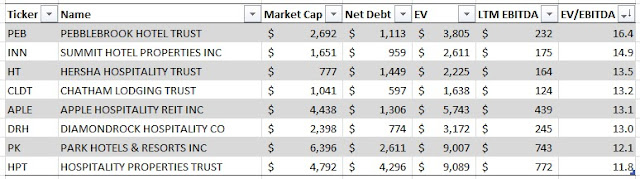

Here's how the combined SRC compares to its net lease peers:

Most REITs are going to look cheap compared to Realty Income Corp, but after the spinoff new SRC should look a lot like STORE Capital and that large discount between the two should close over time.

Spirit MTA REIT (SMTA)

The "bad bank" REIT will primarily contain two sets of assets (today they tossed in some more workout assets similar to Shopko that will be sold with the proceeds going into the Master Trust):

- Shopko is a mostly rural (midwest and western US) discount store that's facing similar pressures to many retailers, its under-invested in its stores and sells ubiquitous products that you can buy almost anywhere. It's target market is similar to Sears, its sort of an unfocused general store. Spirit currently leases 101 properties to Shopko, representing 7.8% of its lease roll (prior to the spinoff), it recently became a secured lender of Shopko as well, advancing $35MM in the form of a term loan at a 12% interest rate. The term loan will provide SRC/SMTA with quarterly financial statements and more direct insight into how the business is performing and also gives them optionality to separate the Shopko assets further if necessary. SRC has been selling down Shopko assets in recent quarters/years, and will continue to do so at SMTA with the goal to completely dispose of the assets within 24 months of the spinoff. With the proceeds from the dispositions, SMTA will contribute those proceeds to the Master Trust and lever it up. The Shopko portfolio is debt free today, so in the event of a bankruptcy/liquidation at Shopko, the remaining assets at SMTA within the Master Trust shouldn't be impacted.

- Master Trust 2014 (also seen it referred to as Master Trust A): Here's the interesting portfolio, the Master Trust portfolio is setup as an SPV, its bankruptcy remote from the rest of SMTA, and has a A+ rating by S&P with a 75% LTV. The asset base is very similar to that of the rest of SRC, single tenant triple net leases, albeit a higher concentration of smaller tenants. The effective leverage SMTA will be able to get inside the SPV is about 12x EBITDA. I was able to locate the trustee report and the distributions to SRC have been pretty consistent over the past few years and they haven't stuffed the SPV with bad assets since announcing the spin. Through the Master Trust and a new CMBS issue, SRC was able to raise an additional $698MM in debt at SMTA that will be used to reinvest in STOR/O/NNN like assets at SRC.

Valuation

I had a simple model put together late last week to break out new-SRC vs SMTA, but today the company released an updated presentation that does all the heavy lifting for us:

New-SRC is the critical piece to the overall SOTP, after the spinoff it will be under leveraged compared to peers with a largely similar tenant roster, if it can re-rate to STOR's multiple (not suggesting it happens over night) it's a $9.75 stock ($0.65 * 15) versus an $8.50 price today, and that's a conservative approach since we already know they're going to have a lot of dry powder ($698MM from SMTA that they'll lever 2-1) to start the acquisition engine again, growing AFFO.

SMTA won't have any close peers that I'm aware of (please correct me if there is one) and will probably trade terribly initially as the investor base for SMTA will be much different than SRC. SRC provided an NAV build in the presentation today, the $1.61 value in the Master Trust is likely pretty solid (as of January 2018) as its just refinanced and had a third party assess the value of the collateral as part of that process.

The Shopko and workout assets are a little trickier, SRC has been able to dispose of some Shopko properties at similar cap rates to what they're showing here, but its unlikely the public REIT market will assign a 9% cap rate to the Shopko leases. Quick and dirty, I'd probably assign a 50% discount to the $2.34 NAV presented here for today's purposes although I like the spinoff for its call option like return potential if their reinvestment plan works given the leverage at the Master Trust.

$9.75 for new SRC + $1.17 for SMTA = $10.92 versus a share price of $8.50 today, or ~30% upside without accounting for any new investments either side makes with their growth capital.

Why is this so undervalued? I think it mostly relates to the typical net lease investor base, REIT investors like simple and safe stories, this spinoff transaction while creative is far from simple and the headline concentration risk to Shopko has scared away many investors. This spinoff should remove the tenant concentration risk, simplifies the story, and then through the reinvestment of the capital raise from SMTA, allows SRC to return to the market and show a growing AFFO/dividend stream which should also help raise the valuation.

Biggest risks here: 1) interest rates moving higher than expected, the majority of their leases do have escalators built in but they're long dated and the investor base is also interest rate sensitive as net lease REITs are viewed as a bond alternative; 2) general recessionary risks, particularly with retail, although SRC is trying to move more towards services based tenants, these are risky borrowers that often can't get traditional financing elsewhere so they turn to a sale-leaseback transaction.

Disclosure: I own shares of SRC