Graphite Bio (GRPH) (~$130MM market cap) is a clinical-stage gene editing biotech that paused development in January for their lead asset, nulabeglogene (a treatment for sickle cell disease), following a serious adverse event in the first patient dosed. About a month later, Graphite Bio made the determination to explore strategic alternatives and did a large reduction in workforce. In the months since, the company sold their IP in a couple transactions for nominal amounts, the CEO resigned to pursue other opportunities and they did a further layoff.

In August, the company brought in Kim Drapkin as the CEO (plus just about every other relevant executive function) to lead the strategic alternatives process. Drapkin was previously the CFO of Jounce Therapeutics (JNCE), a similarly situated broken biotech, which accepted a cash bid plus a CVR from Kevin Tang's Concentra Biosciences (Tang does own ~4% of GRPH). Interestingly, as part of Drapkin's compensation package, she receives an additional $200k in severance if a definitive agreement is reached within 3 months of her 8/21/23 start date:

The Company entered into a letter agreement, dated August 21, 2023 (the “Start Date”), with Ms. Drapkin (the “Offer Letter”). Pursuant to the terms of the Offer Letter, Ms. Drapkin will be entitled to a base salary of $550,000 per year. In addition, Ms. Drapkin will be entitled to cash severance payments in the amount of (i) $400,000 in the event of a termination of her employment other than for cause or death upon or within 12 months after the closing of a strategic transaction, plus an additional $200,000 if the definitive agreement for such strategic transaction is executed within three (3) months after the Start Date or (ii) $350,000 in the event of a termination of her employment other than for cause or death upon or within 12 months after the Board’s approval of a plan of dissolution of the Company under Delaware law, in each case subject to Ms. Drapkin’s execution and non-revocation of a separation agreement and release, as further provided in the Offer Letter.

While that's not enough to ensure a deal is reached in that timeframe, it certainly points to the expectation of a quick deal when she was brought on board. Another attractive quality to GRPH, their net cash position (after deducting current liabilities) is well over $200MM, that's a meaningful amount of money to many potential bidders which should increase the quality of any deal counterparty compared to some of these true micro/nano cap broken biotechs.

The one large red flag here is their operating lease liability; near the top of the recent craziness, GRPH entered into a 120 month lease for some office and laboratory space in San Francisco (which only started after they raised the white flag).

On December 16, 2021, the Company entered into a lease agreement with Bayside Area Development, LLC (“Bayside”) for 85,165 square feet of office and laboratory space in South San Francisco, CA. The lease for the office and laboratory space commenced in April 2023. The term of the lease is 120 months with the option to extend the term up to an additional ten years. This option to extend the lease term was not determined to be reasonably certain and therefore has not been included in the Company’s calculation of the associated operating lease liability under ASC 842. During the three and six months ended June 30, 2023, the Company took possession of the Bayside lease and recognized a $32.0 million right-of-use asset and corresponding lease liability upon the lease commencement date. In addition, the Company recognized $27.2 million in leasehold improvements. Bayside provided a tenant improvement allowance of up to $14.9 million, of which $14.7 million was utilized and recorded in lease liability.

In connection with the Restructuring Plan, the Company has determined that it will not utilize this facility for purposes of its own operations, and as a result, intends to sublease the vacant space to recover a portion of the total cost upon recognition of the lease.

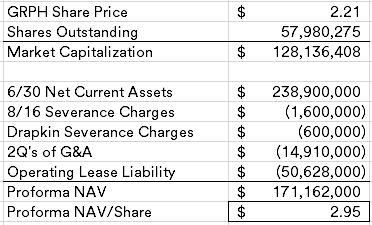

They've yet to sublease the space or negotiate a termination payment with their landlord. Given the state of Bay Area office space, it might be advisable to assume the entire long term operating lease liability against the NAV.

I'm going to assume only two quarters of G&A versus my normal four, to account for the time it has already taken since the original announcement plus the three month incentive fee, it doesn't appear this one should take too long once the operating lease is neutralized in one way or another. Although the default expectation with these should be a reverse-merger, the odds of a simpler cash deal should be higher given Drapkin's experience at JNCE.Disclosure: I own shares of GRPH

I like it. This may get pushed down more in the coming months for tax loss purposes too?

ReplyDeleteI hadn't thought about that, but maybe. Although their drug failed way back in January, I'd guess that most people who owned before that have already taken the loss and sold.

DeleteThis looks like the cleanest net net in a while, Im sure there is a way to workout the lease at some favorable number but even at full cost it isn't the end of the world.

ReplyDeleteWanted to see what your thoughts are with NXDT since the latest supplemental came out.

As always thanks for writing.

I don't have any detailed thoughts on the NXDT supplemental, haven't spent that much time with it. But overall, I'm just disappointed that they don't appear to want to (can?) make the story simpler. Get out and tell the story, maybe this is just destined to be their sandbox for random investments.

DeleteI've been extremely disappointed too as I generally consider Nexpoint a good capital allocator. If they were planning on this being a sandbox we would never have seen James buying shares at much higher prices than today in open market transactions and own 18% of S/O. I think interest rates really hit them from cashflow / asset values. Repositioning cityplace probably is not something public shareholders like even if they had better disclosure. Management fee is being paid in new issues shares if I remember correctly, maybe they are trying to build their stake at a low valuation before they actually try to turn the ship. I'm a holder

DeleteI'm still holding as well, but also not really considering adding until we see a change in strategy.

Deleteexcelent thank you

ReplyDeletethe operating lease liability you are using ($50mm) is an NPV, not a gross liability number. isn't there some decent risk the liability ends up being the full gross number (if they can't negotiate it down of course) and thus much higher than this NPV? they do not disclose the discount rate they use to calc the NPV, other than saying it would be their incremental borrowing cost - but let's assume its pretty high, given the state of this co and general interest rates; and therefore that the grossed up total lease liability could be substantially higher than the NPV number.

ReplyDeletehow do you think about this risk?

8. Operating Leases

DeleteAs of June 30, 2023, the current and non-current portions of the total liability for operating leases was $2.9 million and $50.6 million, respectively.

As of June 30, 2023, the weighted average remaining lease term on the operating leases is 111 months. The weighted average incremental borrowing

rate used to determine the operating lease liabilities included on the condensed balance sheet was 10.9%.

The above is an extract from the latest 10Q.

So, presumably, the gross value would be ~ 130m ( 50*(1.109)^9.25

Delete06/30/23 10Q footnote for Operating Leases shows the undiscounted future minimum lease payments of $88,356,000

ReplyDeleteThat's right. I'm using the NPV of it for now, most of these terminate their leases for much less than the liability on the balance sheet, but here, it seems like a little more of an issue and I wanted to be reasonably conservative. Maybe its $20MM? $30MM? Unlikely it is $50+MM, but we'll see.

DeleteYeah. This is just my common sense opinion, I could be missing something, but from the perspective of the lessor it also seems pretty stupid to turn down a ~$50m offer to buy out that lease. First of all, $50m right now doesn't sound too bad compared to $88m over the next ten years given current discount rates, credit risk, etc. And on top of that they can lease the building to somebody else! I think the equilibrium price to settle that lease should be closer to $20m than to $88m.

DeleteLooking at the most recent 10Q and the 8K disclosing the Drapkin compensation structure I had a few questions and concerns I was hoping to get answers to here:

ReplyDeleteIt looks like Drapkin will get 550k/year (nice work in you can get it?!), 400k for the closing of a strategic transaction, and 350k if the strategic transaction is a dissolution. So in that way, the massive salary and even bigger bonus seems to incentivise a dissolution (liquidation) (at least on a absolute dollar basis) I think.

In that case Drapkin would get 1.3m and SGA could be assumed to go for 4Qs incurring ~30m. Then there would be the costs associated with the actual liquidation process... (2m? just guessing here).

Now they mentioned severance of 1.6m which was related to 18-Aug, whereas the termination/resignation of the previous CEO, Dr Lehrer was effective 21-Aug-23. In that case I am not sure if the 1.6m includes severance payment due to him, or whether they will be reflected in the financial statements in the coming Q (Sep-23) - any guidance on that would be much appreciated.

Finally, while they discontinued their nula-cel program in Feb, they only "transferred to another third-party" their "non-genotoxic" in Aug-23. Now, that, to me implies that the R&D costs for Q2 (Apr-Jun 2023) would be related to this "non-genotoxic" program as the nula-cel program was discontinued in Q1. The Q2 R&D was ~13.5m. Assuming it ran for 5 weeks in Q3 that would mean another ~5.6m (5/12*13.5m) in R&D expenses would it not?

Accounting for the costs identified above in addition to all the balance sheet liabilities etc., but adding 4% interest for the net cash balance (say +~6m over 12 months) I get a net cash balance of 152.5m or 2.63 per share.

I would very much appreciate being told where I have made mistakes in my understanding of the costs and why my alternate scenario is inappropriate/inaccurate etc.

Thank you

No obvious mistakes, don't think there is a "right" answer here. Just a matter of how detailed you want to get and how you think the different scenarios play out.

DeleteI think there's one mistake: the dissolution bonus is not on top of the strategic transaction. It's or/or. Either she gets $400k (or $600k if she's quick) for a reverse merger or she gets $350k for a dissolution. Incentives are geared towards a quick reverse merger, not a liquidation.

DeleteThanks both, much appreciated.

DeleteWritser, re-reading that paragraph several times I think you're right. While subtle, it really does skew incentives towards a strategic alternative that is not a dissolution/liquidation.

I do not interpret it as incentivizing a reverse merger in particular given the wording, and given the recent cash + CRV deal that would likely be a much better option vs the reverse merger lottery.

There's also a 1Mar24 incentive as they issued retention bonuses paying out until then. Some other tweaks I see to the numbers are a slightly larger share count (~1.35mm founder shares on pg16 last Q and unvested RSU's issued dec'20?, some dilution from ~3mm recent options at a 2.19 strike?) gets me to more like 59.53mm diluted shares in a liquidation. The selling of their main IP for a 20% equity stake in a startup points to liquidation as unfavored. The large cash balance and sparkling new office space are maybe attractive for a reverse merger startup but the history of a previous reverse merger deal + a patient death in the trial maybe offset that? How large a discount to liquidation value would a Concentra demand to step in with a bid?

DeleteDid you have any thoughts on BLPH? probably too small for you..

ReplyDeleteYeah, too small. Not just from an accumulating a position perspective, but there are a lot of fixed costs in a strategic alternatives or liquidation process. Some of these are just too small, creates a really tight margin for error.

Delete8K filing describes the Bayside lease terminated for a ~37mm cash upfront payment and handing over their FF&E

ReplyDeleteThanks for pointing it out. Yeah not the best outcome but not the worst either, good to see progress being made. I'm guessing with that out of the way, next steps in the strategic review should follow shortly.

DeleteWhere are they getting the $58 million figure from? Not comporting with what I read in 8-K. Article: https://www.bizjournals.com/sanfrancisco/news/2023/11/02/sfbt-digest-thursday-doordash-braphite-bio-uber-sf.html

ReplyDeleteSeems like just a reporting error.

DeleteAnyone tracked down the Healthpeak REIT comment on it? A few articles seem to have maybe picked up that larger number from their filings

Deletehttps://therealdeal.com/sanfrancisco/2023/11/01/gene-editing-firm-pays-58m-to-exit-south-sf-lease-early/

"Graphite Bio has already subleased a 32,000-square-foot portion of its space to Soleil Labs, according to the company’s filing with the SEC. The drug discovery subtenant has one year left on its sublease. Once the deal expires, the subtenant will become a direct tenant of Healthpeak for another six years, the filing shows.

The $58 million figure is equivalent to five years of rent payments and operating expense reimbursements under the terms of the lease. The amount includes a $21 million tranche that covers future rent credits for the subtenant."

Healthpeak's 10Q obviously spun the transaction to make it look as attractive as possible for them. But I think a clear reading of it and Graphite's disclosure is that GRPH only has to pay $37M to get out of an lease carried at a present value of $53M in their liabilities (and $88M in future lease payments).

DeleteNew 10q out. Looks like g/a burn a little higher than anticipated but lease loss better than anticipated. All in all, about on track?

ReplyDeleteYep, I think so, we're coming up on the end of the 3 month clock. Maybe something happens in the next week.

Deletehttps://www.businesswire.com/news/home/20231115881807/en/

ReplyDeleteReverse merger route, at least this is with a late stage biotech. Plus a $60MM special dividend which is a little over $1/share.

Anyone with thoughts on LINZ's science? Phase 3 readout in the first half of 2024, might be worth holding the stub?

I'm a tourist on the science but there are head to head (eyeball to eyeball?) comparisons of their active ingredient to the already approved competition published all the way back to 1970 (https://bjo.bmj.com/content/bjophthalmol/54/8/510.full.pdf). Aceclidine has been in use for a type of glaucoma in Europe (including the USSR!) for a long time it sounds like with some patients on it for 40y+ already. There does seem to be a lot of competition coming from other twists on the active ingredient that Vuity (the only FDA approved treatment currently, Pilocarpine by AbbVie) uses or other existing glaucoma drugs.

DeleteDoesn't show confidence on the deal's merits that GRPH management signed a support agreement with 52% of shareholders... minority shareholders functionally have no voice on a deal where GRPH holders are contributing the majority of the post-deal cash (115/225mm) for a ~30.7% stake after the PIPE dilution.

I can see some more biotech investors stepping into the stock. Pro forma for the dividend and merger the combined company is trading around the presumed net cash. Going to hold my position for the immediate future.

DeleteA daily eye drop to eliminate age related near sightedness would seem to be a blockbuster drug, I'd be a customer for it thats for sure (have reading glasses stashed in car and 3 locations in house right now so I am never too far away from one). I'm doing the research to consider holding the stub post-dividend, the two big questions are likelihood of approval, and competition.

DeleteOk, after doing all my reading, I really like this deal. If they can do what they claim, it should be a significantly better treatment than Vuity (or any Pilocarpine based drug). Here are my thoughts, if you think I am right, I don't need to hear it but if you think I'm wrong, please speak up!

Deletehttps://open.substack.com/pub/nvariant/p/grph-pulls-off-a-miracle?r=27dyg&utm_campaign=post&utm_medium=web

Any idea how well Vuity is selling?

DeleteAbbVie reported revenues of $207M in "other eye care" for Q3, and $622M for 9 months of 2023. But that's not just Vuity, it includes Xen, Durysta, Ozurdex, and Refresh/Optive. Haven't been able to break them apart, but revenues for the entire segment are up about 14% over last years Q3.

DeleteThey also reported taking a big writedown on Vuity in September 2022, "the company made a strategic decision to reduce ongoing sales and marketing investment related to Vuity... Based on the revised cash flows, the company recorded a pre-tax impairment charge of $770 million." It appears that asset was increased by $1B across multiple products the year prior. So it looks like they had huge expectations and it fell short. How short is difficult for me to parse out so far.

So the question is what is holding Vuity back in the market, and does Lenz address those concerns?

The only negative review I've found so far is an article from the NY Times. She said Vuity stopped working too soon (can only be applied once per day), stung on application and left her eyes red. She felt benefits weren't worth the $3/day expense. Lenz should work roughly twice as long, is that enough to address her main complaint? And no ideas on whether Aceclidine will sting/turn eyes red though Lenz claims its "well tolerated'. The Glaucoma treatments that use it (Glaunorm) report side effects like Vuity, along with excessive salivation/slow heart rate, but they are using 10 times higher concentrations than Lenz.

DeleteFailed biotech's are not always choosing to liquidate, but rather preferring reverse mergers with other bogus companies. Management seems to be motivated to hold on to their jobs or may be it is easier than liquidation. Either way, unless there is a very strong hedge fund that cares about preserving cash going merely by liquidation value a company announces "strategic alternatives" is seeming risky.

ReplyDeleteManagement usually don't keep their jobs in a reverse merger, the target takes over, its truly a backdoor IPO. But I think the motivations of management aren't always aligned with shareholders, biotech at that level is a close knit community, everyone is trying to hit it big, do good for humanity/healthcare, they don't see the benefit in a short term gain in a liquidation. More behavioral things at play here.

DeleteAnd yes, broken biotechs are risky, that's why I've been taking the basket approach.

Are you holding through rm? How do you generally think about/approach rms?

ReplyDeleteThere's no one playbook that I follow with reverse mergers, back when they used to pop on the announcement, I usually exited. But in the current market it is a little more nuanced, here they're going to distribute some cash to us and the NewCo has a late stage asset that at least some here believe has a chance to be something valuable. I don't anticipate being a long term shareholder, but occasionally when the deal closes, the name changes, some more traditional biotech investors step into it.

DeleteWhy didn't the price move up more yesterday given the LENZ news?

ReplyDeleteWhat was the news?

ReplyDeletePlease ignore the Lenz news 6:57am comment. I misread an article.

ReplyDeleteHi @MDC, have they already made the special payment to the GRPH holders? Thanks!

ReplyDeleteNo, not yet, that'll happen on the close of the merger.

DeleteAnyone still holding here? Seems a little frothy

ReplyDeleteIt's a fair question. I'm still holding for now, LENZ will have their phase 3 read out in Q2, so it'll be a short wait to see if this is a hit or not.

Deletehttps://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1815776/000119312524063785/d784350d8k.htm

ReplyDeleteGraphite just announced $1.03/sh special dividend. Nice!

Also nice to see a CEO do what she said she'd do. I'm no longer holding because I found some better opportunities elsewhere, but still hopeful that LENZ will workout for shareholders, and for customers as well (which I hope to be one).

DeleteI'm a bit surprised you're no longer holding, care to share some of the better opportunities you see?

DeleteA lot of stuff that hasn't done nearly as well as GRPH :( Currently biggest positions FRTX, LIAN ACRS, RHPM, and SRG.

DeleteMarket is oddly inefficient, unless I'm missing something, stock is up quite a bit on the special dividend news, although that was already communicated.

DeleteI've decided to sell on this pop. I have enough "science" in my portfolio at the moment, but wish LENZ well.

DeleteLenz ripped today

ReplyDelete