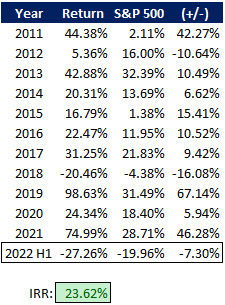

Investing is a humbling endeavor. For the first half of 2022, my personal account is down -27.26% versus the S&P 500 being down -19.96%.

Thoughts on Current Holdings

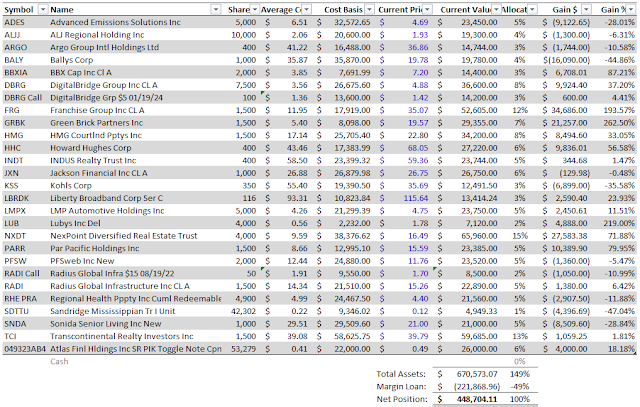

As I have during tough periods before, here's a quick summary thesis of each of my current holdings (in mostly alphabetical order):

- Advanced Emissions Solutions (ADES) is a ~$90MM market cap company with NCAV of ~$70MM plus their activated carbon business/plant. The company is now past month 13 of their strategic review, on their Q1 conference call in May, CEO Greg Marken responded to a review status question with: "while the process has drawn out, the fact remains that we are pleased with where things stand within the process are hopeful that we can provide an update soon." This is a common theme in my portfolio right now, waiting on M&A in a semi-frozen environment for M&A. Their activated carbon business is barely cash flow positive and pretty niche, likely only leaving a limited pool of strategic buyers that would be interested in it. The delay could be blamed on a timing issue as it needs to be the right price for ADES and the right time/price for the handful of potential acquirers. This is not as simple as selling an apartment complex was in 2021. The price has come in quite a bit from my original post and remains reasonably attractive. The bear case from here would be if they're unable to sell themselves, management then decides they'd be too small if they returned cash to shareholders and instead turn into an acquirer.

- ALJ Regional Holdings (ALJJ) is mostly a cash shell now run by the controversial Jess Ravich, both asset sales have closed, the NOLs are exhausted and now the company is looking at strategic alternatives. The RemainCo lost a significant contract with Humana recently that made up ~30% of the pro-forma revenue, but the market doesn't seem to be pricing in much if any value to the remaining operations. NCAV is something like $2.70/share and the stock currently trades for $1.90 with the prospect of a catalyst on the horizon.

- The only thing that has slightly changed for Argo Group International Holdings (ARGO) from my write-up in early May, the CEO who was previously on sick leave has officially resigned and the Chairman and interim-CEO, Thomas Bradley, now loses the interim designation. Bradley is the one leading the strategic alternatives process, maybe I'm reaching, but it at least holds with the story that they'll sell.

- Atlas Financial Holdings (CUSIP 049323AB4) completed the restructuring of their old baby bonds and issued new senior unsecured PIK toggle notes that are denominated in $1 increments to the old baby bond holders. I don't believe these have traded hands yet in the secondary market, so not sure how relevant the story is anymore, but the equity does trade as AFHIF for those who like option-like bets on turnaround stories. Atlas acts as an agent for insurance carriers in the light commercial auto market (think taxis, limos, shuttle buses, etc.), as the world is normalizes, both from covid and UBER/LYFT no longer being irrationally venture capital subsidized, one could envision a world where taxis and limos exist alongside ride sharing services. The company however is still on questionable footing, it's burning cash and might end up needing to restructure again if the turnaround doesn't turn relatively soon.

- The proposed Bally's (BALY) $38 go-private offer from 22% owner Standard General blew up in my face, the independent members of the board couldn't come to terms with Chairman Soo Kim from SG. Whether this was ever a real offer is up for debate, but the offer was made right before the economic outlook got dicey. Since then, the stock has tanked to ~$20, despite the market reaction, several good pieces of news have come out: 1) BALY's won the downtown Chicago bid (still needs to be approved by the Illinois Gaming Board), the mock-up of the casino looks great and its in the perfect location; 2) BALY's announced a $190 dutch tender offering for between $19.25-$22.00; and 3) just this week, they entered into a sale leaseback with GLPI to buy their Rhode Island casinos for $1B or a 7.8% cap rate, much of this will be used for the build out of Chicago and whatever they do with the Tropicana in Las Vegas. BALY's also put out a three year cash flow projections in an 8-K that is worth playing around with if you're interested in the story. The bear case is the impact of a potential recession and draining of liquidity from the system, but regional casinos continue to show their resilience and Bally's seems to be a rational actor in the sports betting/igaming space.

- BBX Capital (BBXIA) is a $117MM market cap holding company run by the controversial Levan family, BBX has 5 core assets: 1) $115MM in cash; 2) $50MM note from Bluegreen Vacations Holding (BVH); 3) Florida multi-family real estate/developer; 4) Renin, a manufacturer of doors; 5) IT'SUGAR, the candy store. The fair value of all that is probably in the low-to-mid $20s per share, but it's currently trading in the $7s, below $8 where the company completed a tender offer last July and $11.10 where they bought out Angelo Gordon in November. The company approved a new $15MM share repurchase program in January, but haven't appeared to use it. So the question is why isn't the company buying back shares here? Maybe they're going to deploy capital somewhere or they're prepping for another large tender offer. I cringe a bit when I type this, but they do seem to be pretty good capital allocators and they've hit a home run in their real estate development business, every few months they sell an apartment complex well above their cost basis, here's the latest example. The bear case is fairly obvious, it is the Levan family discount and whether that ever closes.

- DigitalBridge Group (DBRG) has now almost fully transformed into an alternative asset manager focused on the "digital infrastructure" sector, a term that CEO Marc Ganzi popularized. They've done a few likely value creating actions lately, they purchased AMP Capital for 8.4x EBITDA, reacquired 100% ownership of their investment management business from Wafra (switching from a REIT to a C-Corp in the process) and sold a stake in their DataBank position for well above carrying value. Time is starting to tick on Ganzi's $100MM incentive package, he needs to get the stock to trade above $10 for 90 trading days prior to the summer of 2024. I've bought Jan '24 $5 call options to juice the upside, he's delivered on everything so far, with all digital infrastructure theme tailwinds, I think it's smart to assume he continues to deliver. The bear case is rates increasing bring down the cap rates on digital infrastructure assets, hurting returns in DBRG's funds and limiting their ability to raise future capital.

- We're still awaiting the outcome of Franchise Group (FRG) potentially buying Kohl's Corp (KSS), the three week exclusivity period came and went without either side saying a peep. CNBC reported that Franchise Group was trying to re-cut their bid from $60 to $50, taking $50 might be unacceptable for the KSS board after they said the stock was worth $70 a few months ago. It could be Brian Kahn's (FRG CEO) diplomatic way of getting out of the running for KSS.

- Green Brick Partners (GRBK) is a homebuilder and land developer that's primarily focused on the Dallas metroplex (with additional exposure to Atlanta, Austin, Colorado Springs and Vero Beach FL), David Einhorn remains the Chairman and Jim Brickman, a long time Dallas developer, is the CEO. Things have changed quickly for homebuilders in the last few months, mortgage rates have basically doubled, but demographics and migration trends should be in GRBK's favor. Unfortunately, Green Brick made a strategic decision last year that doesn't look so great now, limiting pre-orders to build more spec homes in order to capture higher margins and have more price certainty around costs. They're likely stuck with a high level of inventory and will need to slash prices. Shares are down -34% this year in anticipation of the housing slowdown, we'll find out how bad things are at the next quarterly earnings call. The stock trades for 1.1x book value and a little more than 4x an increasingly cloudy estimated earnings.

- Howard Hughes Corp (HHC) is a real estate developer with their primary assets located in Las Vegas, Houston, Columbia MD, Honolulu, New York and the recent addition of Phoenix. The company put out an investor day in April that laid out a $170/share NAV including corporate overhead, they've recently been an aggressive buyer of the stock at ~$95/share, the stock now trades for ~$65/share reflecting investors concerns about the company as we head into a potential recession. During peak covid fears, Bill Ackman did a capital raise with himself at advantageous prices, let's hope that doesn't happen again. HHC has similar housing concern headwinds, they fund new commercial real estate development with the sale of land to homebuilders, if homebuilders stop buying land in their communities, the development engine grinds to a halt. But looking longer term, if higher inflation is here to stay, hard to think of a better hedge than land banks in low cost of living growth markets.

- INDUS Realty Trust (INDT) is a small cap industrial/logistics REIT that's led by a few members of the old GPT management team. There is some concern around logistics properties being overbuilt and news coming out that Amazon is pulling back on building/occupying new warehouses after their big covid growth spurt. However, INDT is small and can be selective in their new markets and new developments and there's always the Blackrock BREIT bid in the background of industrial and multi-family REITs. Shares have come in a bit, I have the stock trading at about a 5.5% cap rate, pretty cheap for a high quality portfolio and currently with minimal net debt.

- Jackson Financial (JXN) is the variable annuity provider that was spun from Prudential PLC last fall, the structure of the spinoff attracted me in that a foreign list company was spinning a much smaller U.S. listed company. That's a lot of potential index related selling followed by buying. Shares ran up as the company has bought back a significant amount of stock out of the gates and then has fallen right back down given the economic backdrop and opaque nature of their financial statements. One way I'm thinking about the company is on a shareholder yield basis, JXN has committed to returning $425-$525MM in capital to shareholders this year. At the mid-point, that's 20% of the current market cap.

- Liberty Broadband's (LBRDK) primary holding is a 50+ million share investment in Charter Communications (CHTR) alongside a small operating business in GCI. Assigning a 7x EBITDA multiple to GCI, I get an NAV of ~$140/share while the stock trades at $115/share, they continue to participate in CHTR's buyback on a pro-rata basis then turnaround and buyback their own stock, about 15% of the shares have been retired in the last year. Sentiment is pretty poor around the big cable companies but that only makes the buyback math more attractive, I'm content to hold for now.

- LMP Automotive Holdings (LMPX) is a shaky microcap auto dealer that is potentially in the process of selling themselves. LMPX has delayed their financials and needs to restate previous ones but has provided some financial updates, including a cash balance of $30MM at the end of 3/31 against $85MM of debt, the market cap is $50MM, so the EV is only $112MM against an EBITDA of ~$40-50MM (my estimate, could be totally wrong). There might be some working capital shenanigans in their cash build, they could have just liquidated inventory, we don't know. I compare this one to a REIT selling their portfolio, auto dealerships are pretty ubiquitous and get bought/sold regularly. LMPX does have a slightly different model where they don't own 100% of the dealerships and have some non-controlling interests remaining with the operators of the dealerships. Bear case is pretty scary, this could be a dumpster fire, they have accounting issues and a weak board, power is concentrated in the hands of the CEO who got the company in this mess.

- NexPoint Diversified Real Estate Trust (NXDT) is a closed end fund that is still in the process of converting to a REIT, but the end should be imminent as the fund has received all the proceeds from Amazon buying MGM Holdings, the movie studio not the casino operator, removing a significant securities position from NXDT's balance sheet which was one of the SEC's issues with the conversion. With REIT status comes index inclusion, not just from REIT indices but from broad indices as well that don't include CEFs or BDCs. The stock trades for $16.50/share, the published NAV is $26.26/share, so it is trading for 63% of NAV. I expect that discount to narrow as the company converts to a REIT and tells their story to the market. The controversial James Dondero has been regularly buying shares in the open market ahead of the conversion.

- Par Pacific Holdings (PARR) is a niche downstream energy company, they operate three refineries in small markets (Hawaii, Tacoma WA, Wyoming) and related logistics/retail networks. As anyone that has filled up their gas tank recently knows, refining margins have blown out significantly and there's a lot of talk about the U.S. not having enough refining capacity after several refineries were mothballed during covid. PARR has completed their recent rounds of maintenance turnarounds and should be running at full utilization during this high tide period. Additionally, PARR owns a 46% interest in Laramie Energy, an upstream natural gas company in Colorado, given the natural gas price backdrop, the company is finally looking at strategic alternatives for their investment. It has been completely written down in their financials for some time and they still have their massive NOL to shield any taxable gains. Speaking of the NOL which is about $1.6B and starts to expire in 2027, CEO Bill Pate said in their recent conference call "based on our outlook for the business, we really don't see NOLs expiring. We anticipate that we'll be using those tax attributes to offset profits." The company has yet to hit the NOL after many years, so take that with a grain of salt. The other thing worth mentioning, Sam Zell's fund has come to the end of its life and has been selling/distributing shares to investors, providing an overhang to the stock. PARR has under performed the sector, part of that is their niche position which likely won't fully participate in the industry tailwinds, part of it might be the selling pressure from Zell's fund.

- PFSweb Inc (PFSW) is a similar idea as ADES, PFSW previously operated two businesses, it sold one last year and is now sitting on $155MM in cash with no debt and a $265MM market cap. The remaining business is a subscale third party logistics (3PL) provider to mostly consumer retail companies needing an e-commerce logistics provider. The company was late on their financials because of the complicated nature of their asset sale, they're now current and according to CEO Michael Willoughby on their recent earnings call: "We continued to work with Raymond James on the review of a full range of strategic alternatives for PFS. As we've previously communicated, we believe that completing a second transaction represents the most efficient way to return the significant capital we hold to shareholders... completing this process remains our top priority." I'm guessing there should be more strategic buyers of a small 3PL business than for ADES's activated carbon plant, but similarly, here we are a year after the initial strategic alternatives announcement with no deal. Hopefully the M&A market unfreezes a bit soon, but with the big cash pile and marginally profitable 3PL business, the downside seems pretty minimal here other than opportunity cost.

- The only update since my May post on Radius Global Infrastructure (RADI) is it appears that DigitalBridge is actually interested in buying RADI, just a waiting game now to see if a transaction materializes.

- Regional Health Properties (RHE PRA) is a struggling lessor/operator of skilled nursing and assisted living facilities, the company's balance sheet is upside down and they're trying to exchange their existing preferred into a creative new preferred security, but haven't gotten the votes necessary to date and have pushed the latest vote off to 7/25. It's hard to handicap if they'll ever get the votes, the common stock only has a ~$4MM market cap, so its fair to say that no institutions own it, probably just sitting in some Robinhood accounts where the owners deleted their app after everything crashed.

- Sonida Senior Living Inc (SNDA) is an owner operator of primarily mid-priced independent living and assisted living facilities. The company did an out-of-court restructuring with Conversant Capital in 2021 providing an injection of capital and effectively taking control. Sonida has a significant amount of financial leverage (through mortgage debt, they own, don't lease their properties) and the senior housing business model features a lot of operating leverage (occupancy and margin are the KPIs), a potent upside cocktail recipe if the industry recovers (or the opposite if it doesn't). Senior housing should have significant tailwinds: 1) recovery from covid; 2) demographic tailwinds, SNDA operates the entry care level facilities (rather than nursing homes) which should benefit first; 3) limited new construction/supply given covid and with inflation, any new construction would be costly and targeted at the upper-price points, away from SNDA's mid-priced position. On the bear side, the industry continues to be plagued by increasing labor costs and the use of contract labor, potentially squeezing the stabilized margin profile of the business. Shares trade at a discount to where Conversant invested ($25) and the subsequent rights offering ($30), meanwhile the company's occupancy numbers continue to climb.

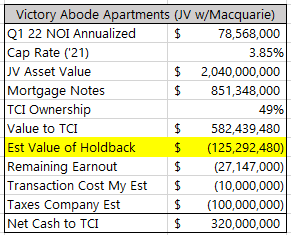

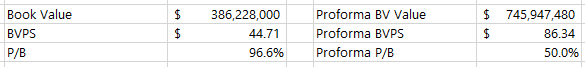

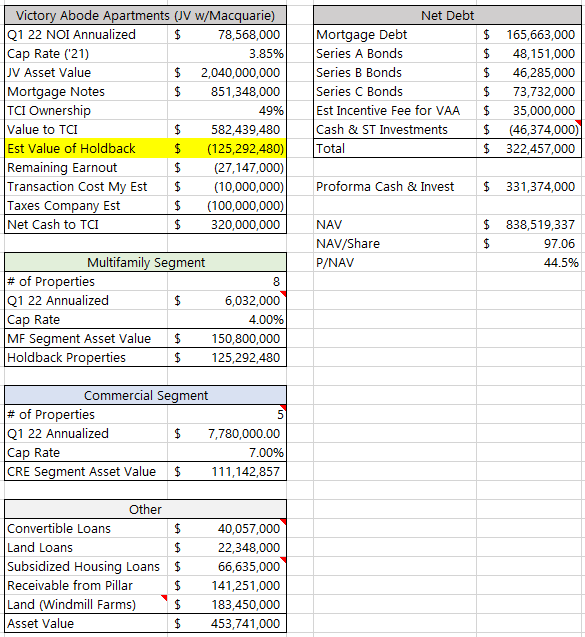

- I recently re-wrote up Transcontinental Realty Investors (TCI) after the company sold their JV creating a lot of liquidity, now the question is whether the 85% controlling shareholder will tender for the remaining 15%? Shares currently trade at approximately 50% of proforma book value after the JV deal closes.

Sold positions

Opportunity Cost Sales:

- Accel Entertainment (ACEL) is a good business model, they are in distributed gaming where ACEL owns the video gaming terminals (aka slot machines) and partner with bars or taverns who then operate them (legacy operations are all in IL) as mini-casinos. It should mint free cash flow. However, their growth story seems a little cloudier than it did several years ago, new states don't seem to be lining up to pass VGT legalization legislation nearly as enthusiastically as they're willing to pass mobile sports gaming and icasino legislation. One is kind of an eye sore that takes time to rollout, the other is a downloadable app on your phone which instantly creates tax revenue. Maybe recognizing this trend, ACEL bought Century Gaming in a deal that just closed, Century is an established operator in Montana and Nevada, two mature distributed gaming states. That might be the play from here, just consolidate the legacy states. Despite holding for ~2.5 years, I never had a big position and ACEL's stock has held up well in this downturn, I sold to re-allocate elsewhere but will continue to follow the business.

- Odonate Therapeutics (ODTC) is a failed biotech cash shell (there are a lot of these at the moment!), they went dark and IR never responded to my inquiries, some investors are perfectly comfortable with dark stocks, I tend not to be one of them. Especially when it is run by a CEO I don't trust, so I sold my shares.

- Technip Energies (THNPY) is an engineering and construction firm focused on large energy infrastructure projects, the stock tanked following Russia's invasion of Ukraine due to uncertainty around their a project in the Russian artic, and if TE would be able to finish the project or get their money out of the country. The shares have recovered some, the company is a major player in LNG facility construction which should have some tailwinds as Europe needs to rethink their energy strategy.

- Laureate Education (LAUR) runs five for-profit universities in Mexico and Peru, last year they returned cash to shareholders via a couple special dividends. The stock is probably still cheap, I don't think it will last long in its current form, but any M&A is probably put off for a while. Refinitiv did report that Laureate was looking to take out a term loan for a dividend recap and put leverage back on the company, that might be interesting but the stock has held up well this year and I sold it to invest in new ideas.

- ECA Marcellus Trust I (ECTM) is a tiny natural gas trust, I sold this one early in the year as the rally was just getting started in natural gas, thus I missed most of the run up. I'm not a good commodities investor and just got lucky with this one in the first place, but it was a big win for me overall.

- Logan Ridge Finance Corp (LRFC) and PhenixFin (PFX) are two small BDCs in the midst of a transition, I still think PFX should sell itself but the company isn't doing that, both of these might be revisits for me at some point but there are more interesting ideas out there than owning a subscale BDC at a discount to NAV heading into a potential recession.

Option Positions that Expired:

- I owned Jan '22 calls in Marathon Petroleum (MPC) which was a covid crisis leaps proxy for PARR and Bluerock Residential Growth (BRG), both great wins.

- My speculative BRT Apartments (BRT) calls weren't as great of a call and expired worthless, BRT is trading a significant discount to private market value, they're pursuing a strategy of buying out their JV partners which should simplify the story a bit. Might be worth looking at if you're still a believer in the sunbelt multi-family thesis.

- Nam Tai Property (NTP) has been a complete disaster and my call options expired worthless, new management still hasn't been able to take full ownership of the company's properties in Shenzhen. If there are any authors out there looking for new material for a book, this story has the makings of a great read.

Mistakes:

- My write-ups on Altisource Asset Management (AAMC) and Armstrong Flooring (AFI) both read almost like a short thesis, probably a sign of the times as those were both near the top of the market, lesson learned, when I start reaching for the really dicey ideas where you need to squint to see the upside, probably time to just sit on my hands. Armstrong ended up filing for bankruptcy, there are still buyers interested in the company but Pathlight grew impatient, one to monitor as a restructuring play. Altisource just seems like a clown show, they were suspended from trading for months, then regained eligibility, now turning into a hard money lender and a crypto ATM company, just all seems haphazardly put together. Luxor still hasn't settled, they hold all the cards and I still don't buy into the idea that their convertible preferred has no teeth.

- I sold Orion Office REIT (ONL) at a small loss, ONL is the suburban office spinoff from the Realty Income merger with VEREIT. In hindsight I talked myself into liking this one despite it being an obvious garbage barge due to the merger-spin setup which has worked well in the past. Repurposing office real estate is going to require a lot of time (decade plus?) and capital, something public REIT investors shun.

- Bluerock Homes Trust (BHM) is the pending spinoff of single family rentals just prior to the close of Blackrock's purchase of Bluerock Residential Growth (BRG).

- Uniti Corp (UNIT) is the PropCo spin of Windstream, Windstream went bankrupt a few years back and re-cut the lease with Uniti Corp. Uniti owns a lot of fiber assets and is another digital infrastructure M&A candidate that DBRG's portfolio company Zayo was rumored to be interested in buying and recombining with Windstream.

- WideOpenWest (WOW) is a cable overbuilder that has a couple rumored buyers circling, they sold assets last year for 10-11x EBITDA and currently trade for 8x.