** Note, I'm a little late in posting my mid-year review as I was unplugged a bit for the last couple weeks. Back dating the post to its usual spot.**

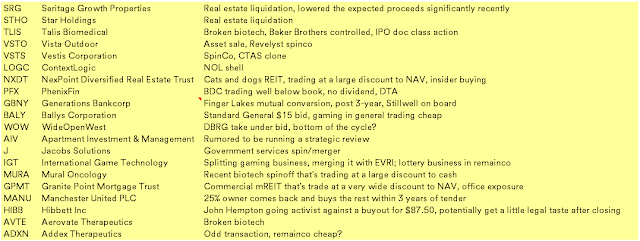

My blog portfolio is essentially flat year-to-date with a gain of 2.99%, well behind the S&P 500 with a gain of 15.29%. The broken biotech basket performed well but was generally offset by declines in a lot of my legacy holdings and just malaise in my speculative M&A ideas (crossing my fingers that M&A picks up in the second half). Long term performance remains solid at a 21.75% pre-tax IRR.

- Quite a bit of churn happened in the broken biotech basket, I sold Eliem Therapeutics (ELYM), Homology Medicines (FIXX), Graphite Bio (GRPH), Kinnate Biopharma (KNTE), Reneo Pharmaceuticals (RPHM), Cyteir Therapeutics (CYT), AVROBIO (AVRO) and Theseus Pharmaceuticals (THRX) as each of these had some sort of buyout or reverse merger transaction. If there was a CVR component, I held through the merger and sold shortly after. Some of these rallied significantly post reverse merger, but in attempt to stick to the original thesis, I generally sold after the shareholder base turned over a bit.

- I got spooked out of both Instil Bio (TIL) and Aclaris Therapeutics (ACRS) -- although I made a nice profit on ACRS -- as both management teams don't appear to be following the reverse merger and/or buyout with a CVR strategy. Instil Bio has yet to sell their new manufacturing facility and I don't have confidence in the property valuation, plus TIL included the line of their intention of "Exploring opportunities to in-license/acquire and develop novel therapeutic candidates in diseases with significant unmet medical need." Aclaris announced alongside their Q1 results "we have decided to progress ATI-2138 into a proof-of-concept Phase 2a trial in patients with moderate to severe atopic dermatitis", however this one might be worth looking at as BML Capital Management has accumulated a significant stake and could push ACRS to revisit their go-forward strategy.

- Sio Gene Therapies (SIOX) made their liquidating distribution and is now pushed into the non-traded bucket. Similarly, Merrimack Pharmaceuticals (MACK) made its liquidating distribution, the remaining penny or two is now in a non-traded liquidating trust.

- Pieris Pharmaceuticals (PIRS) announced they are pursuing a similar strategy as MACK did, minimizing corporate expenses in an effort to extend their cash runway long enough to capture any milestone payments among their disparate portfolio of development partnerships. I sold to capture a tax loss, but will continue to monitor this one for a re-entry, if any of their milestones do hit, the return could be a multiple of the current market cap.

- MariaDB (MRDB) and Asensus Surgical (ASXC) were similar situations, cash burning companies with potentially valuable IP that was subject to a non-binding tender offer, if the tender fell through, both could be worthless. Luckily for me, both deals went to a definitive agreement and I sold each as the spread tightened to a normal range.

- First Horizon (FHN) was added shortly after their transaction with TD Bank broke in middle of the short lived bank crisis last year, this spring FHN passed over the long-term capital gains mark for me and I booked the profit. I could see FHN being an acquisition target for one of the super regional banks trying to use an acquisition as a springboard into a higher regulatory tier category.

- I should probably leave the traditional merger arbitrage trades to the experts, I exited Spirit Airlines (SAVE) after the judged ruled against the merger on anti-trust grounds, Albertsons (ACI) hasn't gone to court yet, but under the current administration, likely faces a similar result. Unlike Spirit, Albertsons is cheap on a standalone basis and their PE sponsor Cerberus is likely to seek liquidity in other ways if their merger with Kroger (KR) fails.

- NexPoint Diversified Real Estate Trust (NXDT) and Transcontinental Realty Investors (TCI) both fall into a similar bucket for me, real estate companies trading at very wide discounts to their NAV, but with management in no hurry to close those gaps (or simply unable to in the current interest rate regime / real estate market). NXDT has seen some recent insider buying that improves the story, but it has been several years since the old closed end fund converted to a REIT and little has been done to simplify the portfolio or tell the story.

- I've initiated a small position in DMC Global (BOOM) which owns three separate and distinct industrial businesses. The company has announced a strategic review to sell two of the three businesses, leaving behind a multi-family residential building products business (Arcadia). I didn't buy earlier in the story because it is unclear to me why Arcadia is chosen one to remain in the public shell, but the situation changed when Steel Partners (savvy, NOL maximizing conglomerate) lobbed in a $16.50/share offer (shares currently trade sub $14). BOOM has acknowledged the offer and stated they'll consider it as part of their greater strategic alternatives process.