 14% upside. No one is going to get rich on this idea, if you could isolate the spinoff directly it'd be a better deal, but I like the risk/reward. Two other points to consider: 1) the $240MM WYN is reserving for taxes approximates a $2.85B EV valuation or 13x EBITDA for CorePoint (21% on the difference between the first day of trading and the book value of the assets); 2) since CorePoint is a taxable spinoff (REIT spins are no longer allowed to be tax free) it will be immediately be available to get acquired, and I expect it won't be a standalone company for very long.

Disclosure: I own shares of LQ

Hmmmm...I thought CorePoint was an externally managed REIT.

ReplyDeleteNo, it'll be internally managed, the current LQ CEO is coming over to the spinoff after the WYN merger news. Each individual property is essentially externally managed by the management company, but the REIT itself isn't externally managed like AHT for instance.

DeleteCan you expand on 2) from your last sentence? Are you saying that since it is a taxable spin there is no lockup period and thus it can be acquired immediately?

ReplyDeleteYes. An example would be the spinoff from the PKY/CUZ merger and then spinoff of new PKY last year, new PKY lasted as a public company only a few months.

DeleteGotcha thank you

DeleteMorgan Stanley out with a note today -- makes a great point that I completely missed, but the spinoff should receive a lot of benefits from the management company being apart of WYN versus a standalone entity: 1) rebranding some LQ hotels to match price point segments, 2)Procurement savings, 3) cross-selling/revenue synergies, 4) OTA/channel mix savings.

ReplyDeleteThanks for yet another great write-up.

ReplyDeleteCould you confirm that the $1.71B transaction EV is being roughly arrived at as follows (just want to make sure I'm not misunderstanding the merger structure):

~$983M equity value

+ $1.52B net debt

+ $240M spinoff tax expense

- $984M dividend from CorePoint

= ~$1.76B effective transaction EV

There's mention that $716M in net debt will be paid off by WYN, but in effect, since the spinoff will happen pre-merger, WYN will be using the CorePoint exit dividend to fund debt repay and incurred taxes of their PF subsidiary.

Also, in terms of CorePoint's PF balance sheet, is the $240M reserve being "withheld" for taxes in addition to, or included in the $1.085B secured debt CorePoint will be issuing to fund the exit dividend?

Thank you!

I think you're correct, but coming at it from a different angle than me that has me a bit confused, and I don't know if we know the PF balance sheet definitively until we see an updated Form 10-12, the latest one is from September, well before the WYN deal.

DeleteBut as of today, I have the proforma CorePoint trading for about 9.3x LTM EBITDA of $208MM. My math:

CorePoint Lodging 2017 EBITDA: $208MM

EBITDA Multiple: 9.3

Corepoint Enterprise Value: $1934MM

La Quinta MgmtCo Enterprise Value: $1942MM

La Quinta Combined Net Debt: -$1530MM

Tax Reserve: -$240MM

La Quinta Combined Equity Value: $2106MM

Diluted Shares Outstanding: 117

Share Price: $18.00

Headline numbers looked fairly bad for the owned segment reported yesterday, but there's some noise in there due to renovations and the hurricanes. I'd expect forward EBITDA to rise once these events work there way through and then some slight uplift from being apart of WYN's management company network. Hope this helps? Let me know if I'm making an obvious mistake or missed something! Thanks.

One thing I think you might be missing is that they are renovating a substantial portion of the owned hotels. RevPat for the owned hotels is substiakky lower for the owned hotels. They are also substantially older. Giving them a face lift might lift them to 60 REVPar

ReplyDeleteYes, I think you're right, that should provide some upside to EBITDA. Since this is a taxable spinoff, LQ might be sandbagging the spinoff a bit, they'll be able to keep any excess from the WYN tax escrow, so their incentivized to make it trade at a low valuation day 1.

DeleteBased on Corepoint's bid/ask, I'd say your $14 estimate ($28 after adjusting for the reverse stock split I believe) was right on the money. Of course, it's still early trading, but just in terms of roughly handicapping things, very astute.

ReplyDeleteThanks! This one has worked out pretty well, they surely don't all.

Delete