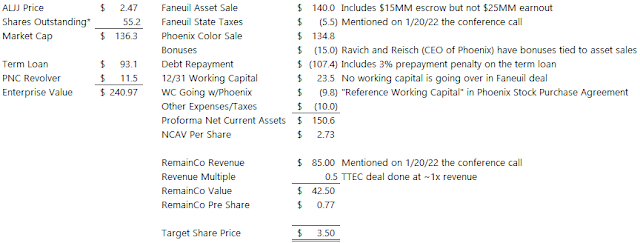

Last June, Regional Health Properties (struggling skilled nursing real estate company) proposed an exchange offer where the company's Series A preferred stock holders (RHE-A) would receive 0.5 shares of common stock (RHE) for each share of preferred stock. At the time of my post, RHE was trading at $12/share, today it trades sub-$5 as all speculative trading sardines have generally come down substantially over the past several months. Last Friday after hours, with no corresponding press release this time, Regional Health snuck in a new exchange proposal whereby Series A preferred stock holders could exchange their shares for new Series B preferred stock. The Series A preferred stock trades for $4.50/share.

The proposed Series B preferred stock has some interesting terms that I haven't seen before:

- First to nudge Series A holders to exchange, if the proposal passes (need 2/3rds) then anyone who rejects the exchange or is just too lazy to exchange gets pretty severely penalized. The Series B becomes senior to the Series A, the liquidation value of Series A goes from $25 to $5 and all the accumulated but unpaid dividends get erased.

- The headline dividend rate is 12.5%, but it will not be payable or start accruing until the fourth anniversary of the issuance/exchange date.

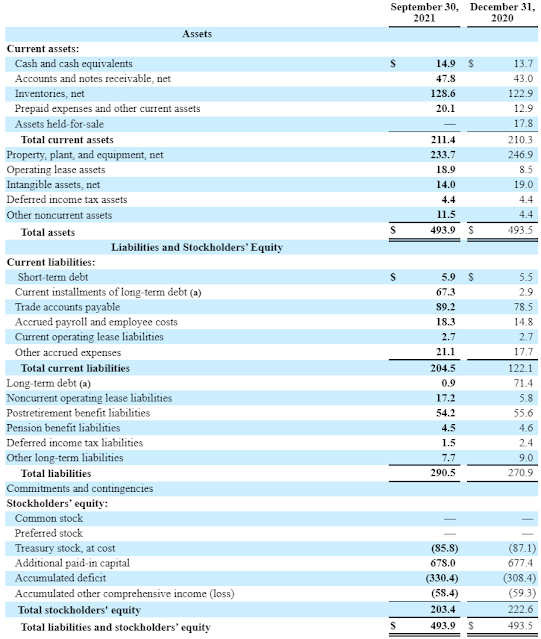

- The liquidation preference starts at $10 and increases back up to $25 at the fourth anniversary. If all Series A holders exchange, the liquidation preference will initially drop to $28.1MM, there's $55MM of debt ahead of the preferred stock, last June I estimated the value of their owned real estate at $87MM (9.5% cap rate), so that might cover the preferred stock at a $10 liquidation preference.

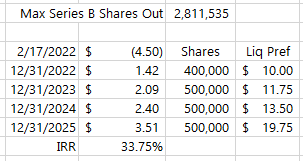

- Instead of the typical 6 quarters of missed dividends penalty to nominate a preferred stock board member, since the Series B won't be paying a dividend for the first four years, the Series B terms call for a "cumulative redemption" where Regional Health has to repurchase or redeem a certain amount of preferred each calendar year. It starts with 400,000 shares in 2022, then 900,000 shares by year end 2023 (again, cumulative, so an additional 500k shares in 2023), then 1,400,000 shares by year end 2024, and then finally 1,900,000 shares by year end 2025. If they fail to do so, then the preferred shares will have director nomination rights.

- Additionally, if Regional Health doesn't redeem or repurchase 1,000,000 with 18 months, Series B holders get common shares in a pro-rata fashion to make up the difference. Interestingly for both this penalty and the cumulative redemption penalty, the threshold is a specific Series B share amount, so if only 2/3rds of the shares are exchanged, each of these milestones becomes a greater percentage of the Series B.

- They then throw in a little game theory to encourage Series B holders to participate in early repurchases or redemptions, once there are less than 200,000 Series B preferred shares outstanding, the liquidation preference drops back down to $5 (for reference, there are 2,811,535 Series A preferred shares currently outstanding).

- Like the last exchange offer, this offer requires both the preferred (2/3rds) and common shareholders (majority) to approve. The common vote might be hard to obtain, they didn't get many shareholders to vote in the last annual shareholder meeting, these shares are likely mostly in retail hands.

Disclosure: I own shares of RHE-A