Check-Cap (CHEK) (~$12MM nano cap) is an Israeli based clinical-stage medical device company that is trading well below cash and recently announced that it hired Ladenburg Thalman (they've generated a few buzzy reverse mergers in the past) to run a strategic alternatives process. The company previously was developing a colon cancer screening test but those efforts failed and alongside the strategic review announcement, Check-Cap also announced they are laying off 90% of their workforce, fully raising the surrender flag.

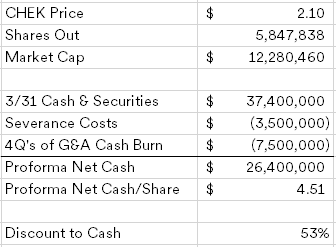

Running it through a really basic liquidation analysis (it should be noted the company didn't include a liquidation in the list of strategic alternative options, but rather they're looking at a sale, licensing agreement or reverse merger):

The severance costs for the 90% reduction in force weren't disclosed, so that's a guess, along with the G&A, but this one still trades at a wide discount to what it could distribute in a liquidation. Now there are some red flags, I don't see a significant shareholder to protect shareholder interests and the foreign company listing and raising money in the U.S. risk is present here, although not entirely uncommon for biotech/bio medical device companies to be based in Israel.

Note this is a tiny company, don't use market orders, but the discount here is wide enough for me to add a small position to my growing basket of broken biotech liquidation candidates.

Disclosure: I own shares of CHEK

Aww, I was still trying to buy some shares! Should have been more aggressive. Anyway, I more or less agree with you. Seems cheap, but there's also a whiff of fraud here. Israeli company, nothing is known about the shareholder base and their invention is either revolutionary or fabricated out of thin air - the share price suggesting the latter.

ReplyDeleteYeah, I hinted at the same above, not the most confidence in their go forward plan here, don't love Israeli companies that are listed in the U.S.

DeleteDirectors and Execs own < 1% of the stock, I don't see any incentives to do a liquidation or maximize proceeds for shareholders. Israeli companies tend to keep the money in the Israeli VC ecosystem.

ReplyDeleteRight, I agree. This won't be a straight liquidation, but the large discount to cash and with Ladenburg Thalman on board, maybe a reverse merger works here.

DeleteThey will reverse merge with an electric motorcycle company.

ReplyDeleteWouldn't surprise me.

DeleteThe other problem beyond governance is heavy Israeli tax/withholdings on dividends paid to US shareholders. IIRC it is 25%, though I believe you can reduce it to 12.5% by filing a form.

ReplyDeleteRandy - nVariantCapital

Looks like my concern might not be viable. BackWeb got a ruling when they liquidated that foreign shareholders would not have witholdings on their distributions, but you had to fill out a form. https://www.businesswire.com/news/home/20130828005097/en/BackWeb-Reports-Progress-on-Liquidation-Plans

DeleteI mentioned in the post and still have the view that this won't be a liquidation, so not sure if this is a top of mind issue right now. It will likely be a reverse merger.

Deletehttps://www.stocktitan.net/news/CHEK/symetryx-corp-announced-a-non-binding-proposal-to-acquire-check-cap-nqyxh8qyxocd.html

ReplyDeletenon-binding proposal for $4.35/share in cash

Thanks, didn't see that. The market sure is skeptical of this management team doing the right thing.

DeleteYes, I was surprised to see the current discount as well. Guess the market isn't sure if this will go through.

Deletehttps://www.prnewswire.com/news-releases/symetryx-corp-increases-non-binding-offer-to-acquire-check-cap-to-4-60-per-share-301885226.html

ReplyDeleteSymetryx has increased their offer. Unfortunately, CHEK didn't respond to their first offer, but now Symetryx is threatening to launch a tender.

I guess there's also the question of whether this offer is legit. Consider me skeptical about an offer without any contact information, no filings, no names, etc. It could be this guy (https://www.linkedin.com/in/barry-r-shiff-b957248/?originalSubdomain=ca), who also seems to have an Israel connection. But it could be an impostor too. It all seems a bit suspicious ..

DeleteI trust your spider sense on these questionable offers more than me. CHEK has always felt a little off, certainly worked out splendidly so far, but makes me nervous.

DeleteWouldn't surprise me if this is a ploy to keep the money within the Israeli funds instead of handing the cash pile to an American capitalist. It's a tough spot, maybe they will sell to their friends and it'll lead to a good outcome for the shareholders but the lack of insider ownership makes me wary.

DeleteYou likely would've come across this already, but do you have thoughts on BLPH? Last month they had announced that they are laying off all their employees (including executives), and shared around $2 million in total severance cost (https://investors.bellerophon.com/node/10521/html). They also said they are terminating their existing clinical trials and exploring business restructuring. Their share price got plowed this morning after receiving a delisting notice from NASDAQ.

ReplyDeleteIt now looks very compelling based on the Q1 numbers but the only hair in the soup is that they haven't shared their recent cash position.

I'm curious as to why it plunged 32% today, only news is delisting which doesn't seem like ti would trigger such a huge decline. It's so tough dealing with informational asymmetry in these situations.

DeleteAgree the delisting notice shouldn't cause the decline, but these really small ones suffer from some negative operating leverage even in a liquidation. Some costs are fixed and the smallish cash balance doesn't provide that much cushion, need to have a pretty sharp pencil to get these right. I prefer ones that are just easier to swag.

DeleteThat doesn't sound like much fun;) I'm proceeding on the assumption that someone who owns BLPH isn't allowed to hold delisted stocks, and built a position today. Hopefully it will be fun and not a learning experience.

DeleteIs this trading more for liquidation value at this point? $3.66/share with updated cash

ReplyDeleteIf we do not successfully complete a strategic transaction, our board of directors may decide to pursue a dissolution and liquidation of our company. In such an event, the amount of cash available for distribution to our shareholders will depend heavily on the timing of such liquidation as well as the amount of cash that will need to be reserved for commitments and contingent liabilities.

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001610590/000117891323002696/zk2330048.htm

The quarter seems pretty in-line to me. You to have to remove the severance costs I had above, I still have approximately the same liquidation value.

DeleteAnother one bites the dust.

ReplyDeletehttps://finance.yahoo.com/news/keystone-dental-holdings-check-cap-210800347.html

I saw the press release and was feeling happy about it given the almost 100% premium on closing. I guess the market isn't optimistic about the deal going through?

DeleteProbably not optimistic about the value of the company. Trading a bird in hand for a single bird in the bush.

DeleteIt’s conceivable it could work out though. Depends on what the margin is on those revenues.

Coming back from a little family vacation. The price action on this one was pretty negative, but for a reverse merger, this doesn't seem *too* terrible.

Delete1) It appears to be a real company, they do have revenues, most of these reverse mergers reset the clock by buying a pre-clinical stage company. That's not the case here, although they don't appear to be profitable.

2) KSD will be based in the U.S. which should help the multiple. This deal seems to creatively solve the issue of getting cash out of Israel, KSD has some R&D and manufacturing there, but is based in Irvine.

3) At today's price (~$2.68/share), the implied value of KSD is around $100MM, that's less than 2x 2022 sales. Presumably this is growing, at least the presentation made it sound that way.

I'll hold for now. Could always change my mind, but this outcome on its face is better than I expected for a reverse merger.

Do you think dilution is a concern here? The merger agreement didn’t specify how many shares are going to be issued to complete the merger. I feel like that’s a pretty important info. they intentionally left out.

DeleteCHEK shareholders are going to own 15% of KSD. So they'll be issuing approximately ~33mm shares.

DeleteI sold today into the 20+% rally. Might continue to run as medical device investors rotate in post closing.

DeleteInteresting to note that Symetrix at least seems to be legit, filing a 13D with NBSE yesterday ( https://www.sec.gov/Archives/edgar/data/1173281/000121390023072694/0001213900-23-072694-index.htm ) . It's indeed Barry Shiff.

ReplyDeleteNeubase itself might be interesting.

I looked at NBSE when it announced strategic alternatives, not sure why I passed, but I'll take another look. Thanks for pointing it out.

DeleteWhat are the chances of the merger going through? After receiving multiple calls to vote on my proxy (after I had already sold the shares) being the record holder, instead of letting the vote go to waste, voted against it. If there is a chance of merger failing, the stock may be worth a gamble. Any thoughts?

ReplyDelete