Andrew Walker recently had Matt Turk on his podcast where they discussed this idea. I generally agree, but for my own process, I wanted to write out my thoughts as well.

Target Hospitality (TH) ($1.2B market cap) is a provider of mobile temporary housing (previously colloquially called "man camps") that historically focused on the energy exploration sector (about 1/4 of their business today) but over the last decade, and mostly in the last few years, TH has moved into the business of housing migrants crossing the U.S. southern border. Their largest contract is an influx care facility ("ICF") called Pecos Children's Center in Texas that houses unaccompanied minors, by law unaccompanied minors cannot be deported immediately and efforts need to be made to reunite them with family members. During this time period, which can last several years, the minors need reasonable and safe housing quarters. There is political risk in this business, for a while there these types of camps were called "kids in cages" and other politically charged terms. But with a large number of migrants coming from destabilized places like Venezuela, Ecuador and Haiti, the need for safe temporary housing doesn't appear to be going away anytime soon.

The oil & gas housing business is not particularly great, Civeo (CVEO) is a good comparable, many oil & gas projects require significantly more employees (temporary residents) during the beginning of projects and relatively few are needed during the maintenance periods, putting the business at the whims of commodity cycles. But with government contracts, contracts tend to be longer in duration, my mental model for the unaccompanied minors camps is more inline with government contractors that provide services to foreign U.S. military bases in conflict zones. Something like V2X (VVX, fka Vectrus, a spin from XLS) comes to mind, there's a continuous need for occupancy as long as the need is there and that need typically lasts longer than the public expects at the outset.

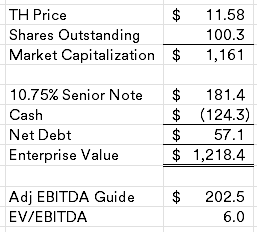

Target Hospitality is currently fairly cheap at only 6x EBITDA with minimal debt (management projects to be in a net cash position by year end).

CVEO and VVX obviously aren't perfect comps, but I've owned both businesses in the distant past and follow them loosely, CVEO trades for 5x EBTDA and VVX trades for 8.5x EBITDA. Blending the two based on Target Hospitality's business mix gets me something closer to a 7.5x multiple or a $14.50 share price.

TH is a former 2019 vintage SPAC (before all the craziness) and is still 65% owned by Arrow Holdings (now TDR Capital), TDR Capital submitted a bid on 3/25/24 to buyout the minority shareholders for $10.80/share. The following day, Conversant Capital (same firm that was involved with Indus Realty (INDT) and currently the controlling shareholder of Sonida Senior Living (SNDA)) popped up with a 5% ownership filing with the below disclosure:

As previously disclosed in its filings on Form 13F, Conversant Capital LLC has owned a substantial position in the Company Common Stock for approximately two years, in the form of shares of Common Stock and options to purchase shares of Common Stock. As long-term investors in the Company, the Reporting Persons closely monitor developments regarding the shares of Common Stock. The reporting persons are aware that TDR Capital LLP (“TDR”) has made an unsolicited non-binding proposal to the Board of Directors of the Company pursuant to which Arrow proposes to take the Company private by acquiring all of the outstanding shares of Common Stock, other than those already owned by any of Arrow, any investment fund managed by TDR or their respective affiliates. The Reporting Persons intend to review that proposal and any other proposals made in connection with their evaluation of their investment in the Company to evaluate whether any such proposal is in the Reporting Persons’ best interests.

In TDR's offer letter, they're requiring their offer receive a majority of the minority shareholders vote for the deal, with Conversant a large and now public shareholder, they provide credible protection against a take under. A special committee was formed on 4/29/24 to consider the offer, the press release also mentioned the following:

The mandate of the Special Committee is to consider and evaluate the Proposal and any alternative proposals or other strategic alternatives that may be available to the Company. The Special Committee has retained Centerview Partners LLC and Ardea Partners LP as its financial advisors and Cravath, Swaine & Moore LLP as its legal advisor.

Sounds like a full process could be underway and not just an exclusive negotiation with TDR Capital. If nothing comes of the process, I still think the shares are cheap as the company has vaguely discussed being in the procurement stage on several large contracts including another ICF/unaccompanied minor location, rare earth mines, large technology projects, etc. Several of which have been described as "impactful" on earnings calls. In total, they expect to generate $500MM in free cash over the next several years that will be used to deploy into new growth opportunities which could further diversify the business model, potentially further raising the multiple.

Disclosure: I own shares of TH

Hey, this unrelated to the stock, but have you looked at Bally's (BALY)? Sort of similar to TH as the largest shareholder is trying to acquire Bally's. I would recommended reading a recent pitch on Bally's on VIC.

ReplyDeleteThanks - will do. That's another familiar name, I've owned it in the past, don't now, but should catch up in light of SG's bid. They've done it before, hard to tell their intentions, without catching up on BALY, I would just say that it is a riskier equity than TH given their leverage and big upcoming projects.

DeleteHas it been made known to investors how long the special committee process will take? If not, on average, how long does it usually take to come to a decision?

ReplyDeleteIf they're starting from zero, probably 6-9 months. This is interesting one, because if they really are just talking to TDR, then it could be 1-2 months, but the verbiage in the press release makes me think its a larger process, so maybe in the 4-6 month period?

DeleteYeah, I like this one. Lots of majority offers lately. Hopefully this one will be quick & (relatively) painless.

ReplyDeleteWhat happens if Trump gets elected?

ReplyDeleteThere's probably more risk to the stock in the short term than the business. I could see the narrative around the stock being negative, but the need to house unaccompanied minors is probably unlikely to go away on an administration change. I get that this is a political lightning rod, might actually be a reason for this business to be privately held and out of the public eye.

DeleteHave you looked at ISSC? Similar setup to this.

ReplyDeleteNo, I hadn't seen that one. Thanks for pointing it out.

DeleteChristopher Harborne seems like a character, crypto guy that is suing the WSJ? But on the positive side, his AML Global Eclipse company does buy from ISSC. Hard to tell if he's a credible buyer, he has no other association with the company?

DeleteAny idea what ISSC is worth? I have it trading at ~12x LTM EBITDA. But EBITDA does look like its moving in the right direction.

https://www.wsj.com/politics/policy/biden-to-close-dilley-detention-center-shift-resources-amid-border-crack-down-2b2cfcb5?mod=us-news_lead_pos1

ReplyDeleteNews out that the Biden administration is cancelling a TH contract. A bit surprised that there's no 8-K out, shares are down significantly (~30%) after hours. Curious to see if we get one in the morning, otherwise this might be an overreaction. But on the other side of the coin, does show the very real risk that these contracts can be cancelled on short notice (I had downplayed that). Hard to put a multiple on a business like that.

https://www.sec.gov/Archives/edgar/data/1712189/000171218924000077/ex99-1.htm

DeleteAnd we get the morning 8-K. A little concerning that the cancellation seems like a total surprise to management, but with very little net debt, don't quite get the reaction from the market. If this was company was levered, yes, but its not. These camps are relatively small compared to the problem, could easily announce a new contract that's bigger in the near future.

Agreed and the problem TH is solving (if only temporarily) is not getting any better.

DeleteMDC prior to this cancellation it sounded like the USG was potentially awarding follow on contracts for this exact service? Timing of this cancellation is somewhat odd, but not out of line for something Gov customer would do. How do you think this impacts evaluation of offers. My thinking is that the 10.80 (which is low) is absolutely still the floor, however the bump above may be lower?

DeleteFrom the Q2 earnings release, sounds like there are more than one bidder, even at or above the $10.80 price:

ReplyDeleteThe Special Committee continues its review and evaluation of the Proposal, as well as evaluating alternative proposals and other strategic alternatives.

My base case is $10.80 in my head, but I think the strategic process might drag out a bit. It seems challenging to me to sell the company ahead of potential big contracts and the election, I'm thinking this doesn't wrap up until end of year, but maybe I'm wrong.

DeleteYeah I agree. I do think elections and contracts are important, but the piece that really stuck out to me was the current debt situation. A takeout even with losing current contract should still be a steal for PE.

Deletehttps://www.sec.gov/Archives/edgar/data/1712189/000110465924102579/tm2424660d1_ex99-1.htm

ReplyDeleteTH is disbanding their special committee after receiving no formal offers and TDW/Arrow did not reaffirm their original offer.

Stock down big pre-market, seems pretty cheap considering they have no net debt. Probably smart not to panic either way, buy or sell.

MDC, what have you decided to do with the position? On one hand, 2024E FCF yield to EV of ~14% looks juicy, and there will be no net debt. On the other, markets seem to pricing Trump’s win, which could materially affect asset utilisation and sentiment around the stock.

ReplyDeleteI wrote some juicy covered calls on it, Nov $9.00, when people were speculating that TDW might still be trying to take it private since they haven't updated their 13D, so that buys me a little more time. I don't know what to make of the political aspects of this stock, sort of consider myself an a-political person, just doesn't interest me, but seems like this is a company that should be private for that reason. Think the public markets will swing around the multiple based on political headlines much more than it really impacts the underlying business.

DeleteLong way of saying, I still don't know on the position.

https://www.sec.gov/Archives/edgar/data/1712189/000171218925000004/ex99-1.htm

ReplyDeleteDon't own this one anymore, but the nuclear risk just hit, the large Pecos facility contract was just terminated by the Trump Administration. Surprising, not sure what to make of it yet.