- OrbiMed is the largest shareholder with approximately 23% of the shares. Recent similar situations, KNTE and THRX, also featured OrbiMed near the top of shareholder registry, both produced good results with cash plus CVR buyouts.

- Bristol-Myers Squibb (BMY) previously had a collaboration agreement with Ikena for IK-175 and IK-412, they declined to go forward with development, but IKNA is looking to sell or out-license these. Probably minimal value, but could add a few cents per share in upside.

- Ikena Oncology has been quick to already sublease space and sell lab equipment, neither for significant sums, but shows some shareholder friendliness in moving quickly to a shoestring operation to preserve value.

Wednesday, May 29, 2024

Ikena Oncology: 50% RIF, Trading Below Cash, Strategic Alternatives

Tuesday, May 28, 2024

Seaport Entertainment: Initial Form 10 Thoughts, Spinoff, Rights Offering

The first public draft of the Seaport Form 10-12 came out on Friday, I took a quick read of it, here are some initial thoughts that I'll likely come back to as the spinoff approaches sometime in Q3. Howard Hughes Holdings (HHH) is going to be spinning four main assets into the newly created Seaport Entertainment (SEG) that will focus on "intersection of entertainment and real estate":

- The Seaport District in Lower Manhattan, which includes the South Street Seaport itself, some neighboring buildings and the 250 Water St development site (which HHH/SEG recently won a lawsuit that sets the stage for construction), all of which Howard Hughes has sunk over $1B into over the last decade and is still bleeding cash (-$55MM in 2023). Thus far, the Seaport has been a disaster (HHH took a $672.5MM impairment on the Seaport last year) and waste of capital, the project was started a year or two after Super Storm Sandy destroyed much of the old structure in 2012 and was underwritten at a 4-6% return on cost. The development had many delays and hasn't come close to the original profitability projections a decade or so later, as a long term HHH shareholder, I blame the Seaport for much of the underperformance over the last 5-7 years (alongside the Ackman covid capital raise). Maybe focused management can turn this around? There are a total of 11 physical buildings at the Seaport, as a whole it is about 2/3rd's leased at this point.

- 25% interest in Jean-Georges Restaurants that was acquired for $45MM (potentially an Ackman vanity investment) with the stated strategy to partner with Jean-George in the future as an anchor tenant in new developments (Jean-Georges leases the entire Tin Building in a JV with SEG for a food hall concept). This investment reminds me of MSGE/Sphere's investment in TAO Group where they argued TAO's nightclub expertise could be used at the Sphere and other entertainment venues, TAO was eventually divested. The Jean-Georges investment feels very non-core and could be sold to raise capital for their two big development projects (250 Water St and Fashion Show Air Rights).

- The Las Vegas Aviators (highest revenue grossing minor league team), the Oakland A's AAA affiliate, and the corresponding newish Las Vegas Ballpark located in Howard Hughes' Summerlin master planned community. The A's are moving to the Las Vegas strip (where the old Tropicana was located) in a couple years, the current plan is to keep the Aviators in Summerlin, but TBD on how that impacts attendance/revenue. HHH did pay $16.4MM for the remaining 50% of the Aviators they didn't own in 2017 and the ballpark cost approximately $125MM in 2019.

- 80% interest in the air rights above the Fashion Show Mall on the Las Vegas strip, which is located on the north end of the strip near Treasure Island and the Wynn hotels. Howard Hughes has brought in Anton Nikodemus as the CEO of Seaport, his previous stop was as the President/COO of MGM's City Center in Las Vegas and before that he led the development of MGM's National Harbor and Springfield, MA casinos. I go annually to a conference in the City Center and have visited the National Harbor property, both are impressive gaming resorts that are well run. The Fashion Show Mall and the other 20% of the air rights are owned/operated by Brookfield Properties (which acquired General Growth Properties (GGP), the original parent of Howard Hughes). There's been a significant increase in supply on the north end of the Las Vegas strip in the past year with the opening of Resorts World and the Fontainebleau (both of which post-opening are relative ghost towns). But with Nikodemus onboard, it clearly signals that they intend to redevelop the Fashion Show Mall in the medium-to-long term.

Seaport Entertainment expects to conduct a $175 million Rights Offering of equity to our stockholders following the distribution. In connection with the Rights Offering, the Company is in serious discussions with Pershing Square Capital Management, L.P. (“Pershing Square”), which through investment funds advised by it is HHH’s largest shareholder, regarding a potential backstop agreement which would be entered into prior to the distribution. Pursuant to that agreement, if finalized, Pershing Square would agree to (i) exercise its pro rata subscription right with respect to the Rights Offering at a price of $100 per share of our common stock and (ii) purchase any shares not purchased upon the expiration of the Rights Offering at the Rights Offering price, up to $175 million in the aggregate. The backstop agreement could result in Pershing Square’s affiliated funds owning as much as % of our common stock if no other stockholders participate in the Rights Offering. Any capital raised through the Rights Offering would further strengthen our balance sheet. With over $ million of liquidity, primarily consisting of (i) $23.4 million of cash contributed by HHH pursuant to the Separation Agreement, (ii) expected proceeds from the anticipated Rights Offering and (iii) amounts available under the Revolving Credit Agreement (as defined herein), we believe we will have ample capital to invest in and drive internal and external growth opportunities in the leisure, tourism, hospitality, gaming, food and beverage and live entertainment spaces.

Wednesday, May 15, 2024

Inhibrx Inc: Cash Buyout + SpinCo (Inhibrx Biosciences) and CVR

Inhibrx Inc (INBX) (~$1.8B market cap) is a clinical stage biotech that announced the sale of their most advanced therapy, INBRX-101 (a treatment for patients with alpha-1 antitrypsin deficiency or "AATD"), in January to Sanofi (SNY) for $30/share in cash, plus 92% ownership in the remaining development pipeline via a taxable spin of NewCo Inhibrx Biosciences (SNY to retain the other 8%) and a $5/share CVR that pays out if INBRX-101 receives final FDA approval prior to 6/30/2027. INBX shares trade for $34.20 today -- all approvals have been received and the merger will close 5/30/24.

The advantage of this structure is Inhibrx won't pay corporate taxes on the sale of INBRX-101, but shareholders will still pay taxes based on their tax basis, avoiding the double tax if Inhibrx had simply sold INBRX-101 and continued on in the same corporate structure. We've seen similar deals with Pfizer/Biohaven (they even mention in the proxy wanting to do a "Biohaven-like structure") and a little further back, JNJ/Actelion/Idorsia, where both SpinCos performed well initially post deal completion.

My thinking around this transaction is pretty straight forward, because the $30/share makes up a vast majority of the consideration here, the merger/stub securities are likely undervalued, although it is hard to size this up enough to create a meaningful position (INBX isn't marginable at my broker for some reason). For the SOTP, I'm going to lean on the proxy statement as I don't have an informed view on the science other than this team already developed one valuable asset in INBRX-101.

The CVR is fairly simple, there's only one milestone, that's FDA approval of INBRX-101 for AATD:

At or prior to the Effective Time, pursuant to the Merger Agreement, Parent will enter into a Contingent Value Rights Agreement between Parent and Continental Stock Transfer & Trust Company (the “Rights Agent”), in substantially the form attached to the Merger Agreement (the “CVR Agreement”). Each CVR will represent the right to receive a contingent payment of $5.00 in cash, without interest, payable to the Rights Agent for the benefit of the holders of CVRs, if the following milestone is achieved:•The final approval by the U.S. Food and Drug Administration (“FDA”), on or prior to June 30, 2027, of the new drug application or supplemental new drug application filed with the FDA pursuant to Section 351 of the Public Health Service Act and 21 CFR §§ 600 et seq. (for clarity, including accelerated approval) that is necessary for the commercial marketing and sale of the Company’s precisely engineered recombinant human AAT-Fc fusion protein, also known as INBRX-101 in the United States of America for the treatment of patients with AATD and clinical evidence of emphysema following the clinical trial with identifier INBRX101-01-201, entitled “A Phase 2, Double-Blind, Randomized, Active-Control, Parallel Group Study to Assess the Pharmacokinetics, Pharmacodynamics, Immunogenicity, and Safety of INBRX-101 Compared to Plasma Derived Alpha-1 Proteinase Inhibitor (A1PI) Augmentation Therapy in Adults with Alpha-1 Antitrypsin Deficiency Emphysema,” regardless of any obligation to conduct any post-marketing or confirmatory study (which we refer to as the “Milestone”).

For the CVR valuation, Centerview (INBX's advisor) put the NPV at $2.05/share using a 60% success rate, which the company provided (management took down the success rate from 90%, citing a less advantageous regulatory environment and potential success of similar products):

Contingent Value Right AnalysisFor analytical purposes, assuming a 60% probability CVR holders receive an aggregate payment of $5.00 per CVR upon the achievement of the Milestone based on the probability of success as estimated by Company management in, and the estimated timing of achievement of the Milestone under the CVR Agreement implied by, the Management Forecasts, as described under the section entitled, “The Transactions — Certain Financial Projections” and further assuming a discount rate of 13.5%, the midpoint of a range of discount rates from 12.5% to 14.5%, based on Centerview’s analysis of the Company’s weighted average cost of capital, Centerview calculated an illustrative net present value for one (1) CVR of $2.05.

Inhibrx Biosciences (SpinCo) is a little more complicated, SNY is going to seed the company with $200MM of cash, which is expected to get them about a year of cash runway. The spin ratio is 0.25 shares of SpinCo for each share of INBX. The spinoff will have INBX's remaining development assets, which includes two oncology therapies currently in clinical studies with data readouts within the next 12 months:

•INBRX-106 is a hexavalent product candidate agonist of OX40. OX40 is a co-stimulatory receptor expressed on immune cells that is enriched in the tumor microenvironment. OX40 ligand is a trimeric protein that activates OX40 signaling through clustering.•INBRX-109 is a precision-engineered, tetravalent death receptor 5 (DR5) agonist antibody designed to exploit the tumor-biased cell death induced by DR5 activation.

INBRX-109 (which has both fast track and orphan designations) is farther along, it is currently in a registration enabling Phase 2 trial for the treatment of chondrosarcoma (an aggressive type of bone cancer where most patients do not respond well to current therapies) with data expected in the first half of 2025. INBRX-106 is in a Phase 1/2 study testing it in combination with Keytruda, initial data is expected towards the end of 2024. Again, leaning on Centerview's analysis:

SpinCo Discounted Cash Flow AnalysisCenterview performed a discounted cash flow analysis of SpinCo based on the Management Forecasts. A discounted cash flow analysis is a traditional valuation methodology used to derive a valuation of an asset or set of assets by calculating the “present value” of estimated future cash flows of the asset or set of assets. “Present value” refers to the current value of future cash flows or amounts and is obtained by discounting those future cash flows or amounts by a discount rate that takes into account macroeconomic assumptions and estimates of risk, the opportunity cost of capital, expected returns and other appropriate factors.For purposes of the analysis of the net present value of the future cash flows of SpinCo, Centerview calculated a range of equity values for 0.25 of a share of SpinCo common stock by (a) discounting to present value as of June 30, 2024 using discount rates ranging from 14.0% to 16.0% (reflecting analysis of SpinCo’s expected weighted average cost of capital) and using a mid-year convention: (i) the forecasted risk-adjusted, after-tax unlevered free cash flows of SpinCo over the period beginning on June 30, 2024 and ending on December 31, 2043, utilized by Centerview based on the Management Forecasts, (ii) an implied terminal value of SpinCo, calculated by Centerview by assuming that unlevered free cash flows would decline in perpetuity after December 31, 2043 at a rate of free cash flow decline of 60% year over year (with the exception of platform cash flows for which a 0% perpetuity growth rate was assumed), and (iii) tax savings from usage of SpinCo’s federal net operating losses from SpinCo’s estimated future losses, as set forth in the Management Forecasts, and (b) adding to the foregoing results SpinCo’s estimated net cash of $200 million, assuming SpinCo is capitalized with $200 million in cash and no debt, as of June 30, 2024, and the net present value of the estimated costs of an assumed $150 million equity raise in 2025 and $300 million equity raise in each of 2026 and 2027, as set forth in the Internal Data. Centerview divided the result of the foregoing calculations by the number of fully diluted outstanding shares of estimated SpinCo common stock (determined using the treasury stock method and taking into account the dilutive impact of warrants on the then-existing terms and 8% of shares of SpinCo common stock to be retained by the Company, and assuming no exercise of Company options receiving SpinCo common stock, as instructed by Company management) as of January 18, 2024, based on the Internal Data, resulting in a range of implied equity values per 0.25 of a share of SpinCo common stock of $5.85 to $7.95 rounded to the nearest $0.05.

Just based on cash, the NewCo would be worth $3.40/share of INBX at the outset, although that's a bit faulty logic as the cash is already spoken for in the projected cash burn. But again, pattern recognition here tells me that this situation has a decent shot of working out well in the near term, $30.00 + $2.05 + $5.85 = ~$38/share versus the current $34.20/share. If you back out the $30/share in cash, the stub is a potential bargain heading into closing at month end.

Disclosure: I own shares of INBX

Friday, May 10, 2024

Enhabit: Failed Strategic Alternatives Process, Proxy Fight

Enhabit (EHAB) ($413MM market cap) is a July 2022 spinoff of Encompass Health (EHC) that provides home health and hospice care. Similar to many recent spinoffs, Encompass Health loaded Enhabit up with debt and dividended back the proceeds to themselves, as is also typical recently, Enhabit ran into business headwinds shortly after being spun and the stock price has suffered since. Activists showed up pretty quickly here demanding a sale as the home health and hospice care industry has been consolidating with Enhabit being one of the few remaining standalone public companies in the sector.

With tax free spinoffs, there's a two year safe harbor waiting period for the spin to be acquired without risking tax free status. The risk of voiding the tax free status relates to if the buyer had acquisition discussions regarding the spin prior to the spinoff, if there have been no talks, then there can be M&A within that two year period. An example I remember off the top of my head was Baxalta (BXLT) that was spun from Baxter International (BAX) back on 7/1/15 and was quickly acquired by Shire (which was later acquired by Takeda) on 1/11/16. Prior to spinning out Enhabit and considering the consolidating nature of the industry, Encompass likely had discussions with various strategic and other buyers leading up to the spin decision, potentially boxing out the most logical buyers.

With that background, it is unsurprising that alongside earnings this week, Enhabit announced that they were concluding their strategic review without a sale and are going to continue as a standalone company. The stock dropped roughly 15% and activist investor AREX Capital Management (4.8%) put forth a proxy fight to replace seven board members with their own slate. I don't know anything about AREX, but EHAB is an outsized position for them and on the surface, their board slate does look highly qualified.

Back to the business, home health and hospice care has some strong tailwinds with an aging population, a push towards cheaper healthcare settings and a highly fragmented market (even the larger players like Enhabit only have single digit market shares) in need of consolidation (clinic/route density is an important driver of operational leverage). This should be a GDP plus a couple hundred basis point growth business. The industry is also undergoing a shift from traditional Medicare to Medicare Advantage plans where the patient has more of a financial responsibility and services are discounted/margins are lower. At the time of the spin, Enhabit had a larger share of traditional Medicare patients than peers and the move to Medicare Advantage or other private plans hurt margins pretty dramatically, causing Enhabit to miss guidance several times and lose credibility with investors. That mix shift seems to have stabilized with traditional Medicare patients increasing for the first time sequentially in Q1.

With the business somewhat stabilized (although highly levered) and an activist in the mix pushing for both operational improvements and likely a restart of a sale process following 7/1/2024, this could be a compelling opportunity.

The two most recent public transactions have been with Optum/UnitedHealth as the buyer as they look to reduce their costs by bringing home health care in house. Amedisys has yet to close, the EBITDA multiple was 15.5x when it was announced and has since dropped down to 13.7x with continued EBITDA growth. Addus HomeCare (ADUS) is a somewhat similar business, they do compete in the home care and hospice spaces but the majority of their business is in what they call personal care, which means someone comes to help with the daily tasks that become more difficult as people age rather than medical services.I don't like putting 100+% price targets on new positions, but with the combination of financial leverage, some improved operating leverage and the potential for a strategic takeout sometime down the road, EHAB could really be that cheap here.

Disclosure: I own shares of EHAB

Target Hospitality: Majority Shareholder Low Ball Bid, Now Considering Strategic Alternatives

Andrew Walker recently had Matt Turk on his podcast where they discussed this idea. I generally agree, but for my own process, I wanted to write out my thoughts as well.

Target Hospitality (TH) ($1.2B market cap) is a provider of mobile temporary housing (previously colloquially called "man camps") that historically focused on the energy exploration sector (about 1/4 of their business today) but over the last decade, and mostly in the last few years, TH has moved into the business of housing migrants crossing the U.S. southern border. Their largest contract is an influx care facility ("ICF") called Pecos Children's Center in Texas that houses unaccompanied minors, by law unaccompanied minors cannot be deported immediately and efforts need to be made to reunite them with family members. During this time period, which can last several years, the minors need reasonable and safe housing quarters. There is political risk in this business, for a while there these types of camps were called "kids in cages" and other politically charged terms. But with a large number of migrants coming from destabilized places like Venezuela, Ecuador and Haiti, the need for safe temporary housing doesn't appear to be going away anytime soon.

The oil & gas housing business is not particularly great, Civeo (CVEO) is a good comparable, many oil & gas projects require significantly more employees (temporary residents) during the beginning of projects and relatively few are needed during the maintenance periods, putting the business at the whims of commodity cycles. But with government contracts, contracts tend to be longer in duration, my mental model for the unaccompanied minors camps is more inline with government contractors that provide services to foreign U.S. military bases in conflict zones. Something like V2X (VVX, fka Vectrus, a spin from XLS) comes to mind, there's a continuous need for occupancy as long as the need is there and that need typically lasts longer than the public expects at the outset.

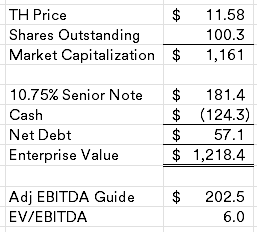

Target Hospitality is currently fairly cheap at only 6x EBITDA with minimal debt (management projects to be in a net cash position by year end).

CVEO and VVX obviously aren't perfect comps, but I've owned both businesses in the distant past and follow them loosely, CVEO trades for 5x EBTDA and VVX trades for 8.5x EBITDA. Blending the two based on Target Hospitality's business mix gets me something closer to a 7.5x multiple or a $14.50 share price.

TH is a former 2019 vintage SPAC (before all the craziness) and is still 65% owned by Arrow Holdings (now TDR Capital), TDR Capital submitted a bid on 3/25/24 to buyout the minority shareholders for $10.80/share. The following day, Conversant Capital (same firm that was involved with Indus Realty (INDT) and currently the controlling shareholder of Sonida Senior Living (SNDA)) popped up with a 5% ownership filing with the below disclosure:

As previously disclosed in its filings on Form 13F, Conversant Capital LLC has owned a substantial position in the Company Common Stock for approximately two years, in the form of shares of Common Stock and options to purchase shares of Common Stock. As long-term investors in the Company, the Reporting Persons closely monitor developments regarding the shares of Common Stock. The reporting persons are aware that TDR Capital LLP (“TDR”) has made an unsolicited non-binding proposal to the Board of Directors of the Company pursuant to which Arrow proposes to take the Company private by acquiring all of the outstanding shares of Common Stock, other than those already owned by any of Arrow, any investment fund managed by TDR or their respective affiliates. The Reporting Persons intend to review that proposal and any other proposals made in connection with their evaluation of their investment in the Company to evaluate whether any such proposal is in the Reporting Persons’ best interests.

In TDR's offer letter, they're requiring their offer receive a majority of the minority shareholders vote for the deal, with Conversant a large and now public shareholder, they provide credible protection against a take under. A special committee was formed on 4/29/24 to consider the offer, the press release also mentioned the following:

The mandate of the Special Committee is to consider and evaluate the Proposal and any alternative proposals or other strategic alternatives that may be available to the Company. The Special Committee has retained Centerview Partners LLC and Ardea Partners LP as its financial advisors and Cravath, Swaine & Moore LLP as its legal advisor.

Sounds like a full process could be underway and not just an exclusive negotiation with TDR Capital. If nothing comes of the process, I still think the shares are cheap as the company has vaguely discussed being in the procurement stage on several large contracts including another ICF/unaccompanied minor location, rare earth mines, large technology projects, etc. Several of which have been described as "impactful" on earnings calls. In total, they expect to generate $500MM in free cash over the next several years that will be used to deploy into new growth opportunities which could further diversify the business model, potentially further raising the multiple.

Disclosure: I own shares of TH