This is a similar idea to WMC, Acres Commercial Realty (ACR) ($73MM market cap) is also a mortgage REIT trading at a similar discount to book value (38% of BV) but without the near term catalyst of a potential sale. ACR has gone through a few name and manager changes over the years, it was originally Resource Capital (RSO), then became Xantas Capital (XAN), and following a 2020 margin call of their CMBS portfolio, current management came in and once again rebranded. This is my third bite at the apple and is less of a short term event driven idea and more a 2-3 year transformation path back to a normal commercial mREIT.

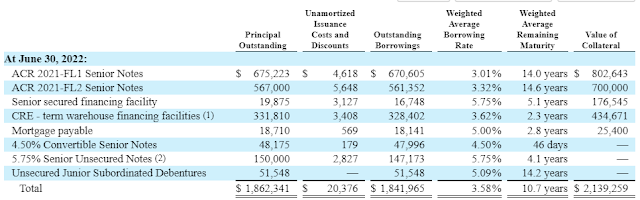

While ACR doesn't have the near term catalyst of WMC, the assets and balance sheet are cleaner at ACR and a majority of the cheap price can be attributed to its small size, current market conditions and lack of a dividend, the latter being the main appeal of mREITs to retail investors. The reason ACR doesn't pay a dividend is two fold, both of which should appeal to readers of this blog: 1) since shares trade at a significant discount, management have been buying back shares, approximately $30MM worth (significant for an entity this size) since November 2020, with $10MM remaining on their authorization; 2) following the 2020 margin call, ACR has a significant amount of both net capital losses and net operating losses ("NOLs"). To monetize the net capital losses, ACR has created a side pocket of opportunistic equity real estate investments with turnaround plans that if executed should generate taxable income or gains. Those proceeds would then be reinvested in the core business of originating and holding transitional commercial real estate loans. The tax asset is valued at $21.6MM (again, meaningful for an entity this size), but has a full valuation allowance against it on the balance sheet. Once the tax assets are soaked up and the shares trade closer to book value, the REIT will turn the dividend back on and retail investors should return.

ACR lays out the tax monetization strategy in one of their slides, but this doesn't include the potential for more accretive buybacks. Shares currently trade for $9.26 vs. $8.19 below and I wouldn't count on it trading for book ($24.48) anytime soon, but the math they layout is quite attractive.

ACR's core business is originating and holding "transitional" commercial real estate loans, this typically means ACR will help a developer or investor finance a value-add property, the equity owner will execute on their plan over a couple year period and then will refinance the property at stabilization, taking out ACR's loan in the process. Over 3/4ths of ACR's loans are to multi-family properties, I remain reasonably bullish on this sector, at least from a lender's perspective. With interest rates increasing, potential new homeowners will be stuck renting for a few more years and ACR's heavy concentration to FL and TX (44% between the two) should have continued demographic tailwinds as people/businesses migrate to sunny skies and lower cost of living geographies. If multi-family properties do get hit, ACR does have a reasonable equity cushion below each loan with a weighted average loan-to-value of 72%. ACR's loans are floating rate, thus should have minimal duration risk, although as rates continue to increase, that added interest expense borne by their borrowers will start to increase credit risk at a certain point.Disclosure: I own shares of ACR

Thank you, as always. Lovely set-up, and what looks like thoughtful capital allocation.

ReplyDeleteAAIC sort of rhymes with this: well under half book, no dividend, has bought back a significant amount of stock in the past few years, has some favorable in-place financing. The knock against them is that management, while now both saying and, it seems, doing the right thing, is the same that utterly destroyed them over the past decade-plus!

ReplyDeleteThanks! I think you mentioned this one before because I have it on my watchlist. Even though management is the same, at least its internally managed. I'm more familiar with commercial real estate credit assets vs. residential in my real life, but AAIC certainly does rhyme, I'll spend some time on it.

DeleteFor what it's worth, I think both AJX and SACH might be interesting given your familiarity and their expertise with distressed/formerly-distressed/hard-money assets. Obviously small-ticket finance REITs are super-blackboxy and time-consuming to look at (and AJX is mostly resi, too), but they are at least very far from plain vanilla and might have some opportunities in conditions that cause others to struggle.

DeleteAnd this definitely isn't your bag, but it's sort of amazing: USEA, a super-tiny Greek-ship spinoff from a tiny Greek-ship company, recently did a $26 million share-and-warrant offering to pay for the equity portion of an $80 million 4-ship fleet expansion.

Share prices tanked, even in the face of higher tanker rates, and the co turned around and bought back 40% of the shares it had just sold for $6 million, announced a further buyback, and sold 2 of the 4 fleet expansion ships for $62 million. This is all over the course of a few months.

It's Greek shippers so I can't imagine it ends with anything other than dilution and heartbreak, but it's amazing opportunistic trading. If they keep it up (I doubt it!) they'll be Teledyne.

AAIC selling the rest of their SFRs, makes the story a little simpler, more dry powder for share repurchases, still saying all the right things.

DeleteAgreed. Still taking a hit to book on operations, which they make up for with asset sales/repurchases. Chosen leverage metric (FWIW) low. More or less treading water, which in this market is a modest win.

DeleteSome big bargains based on trailing, if not prospective, book in the levered smaller/lower-quality commercial RE loan space. Market not believing the marks. Have been looking at GPMT, though it's brain damage city.

https://www.sec.gov/Archives/edgar/data/1332551/000156459022036618/0001564590-22-036618-index.htm

ReplyDeleteQuarter seemed pretty boring, which for a lender is great. One comment I found interesting on the earnings call, they're buying back as much stock as they're able to under exchange liquidity rules.

You probably already know about it, but CMRX maybe-interesting with activist pushing for shareholder return (not sure how to handicap odds here, but gut says sub-50% Rubric gets what it wants). And MACK now a very interesting lower-risk setup; have a bunch and will probably add.

ReplyDeleteI didn't already know about CMRX, does sound interesting, thanks! I owned MACK a long time ago, sold when they raised capital and thus diluted the CVR like payment, need to revisit with the recent news.

DeleteThe remaining variables on MACK are 1) FDA approval, sounds likely; 2) timing of FDA approval, they have fast track designation, but how to handicap timing?; 3) tax leakage, peeked at the 10-K, they had $209.5MM of NOLs, so the Ipsen proceeds above that would get taxed? Do I have that about right?

DeleteAgree with all of that, AFAIK (main/closest milestone will approximate NOLs, and they do have other potentially claimable credits). Small chance they also file in SCLC, which is good for ~$10 if approved--program was not a great success but may still be fileable/approvable based on response and safety. Very small odds of some 3rd indication being approved one day. Minor milestones from Elevation (I have not been following their development, TBH; quick glance says valuing the Elevation assets at a dollar would be generous) and cash on BS, which will likely be gone if they stick around. So odds of approval at your discount rate plus, say, a dollar will determine how good a buy this is. Better buy in the $11s, obviously!

DeleteObv odds AND TIMING of approval. I mentally pencil in a year, though I doubt it's that long.

Deletehttps://danakali.com.au/wp-content/uploads/2022/10/20221003_Term_Sheet_Asmara.pdf

DeleteADL, you may like this one, as a fellow tourist in spicy risk arb

Ooh, thank you, Alex! Funny, I owned some Danakali and sold it earlier this year because I had no particular idea what would happen or when. Now to revisit!

DeleteAnyone has any idea about what is happening with Luby's liquidation trust? Haven't heard anything for a while.

ReplyDeletehttps://www.sec.gov/ix?doc=/Archives/edgar/data/16099/000162828022024293/lub-20220531.htm

DeleteThey did put out a 10-K by in September. I'm not sure if they're going to continue SEC reporting, there tends to be limited financial disclosures in liquidations once they go non-trading.

Thanks, MDC for the pointer. From that 10-K: “ The net assets in liquidation at May 31, 2022 would result in liquidating distributions of $1.96 per unit in the Trust based on 31,300,837 common shares that were converted to units in the Trust on that date.”

DeleteHad a GTC at $7.9 on this for a while which finally struck. Grabbed a bunch more at 7.3 right before the close. Didn’t see any news, did you?

ReplyDeleteI didn't see any news, no.

DeleteAlso, I liked the MACK idea ADL posted above. Risk seems to be mostly baked out. Grabbed some in mid to upper 10s the other day as I can’t find any reason for the dip other than maybe profit taking. ADL - have you seen anything else?

ReplyDeleteBiggest risk with MACK is that we haven't seen the full data yet. That's why it trades at a discount. I think the drug is approvable but with just Ipsen's PR (especially in mPDAC) it's still hard to be highly confident. Ipsen will be presenting data at ASCO GI Cancers on Jan 20th at 4:30pm ET (links below).

Deletehttps://imgur.com/a/ECkEjLe

https://meetings.asco.org/meetings/2023-gastrointestinal-cancers-symposium/297/program-guide/search?q=Napoli

Onivyde almost certainly gets approved in 1L mPDAC now. I estimate MACK NAV at ~$16/share by year end.

Deletehttps://www.businesswire.com/news/home/20230120005252/en/Ipsen-Presents-Phase-III-NAPOLI-3-Trial-of-Onivyde%C2%AE-Regimen-Demonstrating-Positive-Survival-Results-in-Previously-Untreated-Metastatic-Pancreatic-Ductal-Adenocarcinoma-at-ASCO-GI

"We're now in a place where we believe those assets are going to begin to get monetized and the gains will be utilized through those NOLs to increase book value."

ReplyDeleteBit of a change in the cc wording, and if I recall, I believe early '24 was their target.

Additionally, I grew up in TLH/went to FSU, now own commercial in TLH - although I have lived in Chicago for a decade now - but I know the Chapel Dr. property. Google maps street view shows the carpentry nearly complete as of June of this year. I've reached out to one of my buds in TLH commercial RE to figure out if a buyer is known or deal is in the works.

501 Chapel Dr (west side of street) for those who want to play along

DeleteThanks. I did notice that change in language as well.

DeleteThis thing seems to bounce around a lot toward the eoy my surmise 2/2 low float and rebalancing. As I did last year at this time, I have a sizable gtc on for sub $7 hoping to catch someone selling out.

DeleteI think the big downside risk here, as with all of the mreits (and really market as a whole) is an economy roll over.

They rely on the bank/CMBS market functioning, need someone to refinance their bridge loans when they come due, that's the big risk, continued freezing of CRE credit markets. The downside risk is they morph from a mortgage REIT to an equity REIT when they foreclose on borrowers. I'm still holding, but it is a relatively small position that I don't think too much about.

DeleteI sold today, maybe a bit too soon as they've yet to sell the equity properties and turn the dividend back on, but ACR has rallied quite a bit to the point it's not really cheap to peers anymore. Well done by the ACRES team, impressive turnaround with minimal losses thus far through the CRE cycle.

ReplyDelete