Creative Media & Community Trust (CMCT, fka CIM Commercial Trust) (~$20MM market cap) is a tire fire of a REIT (externally managed by CIM Group) that owns a mixture of traditional office, "creative office", multi-family and a hotel, the majority of which are located in California. I owned CMCT briefly back in 2021 as it was the target of an activist campaign, CIM Group eventually thwarted the activist by doing a dilutive rights offering (and backstopping the rights offering) at $9.25 (the shares trade for $0.23/share today) to cement voting control. After the rights in 2021, management owned 45+% of the company.

As most know, the commercial real estate market has struggled significantly as the result of slow return-to-office trends, higher for longer interest rates and some location specific issues to the Oakland/Bay Area market where several of CMCT's chunkier assets are located.

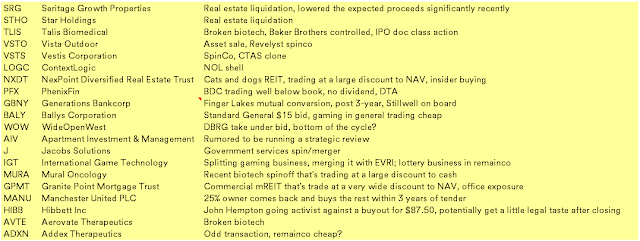

Here's a quick snapshot of the company's assets:

CIM Group had an ongoing preferred stock issuance program going at CMCT, it was a way to increase assets (and thus external management fees) without issuing common stock at below NAV and CIM also had an affiliate act as a placement agent to collect additional fees. As the real estate asset value dropped at CMCT and preferred stock issuance didn't slow (CMCT was issuing preferred stock as recent as earlier this year), the common stock felt the pain and was upside down. Additionally, their bank credit facility is no longer in compliance with its financial covenants.

Earlier this year, CMCT tried to sell a handful of assets in order to raise cash and payoff the credit facility, but the buyer wasn't able to close:

CMCT recently explored the sale of several high-quality assets to improve its common equity ratio. The offer CMCT received reflected what the Company believed to be the fair value of these assets, but the buyer was unable to close. As a result of this and the recent decline in interest rates, CMCT has decided to shift its focus to refinancing rather than a sale of these assets.

CMCT's preferred stock is convertible into common shares at the option of the issuer. Subsequentially to the failed asset sale, in September, CMCT decided to "improve its common equity ratio" by converting some preferred stock to common:

As part of its program to improve its common equity ratio, the Company is suspending its Series A1 Preferred Stock offering and announcing the redemption of approximately 2.2 million shares of Series A Preferred Stock and approximately 2.6 million shares of Series A1 Preferred Stock, with the redemption price to be paid in shares of common stock in accordance with the terms of the Series A Preferred Stock and Series A1 Preferred Stock, respectively.

In total, they redeemed $118.9MM (~$345MM is remaining) of preferred stock with 60,526,804 common shares, or at a price of $1.96/share.

Preferred stock holders (probably RIA's in the HNW channel) naturally puked the stock out (they only had 22.8 million shares outstanding before the preferred conversion, nearly 4x'ing the shares outstanding to motivated sellers), when the price dropped due to the forced selling, it created tax loss selling and further spiraling down the drain to $0.23/share where it trades today. The new plan, to refinance at the property level and repay the credit facility is outlined in the most recent 10-Q:

Management plans to address any possible future event of default under the 2022 Credit Facility by entering into new financing arrangements to repay amounts outstanding under the 2022 Credit Facility. The Company is in the process of obtaining refinancing for the Company’s hotel in Sacramento, California (the “Sheraton Refinancing”). If completed, the Company intends to use the proceeds of the Sheraton Refinancing to repay part of the amount outstanding under the 2022 Credit Facility and to pay for the Hotel Renovation described above. In addition, the Company is in the process of obtaining refinancing (the “Los Angeles Refinancing”) for three of its properties in Los Angeles, California. If completed, the proceeds of the Los Angeles Refinancing, along with a portion of the proceeds from the Sheraton Refinancing, are anticipated to be in an amount sufficient to repay all amounts outstanding under the 2022 Credit Facility, with the rest to be used for general corporate purposes. The Company expects that each of the Sheraton Refinancing and the Los Angeles Refinancing will close by the end of the first quarter of 2025.

Management of the Company believes that its plans to repay amounts outstanding under the 2022 Credit Facility are probable based on the following: (1) the Company has executed term sheets with the respective lenders under the Sheraton Refinancing and the Los Angles Refinancing; (2) the Company expects that both the Los Angeles Refinancing and the Sheraton Refinancing will close by the end of the first quarter of 2025; (3) the favorable loan-to-value ratios (“LTVs”) of the properties that are the subject of the Sheraton Refinancing and the Los Angeles Refinancing and (4) the Company’s plans and efforts to date to obtain additional financing to be secured by two properties that it owns (in addition to the Sheraton Refinancing and the Los Angeles Refinancing), and the favorable LTVs of these two properties. Management’s plans are intended to mitigate the relevant condition that would raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the interim financial information contained in this Quarterly Report on Form 10-Q is issued. The accompanying consolidated financial statements have been prepared assuming that the Company will continue its operations as a going concern and do not include any adjustments that might result from the outcome of events described in this paragraph.

Potentially there's some value here if the company is able to switch from recourse to non-recourse debt and ride out any real estate recovery. CMCT does have a series of potential development sites, (through CIM) access to co-investors for project specific capital (so they won't need to raise it at the CMCT level, because they can't), there's a world where they don't file for bankruptcy and they can limp along far enough to make to the other side of their transition to "creative office" and multi-family. The underlying asset value of the company haven't changed much since the preferred conversion (likely only improved slightly as short-term rates come down and more companies call employees back into the office) and they're going to save roughly $8 million per year in preferred dividends as a result of the conversion. Yet the stock is down ~90% from the conversion price. Could this be a potential January effect beneficiary? Again, super speculative, but I think it might.

In attempt to determine how much if any value is here, one way is to back into an implied cap rate of 5.8% based on the last-twelve months of net operating income, not particularly cheap. Howard Hughes (HHH) just had an investor day where they laid out their NAV using an 11% cap rate for their office properties.

Another way, CMCT pays CIM Group a base management fee based on the NAV which is determined by a third party, they used to disclose NAV, but I haven't seen it called out for year-end 2023. But based on the quarterly fee (0.25% of Net Asset Value Attributable to Common Stockholders) you can back into the NAV.

Of course all the normal caveats apply to the NAV, there's an inherent conflict of interest to inflate it when your management fees are calculated off it.

The bet here is that CMCT is indeed able to refinance their properties and extract value embedded in their assets, reinvest those cash flows into new multi-family buildings and no longer be a bankruptcy candidate. Any slight positive change in the outlook for California commercial real estate could make this turnout to be a multi-bagger, the opposite is true as well, if CRE continues to stink it up, this will be a zero or effectively so through more dilution of the remaining preferred shares.

Risks/Other thoughts:

- This very likely could be a zero, it is a call option disguised as common stock on commercial real estate values improving and interest rates continuing to fall.

- CMCT could convert more preferred to common and crash the stock again.

- CMCT pays their dividend in shares now, so don't get excited over the appearance of a big dividend yield.

- They have a small SBA lending operation that lends into the mom and pop owner/operator hotel market, this along with their hotel they've called out as being non-core and potentially look to sell those assets to reinvest in more multi-family developments.

- After the conversion, management now only owns 15% of the company. Remember, they were buyers at $9.25, odd that they tanked their own position to such a degree, but now with less ownership, might be even more likely to do it again to save their management fee income.

Disclosure: I own shares of CMCT (about a ~2% position, and sworn to myself I won't average down)