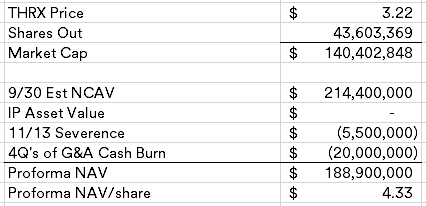

Theseus Pharmaceuticals (THRX) (~$140MM market cap), a cancer therapy researcher, is the latest addition to the broken biotech basket trade. This week, Theseus announced a 72% reduction in workforce and the exploration of strategic alternatives "to consider a wide range of options with a focus on maximizing shareholder value, including potential sale of assets of the Company, a sale of the Company, a merger or other strategic action." The company hasn't reported for Q3 as of this writing, but did disclose an estimated cash and securities balance of $225.4MM in the same press release.

The 6/30 cash and securities balance was $234.2MM, so the company only burned a bit under $9MM during the quarter despite attempting to push forward a few early stage programs (which may have some value?) after shutting down their Phase 1/2 trial for their lead candidate in mid-July, pointing to some expense discipline here. Otherwise the balance sheet is fairly straight forward, there's a small lease obligation (already backed out in my NCAV number) and no debt. Despite jumping 50% on the strategic alternatives news, I still think this one is attractively priced.Disclosure: I own shares of THRX

Posted right after yours

ReplyDeletehttps://generalsandworkouts.substack.com/p/theseus-pharmaceuticals

Nice write-up, more thorough than mine, others should read it before getting involved.

DeleteHave you looked into Talis Biomedical (TLIS)? $13M market cap, announced pursuit of strategic alternatives, laid of 90% staff, revealed $88M cash position, has $25M total liabilities (including lease). Even with a hefty severance and a reasonable cash burn rate, there seems to be a good value gap.

ReplyDeletehttps://investors.talisbio.com/news-releases/news-release-details/talis-biomedical-announces-exploration-strategic-alternatives

DeleteI have yes, I think the market cap is more like $27MM when you exchange the convertible preferred stock. But it is an interesting one, I like that Baker Brothers are in control and they seem determined to stem the cash burn. As typical, there are a lot of NOLs here, possibly Baker Brothers could do something creative and stick a real operating business inside the shell. It's a bit messy, so I haven't taken a position yet, but it is intriguing to me.

DeleteNo position in TLIS (yet) but I struggle with whether the class action lawsuit against them around the IPO disclosures will slow down its resolution. In the Q it says initial stages of discovery are underway, good reverse merger candidates wouldn't want exposure to that and a liquidation would presumably wait for that to get resolved. It's a small enough entity that paying a nuisance fee to settle combined with a slow process could hurt.

DeleteDoes Baker Brothers have a track record of treating minority interests reasonably well when they've been in a control position?

I try to stay away from the biotech's that have announced strategic alternatives but don't have a large activist shareholder. I've noticed without a large activist shareholder, the possibly of a reverse merger going through is higher. Just my 2 cents.

ReplyDeleteThat's fair, I might need to refine the approach a little.

DeleteAre there any current biotechs that have announced strategic alternatives that do have a large activist at the moment?

ReplyDelete13D filed by Tang - "On behalf of Concentra Biosciences, LLC, I am pleased to submit this non-binding proposal to acquire 100% of the equity of Theseus Pharmaceuticals, Inc. for $3.80 per share in cash, plus a contingent value right (“CVR”) representing the right to receive 80% of the net proceeds payable from any license or disposition of Theseus Pharmaceuticals’ programs (the “CVR Products”). We applaud your decision to preserve capital and pursue a strategic transaction with the objective of maximizing value for shareholders. We hope that you find that our proposal meets this objective."

ReplyDeleteLooks like Orbimed and Foresite are also intending to make an offer. Wish I had better insight on which of these situations work out better than others, still developing that skill.

DeleteGreat post! I wonder if the fully diluted share count could increase. Q3 was 43,802,221.

ReplyDeleteI don't know if the liquidation or a sale would accelerate the vesting on shares and options. About 472,000 in unvested restricted stock and unvested RSUs. 4.1 million vested options with a weighted average strike of $5.03, I am guessing that a little bit of it might be in the money and not counted on the 9/30 fully diluted share count since the price has increased since then. Any thoughts on this? I wonder if I am thinking correctly on this - even though the share count changes are not likely to material.

Also, I could not find the shares outstanding that you are using (43,603,369). Thanks.

Right, those shares are unlikely to vest.

DeleteI was using the share count as of the Q2 10-Q, the Q3 10-Q hadn't been published yet.

With competing offers from Tang and Foresite/Orbimed, this now looks interesting. Tang's offer at $3.80 is probably under what Foresite/Orbimed will offer. I'd imagine Foresite/Orbimed would at least offer cash value of around your projected $4.33 a share which is a low estimate now that we know 4 quarters of cash burn may not be in the cards. Currently trading above Tang's offer at $3.82. A safer possible 12% return at these levels. I like this play now that it has been de-risked a bit and reverse merger seems out of the cards.

ReplyDeleteHow is the reverse merger off the table? What happens if they simply reject both offers? I’m a little stumped on what to do here, sell with a small gain right now or wait hoping they’ll entertain one of those offers. (they did file an 8-K this morning acknowledging the receipt but that doesn’t mean they’ll accept it)

DeleteI generally agree that a reverse merger is off the table, Foresite and OrbiMed together own over 50% of the company. I'm guessing they'd vote against any reverse merger considering they're looking to bid on the company themselves.

DeleteForesight recently had a similar play where they made a offer of interest for Pardes Biosciences. They explained in their filing they wouldn't accept a reverse merger. They didn't explicitly state that in this filing but I'd assume with such a large ownership postition that this would be the case here as well.

ReplyDeleteWhat do you think about Galera GRTX? Are reverse mergers always bad for shareholders of the target?

ReplyDeleteHit or miss IMO. Chek-cap for example worked out well earlier this year. But most of them are intended more for science rather than creating shareholder value.

DeleteDid they announce a reverse merger? Reverse mergers aren't always bad, but they tend to be lower quality, similar to SPAC targets, it is an easier/quicker way for a company to go public. In biotech bull markets, they're often bid up, at least in my experience, but we're not in that environment so most reverse mergers have been sold off.

DeleteGRTX is probably too small for me, there are some fixed costs with just existing as a public company, with no revenue coming in, GRTX is going to burn through cash pretty quickly. Hard to tell if their IP is worth anything, I see they got a CRL, maybe another chance on goal if they do another phase 3 trial, without reading the docs, I'm guessing that Blackstone royalty liability would travel with the IP assets in a sale decreasing their value. Just don't think they have enough net cash on an absolute basis to be an attractive addition to the basket trade.

@MDC, your investing knowledge and ability to assess these situations WHILE managing a full time job and a family is extremely impressive. Thanks for sharing your thoughts publicly, I've learned a lot being here.

DeleteThanks for the kind words and reading. Investing is my main hobby, my fantasy football takes and results are much worse.

DeleteGalera GRTX announced pursuit of strategic alternatives.

DeleteWhat do you think of the odds of a higher bid? Given that Orbimed and Foresite hold >50% of shares.

ReplyDeleteSolid outcome-

ReplyDeleteTheseus Pharmaceuticals(THRX) said Friday it has agreed to be acquired by Concentra Biosciences for between $3.90 and $4.05 in cash per Theseus common share.

The purchase price comprises a base per-share cash price of $3.90 and additional cash not exceeding $0.15 per share plus one non-tradeable contingent value right, or CVR, Theseus said.

The company said the CVR represents the right to get 80% of the net proceeds from any license or disposition of its programs effected, and 50% of the potential total value of some potential cost savings realized, within 180 days of the completion of the deal.

The transaction is expected to close in February.

When I first saw this (half awake this morning) I thought it was Foresite/OrbiMed, interestingly it is Tang. Agreed, nice outcome, this one I'm not super optimistic about the CVR but not going to sell this ahead of year end and pay the taxes, content to hold through the transaction close.

DeleteI don't see them paying less than $4.05, even my most conservative liquidation estimate leaves them with significantly more than the minimum cash level at closing.

ReplyDeleteWho knows about the CVR but I find it much more interesting than the typical blue sky opportunity CVR because of the 50% of 6 months cost savings. I can't imagine THRX negotiated for a cost savings share without knowing that significant savings are likely to happen. And dollars in 6 months are much more beneficial than dollars in two years.

Any idea why they have file the tender offer? In the press release, they said they will file by 1/9

ReplyDeletehttps://www.sec.gov/Archives/edgar/data/1745020/000114036124001546/0001140361-24-001546-index.htm

DeleteWas just filed.

Nice! Thanks!

DeleteFinal number is $4.05 + CVR

ReplyDeletehttps://www.sec.gov/Archives/edgar/data/1745020/000114036124004440/ny20018184x3_exa5b.htm

I'm seeing something weird on my brokerage account. I participated fully in the tender. I received the $4.05/share + CVR but the cost basis on the CVR is my initial principal and the cash received is being shown as short term gain. Definitely seems incorrect as I'll pay more in taxes than the gains I made but was wondering if anyone else also saw this and contacted their brokerage to fix it?

ReplyDeleteby "cash received" here I meant the entire principal + gains (with cost-basis $0).

DeleteMine appears correct, I would just call your broker. Not uncommon for them to adjust it a few weeks post-merger too.

DeleteReceived $0.008 on the CVR

ReplyDeleteThank you for the update! Other than seeing it in your acct, is there any other means of seeing this information disseminated publicly? I don't see filings and even AI can't help...shocking.

DeleteNo, that's part of the mental struggle of CVRs. Virtually no way of tracking their progress most of the time.

DeleteDid the CVR just magically disappear from anyone else's account? I received the minor cash payment a few days ago but the CVRs are just gone from my account now.

DeleteNever mind, looks like they were removed after the CVRs paid in full.

Delete