MBIA Inc (MBI) ($680MM market cap) is now a shadow of its former self, prior to the 2007-2009 financial crisis, MBIA was the leading financial guarantee insurer in the U.S., where MBIA would lend out its AAA rating to borrowers for an upfront fee. This business model probably never made sense, it assumed the market was consistently mispricing default risk, the fee MBIA charged had to make it economical to transform a lower rated bond to a higher rated one.

In the early-to-mid 2000s, MBIA was leveraged over 100 times, they guaranteed the timely payment of principal and interest on bonds that were 100+x that of their equity, only a small number of defaults would blow a hole into their balance sheet. When the business was first founded, MBIA focused on municipal debt through their subsidiary National Public Finance Guarantee Corp ("National"), with the thesis being that even if some municipal bonds weren't formally backed by taxpayers, there was an implied guarantee or a government entity up the food chain that would bail out a municipal borrower. That has largely proved true (minus the recent quasi-bankruptcy in Puerto Rico), however MBIA was greedy and grew into guaranteeing securitized vehicles (via subsidiary MBIA Corp) prior to the GFC. MBIA and others (notably AIG Financial Products) got caught, finding themselves on the hook for previously AAA senior tranches of ABS CDOs and subprime-RMBS that went on to suffer material principal losses. There was no one up the chain to bail out a Cayman Islands special purpose vehicle with a P.O. box as a corporate address. A lot has happened in the 15 years since 2008, MBIA Corp stopped writing new business almost immediately, National continued to write new business on municipal issuance but stopped in 2017 after Puerto Rico went further into distress, National had significant exposure to island. The business has been in full runoff since then.

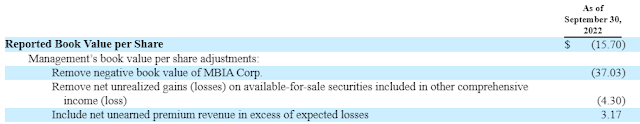

The distinction between National (municipal bonds) and MBIA Corp (asset backed securities) is important, MBIA Corp and National are legally separate entities that are non-recourse to the holding company, MBIA Inc. MBIA Corp's equity is way out of the money, completely worthless to MBIA Inc, the entity is being run for the benefit of its former policyholders. National on the other hand has positive equity value, but when consolidated with MBIA Corp on MBIA Inc's balance sheet, results in an overall negative book value. But again, these are two separate insurance companies that are non-recourse to the parent. The SEC slapped MBIA Inc's wrist for reporting an adjusted book value based on the assumption that MBIA Corp's negative book value was no longer relevant to the parent, as some compromise, MBIA Inc stopped providing the end result, but still provides the components of their adjusted book value (not sure how that's significantly different, but whatever). Here are the adjustments for Q3:

By making these adjustments, MBI's adjusted book value is roughly $28.80/share, today it trades for $12.50/share. The last two items in the adjusted book value bridge are more runoff-like concepts, these are the values that MBIA Inc would theoretically earn over time as the bonds mature in their investment portfolio and erase any mark-to-market losses (largely driven by rates last year) and then any unearned premiums assuming their expected losses assumptions are accurate.

I've kind of skipped over Puerto Rico, I've passively followed it over the years via Reorg's podcasts, it is too much to go into here, but MBIA Inc's (via National) exposure is largely remediated at this point (announcing in December that they settled with PREPA, Puerto Rico's electric utility that was destroyed in Hurricane Maria), clearing the way to sell itself. From the Q3 earnings press release:

Bill Fallon, MBIA’s Chief Executive Officer noted, “Given the substantial restructuring of our Puerto Rico credits, we have retained Barclays as an advisor and have been working with them to explore strategic alternatives, including a possible sale of the company.”

Essentially all of the bond insurance companies have stopped writing new business, the only one of any real size remaining in the market is Assured Guaranty (AGO) ($3.7B market cap). Assured has significant overlap with National that would drive realistic synergies. Street Insider reported that AGO and another company are in advanced talks with MBIA. They're the only true strategic buyer (maybe some of the insurers that bid on runoff operations might be interested too), AGO also trades cheap at roughly 0.75x GAAP book value. AGO would need to justify a purchase to their shareholders that would at least be on par with repurchasing their own stock (which they do constantly).

In my back of the envelope math, I'm only pulling out the negative book value associated with MBIA Corp from the adjusted book value, then slapping a 0.75x adjusted book value multiple on it. Again, the other two items in MBI's adjusted book bridge seem more like market risks a buyer would be assuming and should be compensated for bearing the risk of eventually achieving. AGO should be able to justify paying the same multiple for MBIA Inc since it will include significant synergies. I come up with a deal target price of approximately $16/share, or 28% upside from today's prices.I bought some shares recently (I know, another speculative arb idea!).

Disclosure: I own shares of MBI

I also own this a bit. After seeing you mentioning this on one of your to-do lists in the comment section I thought there was a decent chance you'd join in the dumpster fire!

ReplyDeleteWorth mentioning that insiders have been accumulating (or: gifted themselves) a ton of shares over the years while MBI has been buying back tons of shares in the open market. With the result that as of the latest proxy insiders owned 13% of shares outstanding. The CEO alone owns ~$30m worth of stock. I like those numbers - they own more than enough to have every incentive to strike a good deal, but they don't own enough to easily screw over outside holders.

I think this could be a typical case of a deal where the market doesn't like the uncertainty and complication, even though the company telegraphed pretty clearly that they want to sell and insider incentives are pretty decently aligned. Not sure where the price ends up, could be a turd, but I think odds are in our favor.

If your price target is $16 it might be worth considering looking at some of the option series.

Also, I'm wondering what will happen with MBIA corp in case of a deal. Would AGO have to buy everything? Or will it be stranded somewhere? I can see that being a headache.

/ramblings

Thanks for the thoughts. I sort of have sympathy for the gifting of shares here, who wants to stay at a company with no real future? There's limited individuals who have the skill set to unwind all this mess over the last decade, retention style bonuses of shares makes sense to me.

DeleteI have been looking at options too, may add those.

Good questions - I do wonder why the NY regulator hasn't put this into full rehabilitation yet, taken it off of MBIA's hands. Maybe others that have followed the story or know insurance/insurance regulators more will know. But listening to their conference calls, they seem confident enough that it shouldn't be a problem. Although if AGO did buy them outright, wound throw a wrench into their financial statements, maybe that's worth another additional discount.

Thanks for the excellent writeup.

ReplyDeleteMany long suffering MBI bagholders will be pretty upset over a deal at $16, especially after it traded there on deal speculation recently. By reporting adj book value at $29 they’re essentially guiding shareholders to expect a deal around $20.

I'd welcome $20, but that seems a bit too high. I will probably make the same anchoring mistake with some rumored targets that I'm bagholding too. The ask probably needs to come down a bit to get these deals done in the current market.

DeleteHave you considered how fast their tangible book value per share would deteriorate if the deal doesn't materialize for another year? Would it be minimal in your opinion?

ReplyDeleteMinimal yes, but you could scenario test it yourself, if you think rates or spreads are going to move significantly in one direction or another that could impact their unrealized loss/gain adjustment in the book value. But otherwise, I don't see any major issues with U.S. municipalities? Always could be something if we do get a severe recession.

DeleteAlso own small. Operating supplement is useful here. As of Q3, it shows $1.995b in equity at National and -$868mm at holdco for a net of $1.13bn. I'm not sure I would add back unearned premium as AGO is trading at .75x inclusive of their unearned premium number.

ReplyDeletehttps://s22.q4cdn.com/567650046/files/doc_financials/2022/q3/3Q2022-Operating-Supplement.pdf

Thanks. I feel a bit sill, missed that they published those.

DeleteIf they were to buy back shares or holdco bonds below par, it would probably help.

ReplyDeleteSince CBIO was discussed before and I couldn't figure out a proper place to ask the question, I am posting here. Wondering of one buys CBIO shares today if they would still receive the CVR. CVR was not distributed yet even though the record date for being eligible for CVR is Jan 5th. I am assuming they will be treated as due-bills and will go to the buyer, otherwise the stock would have dropped on Jan 6th. Based on original estimates from the company, for whatever it is worth, of $2.06, after subtracting $1.43 and $0.24, the residual should be worth about $0.39. The stock in pre-market is trading at $0.28. This may be good value if (a) The company estimates are actually realized (b) the one buying the shares today actually recives the CVR. Both are risks of course.

ReplyDeleteCBIO- the cvr went ex on Jan 4th. The dividend went ex today. If you buy today, you are only getting the 2.5% of newco. There are ~1.15B shares outstanding post merger.

DeleteSo, I am a bit confused about how that estimated $0.63 left after the $1.43 dividend breaks down. I suppose $0.63 = $0.24 + CVR + share in new co? How much is the estimated value of CVR and how much of the share in the new company?

ReplyDeleteConfirmation hearing on PREPA deal is not until July. Is it clear that enough parties will agree even though MBIA has ?

ReplyDeleteIf I were AGO, why wouldn't I wait until PREPA deal is sealed?

DeleteMBIA management has claimed they don't it necessary for it to be confirmed. We'll see, maybe it is a sticking point, but given how long this has dragged on, I'm fairly sure that MBIA management has a good sense of what needs to be done for the buyer.

DeleteWhat's with these people, wanting to gamble with other people's money? Another disaster, ANGN wants to buy into a speculative Phase I drug company. Management should be held personally liable for such questionable behavior. ADES was another such.

ReplyDeleteThankfully I hadn't bought that one. It is odd, like no real rhyme or reason why some of these reverse mergers pop and some fall on their face. I think ADES is a slightly different example, but yeah, to your point, gambling other people's money. Investors have the choice to invest in Phase I drug companies on their own.

DeleteAny opinion on CBIO at the current price?

ReplyDeleteSorry, I haven't looked at it recently (after the reverse merger announcement), sounds like others have that might chime in.

DeleteOn CBIO, I have no view now. Just have a piece of the newco at this point I believe.

DeleteFYI, my fave ultraYOLO merger anticipation CLXT announced a deal today. Couldn't recommend in good conscience because this was a company with incipient bankruptcy, and can't recommend now because the whole indie croptech realm is until proven otherwise the land of unprofitable science experiments and broken dreams. Sold half of my position to lock in a profit and keeping the rest. May or may not be worth a look for further upside, but see above.

ReplyDeleteSomebody on Twitter came up with an interesting data point, not sure if it is actionable. For years (I checked the last decade) Assured Guaranty has been incredibly consistent with earnings releases. Check for yourself: https://info.assuredguaranty.com/press-room/all-press-releases/default.aspx . The second Thursday of February they issue a press release stating when F/Y earnings will be released (quarterly earnings follow a similar pattern).

ReplyDeleteThis is the first February since, well, forever, where they didn't issue such a press release. Could be a coincidence, maybe the PR guy has been fired. But the timing seems a bit conspicuous given that they are the supposed buyer of MBI and that such a deal could be in the final stages.

That would be fun, let's cross our fingers, I did add to my position and added options since I published this post.

DeleteMDC, Stock was slammed hard on earnings. Any change in thoughts?

ReplyDeleteThe stock is honestly always slammed hard on news. I’ve often thought about selling before earnings to buy back because it’s getting so predictable.

DeleteThere’s no substantive change as far as I can tell to the thesis.

I agree with the above, hard to see what caused the stock to tank. Still roughly the same situation, earnings call didn't reveal anything negative in my mind, sounds like the process is still ongoing. These things take more time than investors believe.

DeleteHow can they realize value if the sale is off?

ReplyDeleteThey can liquidate by putting the policies in run-off and pay out liquidation dividends. What the present value of that is or how long it takes is of course not known at this time.

ReplyDeleteA bit surprised why no one wanted to buy the company though. Could be some negatives that we are missing.

ReplyDeleteThis is pretty disappointing, stings a bit. My best guess is its a bit of bid-ask problem here, with the stock dropping as much as it has since the beginning of the year, it was probably hard for an acquirer to pay fair value when it would be such a huge premium to the stock price. Maybe a bagholder comment, but slightly positive that they might restart the process again in Q4/Q1 2024.

DeleteIf they just liquidated, what would be the present value?

ReplyDeleteWell the adjusted book value is $28/share, that's the future value in the finance calculator math. But that's in a full run off, most of their insured portfolio would run off in the next five years.

DeleteLooks like MBI book value now is slightly higher at $29 vs price of $8.5. Hopefully, in Friday conference call they will announces something good (like a liquidation).

ReplyDeleteA liquidation would probably take 3-5 years, but might be the best option. Have we (MBI bulls) collectively underestimated the complication of MBIA Corp? Separating it from National, putting it into receivership, etc.

DeleteCould be. Gotta like the repurchases and the open authorization though!

DeleteFrom the call:

ReplyDelete1. There seems to be slight concern about PREPA settlement as other party hasn't filed it in the court, although the company is putting a brave face saying they have a legal agreement.

2. Stock buybacks are a vote of confidence, hopefully. Or do they want to use up the cash/return to shareholders so that nobody can place a claim to it.

https://velazquez.house.gov/media-center/press-releases/velazquez-and-menendez-introduce-resolution-opposing-harmful-debt

ReplyDeleteNot sure about the status of this bill. Could this alter the PREPA Plan of Adjustment materially?

Looks like the Plan of Adjustment hearing postponed to Aug 23rd

ReplyDeletePREPA plan of adjustment was due today. Can not find any news. Does anyone know if it was filed today or did they get yet another extension?

ReplyDeletePREPA plan was filed on Friday.

ReplyDeleteMDC, any change in thesis? Price movement is concerning given the volume is not insignificant.

ReplyDeleteNo major change, I'm still holding. MBIA hinted when they stopped the auction earlier in the year that they would restart it, my guess is that's close to happening. My current concern is somewhat similar to some of the banks, but in a different way, if an acquirer needs to take MBIA Corp, is that really worth the accounting/financial statement headaches? Can these two really be separated? Might end up being a true runoff/liquidation scenario which could take 4-5 years to fully unfold. That's the downside to me.

DeleteMDC, Any thoughts on the quarterly report?

ReplyDeleteJust more pain as we wait for PREPA to be resolved. Now March, doesn't sound like there's anything happening on the strategic alternatives side, just all around disappointing, I've lost a lot of money on this one.

DeleteOne good news is the company can continue to buy back shares at a discount as this drags on. Hopefully it doesn't blow up in the face. At least the management incentive is aligned with ours.

ReplyDeleteAdjusted book value seems to be $26.93. Is that correct?

ReplyDeleteThat's correct. But keep in mind, AGO's adjusted book value is $144/share and trades for $65/share.

DeleteUnless AGO is also in a run off mode, it is probably not a good comparison, right?

ReplyDeleteUm, half agree. MBIA seems set on selling the company (Fallon said so on the call), AGO would be the natural buyer as the last player standing, they're not going to pay a higher valuation for MBIA than their own stock (relatively speaking, maybe could justify a slight premium to where AGO trades to factor in synergies).

DeleteThough ~32% of the AGO adjusted book value is 'net deferred premium in excess of expected losses' whereas for MBI it's just 10%. I think all else being equal you'd rather pay a higher multiple for tangible book today than for expected future earnings.

Delete8$ div declared. Guess Book/Run-off Value is, real enough, for now.

ReplyDeleteThat is fun news, don't often see a special dividend that's more than the current trading price.

DeleteI'm having fun :)

DeleteThoughts on value AH? $8 tax free and the stub now trades < $4 vs ~$12 book value (ignoring unrealizes losses and premium addbacks). And it looks like there should be a decent chunk of cash left in the holding. So hard to value this puzzle though.

DeleteI forget what you call it Writser, but we could have that undervalued stub trade effect, but also hard to put on without using too much capital. On the last call, Fallon mentioned that he still believed selling the company was the best option, curious if that's still on the table and sort of a step 2 in this process. I'll probably hang onto the stub, but undecided about getting aggressive into the dividend payment.

DeleteSingley effect :) The name is not my invention.

DeleteI'm gonna jot down some ramblings here. First of all, it seems likely that a huge distribution from National isn't a complete surprise for insiders. If there was so much excess capital, you'd think early 2023 was a great time for AGO to make a move for National and/or MBI. That, combined with the phrasing in the 8-K about a 'ultimate resolution', makes me think that AGO isn't super eager to engage in a transaction.

Most likely scenarios seem to me that MBI sells National and puts the stub in run-off mode or that they have to do the complete run-off themselves. Seems a bit optimistic to me to expect AGO to buy MBI entirely in a clean transaction for MBI shareholders.

Second: as of the q3 operating supplement, the holdco had ~$520m in invested assets and cash. Adjusted for the distributions that should be ~$750m. As far as I know, until 2030, the company needs to pay off $85m in notes, $170m in investment agreements and $250m in debentures. Seems to me that the holdco as a decent amount of liquidity left and, if they get more distributions from National in the future, some of that money could be distributed to shareholders. Last few years they received high double digit millions from National. A lot, compared to the pro forma market cap. I'm leaning towards thinking the stub looks attractive at the moment, barring any further disasters at National.

Finally, I have seen a lot of noise about PREPA in connection with MBI. However, as of Q3, National also has a huge exposure to LCAR Alexandria. I'm assuming that is this? https://www.alxnow.com/2023/08/31/notes-patent-and-trademark-office-downsizing-puts-alexandrias-largest-landlord-in-hot-water/ . Also quite a bit of exposure to "City of Chicago Board of Education" and "Toll Road Investors Partnership II L.P. Dulles Greenway Project". Any reader familiar with what is happening there? All in all National has quite a bit of exposure to below-investment grate bonds. There could be some more skeletons in the closet ..

I bought a bit more MBI yesterday during after hours, I think I'm fine with a tiny single digit position in the stub at current prices. If they resolve PREPA AGO could still swoop in, that would probably work out very nice for shareholders. And if not I think even in run-off mode there is enough liquidity for shareholders to get some more cash during the next few years.

However, the fact that this is all so complicated means I could be wrong on so many levels. And some more losses at National could quickly wipe out (adjusted) equity. Seems like a risky levered stub, don't think I want a large position in that.

Looks like your after hours buy worked.

DeleteI took most of my chips off the table, because I figure that's what management is doing by paying out the div vs doing more buybacks (and I owned too much of this).

I struggled last night the (good) argument that the stub seems very cheap, but this particular situation I don't love chasing, because, as you say, always room for more skeletons in the closet.

I do wonder what you both think of Ambac, here.

Didn't expect to see this trade at $14+! I'm selling. The stub is up from $3.75 to $6 in a couple of sessions. With adjusted book around $11, well, the former seems much more attractive than the latter.

DeleteYou might have moved the stock $0.50, ha. What's a bit interesting to me about the stub is that they're not dividending out everything to shareholders they're receiving at the Inc level from National. If I'm doing my math right, the HoldCo will have $4.50+/share left in cash from the internal dividend. Could potentially execute more buybacks etc., but maybe I shouldn't get too greedy.

DeleteYou are right. I have a hard time figuring out the fair value / cash requirements of the liabilities at the holding level.

DeleteLike a simpleton my approach has mostly been valuing MBI on an (adjusted) P/B basis, slapping the multiple on it the market is applying to AGO. Which got me to $13 - $16 per share before the dividend was announced. If I use the same approach for the stub I get to ~$9 but I felt that's too aggressive as the stub is worse capitalized. And the upside from $6 to something like $8 doesn't seem that spectacular given MBI is levered and difficult to understand.

Such a complicated company ... Probably I am just overthinking things and got lucky with my extra trading.

Latest Adj BV of $17.09/share against a $6.40/share stock price. Strategy from here is pretty clear, from the conference call:

ReplyDelete"Our first quarter 2024 results were relatively straightforward and relatively unchanged versus a year ago. Our new CFO, Joe Schachinger, will have more to say about these results shortly.

In the meantime, our primary objectives continue to be focused on the resolution of our remaining Puerto Rico exposure and then restarting the process to sell the company."

are you still doing the same calculations for this today? Adj bv of $14.36/share against $3.85. Q2 ccall also talked about continuing sale prcess after PREPA is resolved.

ReplyDeleteI still own it, doing the same math. AMBC sold their business for ~50% of book value, so maybe MBI goes for $7? No insight on the PREPA resolution timing but management didn't seem overly optimistic on the call.

Delete