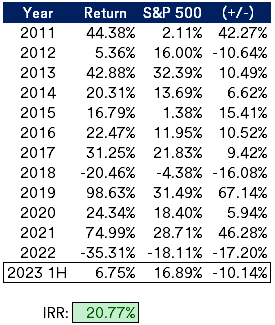

This will be more of a brief check-in rather than a full review. Unfortunately, my recent spell of underperformance has continued into the first half of 2023, my portfolio is up marginally, 6.75% versus 16.89% for the S&P 500. I'm still above my long term goal of 20+% IRR; the show goes on.

The main performance detractors were oversized positions in MBIA (MBI) and Transcontinental Realty Investors (TCI), two speculative M&A candidates that have failed to materialize. Many of my other speculative M&A ideas did announce deals, but well below where I had penciled them out. As a result, I've leaned more on smaller position sizes in the broken biotech basket and other flavors of special situations for new ideas recently.

The one outsized performer was Green Brick Partners (GRBK), homebuilders have exceeded low expectations as single family home inventory has remained tight despite rising interest rates. I've begun to sell down my position, it had become too large and doesn't really fit into a value or special situation bucket any longer.

Closed Positions

- Radius Global Infrastructure (RADI), INDUS Realty Trust (INDT) and Argo Group International (ARGO) all received bids that were a bit disappointing from elevated early 2022 expectations when rumors surfaced that each were for sale. All were interest rate sensitive businesses where the value declined as rates rose faster than initially expected.

- In the broken biotech basket: 1) sold Talaris Therapetuics (TALS) after their recent reverse merger with Tourmaline Bio for a nice gain; 2) sold Oramed Pharmaceuticals (ORMP) for minimal gain after a few readers pointed out their promotional (maybe being kind) management and then saw it first hand; 3) Sold Carisma Therapeutics (CARM, fka Sesen Bio) after the reverse merger, was left with a stub position (received the non-tradable Sesen CVR) that I sold fairly indiscriminately for a small loss.

- The Franchise Group (FRG) story ended rather disappointingly, have a bit of a bitter taste in my mouth, after rumors surfaced early in the year that CEO Brian Kahn was considering taking the company private. FRG then went on to have a terrible Q1 where they breached a covenant in their credit facility, preventing them from continuing their dividend, that was disclosed at the same time as the company agreed to Kahn's $30/share buyout. Since the company is kind of a one-of-one based on Brian Kahn's deal making, with a covenant breach, it was unsurprising that no other bidder came forward during the go-shop period.

- I sold Star Holdings (STHO) shortly after the close of iStar/Safehold transaction after a few readers reached out with some concerns on SAFE. I'll re-evaluate down the road, this is one I'll likely rebuy again at some point in its liquidation journey.

- My thesis in Liberty Broadband Corp (LBRDK) was stale, I originally bought General Communications as a merger arb and held through GCI Liberty into Liberty Broadband. Sold it more because of the opportunity cost, reinvested those proceeds into more current ideas.

- Digital Media Solutions (DMS) ended up rejecting management's buyout offer and instead took on debt to make an acquisition, now it's trading below a dollar. I want to believe the existence of all these busted SPACs will eventually turn into more special situation type opportunities, but these are questionable management teams and it might take a little while longer for management and boards to fully come to their senses.

- Sonida Senior Living (SNDA) disclosed a going concern warning, I mentioned some place else that I oversized this position given the combination of operating leverage and financial leverage, should have treated this more as an option than a core position. Shares have recovered a bit, but they still face a challenging labor environment and a lack of scale.