Sculptor Capital Management (SCU) (~$500MM market cap) is probably more familiar to most by their old name, Och-Ziff (OZM was the old ticker) or OZ Management, but the storied hedge fund manager (one of the first alternative managers to publicly list pre-GFC) has run into tough times in recent years. There was a bribery scandal in the mid-2010s that saw the firm pay over $400MM in fines and in more recent years a public succession spat between founder Daniel Och and current CEO/CIO Jimmy Levin over Levin's pay package.

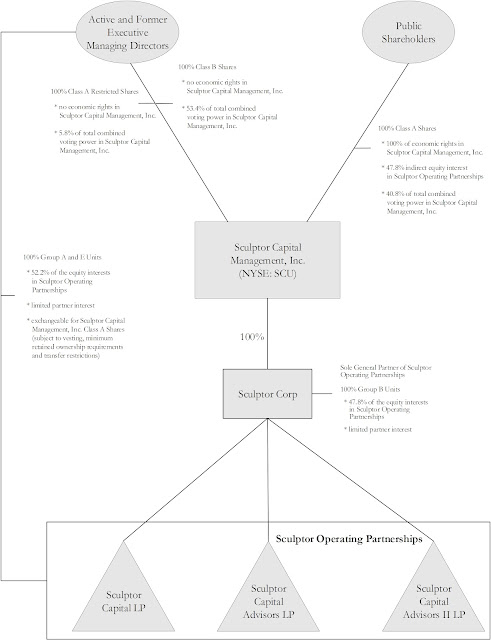

Sculptor today has approximately ~$36B in assets under management, roughly half of which is in CLOs that have lower management fees, with the rest in a mix of their flagship hedge fund, real estate and other strategies. The publicly traded entity is a holding company that owns partnership units in the operating partnership (see the below diagram) which creates confusion around the share count and ownership percentages of the parties involved.

Och left the company in 2018, but continues to own a piece of the operating partnerships and controls ~12% of the vote (Levin has ~20% of the vote) through the B shares. B shares don't have any economic interest in the publicly traded holding company, but are meant to match the economic interest in the operating partnership (if you squint, its one share one vote), if you see it reported that Och owns less than 1% of the company, that's just the publicly traded SCU shares. He's presumably still a significant owner of the business, which makes the current situation awkward and certainly doesn't help capital raising efforts. Och doesn't want Levin running what he views has his company, and Levin doesn't want Och owning a piece of what he views as his company.

In October, Och sent a letter to the board, the key excerpt:

I, as well as other founding partners, have been contacted by several third parties who have asked us whether the Company might be open to a strategic transaction that would not involve current senior management continuing to run the Company. It is not surprising that third parties would see the potential for such a transaction given that outside analysts have previously identified the Company’s management issues and concluded that, at its current trading price, the Company may be worth less than the sum of its parts.

Shortly after, Sculptor's board responded that they're always open to third party offers. The back and forth went on from there, on 11/18 the board formed a special committee, presumably there's an effort being made to either sell the management company in whole to a third party or Levin taking it private and out of Och's hands, or possibly some combination where the CLO business gets sold to a third party and the remaining business is taken private.

What might it be worth? The financials are pretty confusing here, there's a lot of operating leverage in the business, high fixed costs in the form of large minimum bonuses, the business isn't one you'd consider being run for the shareholders first. Last year was a tough year, the flagship fund finished down mid-teens, but a few quarters back, Levin outlined the following "run-rate" expectations for the business:

Today, we have meaningful earnings power, and we generally think about this in 2 buckets. First bucket, management fees less fixed expenses or, said differently, earnings without the impact of incentive income and the variable bonus expense against that incentive income. And the second is inclusive of that incentive income and that variable bonus expense against it.

So in the first bucket, we look at it as management fees less fixed expense, and this went from a meaningfully negative number to what is now a meaningfully positive number, and that's the simple result of a couple of things. It's growing management fees while reducing or maintaining fixed expenses. And the growth in the management fees comes from the flow dynamic we discussed, and it comes from compounding capital within our evergreen funds. And so where that leaves us today is just shy of $1 of earnings per share from our management fees less fixed expenses.

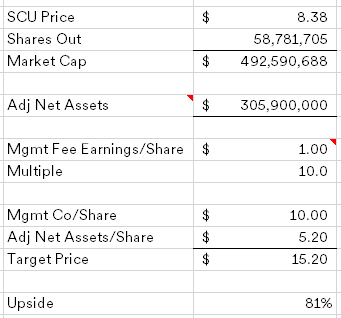

Alternative managers are typically valued on base management fees, incentive fees are often lumpy and shared heavily with the investment team. If we're trying to derive a private market value, $1/share of management fees is a nice round number to use. Most alternative managers trade for a high-teens multiple of management fee earnings, but we'll discount SCU here to 10x to account for the hair and past reputation. Also a third-party might be worried that assets would flee without Levin in the CEO/CIO seat.

Sculptor's balance sheet is in fairly good shape, with $250MM in cash and ~$150MM in investments in their funds, backing out the remaining $95MM term loan gets you to $306MM of net assets. Putting it all together, I get something around $15/share for SCU versus a current price below $8.50.I'm over simplifying things here, I could be making an obvious error, but the current structure doesn't seem to work for Och, Levin or the business. Some corporate action needs to happen and there's plenty of candidates that would be interested in this business. If the status quo prevails for some reason, the stock seems cheap anyway, the company seems to agree as well, they have spent $28.2MM of a $100MM stock repurchase authorization (significant compared to the Class A float) as of their Q3 earnings.Disclosure: I own shares of SCU

How do they get Levin to go along with a sale? His incentive is to drain equity value from the business via compensation and then agree to a take private when he can buy the business as cheap as possible. I think the key question is when is it cheap enough relative to his potential compensation. It would be interesting to look at the historical incentive pool and think about whether the next couple years are likely to have strong incentive performance (which would motivate Levin to delay the take private).

ReplyDeleteIt seems pretty cheap now and so I think the incentives align pretty well. I doubt it gets sold in one piece to a third party where Levin "would go alone with the sale", my guess is the CLO business gets sold (these trade hands relatively often) and then Levin takes private the rest with the proceeds basically. Buys out Och and all minorities. The status quo doesn't seem to work for Levin because fund raising will be difficult under this shadow of uncertainty, its a big distraction.

DeleteNice write up. What do you make of the $10m spent on legal fees for the special committee in Q4? Not to speculate, but does it make you think a deal is already in motion, or that the company is taking the sale process more seriously?

ReplyDelete"Our GA&O expense trended higher during 2022, since we incurred approximately $10 million of elevated legal expenses related to the books and records actions and the activities of the Special Committee of our Board of Directors."

Not sure to be honest, might also include pre-process legal fees for the back and forth between Levin and Och.

DeleteHas management released any estimates on the remaining stub value?

ReplyDeleteHave you looked at CPPTL?

ReplyDeleteI have, seems interesting, but unfortunately I can't buy that one with the restrictions my broker puts in place.

DeleteHi man,

ReplyDeleteFirs of all thank you so much for you work.

Always learn a lot reading your blog as an investor starting the journey.

I also have a curiosity, that if possible I'd like to have an reply for you, how has this investing style been for you in terms of CAGR returns?

Thank you so much!

Every 6 months I disclose that, as of 2022 year end, my CAGR is just over 21%.

DeleteEMBK seems interesting. Current Assets - All liabilities is about $161 million as of Sept 30th, 2022. Operating expenses were about 37 million per quarter. On March 3rd they had fired 2/3rds of the 300+ employees. That should bring down the cash burn significantly. Worth watching what the numbers look like in the latest 10Q that should be out soon. I don't know what to make of the following statements in the 10Q though. How much of an adjustment to be made to balance sheet.

ReplyDelete1. As of September 30, 2022, there was $75.7 million unrecognized stock-based compensation expense related to outstanding PSUs granted to employees, with a weighted-average remaining vesting period of 7.4 years.

2. As of September 30, 2022, the total unrecognized compensation related to unvested stock option awards granted was $3.40 million, which the Company expects to recognize over a weighted-average period of approximately 2.1 years.

3. As of September 30, 2022 there was $41.1 million unrecognized stock-based compensation expense related to outstanding RSUs granted to employees, with a weighted-average remaining vesting period of 3.0 years.

The current market cap of EMBK is $58 million.

I did spend some time with this one, don't know what to make of the stock-compensation expense you mention, but I assume it is all worthless now. My issues are more with the cash burn, that it is a controlled entity, has a lot of fraud claims lobbed against it in the past, and just more nervous about de-SPACs in general. Require more of a margin of safety compared to the similarly situated biotechs in my mind, but maybe I'm being too conservative. It is worth monitoring this one.

DeleteThanks for the idea! Any recent sales comp? 10x sounds a bit high esp. if you are including incentive and bonus expenses.

ReplyDelete*excluding

DeleteIt is not excluding bonus expenses. But I think 10x management fee earnings is actually a bit low, most of the alts trade in the range of 15-25x, but to be fair, those are growing where SCU is just treading water. 10 is a nice round number, but pick your own value, after backing out the balance sheet, the market is putting a very low multiple on the asset management business.

DeleteNEW YORK - (BUSINESS WIRE) — Rithm Capital Corp. (NYSE: RITM; “Rithm”), an asset manager focused on the real estate and financial services industries, and Sculptor Capital Management Inc. (NYSE: SCU; “Sculptor”), a global alternative asset manager with $34 billion in assets under management (“AUM”)(1), today announced entry into a definitive agreement under which Rithm will acquire Sculptor in a transaction valued at approximately $639 million(2), which includes $11.15 per Class A share of Sculptor.

ReplyDeleteI'll take it! As usual, I was a little over optimistic on the price, but this one turned out pretty well.

Delete