KAR Auction Services (RemainCo)

ADESA ("Automotive Dealer Exchange Services of America") is the second largest provider of used car auctions in North America, with about 28%-30% of the market, behind industry leader Manheim, a subsidiary of privately held Cox Enterprises, that commands 42% market share. ADESA's auction sites link large volume car sellers (off-lease, rentals, repossessions, excess dealer inventory) with used car dealerships utilizing a consignment model where the company doesn't take ownership of the vehicles, but charges buyer/seller fees, transportation fees, and other fees that help prepare a car for sale (paint, small dent repair, detailing, etc.). Each car sold through ADESA represents about $600 in revenue. This is a reasonably good business, there are significant barriers to entry (for one it would be difficult to replicate their auction site footprint), low capital expenditures and limited working capital requirements, but it does feature some cyclicality to it via the supply and price of used cars.

There are two big sources of used vehicles for ADESA: 1) cars going off-lease, as leasing has become a more popular option in recent years (although leveling off now) it provides ADESA with a strong tailwind as lessees turn their cars into the lessor, who then sells through an auction provider to used car dealers; 2) repossessions, on one call management described themselves as "Repo Kings" since KAR has an active repo business inside of ADESA, auto lenders are not natural sellers of cars on their own, so they sell to used car dealers through an auction provider. More people financing cars at greater and greater loan balances translates into more cars falling into default and repossession.

AFC ("Automotive Finance Corporation") is the second piece of RemainCo, AFC provides "floorplan financing" to independent used car dealers to help facilitate sales at ADESA. Floorplan financing is a short term loan secured by the car that's paid back once the car is sold by the dealer. Because the loans are short term (65 days on average), 50% of the revenue ends up fee based generating mid-teens ROE and adding to the attractiveness of the business. Additionally, there are tens of thousands of independent dealers making this a difficult business to replicate at a nationwide scale and AFC's securitization financing provides a cheap competitive funding source.

In 2017, KAR purchased the remaining 50% in TradeRev that it didn't already own, TradeRev is a dealer-to-dealer mobile app that facilitates real time auctions between dealers versus a traditional auction platform where the dealers are typically only on the buyer side. With the spin dividend cash from IAA, KAR will continue to invest heavily in TradeRev as they're in the midst of a nationwide dealer by dealer roll-out of the platform. Additionally, KAR has international ambitions and recently bought an online auction platform that serves much of Europe with stated desires to continue to pursue international acquisitions.

Insurance Auto Auctions ("IAA Spinco" in the Form 10 or just "IAA")

IAA will be a standalone salvage auction business, when a car is totaled in an accident or has aged out of useability (think car donation charities) the car will be sold at a salvage auction for parts or scrap. Salvage auctions are similar to whole used car auctions in its transaction based ($500/car revenue, slightly lower due to fewer add-on services) where IAA doesn't take ownership of the car, however it's a more predictable business as cars will always need to be salvaged regardless of the economic cycle.

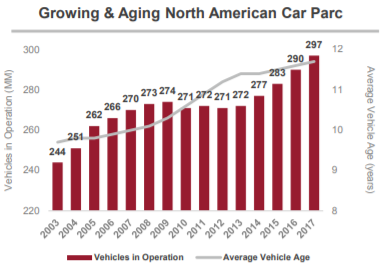

IAA in their Form 10 forecast the salvage vehicle auction industry will grow at 5%-to-7% annually for the foreseeable future driven by 3 main tailwinds:

- Growing automotive car parc -- Industry speak for the total number of cars on the road, now just under 300 million, the average age of vehicles continues to rise, older cars getting into an accident are more likely to be a total loss.

- Increasing vehicle complexity leading to higher total loss frequency -- there are more electronic components and repair labor costs are rising making car repair more expensive, if the repair costs are more than the car is worth, it of course results in a total loss.

- Increasing accident frequency -- here they cite more cars on the road and more distracted driving (texting and driving, etc.).

The stated reason to spinoff IAA is to create a standalone company that compares directly with their competitor Copart (CPRT). Copart maintains a similar ~40% salvage market share but has superior margins partially due to owning the real estate beneath their auction sites (IAA leases their sites), the rest of the margin difference is hard to parse out and might be an opportunity for improvement post-spin. IAA has been managed separately from KAR (different auctions sites, different customer bases, separate headquarters) and the soon to be CEO, John Kett, has been running IAA since 2014, eliminating some of the risk of IAA stumbling out of the gate that we often see with spinoffs.

Valuation

New KAR Auction Services doesn't have a direct North American public competitor since Manheim is privately owned by Cox Enterprises, but it does have a peer in the leading wholesale auction provider in the UK, BCA Marketplace PLC (BCA.LN). The combined KAR has $2.74B worth of debt and $345MM of cash, KAR is going to raise $1.3B of debt (not finalized) at IAA, sending $1.25B back to new KAR after gifting IAA with $50MM in cash, leaving new KAR with $1.145B in net debt.

Copart (CPRT) trades for 15.5x EBITDA, but its better run and has minimal debt so it should trade at a significant premium to IAA. For the sum-of-the-parts, I'm going to use 10.5x for new KAR (1x discount to BCA) and 12x for IAA (2.5x turn discount to CPRT):

Adding to the two pieces together, I get a price of $60, not a ton higher than today's $52 share price. Despite that I added a smallish position going into the spinoff, IAA in particular interests me as an interesting long-term spinoff:

Valuation

New KAR Auction Services doesn't have a direct North American public competitor since Manheim is privately owned by Cox Enterprises, but it does have a peer in the leading wholesale auction provider in the UK, BCA Marketplace PLC (BCA.LN). The combined KAR has $2.74B worth of debt and $345MM of cash, KAR is going to raise $1.3B of debt (not finalized) at IAA, sending $1.25B back to new KAR after gifting IAA with $50MM in cash, leaving new KAR with $1.145B in net debt.

Copart (CPRT) trades for 15.5x EBITDA, but its better run and has minimal debt so it should trade at a significant premium to IAA. For the sum-of-the-parts, I'm going to use 10.5x for new KAR (1x discount to BCA) and 12x for IAA (2.5x turn discount to CPRT):

Adding to the two pieces together, I get a price of $60, not a ton higher than today's $52 share price. Despite that I added a smallish position going into the spinoff, IAA in particular interests me as an interesting long-term spinoff:

- IAA doesn't have to make a significant change to its business model to succeed, instead there is both a discounted valuation and a margin gap, if both of these close it could be a home run;

- Deleveraging, as mentioned, since IAA doesn't have to do anything transformational or reinvent the business, and its growing at a healthy clip, they'll have plenty of FCF to deleverage and/or return cash to shareholders via buybacks or dividends;

- Management has been running this company as a separate unit, we should see some animal spirits unlocked now that their comp will be directly tied to the success or failure of IAA and the operating performance gap between IAA and CPRT will be on full display.

Disclosure: I own shares of KAR

Take a closer look at how many recent spinoffs have performed, not just their stocks, but actual financial performance via liquidity problems, and it becomes clear the reason for the deluge of garbage barge spins. Spins became a fad with activist-lemmings quacking for them and managements obliged to keep their jobs. This spinoff area has gone from being an under the radar gem to an overcrowded battleground... hence the poor performance from the likes of Einhorn et al. Even Guru Greenblatt moved on to Magic Formula investing, clearly a sign of the excessive interest in what used to be a good hunting ground. The period when investors, managements lose interest in spins will be the time to focus on them. Need some more event driven funds to blow up and its already started. good luck.

ReplyDeleteI think its more that you need to know what kind of spinoff you own, don't confuse the garbage barges (REZI or GTX are examples) with quality or know when a spin is being dressed up/spun at peak earnings (admittedly DFIN was one of these). I don't think IAA falls into either category, the business is growing, has a moat, sure they're putting on a significant amount of leverage but no other garbage assets or liabilities.

DeleteI got the chance to ask Greenblatt recently about the attractiveness of special situations and spinoffs, he said the opportunity set is equal or better to when he was active practitioner in the space, he taught his kids who have less capital, but its just not scalable. He's having tremendous success with his index plus strategy, which works much better in the retail mutual fund format than a special situation/spinoff strategy would with the inherent volatility.

Thanks as always for the comment.

I whole heartily agree, not all spin off scenarios are created equal. True there are a lot of spin offs that doesn't unlock value for shareholders or present opportunities and you can categorize them as "Garbage spins" but if you do the work and dig deep into spin off situations, you can find a healthy business underneath that is trading at a reasonable/cheap price.

DeleteIn this scenario, I happen to agree with MDC's thesis. I think IAA has a pretty strong moat (not all companies can have insurance hook ups to sell their vehicles), one of the two major players within the salvage space, CAPEX light business model, and decent leadership transition. That being said...them taking on 1.33b in debt isn't too alarming as they have pretty strong FCF and will be growing nicely. I think eventually IAA will settle down after the spin and start focusing on increasing their margins to be more in line with Copart.

I think this will be a decent company to purchase for a value investor willing to wait a few years to see IAA grow.

I wish I could do this without a heavy dose of cynicism but here it goes:

ReplyDelete1. "a margin gap, if both of these close it could be a home run" - - What is your basis for expecting the margin gap to close? and on this boilerplate, Greenblatt-sounding thesis, have you seen any study or empirical evidence to believe in it? If so, can you please point to such a study?

2. Your point on deleveraging as a positive is logic turned on its head. Why lever up a spin-off 3x+ to begin with? Isn't that a sign of a garbage barge" being set adrift?

3. Your point on Management comp and so-called "animal spirits".. Another Greenblatt cliche'. Okay. Are you suggesting that management, until now, was sitting on its thumbs because it was part of a larger org and now someone will turn the "on switch" and it will magically turn into The Energizer Bunny? Doesn't make any sense to me but to each his own..

4. I guess I agree with your SOP point and that IMO is the only short-termish, event-driven reason why these spins are effectuated - no other reason (mostly). Very shaky ground if comps blow up a'la Cars.com..

5. "a strong tailwind as lessees turn their cars into the lessor": Just curious. I have read that there is a deluge of such cars hitting the market and will severely depress used car and new car prices. Have you considered how that might affect future earnings here?

My advice: Any time when someone tells you that 2+2= more than 4, stop listening. Only in the world of faux-finance does such flawed logic makes sense to people.

Sorry if I offended you but maybe I gave you something to think about in the process.

Peace Out.

No offense taken, thanks for the feedback.

DeleteWhat puts REZI and GTX in the garbage bin? I've seen worse businesses. They look attractively priced too.

ReplyDeleteSorry - I didn't mean the businesses themselves were garbage, but they're what I would call garbage barge spins because Honeywell saddled them both with big liabilities to improve the parent.

Deletethanks for presenting this investment thesis. Given the discount to intrinsic value of the company as a whole 52 vs 60 isn't that steep, would it be worth waiting until the spin is complete and hopefully IAA sells off.

ReplyDeleteThe spin is partly to capture the valuation gap between IAA and CPRT, but this isn't new. Management has recently decided to do the spin as the two companies will have different strategies going forward. ADESA is pushing tech advancements and international exposure, IAA is an organic growth and deleverage story. (Leverage was shifted to IAA to give ADESA room for additional M&A, knowing IAA can support the debt) The amount of data ADESA has on the auto business is insane. The data/tech in this business is completed undervalued by the market.

ReplyDeleteThat said, IAA/CPRT margin gap is unlikely to close. A portion of the gap is owned vs leased RE as noted in the original post, but the remainder is an operational choice. IAA offers joint live online and offline auction services. CPRT does not. Management sees this as a way to differentiate themselves and is hoping to take some market share with this strategy.

Tech/Data is undervalued in ADESA and IAA is a solid compounder and deserves a reasonable market premium. If it doesn't get it, I'd be happy to own this while the delever. If you take this viewpoint, you can add an additional turn to each valuation multiple, you're in business.

Just my opinion. Buying pre-spin and ready to add/sell either company post-spin.

@Anonymous How do you figure that IAA's joint live online and offline auction services contributes to the margin gap b/t them and CPRT?

DeleteAlso according to the Form 10, IAA has explicitly called out M&A and International as priorities. (Could I be reading this wrong in the Form 10?) I haven't come across anything where ADESA or AFC mention international/M&A as priorities, as you and Clark Street mention.

The cost structure is going to be higher in a live auction, not a perfect analogy, but you could draw comparisons to physical retail vs online.

DeleteKAR recently agreed to buy CarsOnTheWeb, checks both the technology and international priorities at RemainCo, they've mentioned a few times in recent presentations that KAR will focus on international deals with their new found liquidity from the spin dividend. I took the international M&A priority at IAA to be more of a longer term goal, I'd be surprised if they made a significant acquisition in the first year or two.

Thanks @MDC. But isn't IAA running online and live auctions concurrently as opposed to CPRT's live auctions. Still don't see why that lifts CPRT's margin so substantially above IAA's.

ReplyDeleteAs for "use of proceeds", IAA has explicitly stated that their business strategy is to focus on International markets and M&A.

CPRT runs just online auctions, so they avoid the expense and capital requirements associated with live auctions, I think there's likely some room for the two to converge, but there might always be a gap if IAA's long term strategy is a hybrid approach.

DeleteKAR is getting the "use of proceeds" and that's their plan. It's fair that its IAA's stated plan as well since the US market is effectively a mature duopoly but with 3-3.5x leverage I'd imagine in the short term they'll choose to delever over pursue acquisitions out of the gate, but that's just my read of the situation.

@MDC Thanks

DeleteThanks MDC. This overview is very helpful.

ReplyDeleteStrange price action today, I assume the market is upset about:

ReplyDelete1)the IAA spinoff seems to be delayed, they haven't received the PLR from the IRS and are also exploring other options, although not entirely sure what that would look like that would be better than a tax free spinoff unless their was a bid for all of KAR, which seems unlikely.

2)On the KAR side of the business, they're investing more in TradeRev, short term pain but sounds necessary as the industry moves away from live auctions.

I had an average sized position going into today, but bumped that up and added some July 50 calls.

The competitive dynamics (comments during the conference call about competitive products backed by venture capital) reminds me a little bit of the situation heading into the CARS spin (competition from Carvana and Car Gurus) where the market dynamics changed completely and CARS experienced significant margin compression. At the same time, ADESA's margins aren't as juicy as CARS were and CARS currently trades at 10x forward EBITDA so not much downside there on that basis. However, CARS trades at 11x forward earnings so there could be some downside on a P/E basis for ADESA. I guess the big risk would be if we saw significantly more margin compression in ADESA.

ReplyDeleteI don't think that's a fair history of either story. First, CVNA isn't a competitor. Second, ADESA and CARS have very different businesses, so you can't compare margins.

DeleteCARS is trading at a low P/E multiple because the business is under intense pressure and shrinking topline (ADESA is not). CARS has a larger competitor (CARG) that provides more value to customers (dealers) at a lower price. CARS ended up in this situation because a) CARG has a better model (freemium) and b) the previous owners underinvested in the business which allowed CARG to succeed.

ADESA is very different. Management's messaging on the call was poorly communicated. The point they were trying to make is that they are doubling down on TradeRev and growing more aggressively. TradeRev is a huge opportunity for ADESA to grow their TAM by 50%. Yes there there will be some cannibalization, but the economics of the cannibalized vehicles are similar at physical ADESA and TradeRev - focus should be on a profit per vehicle basis (not % margin) and you need to adjust for the fact that the average ASP vehicle at physical ADESA is ~2x higher than TradeRev.

KAR received their PLR for IAA, spinoff is back on:

ReplyDeletehttps://ir.karauctionservices.com/investor-relations/investor-news/press-release-details/2019/KAR-Receives-Favorable-IRS-Private-Letter-Ruling-on-Tax-Free-Nature-of-Its-Previously-Announced-Salvage-Auction-Business-Spin-Off/default.aspx

I closed out my position in IAA, $47.50ish

ReplyDeleteADESA is very different. Management's messaging on the call was poorly communicated. The point they were trying to make is that they are doubling down on TradeRev and growing more aggressively. TradeRev is a huge opportunity for ADESA to grow their TAM by 50%. Yes there there will be some cannibalization, but the economics of the cannibalized vehicles are similar at physical ADESA and TradeRev - focus should be on a profit per vehicle basis (not % margin) and you need to adjust for the fact that the average ASP vehicle at physical ADESA is ~2x higher than TradeRev.

ReplyDeleteHemp Crop Insurance