KAR Auction Services (RemainCo)

ADESA ("Automotive Dealer Exchange Services of America") is the second largest provider of used car auctions in North America, with about 28%-30% of the market, behind industry leader Manheim, a subsidiary of privately held Cox Enterprises, that commands 42% market share. ADESA's auction sites link large volume car sellers (off-lease, rentals, repossessions, excess dealer inventory) with used car dealerships utilizing a consignment model where the company doesn't take ownership of the vehicles, but charges buyer/seller fees, transportation fees, and other fees that help prepare a car for sale (paint, small dent repair, detailing, etc.). Each car sold through ADESA represents about $600 in revenue. This is a reasonably good business, there are significant barriers to entry (for one it would be difficult to replicate their auction site footprint), low capital expenditures and limited working capital requirements, but it does feature some cyclicality to it via the supply and price of used cars.

There are two big sources of used vehicles for ADESA: 1) cars going off-lease, as leasing has become a more popular option in recent years (although leveling off now) it provides ADESA with a strong tailwind as lessees turn their cars into the lessor, who then sells through an auction provider to used car dealers; 2) repossessions, on one call management described themselves as "Repo Kings" since KAR has an active repo business inside of ADESA, auto lenders are not natural sellers of cars on their own, so they sell to used car dealers through an auction provider. More people financing cars at greater and greater loan balances translates into more cars falling into default and repossession.

AFC ("Automotive Finance Corporation") is the second piece of RemainCo, AFC provides "floorplan financing" to independent used car dealers to help facilitate sales at ADESA. Floorplan financing is a short term loan secured by the car that's paid back once the car is sold by the dealer. Because the loans are short term (65 days on average), 50% of the revenue ends up fee based generating mid-teens ROE and adding to the attractiveness of the business. Additionally, there are tens of thousands of independent dealers making this a difficult business to replicate at a nationwide scale and AFC's securitization financing provides a cheap competitive funding source.

In 2017, KAR purchased the remaining 50% in TradeRev that it didn't already own, TradeRev is a dealer-to-dealer mobile app that facilitates real time auctions between dealers versus a traditional auction platform where the dealers are typically only on the buyer side. With the spin dividend cash from IAA, KAR will continue to invest heavily in TradeRev as they're in the midst of a nationwide dealer by dealer roll-out of the platform. Additionally, KAR has international ambitions and recently bought an online auction platform that serves much of Europe with stated desires to continue to pursue international acquisitions.

Insurance Auto Auctions ("IAA Spinco" in the Form 10 or just "IAA")

IAA will be a standalone salvage auction business, when a car is totaled in an accident or has aged out of useability (think car donation charities) the car will be sold at a salvage auction for parts or scrap. Salvage auctions are similar to whole used car auctions in its transaction based ($500/car revenue, slightly lower due to fewer add-on services) where IAA doesn't take ownership of the car, however it's a more predictable business as cars will always need to be salvaged regardless of the economic cycle.

IAA in their Form 10 forecast the salvage vehicle auction industry will grow at 5%-to-7% annually for the foreseeable future driven by 3 main tailwinds:

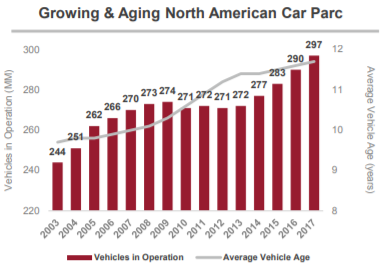

- Growing automotive car parc -- Industry speak for the total number of cars on the road, now just under 300 million, the average age of vehicles continues to rise, older cars getting into an accident are more likely to be a total loss.

- Increasing vehicle complexity leading to higher total loss frequency -- there are more electronic components and repair labor costs are rising making car repair more expensive, if the repair costs are more than the car is worth, it of course results in a total loss.

- Increasing accident frequency -- here they cite more cars on the road and more distracted driving (texting and driving, etc.).

The stated reason to spinoff IAA is to create a standalone company that compares directly with their competitor Copart (CPRT). Copart maintains a similar ~40% salvage market share but has superior margins partially due to owning the real estate beneath their auction sites (IAA leases their sites), the rest of the margin difference is hard to parse out and might be an opportunity for improvement post-spin. IAA has been managed separately from KAR (different auctions sites, different customer bases, separate headquarters) and the soon to be CEO, John Kett, has been running IAA since 2014, eliminating some of the risk of IAA stumbling out of the gate that we often see with spinoffs.

Valuation

New KAR Auction Services doesn't have a direct North American public competitor since Manheim is privately owned by Cox Enterprises, but it does have a peer in the leading wholesale auction provider in the UK, BCA Marketplace PLC (BCA.LN). The combined KAR has $2.74B worth of debt and $345MM of cash, KAR is going to raise $1.3B of debt (not finalized) at IAA, sending $1.25B back to new KAR after gifting IAA with $50MM in cash, leaving new KAR with $1.145B in net debt.

Copart (CPRT) trades for 15.5x EBITDA, but its better run and has minimal debt so it should trade at a significant premium to IAA. For the sum-of-the-parts, I'm going to use 10.5x for new KAR (1x discount to BCA) and 12x for IAA (2.5x turn discount to CPRT):

Adding to the two pieces together, I get a price of $60, not a ton higher than today's $52 share price. Despite that I added a smallish position going into the spinoff, IAA in particular interests me as an interesting long-term spinoff:

Valuation

New KAR Auction Services doesn't have a direct North American public competitor since Manheim is privately owned by Cox Enterprises, but it does have a peer in the leading wholesale auction provider in the UK, BCA Marketplace PLC (BCA.LN). The combined KAR has $2.74B worth of debt and $345MM of cash, KAR is going to raise $1.3B of debt (not finalized) at IAA, sending $1.25B back to new KAR after gifting IAA with $50MM in cash, leaving new KAR with $1.145B in net debt.

Copart (CPRT) trades for 15.5x EBITDA, but its better run and has minimal debt so it should trade at a significant premium to IAA. For the sum-of-the-parts, I'm going to use 10.5x for new KAR (1x discount to BCA) and 12x for IAA (2.5x turn discount to CPRT):

Adding to the two pieces together, I get a price of $60, not a ton higher than today's $52 share price. Despite that I added a smallish position going into the spinoff, IAA in particular interests me as an interesting long-term spinoff:

- IAA doesn't have to make a significant change to its business model to succeed, instead there is both a discounted valuation and a margin gap, if both of these close it could be a home run;

- Deleveraging, as mentioned, since IAA doesn't have to do anything transformational or reinvent the business, and its growing at a healthy clip, they'll have plenty of FCF to deleverage and/or return cash to shareholders via buybacks or dividends;

- Management has been running this company as a separate unit, we should see some animal spirits unlocked now that their comp will be directly tied to the success or failure of IAA and the operating performance gap between IAA and CPRT will be on full display.

Disclosure: I own shares of KAR