Markets have seen quite the rally in the past two months, my portfolio followed along, pulling my returns for 2023 up to 38.54% for 2023 versus 26.29% for the S&P 500. My lifetime-to-date IRR is currently 22.47%, which continues to be above my 20.00% goal.

Despite the good year, I'm still below my high water mark due to a disappointing 2022. I admire anyone that invests professionally through volatile markets, my returns wouldn't be as good if I was managing outside capital.

Updated Thoughts on Current Positions

As usual, these brief updates were written over the past two weeks, share prices might have moved around a little, but hopefully still directionally relevant. Excuse the inevitable typos.

Broken Biotech Basket:

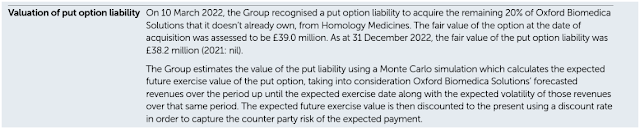

- Homology Medicines (FIXX) has been the laggard in the broken biotech basket, in November the company announced a reverse merger with Q32 Bio, a private biotech focused on the treatment of severe alopecia areata and atopic dermatitis, hair loss and a skin condition respectively. The transaction assigned an $80MM ($60MM of cash, $20MM public listing) to FIXX exclusive of their legacy assets, which equates to roughly $1.38/share compared to the current share price of $0.55/share. The cash at closing is expected to be $115MM, pre-merger FIXX shareholders will own 25% of the post-merger company, or roughly $0.50/share in cash. It is not unusual in the current market for the enterprise value of a pre-revenue biotech to be near zero, but in addition to the NewCo, FIXX shareholders will get a CVR for the monetization of any legacy assets. There's reason to believe that the CVR will have some value, FIXX's IP had initial positive Phase 1 results, but the data is still "immature and inconclusive". Plus there's the JV, OXB Solutions, that will be put to Oxford Biomedia Solutions for 5.5x TTM revenue by March 2025. My current plan is to hold through the reverse merger, maybe the name change, upcoming Phase 2 study data readouts (second half of 2024), conferences/investor reach out, etc., will encourage traditional biotech investors to rotate into the stock providing a slightly better exit. And I'm bullish on the CVR, it'll act as a liquidating trust, Q32 Bio needs to use "commercial reasonable efforts" to dispose of the legacy assets.

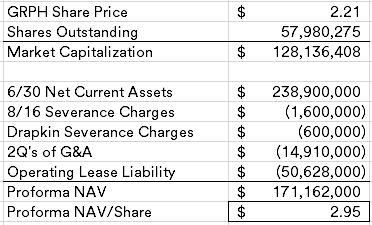

- Graphite Bio (GRPH) is a similar situation, they also announced a reverse merger in November, this one with LENZ Therapeutics, LENZ has a late stage product candidate for treating near sightedness that is expecting a Phase 3 read out in the second quarter of 2024. GRPH shareholders will receive approximately a $1/share special dividend at close (targeted for Q1) plus will own 30.7% of the post-merger LENZ. Post-merger LENZ is expected to have $225MM in cash after close (there's a $53.5MM PIPE), equating to another ~$1.20/share of cash per GRPH share. GRPH currently trades at $2.33/share, giving it only a slightly positive enterprise value, seems cheapish for a biotech with a near term catalyst in a big addressable market. I'll likely hold onto the stub and see what happens.

- AVROBIO (AVRO) announced strategic alternatives in July and is still determining its next steps. As of 9/30, the company has ~$100MM of NCAV, assuming another $10MM of cash burn (they further reduced their workforce in October) before a deal can be commenced would equate to $2/share of value without any value attributed to their IP. AVRO sold one of their programs to Novartis for $80+MM, the other, HSC gene therapy for Gaucher, might have some value as a kicker. Shares currently trade for $1.32/share, making it an attractive risk/reward.

- Pieris Pharmaceuticals (PIRS) ran up quickly after my initial write-up, I took profits, but then it fell and I re-entered, a little too early in hindsight as shares have dropped roughly in half since. As of 9/30, PIRS had $30.5MM in net current asset value, or $0.31/shares versus a current share price around $0.15/share. That number doesn't include a number of IP assets and possibly valuable partnerships, but with limited cash on an absolute basis, they'll need to move fairly quickly. Pieris did just terminate their operating lease, often a precursor to a deal announcement. This one is on the riskier side, but could be interesting if you see any value in their hodgepodge of IP.

- Sio Gene Therapies (SIOX) is a liquidation that's now a dark stock. One reader has been keeping better tabs on the liquidation than me (see the comments), apparently they have two of their three subsidiaries liquidated and should have the third done soon. The expected initial distribution in the proxy statement was $0.38-$0.42/share versus a current price of $0.37/share. It's been an annoying wait with limited-to-no public disclosure, which is one of the downsides of investing in liquidations, you need to have a certain personality quirk to set it aside in the meantime. Hope this liquidation is put to bed soon.

- Cyteir Therapeutics (CYT) is in the final stages (as we've seen with SIOX, could last a while) of its corporate life, shareholders approved the liquidation plan on 11/16/23 and now we await timing of the liquidation distribution which is estimated at $2.92 to $3.31/share in the company's proxy. Liquidation estimates tend to be conservative and this appears to be a cleaner situation than most as CYT is only holding back $500k for a reserve account. Shares trade at $3.09/share, I likely wouldn't buy it today, but content to hold awaiting the liquidation distribution.

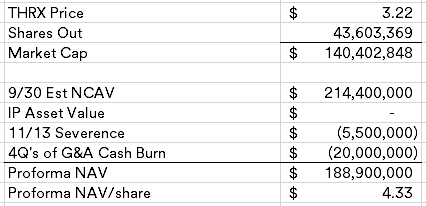

- Kinnate Biopharma (KNTE) and Theseus Pharmaceuticals (THRX) are in similar situations to each other where Foresite and OrbiMed, as a group, have indicated plans to make an offer for each company. Presumably the structure would result in a cash buyout for a discount to net cash plus a CVR for any IP value, similar to Pardes Biosciences (PRDS) which Foresite took private earlier in the year. Both stocks trade for only a slight discount to my best guess of a take private offer (5-15% upside on each), but it's worth keeping an eye out for other biotechs where these two are involved as they pop up. Late breaking news, on the Friday before the Christmas holiday weekend, Theseus announced they reached an agreement with Kevin Tang's Concentra Biosciences for $3.90-$4.05/share in cash, plus a CVR for 80% of legacy asset sales proceeds and 50% of synergies. I'm a bit surprised that it was Tang versus Foresite/OrbiMed but hopefully that means well for Kinnate.

- Eliem Therapeutics (ELYM) is a new addition to the basket, nothing too much has changed since that write-up.

- Reneo Pharmaceuticals (RPHM) received an offer from Kevin Tang's Concentra Biosciences for $1.80 per share plus a CVR for 80% of any legacy asset sales. Considering the company has not yet declared strategic alternatives formally, I think it might be some time before we here an official yes/no response to the offer or an alternative deal. But with Tang tossing in a cash offer early, maybe it is less likely Reneo chooses the reverse merger path.

Esperion Therapeutics (ESPR) is a broken biotech adjacent idea, unlike the others, this is a revenue generating company that has a non-satin commercial product (Nexletol) for cholesterol. Esperion is locked in a lawsuit with their primary commercialization partner, Daiichi Sankyo, over a disputed milestone payment tied to the amount of "relative risk reduction" for heart attacks and other cardiovascular diseases/events that was reported in the company's CLEAR Outcomes Study. Esperion has a PDUFA date set for 3/31/24 that would expand the label of their primary asset to include cardiovascular risk reduction and a trial start date of 4/15/24 with Daiichi Sankyo. This remains a speculative idea, but could be a multi-bagger if both catalysts go their way in the first half of 2024.

Mereo BioPharma (MREO) is more of a regular-way biotech, the original thesis revolved around Rubric Capital taking an activist stance and gaining board seats with a general plan to realize the sum of the parts valuation of MREO's hodgepodge of programs. No publicly disclosed progress has been made in that regard, but the company did report positive Phase 2 results for Setrusumab in patients with osteogenesis imperfecta with partner Ultragenyx (RARE) that boosted the stock. Following the announcement, Rubric Capital has been a consistent buyer of MREO shares, giving confidence that their plan is working out.

Albertsons (ACI) and previously unmentioned Spirit Airlines (SAVE) are two well covered merger arbitrage situations that don't necessarily need more inked spilled on them. I'll use this post as a thank you to Andrew Walker and his wonderful Substack/Podcast, he really ramped up coverage on Spirit as the market became increasingly nervous in early November dropping the shares into the low $10s/share. I picked some up and the market has bid up shares since awaiting a ruling any day now in their anti-trust case with the U.S. government. Albertsons is facing similar push back, regulators are pointing to local market monopolies similar to Spirit, although I still believe the asset divestiture and any further divestitures should be able to create a compromise situation given Albertsons and Krogers general lack of national overlap.

MBIA (MBI) is a bond insurance company that has been in runoff for many years now. It has confusing accounting due to a GoodCo/BadCo structure hiding the value of the GoodCo in their consolidated financials. My original thesis centered around MBIA putting itself up for sale, but as rates increased (this company is also very interest rate sensitive due to their bond investment portfolio) and the Puerto Rico Electric Power Authority ("PREPA") restructuring continuing to drag on, the company paused the sale process since they presumably weren't getting anywhere near management's adjusted book value of $27/share. At the start of December, shares were trading under $8/share, then some lucky news hit

that National Public Finance Guarantee Corporation (the GoodCo) was dividending up to the parent $550MM in a special dividend. Much of which was then going to be distributed to MBIA shareholders in an $8/share dividend, more than the shares were trading at the time. Post special distribution, the company should have a book value of ~$11-12/share ex-BadCo and ~$19/share if you use management's adjustments and back out the unrealized losses on their investment portfolio and add in their unearned premiums. On the 11/3/23 Q3 earnings call, CEO Bill Fallon (presumably knowing the National dividend was a possibility/probability) said, "With regard to the strategic alternatives, as we've suggested in the past, we think the optimal transaction would be a sale of the company." With shares current trading for $6/share, there's still room for a healthy premium for MBIA shareholders and a discount to book for an acquirer. Absent a deal, if rates do indeed come down and municipal credits remain strong, MBIA can continue to limp along in runoff, returning capital via either repurchasing shares or potentially more special dividends in future years. I lost a fair amount on some call options speculating on a takeout earlier in the year, I won't make that same mistake with MBI today, but I continue to hold.

HomeStreet (HMST) is a regional bank based in Seattle that also does a lot of business in southern California, which was caught up in the deposit flight crisis last spring. I bought it after a Bloomberg article suggested the company was exploring a merger or an asset sale, later we found out that several bidders have made offers for the company's DUS business line (a license that allows them to directly originate Fannie Mae commercial loans), but the company has thus far not been agreeable to a sale. HomeStreet's deposits costs have risen dramatically, squeezing net interest margin, they've cut expenses, and reduced loan originations to the point where they could be classified as a zombie bank. A full out sale is highly unlikely here in the near term, any acquirer would be required to mark-to-market HomeStreet's balance sheet, which currently would have negative equity value due to the current value of their loan portfolio (rate driven, not credit driven, yet). Without the DUS asset sale as a catalyst, this bank is one big bet on lower interest rates, indeed in the last few weeks, shares have spiked back above $9/share. Tangible book value is $26/share (ex-loan fair market value), if rates decline enough over the next year or two, HomeStreet will limp along until the accounting is satisfactory enough where they become an acquisition target by someone with a stronger deposit franchise. That's a bit of thesis drift for me and I have plenty of interest rate risk elsewhere in my portfolio, so I might exit this position for future new ideas.

First Horizon (FHN) is a mid-to-large sized regional bank that does most of its business in the southeastern United States. It came on my radar when their sale to TD Bank was terminated after regulators made it clear they were penalizing TD for previous anti-money laundering wrongdoings by not approving the merger. The deal broke towards the tail end of the regional bank panic earlier this year and FHN sold off hard as arbs exited and market participants were unsure if the regional bank model was even sustainable anymore. Six months later, things have calmed down considerably for banks, deposit costs are still rising but with the Fed about to pivot, many bank board rooms are breathing a sigh of relief. First Horizon is a solid franchise, footprint has good demographics (although I've seen some stories about multi-family overbuilding in Nashville), minimal mark-to-market losses and strong capital ratios to the point where management has signaled plans to return cash to shareholders next year by repurchasing shares. On the negative side, the bank had a surprise loan go bad for $72MM (Yellow maybe?) and they've got some expense ramp happening as FHN modernizes its technology stack. Today it trades at $13.80/share, tangible book value is $11.22/share, a target valuation of 1.5x book still seems reasonable, which would yield a $16.83/share target price. I'm content holding until we get a bit closer to that number, maybe get long-term capital gains tax treatment too.

Banc of California (BANC) is another regional bank that closed on their transformational merger with PacWest (PACW) after the former got caught up in last spring's banking crisis. Following the merger, Banc of California should have a tangible book value around $14.25/share compared to the current share price of $13.43/share (0.94x book), with earnings guidance of $1.65-$1.80/share (12% ROE, sub-8x earnings). My thesis continues to be that there will be significant realized synergies as the two banks had significant overlap which will become more apparent in 2025 earnings. Until then, the bank is in pretty decent shape after an equity injection, low 80s loan-to-deposit ratio and sub-4% office exposure.

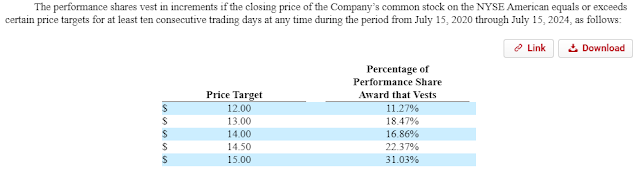

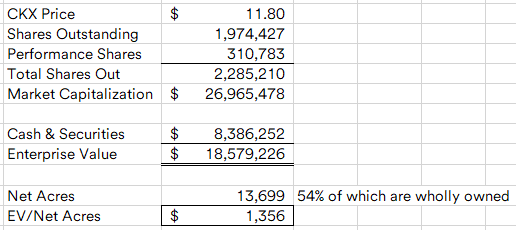

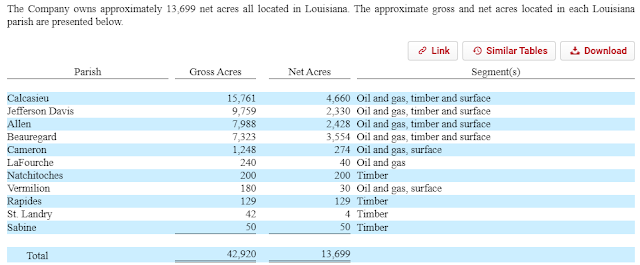

CKX Lands (CKX) is a micro cap (~$25MM) land bank in Louisiana where management is potentially looking to take it private (management hasn't said this explicitly, but the company is exploring strategic alternatives) as plans advance for a carbon capture sequestration plant on or near CKX's land. Historically, CKX has generated revenue from timber sales, oil and gas royalties and other miscellaneous land fees. The rock underneath CKX's land is porous rock that makes it suitable for carbon capture sequestration technology, which is essentially means collecting the pollutive output of the area's numerous refineries and piping it back deep into the earth. If a sequestration plant is constructed on CKX land, the company would be entitled to a revenue share, management might be trying to get ahead of that event by taking the company private. This

article provides a great overview of the sequestration opportunity and mentions CKX CEO Gray Stream quite a bit. I don't have a great sense of what the fair value is for CKX, but others more familiar with the situation have put an $18/share value of it, today it trades a bit under $13/share.

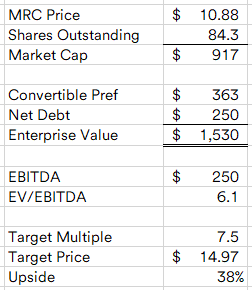

MRC Global (MRC) is a distributor focused on natural gas utilities, energy transition projects and servicing the upstream oil & gas industry. No MRC specific news has really come out since

my write-up, so it still holds up fairly well, the macro backdrop has improved a bit as LBO financing conditions have improved. The company needs to refinance a term loan that comes due in September, the preferred shareholder is blocking any contemplated refinancing that wouldn't include taking them out, I still think a sale should work well for all sides here and is likely to happen.

Green Brick Partners (GRBK) is a homebuilder with a land development heavy model that continues to outperform, turning on its head the value investor idea that an asset-lite homebuilding model is necessary to succeed in this cyclical industry. Count me as surprised too how their land sourcing and infill location model has continued to be a sustainable competitive advantage (key man risk with Jim Brickman?), but with migration trends continuing to be a tailwind for their Dallas and now Austin markets, their growth should continue. GRBK currently trades at a reasonable 7.5x NTM earnings according to TIKR estimates and has $121MM remaining on their share repurchase plan. I cut back on my position during the year, but still have confidence in Green Brick's medium-to-long term future although not necessarily an actionable idea today.

Acres Commercial Realty Corp (ACR) is a commercial real estate bridge lender, primarily to multi-family properties, but also a smattering of office, hotel and retail. The market is particularly worried about lenders like ACR, they lend to developers/sponsors who are repositioning a property, which upon stabilization will then obtain long term financing to take out ACR's bridge loan. Banks have pulled back, no one wants to extend new loans to office in particular, but multi-family also has some fears of covid induced overbuilding, the pull back in financing itself could cause a sinkhole in CRE asset value. If the sponsor is unable to obtain new financing, ACR might be handed back the keys. The formation of ACR was basically sponsored by Oaktree, the distressed specialist, my inclination is their loan book is stronger than the average commercial mREIT as a result. ACR additionally is the odd REIT that doesn't pay a dividend, which gives them flexibility to plug credit holes or as they recently announced, return cash to shareholders via a share repurchase program. Shares have rallied with the repurchase news and Fed pivot, but at $9.80/share, it still trades at a massive discount to book of ~$25/share.

Howard Hughes (HHH) is a real estate developer effectively controlled by Pershing Square's Bill Ackman, he has been a consistent buyer of shares this year as the stock has traded around $80/share in recent months. With rates increasing, new commercial development has slowed at Howard Hughes, plus one of their main products in new office is all but dead for the next decade or so. Even if commercial development slows in the near term, their land sales should be strong in the near term as homebuilders are increasing their activity to meet demand. Absent some kind of Ackman take-private, the near term catalyst for HHH is their upcoming spinoff of Seaport Entertainment which will house the disastrous Seaport segment (much of which they operate themselves), the Las Vegas Aviators (presumably the stadium too, but they need lender approval) and the Fashion Show air rights. They've hired Anton Nikodemus to be the CEO of Seaport, he previously was an executive at MGM where he ran the CityCenter properties and was instrumental in the development of MGM National Harbor and MGM Springfield. Presumably that means they're finally serious about utilizing the Fashion Show air rights, but with several large new strip casinos coming online this year, their timing might not be right. My initial reaction is the spin is a positive development, it'll remove the Seaport cloud from the pure play real estate assets, although I question how Seaport will be funded/financed. The Aviators ballpark provides a nice steady revenue stream, but not enough to cover further Seaport losses, let alone develop their planned 250 Water St tower or a new Las Vegas strip casino. I'll likely do a deeper dive once the Form 10-12 comes out on the spin.

DigitalBridge Group (DBRG) is in the final stages of its transition from a diversified REIT to a pure play asset manager focused on the digital infrastructure industry. Continually increasing rates in 2023 were initially a negative for DigitalBridge as many of their portfolio companies were purchased at low entry cap rates, but the company was saved a bit by the artificial intelligence trend that has continued the need for data centers and other digital infrastructure assets. This remains a bit of a jockey bet on CEO Marc Ganzi, he's a talented fund raiser, but he is losing his number 2 in CFO Jack Wu who is moving on to lead his own investment organization. I don't have much to add to the discussion on DBRG, content to hold a while longer to see the full transition from a balance sheet play to an income statement story, we're still probably 1-2 years away from that being complete.

Transcontinental Realty Investors (TCI) is a heavily controlled real estate company that primarily owns multi-family properties in the sunbelt, but does have a smattering of office and land development projects as well. This year was pretty quiet for TCI, they did start developing two new apartment complexes (one in FL, the other in TX), but otherwise simply deleveraged their balance sheet after the previous transformational Macquarie JV sale in 2022 (which in hindsight was very well timed, sold near the very top). The

recent proxy statement had two interesting proposals, one put forth by management that would clear some red tape in merging the Russian doll structure with ARL and IOC and another from a shareholder asking the company to hire an advisor and pursue strategic alternatives. The shareholder proposal naturally failed since TCI is 85% owned by the controlling family. But seems like there might be some movement in cleaning up the structure, it is still a bit puzzling why TCI is public, management does have an external management agreement, but it really only applies to the 15% of stock that is held by the public. With NAV arguably over $100/share and the stock trading for $35/share, there's a lot of room for minority shareholders to be happy and management to transfer significant value to themselves in a take-private deal. I had an outsized position in TCI to start the year, did trim my position by a third, content now to wait a year or two longer for a corporate action to happen here.

NexPoint Diversified Real Estate Trust (NXDT) is formerly a closed end fund that 18 months ago converted to a REIT. Unfortunately, this story has been very slow to develop, not much has happened here post conversion, the REIT continues to be a confusing mess of limited partnership stakes, many of which are with related parties, and limited investor outreach to simplify the story. Rising rates didn't help NXDT and its valuation has suffered, trading around $8/share today versus a $23.89/share reported NAV (as of 6/30) or a $22/share tangible book value. CEO James Dondero (a controversial figure) continues to buy shares via funds he manages, personally and is taking their management in shares (although that's a bit of a negative given where the shares trade), all bullish signs for the underlying value compared to trading price. The REIT doesn't cover its dividend with AFFO, it recently started paying 80% of the dividend in shares, I'd rather see them cut the dividend to zero and build some liquidity, only paying a special dividend necessary to comply with IRS REIT regulations. In summary, it is just odd that NXDT doesn't publish press releases, conduct earnings calls or do the typical REIT conference circuit investor presentations. All things I would have assumed they would do considering how they manage NexPoint Residential Trust (NXRT). Similar to TCI, I'm willing to give management here another year or two to see what develops, but my confidence is lower than when I first bought into the idea.

Par Pacific Holdings (PARR) is a downstream energy company with refining, midstream and retail locations in geographically niche areas in the Rockies, Pacific Northwest and Hawaii. Par Pacific has benefited from another year of above average refining crack spreads causing the company to gush cash. They've successfully fixed their post-covid balance sheet and this year closed on the acquisition of a formerly Exxon refinery in Billings, MT. The company is generating significant taxable earnings which are now offsetting their $1B+ NOL tax asset. Par Pacific is additionally beginning to invest in renewable fuel assets, which might help people think through the terminal value question of oil refineries, but I tend to think that's premature by a couple decades. The management team is formerly from Zell's Equity Group and continues to execute on value accretive deals (other than injecting additional equity in Laramie (a private natural gas producer PARR owns 46% of), it is hard to think of a bad deal they've done). It's not necessarily actionable today, I did sell down some of position during the year, but at 5x NTM EBITDA and 6.75x NTM earnings (TIKR estimates, to be fair, they're overearning in the current environment), I continue hold due to being comfortable with the management team.

Closed Positions (since 6/30)

Broken Biotech Basket:

- Pardes Biosciences (PRDS) was acquired for $2.13/share in cash and a CVR for 80% of any legacy asset sales by an affiliate of Foresite Capital.

- MEI Pharma (MEIP) settled with activists Anson/Cable Car and paid out a $1.75/share special dividend, the shares rallied a fair amount to the point where I think it is somewhat a bet on MEIP's development pipeline reporting positive results. MEIP hasn't had a particularly good history of developing new drugs, so I booked a small win. Best of luck to the activists, I hope it works out as to encourage more activism in these broken biotechs.

- Check-Cap (CHEK) is a strange little story, the company entered into a reverse merger with Keystone Dental Holdings in August. Prior to the announcement, 5.8% shareholder Symetryx Corporation had offered $4.60/share in cash, but it was unclear how serious this bid was or if Symetryx actually had the financing to close. After the deal announcement, Symetryx went activist against Check-Cap and recruited the founder to join them in replacing board, which they won and earlier this month terminated the reverse merger with Keystone. Now that Symetryx has control of the board, they're out looking for a new deal, Check-Cap has approximately $4.64/share in NCAV as of 9/30 versus a stock price of $2.08/share.

- Dianthus Therapeutics (DNTH) closed on the reverse merger transaction with Magenta Therapeutics (MGTA), issued CVRs for the legacy assets and then rallied a bit after. I took a small profit and await proceeds, if any, on the CVR.

- Quince Therapeutics (QNCX) ended up spurning the Echo Lake offer for $1.80/share in stock plus a CVR, instead they ended up buying another biotech in a transaction that didn't require shareholder approval. Shares now trade for $1.10/share, well below Echo Lake's offer. I took a small loss on the stock.

PFSWeb (PFSW) was a third party logistics ("3PL") provider that was

acquired by GXO Logistics (GXO), the deal closed in October for $7.50/share, a nice result.

Sculptor Capital Management (SCU) was a hedge fund manager that put itself up for sale after a very public spat between founder Daniel Och and CEO Jimmy Levin. The firm found a buyer in Rithm Captial (RITM) (fka New Residential), a little bidding war ensued but eventually Rithm Capital closed on the deal in November for $12.70/share.

Jackson Financial (JXN) is a 2021 spin of Prudential PLC that primarily provides variable annuity insurance products. I liked the setup because it was a UK listed company spinning off a much smaller US listed company; Jackson Financial initially traded substantially below book value (still does) as it was an orphaned security with no initial index ownership and complicated financials. Over the following two years, Jackson was added to indices, paid a healthy dividend and bought back a substantial amount of stock. While that gameplan is still occurring and some potential excess capital could be dividended up to the parent (similar to MBIA) in the near future, my initial thesis has generally played out and I'm not a strong enough accountant to figure out their financial statements. I decided to sell and relocate to newer ideas.

Carlyle Credit Income Fund (CCIF) (fka VCIF) was previously a residential mortgage closed end fund that transitioned to a CLO equity fund. The thesis generally played out expect for one important risk, when it came time to sell the residential mortgages in the old VCIF portfolio and deliver the cash to Carlyle, the fund took a large 17% write-down. I'm still not entirely clear why or what happened in the few weeks from the proxy to the asset sale, but that cut almost all my gains in the investment. Carlyle is a quality manager and I generally like CLO equity as an asset class, but post transition and dividend reinstatement, my position was generally smallish and decided to move on. Might re-visit it if we see some stress in private credit and the leveraged loan market.

Manchester United (MANU) is the famed English Premier League soccer club, my thesis revolved around the bidding war between Sir Jim Ratcliffe and Sheikh Jassim of the Qatari royal family, I wrongly guessed that Sheikh Jassim would come out victorious since his bid was for all MANU shares and at a higher price than Ratcliffe. But for whatever reason, the Glazers choose Ratcliffe, after months/weeks of rumors, the official announcement was made this past week that Racliffe was tendering for 25% of both Class A and Class B shares at $33/shares, plus investing another $300MM at $33/share for club facility improvements. I had hoped there would be some language around a path towards majority or full ownership, but didn't see anything explicitly stated to that effect. Without a concrete timeline, and Ratcliffe taking operational control of the team, its uncertain why or when he'll buy economic control of the team, the prestige is being the ownership face, and he'll be that now. As a result, I would expect MANU shares to trade at a significant discount following the tender and possibly be dead money for a while. I was wrong, but didn't really lose any money on this one.

Performance Attribution

Current Portfolio

In addition to the above, I also have a bunch of CVRs, non-traded/illiquid liquidations, an illiquid bond and a litigation stub.

Please feel free to ask any questions or leave any interesting new ideas for 2024. Thank you to all my readers, especially those that have reached with positive or negative feedback, new ideas, or just wanting to chat. Happy New Year, hopefully 2024 is prosperous as well.

Disclosure: Table above is my taxable account/blog portfolio, I don't manage outside money and this is only a portion of my overall assets. As a result, the use of margin debt, options or concentration does not fully represent my risk tolerance.