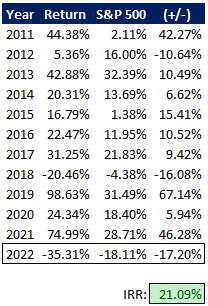

This year in the markets wasn't fun. While I didn't participate in the headline driving speculative manias (growth stocks, SPACs, crypto, etc), I did get caught with a leveraged PA heavy in real estate and pre-arb/takeover situations which were hit by rising interest rates and M&A financing markets tightening up. I was down -35.31% for the year, versus the S&P 500 finishing down -18.11%, my worst absolute performance and relative result to the markets since beginning investing in individual stocks. My lifetime to-date IRR fell to 21.09%.

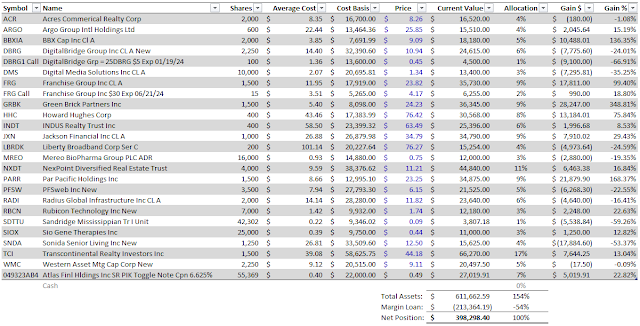

Current Positions UpdatesAs usual, I wrote these intermittently over the last week, some of the share prices/valuations might be slightly stale. Presented in mostly random order:

- My largest holding by a fair amount -- partially because it has held up in price this year versus everything else falling -- is Transcontinental Realty Investors (TCI), TCI's joint venture with Macquarie recently completed the sale of their portfolio, including the holdback of seven properties by TCI. The book value of TCI jumped to approximately $90/share, but this possibly understates the value created in the JV sale transaction, the holdback properties were valued at market in the split between TCI and Macquarie, but remain at historical cost in TCI's book value. Reasonable people can argue where sunbelt multi-family would trade today (lower) versus earlier in the year when the JV sale was announced, but the likely fair value of TCI is more than $100/share while it trades for ~$43/share. Of course, TCI shareholders will never see that amount, but the larger the gap between fair value and the share price, the more likely it is that the Phillips family's incentives would align with a go-private proposal. The current stated plan for the JV cash is "for additional investment in income-producing real estate, to pay down our debt and for general corporate purposes." Optimistically, I view that as boilerplate language and doesn't rule out a go-private offer with the proceeds, however, if a portion of the proceeds get swept back to the Phillips family via their role as "Cash Manager", that will be the signal to exit as they'd be getting liquidity for themselves but not minority shareholders.

- In hindsight, lucky for Franchise Group (FRG) they got cold feet in their attempt to buy Kohl's (KSS) (I sold my position in KSS at a loss after the potential deal was called off), despite the upside potential due to extreme financial engineering. Following that pursuit, the current economic environment's grim reaper came for FRG's American Freight segment (liquidation channel furniture store concept where unlike their corporate name, they own and operate these locations). Management made the covid era supply chain mistake of buying anything they could get their hands on, when consumer preferences shifted, they were left with inventory that was no longer in demand. FRG remains bullish on American Freight, on the last conference call Brian Kahn stated in the context of his M&A appetite, ".. if we even pick what you might consider to be a low multiple of 5x, which not many businesses go for we can go investor our capital in opening more American Freight stores at less than 1x EBITDA." I'm guessing next year, Kahn will stay out of the headlines and refocus on the business. Most of FRG's problems are centered in the American Freight segment, their other two large segments, Vitamin Shoppe and Pet Supplies Plus, continue to perform well. Excluding their operating leases, using TIKR's street estimate of $375MM in NTM EBITDA, I have it trading for approximately ~5.5x EBITDA. June 2024 LEAPs are available, I bought some versus averaging down in the common stock.

- My valuation was sloppy on Western Asset Mortgage Capital (WMC), the hybrid mREIT recently announced that their current estimated book value is $16.82/share (not including the $0.40 dividend) versus $24.58/share at the time of my post. I called out that the $24.58 number was overstated and was going to come down, but didn't anticipate the magnitude. The company is currently up for sale, there will be an additional ~$3/share in a termination fee to the external manager, so if the current book is relatively stable, looking at ~$11-12/share value in a takeout after expenses and need to split part of the discount with the buyer. Surprisingly, the shares have traded up since the current book value disclosure, trading today for ~$10.00/share. I should probably sell given I'm surprised by that reaction, but my current inclination is to wait for a deal announcement. There should be plenty of buyers, there are always credit asset managers looking for permanent capital, and a deal shouldn't rely on the M&A financing window being open like an LBO (it'll be a reverse-merger like transaction). On the negative side, they have remaining commercial loan exposure to the albatrosses that are American Dream and Mall of America, their residential assets (the core of the portfolio) are high quality non-QM adjustable rate mortgages, but most are in their fixed rate period and thus susceptible to rate volatility.

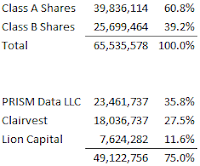

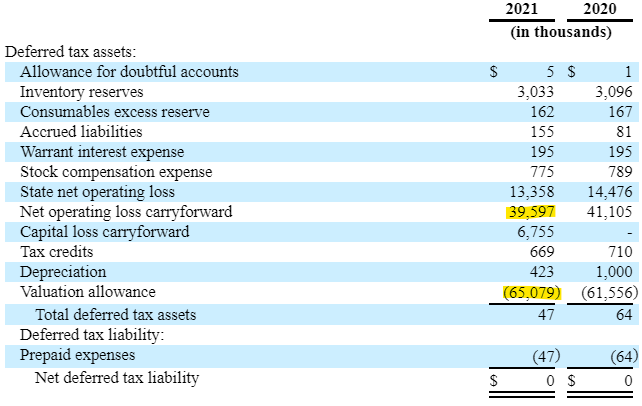

- In contrast, Acres Commercial Realty Corp (ACR) is a clean mREIT with minimal legacy credit problems, all floating rate assets and floating rate debt (via CRE CLOs) that should minimize interest rate risk. A majority of their loans are to the multi-family sector, reasonable people can argue that multi-family is being overbuilt in many areas of the country today, but these are not construction loans to future class A properties that are at higher risk for oversupply, but rather to transitional properties that are undergoing some kind of repositioning, value-add cycle. ACR is trading for an absurd 32% of book value, mostly because of its small size ($70MM market cap) and lack of a dividend. Instead of paying a divided, ACR is using their NOL tax asset generated by prior management to shield their REIT taxable income (thus not being required to pay a dividend) to repurchase stock at a discount. First Eagle and Oaktree are large shareholders, two well regarded credit shops, that might keep management honest. If the shares don't fully rerate by the time the NOLs are burned off, I could see a similar scenario to WMC where it makes sense to sell, despite needing to pay the external management termination fee.

- One mistake I made in 2021 that carried over into 2022 was oversizing my initial position in Sonida Senior Living (SNDA). SNDA was an out of court restructuring sponsored by Conversant Capital, which controls SNDA now, that resulted in an injection of cash, but still a very levered entity (SNDA doesn't have leases, they own their properties). After the shares have been more than cut in half this year (likely due to inflation/shortages hitting their labor cost structure and slower than anticipated occupancy recovery), the market cap is roughly 10% (pre-convertible preferred stock conversion) of the overall enterprise value. SNDA features both high financial leverage and high operating leverage, occupancy sits at around 83%, if occupancy moves another 5-6% higher to normalized levels, SNDA is likely a multi-bagger. But the opposite could be true also. I'm sitting on a big loss, but sticking it out with the original thesis that occupancy levels will normalize as Covid-fears subside and aging demographics shift in their favor.

- PFSweb Inc (PFSW) recently distributed the cash ($4.50/share) from their 2021 sale of LiveArea, what remains is a third-party logistics ("3PL") business that is subscale but has navigated the current environment better than you'd expect from a Covid-beneficiary, signing up new clients and estimating 5-10% revenue growth in 2023. While investors were likely disappointed that PFSW hasn't sold the 3PL business to-date, they did re-iterate on their Q3 earnings call that completing a transaction is their top priority and extended their executive team's incentive comp structure based on a sale through 2023. I've got PFSW trading for approximately ~4.6x 2023 EBITDA (using the TIKR estimate), extremely cheap for a business that should have multiple 3PL (there are dozens of them) strategic buyers, just need the M&A window to open back up. I'm comfortable seeing that process through to completion.

- The rose is off the bloom with DigitalBridge Group (DBRG), shares have retraced most of their gains since the summer of 2020 when the transition to an infrastructure asset manager was in its infancy. That transition is largely completely, they still own a slug of BrightSpire Capital (BRSP) -- likely cheap on its own, trades at 61% of book -- and equity positions in two data center companies that they're in the process of moving to managed vehicles. Multiples likely need to come down for previously high-multiple digital infrastructure investments in a non-zero interest rate world, it's hard to know how accurate their marks are inside their funds and how the current environment is impacting future fund raising. I attempted to catch a bottom too early, purchasing Jan 2024 LEAPs that have a post-split adjusted strike price of $20/share. Shares currently trade for $10.45/share, well short of my LEAPs and well short of CEO Marc Ganzi's $100MM pay day at $40/share. Activist investor Legion Partners Asset Management has recently pushed DBRG to put itself up for sale if shares don't recover.

- INDUS Realty Trust (INDT) and Radius Global Infrastructure (RADI) have similar characteristics, each have high overhead expenses compared to their asset bases as they look to develop/originate new assets. Both have been hurt by rising rates this year as they're focused on low cap rate asset classes with long term leases (RADI thus far hasn't been able to flex its CPI-linked resets, possibly an unfair criticism as they're on a lag), but both have relatively recession proof cash flows. The weakness in their share prices is almost entirely rate driven. Both companies still have reasonably long growth runways without needing to raise capital, but looking out, both might benefit from being in private hands where the cost of capital might be lower or at least less volatile. INDT has a public $65/share bid from Centerbridge outstanding and RADI has been the constant target of deal speculation throughout the year, the latest firm said to be interested is infrastructure manager EQT. I underestimated how high interest rates would rise this year and hope one or both of these holdings is successful in shopping themselves early in the new year.

- NexPoint Diversified Real Estate Trust (NXDT) finally did fully convert to a REIT from a closed end fund. However, the shares haven't reacted much to that change, the company did put out regular way SEC financials for their 9/30 10-Q, but disappointedly haven't hosted an earnings call or put out a supplemental that would make the tangled web of holdings more digestible. I get a lot of questions about my current thoughts on NXDT, and the "no change" answer is probably unsatisfying, but I'm content holding this for another several years and letting the story slowly (a little too slowly right now) unfold. There's a lot of wood to chop, this is one of those balance sheet to income statement stories that'll take time, I could see it being a triple from here (~$11.50/share) over the next 3 years.

- Howard Hughes Corp (HHC) continues to be a value trap, anyone who spends time doing the bottoms up analysis comes away saying it is undervalued but it's just never going to be fully appreciated by public markets (due to complexity, Ackman, development/capital allocation risk, etc., take your pick). In October, Pershing Square (Ackman's investment vehicle) attempted to take advantage of this value disconnect by launching a tender offer at $60/share, later raising it to $70/share, and still got very few takers. James Elbaor on Andrew Walker's fantastic podcast offered some speculation that Ackman could do a reverse merger of Pershing Square into HHC in order to redomicile. Pershing Square currently owns ~30% of it and it's a double discount inside the publicly traded PSH as the fund trades at a wide discount as well. Maybe Ackman does something one of these years, but in the meantime, I'm emotionally vested to continue to hold.

- BBX Capital (BBXIA) is essentially the publicly traded family office of the disliked Levan family. Shares trade for ~$9.40/share and the 9/30 book value was $20.72/share, included in the $20.72/share is approximately $11.63/share of cash, securities and their note from related party Bluegreen Vacation Holdings (BVH). Additionally, they own a spattering of multi-family real estate in Florida, a real estate developer, door maker Renin (slightly financially distressed) and candy store IT'SUGAR (you've probably seen these is airport terminals). Management isn't to be trusted here, but similar to my hopeful thesis in TCI, the discount between the share price and fair value is so wide that management's greed is sort of on the shareholders side at the moment. BBXIA recently completed a $12MM tender offer for 1.2 million shares, that makes the proforma book value ~$21.70/share. Shares trade for just 43% of that value, and still have $11.75/share in cash/securities to buyback more stock. Because the shares trade below that number, each repurchase below that line are actually accretive to the cash/securities per share metric. While it is hard to see a firm catalyst to get the shares much higher in the near term, the discount seems too severe to sell into their periodic tender offers.

- A stock that likely won't mention again for three years, I bought back into Rubicon Technology Inc (RBCN) this month as the stock has sold off considerably, presumably sellers getting out before the company stops reporting here soon (might trade with expert-market status), following the transaction with Janel Corporation (JANL). To recap, Janel effectively paid $9/share for RBCN's NOLs in the tender offer, they're restricted from purchasing more RBCN for three years, but now the shares trade for ~$1.40. There's plenty of room in there for JANL to pay a premium in three years and get a fantastic deal for themselves. The main remaining risk is JANL going bust in the meantime.

- My energy tourist hedge is Par Pacific Holdings (PARR). PARR is a rollup of niche downstream energy businesses in remote locations (Hawaii, Washington, Wyoming, soon to be Montana). Their thesis is these refineries are overlooked by the large players but also have a defendable market position because of cost advantages in their local markets due to their remote locations (high transportation costs for competitors). 2022 was finally the year when stars aligned, crack spreads widened out significantly and PARR's refineries were running at near fully capacity with no significant downtime for maintenance capex projects. In Q3 for example, PARR reported $214MM in adjusted EBITDA, roughly their mid-cycle guidance for an entire year. Similar to other energy businesses, this year's cash flows allowed PARR to clean up their balance sheet and now are positioned to once again buy another refinery, this time Exxon's Billings refinery. The deal should close in the first half of 2023, just maybe PARR is turning a corner and has gained enough scale to finally start significantly chipping away at their large NOL (that was my original thesis 8 years ago).

- Similar to PARR, I've owned Green Brick Partners (GRBK) for 8+ years and just sort of let it sit there. Despite new housing development hitting a wall in the back half of 2022 as mortgage rates briefly peaked above 7%, GRBK shares are actually up 20% since 6/30. It's fairly certain that tough times in housing will continue in the near term. But I'm guessing it won't last overly long, single family homes have been underdeveloped following the excesses of the GFC, politically overly tight mortgage conditions for a long time seems untenable, and millennials need homes. With attractive land in short supply, I don't see the large scale write-downs of the GFC reoccurring, maybe asset heavy homebuilders like GRBK will be seen to be attractive again versus asset-lite builders. Shares trade for a relatively undemanding 7x TIKR's NTM (trough?) earnings estimates.

- Another sloppy buy from me was Argo Group International Holdings (ARGO), shortly after my post the specialty insurer came out with disappointing results and dropped significantly despite being in the middle of a sale process (the initial interest from potential buyers was reported to be muted). I tax harvested my position and re-entered at lower prices. Management recently survived a proxy contest from activist Capital Returns, now appears to have found religion and reiterated time and time again they're committed to their restarted sale process. My conviction is pretty low here, hoping for a sale in 2023. It trades well below peers on P/B, optically for a P&C insurer tourist like myself, a sale should make sense for both a buyer and ARGO.

- Mereo BioPharma Group (MREO) similarly faced a proxy contest in the fall, instead of fighting like ARGO, MREO saw the writing on the wall and let activist Rubric Capital on the board. Rubric's stated strategy for MREO is to monetize/liquidate much of the company's assets, we've yet to see movement on that (I'd argue it is still early, but others might disagree). Despite the potential for a strategy change, shares have dropped roughly in half as money burning biotechnology companies continue to be out of favor in a rising rate in environment. MREO is an option like equity at this point, could be a multi-bagger or shareholders could get significantly diluted.

- Another pick of mine that is down significantly despite little news is Digital Media Solutions (DMS). DMS has an a $2.50/share bid from a consortium of management and PE sponsors that own 75% of the DMS shares. No news has come out since 9/8/22 non-binding offer, shares have fallen all the way to ~$1.30/share today. There's a great discussion in the comment section of my post speculating on various scenarios, anyone interested should sift through them.

- I don't have any original thoughts on either Jackson Financial (JXN) -- seems like most of the index buying has happened -- or Liberty Broadband Corp (LBRDK), others are going to speak more intelligently than me. Each are buying back a significant amount of stock, optically cheap, could be coiled springs if recession fears break, but both also have challenging/complex business models in their own respects. I might sell one, both, or none to fund new ideas early in 2023.

- Nothing has really changed in the last two weeks for Sio Gene Therapies (SIOX), it is a failed biotech liquidation, which likely will be a continued theme for me in 2023. Other liquidations I continue to hold include Sandridge Mississippian Trust I (SDTTU), Luby's (non-traded) and HMG Courtland Properties (non-traded). One old 2019 liquidation, Industrial Services of America (non-traded), recently made its final distribution and ended up being a disappointing low-single digit IRR. To round out the miscellaneous stuff, I own the Atlas Financial Holdings bonds (CUSIP 049323AB40) which don't appear to have traded since the exchange offer, and remaining CVRs in Prevail Therapeutics, Applied Genetic Tech, OncoMed and the BMYRT potential ligation settlement.

- One of the most puzzling M&A transactions of 2022 has to go to Advanced Emissions Solutions (ADES). Management dragged shareholders on a long strategic alternatives process in which it was widely assumed that ADES would be a seller and return their cash to shareholders. Instead, ADES flipped around and became a buyer of an early stage venture company, destroying value in the process. Shares traded for $6.28 the day before the deal announcement and now trade for $2.23, I don't know how this deal even closes. If it weren't for the poison pill to protect the NOL (which I believe is being disqualified in this transaction anyway), I'd assume an activist would come in here and block the deal.

- My original thesis for ALJ Regional Holding (ALJJ) centered around the NOLs being monetized following a couple asset sales, thus the reason for the vehicle existing was gone and Jess Ravich would take out minority shareholders with the new liquidity on the balance sheet. That didn't happen, instead Ravich delisted ALJJ and went on a mini-buying spree, turning ALJJ into a family office. I moved on after that.

- Ballys Corp (BALY) was a tax harvesting casualty for me (despite the terrible performance, I still realized gains in 2022, mostly holdovers from very early in the year), I still like the company and follow it. The Chicago casino project will be a home run, likely the same for whatever they do with the old Tropicana on Las Vegas Blvd strip. It is cheap and worth a look.

- WideOpenWest (WOW) was another sloppy mistake, the M&A financing environment changed and I didn't change my framework as quickly, thought that an LBO could get done, but with the limited free cash flow, it just didn't make sense. Despite the few rumors around it, nothing got done, if the M&A market reopens, WOW could be one of the early targets.

- I sold Regional Health Properties (RHE-A) recently to harvest the loss, the company's preferred exchange offer failed to get enough of the common stock to vote in favor of the unique proposal. Shares have drifted significantly lower since, the company's fundamentals are still strained, their operators are suffering under the same labor issues as SNDA, RHE has been forced to takeover management of these underperforming nursing facilities. The asset value appears to still be there in a liquidation like scenario, but not sure how that gets initiated, the preferred stock is in a tough spot. I might re-enter a position, there's a commenter on my RHE posts looking for others to exchange notes on where the preferred stockholders should go from here.

- LMP Automotive Holdings Inc (LMPX) and Imara (IMRA) were my two big winners this year, both situations played out very quickly. IMRA didn't pursue a liquidation, but rather a reverse merger, I exited shortly after that, still making a large quick gain, but missed the run up to the top by a good margin. Still working on when to sell these when day traders get ahold of them.

- STAR/SAFE, BHM, SRG, AAIC, ACEL, SCPL, ABIO, ANGN, SFE, ADMP, MBI, NWSA, TV, MACK, FPH, AIV, ILPT, CMRX, ADMP, SCU