Thanks to Writser for pointing me to this idea

Rubicon Technology (RBCN) ($36MM market cap) is primarily an NOL cash shell with a small $4MM revenue, roughly break-even, industrial sapphire business. RBCN was previously trading below net current asset value until 7/5 when Janel Corporation (JANL) offered to tender for 45% of the shares at $20/share. Following the tender, Rubicon will distribute a $11/share special dividend (approximately their excess cash) to all shareholders including Janel and also delist from the NASDAQ along with suspending their SEC reporting requirements ("go dark"). If everyone fully participates in the tender offer (which they should, but is unlikely, probably a few forgotten shares out there), RBCN shareholders will receive a total of $15.05 in cash per share (45% x $20 + 55% x $11) in the next couple months, plus a dark NOL stub. The shares roughly trade for the $15.05 cash consideration number today.

To fully access the NOLs, Janel will then be incentivized to make another tender offer on that residual stub in three years (IRS required waiting period to preserve the NOL) to get their ownership level above 80% so they can consolidate the financial statements. Janel spells out that potential second step in their schedule 13D:

The purpose of the offer is for Janel to acquire a significant ownership interest in Rubicon, together with representation on Rubicon’s Board, in an attempt to (i) rejuvenate, reposition and restructure Rubicon’s business and brand by focusing on its profitable business line and implementing a lower cost structure to achieve profitability and (ii) allow Janel to be in a position to potentially more easily acquire such number of additional Shares of Rubicon three or more years thereafter that would, after which, should such transaction occur, permit Janel to consolidate the financial statements of Rubicon’s with its own, thereby allowing Janel to benefit from Rubicon’s significant net operating loss (“NOL”) carry-forward assets. Under federal tax laws, Janel would then be able to carry forward and use these NOLs to reduce its future U.S. taxable income and tax liabilities until such NOLs expire in accordance with the Internal Revenue Code of 1986, as amended.

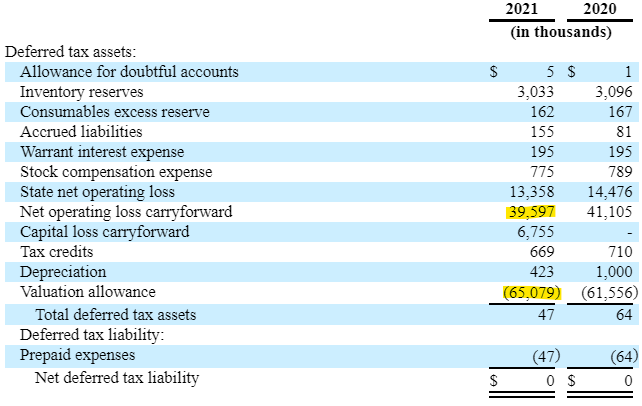

Since the company isn't cash flow positive, they currently have a full valuation allowance against the ~$65MM in tax assets:

While the total tax asset is $65MM, about $39.5MM is federal which is likely more valuable and easily transferrable than the $13.3MM in state taxes (IL and IN), I'm guessing Janel could also take full advantage of the $6.75MM of capital loss carryforwards too. Let's remove the state tax assets and call it $46.25 in value or $19/share (plus whatever you value the remaining business for) that Janel is paying $9/share ($20 minus the $11 special dividend). You've got some time value of money in there since they'll need to wait 3 years for the next tender, and during that time some of the NOL will expire (it started expiring in 2021, but I don't know the amortization schedule of the NOL). Sounds like potentially a great deal for both sides given RBCN traded for $9.00-$9.25 prior to the announcement.

I don't know much about Janel Corp, it is a $37MM market cap company traded OTC that is 42% owned by Oaxaca Group. It appears to be a holding company of smallish operations in logistics, manufacturing and some health care. We are taking some counterparty risk here in both the deal being completed successfully and Janel ultimately being able and willing to buyout the remaining stub in 3+ years. They have committed financing already from the expansion of their established credit line with Santander (don't need to go to the syndicated or private debt markets like FRG/KSS for example). Santander is also providing them with a bridge loan while they wait for the special dividend to get paid out. The other minimum condition is 35% of holders tendering, four major shareholders including names people reading this blog would recognize own 27% of the shares have already agreed to tender, so that should be no problem either.

I go back and forth in my head on what value to ascribe to the stub position. Post tender it will still have the same $19/share (or approximately that, again not sure how much will expire) in tax assets, Janel will be situated as the only bidder but also they'll have a sunk cost of purchasing 45% of it, we might be under a different corporate tax regime, it will be immediately useable so no discount for the time value or risk from their perspective that they won't get access to the NOL. I don't see why the base case shouldn't be $9 again, but I could be too optimistic in that view, the good thing here is it doesn't matter much as it's a free roll once the deal closes.

Other thoughts:

- Why is it cheap? Post tender and special dividend, it will go dark and be a small stub with a catalyst 3+ years out, that doesn't appeal to many investors, particularly in the current environment when time horizons are shrinking as people are scared of the economy. It is a CVR like asset, you've got some counterparty risk with JANL, it needs to have the ability and desire to acquire the remaining stub in 3 years. Many investors are down for the year (me included!), potentially behind their benchmarks and don't want to invest in something where you're just going to get your money back in 2022, and have this illiquid hard to value dark security after that we won't know the true value for 3 years.

- I like this better than other NOL shells, it is a better structure for current shareholders, as it doesn't rely on new management to make acquisitions at a time when there's still plenty of SPACs and busted biotechs looking at reverse merger style deals.

- RBCN sold some raw land in Batavia, IL. The sale hasn't closed yet, but the company expects to net $600k in cash, or roughly $0.25/share. The company also owns their current industrial facility in Bensenville, IL which they bought for $2.3MM (or just under $1/share) in September 2018. Even after the special dividend, there should be some residual liquidation value left in the operating business and possibly more if they can turn it around.

- Not sure yet of the tax implications of this idea, might be best to play it in a tax deferred accounts or given it is 2022 and a lot of us have tax losses, might not be so bad in a taxable account either.

- There's currently not an odd-lot priority provision, I'm assuming that is on purpose by the four large fund shareholders, they do not want people piling in to the odd-lot provision and end up transferring value to small shareholders playing that arb game. There's also no cancel provision based on a drop in the over market either like we've seen in other tender offers.

- If you have access to the expert market, might be worth watching this one after the special dividend, especially if I'm right that the second step won't be done at a huge discount.

Disclosure: I own shares of RBCN

Thanks for the shoutout. I had a quick call with the CEO regarding the taxation of the distribution. To determine the qualification there is basically a two-pronged test. 1: does the company have sufficient accumulated losses (absolutely) and 2: did the company make a profit during the distribution year (probably not, perhaps a tiny one).

ReplyDeleteSo in theory the tax qualification can only be determined with certainty after the company has filed their taxes for the current year. If the company makes a profit, then that part will be qualified as a dividend, the rest as a return of capital.

But in practice the company will not be profitable or barely profitable for the year unless something crazy happens, so you can basically assume the distribution will be a return of capital.

Perhaps your broker classifies it as a dividend at first, by default, but that should be reversed as soon as the company files the correct documents.

Retail Value does the same thing; some of their distributions were initially taxed as dividends but that was reversed when they filed the correct forms and those reached your broker through the chain of custody. For Retail Value you can see those forms here: https://retailvalueinc.com/organizational-actions

Note that I'm not a US citizen. Perhaps this stuff is painfully obvious to all your readers, in which case I apologize.

Thanks, that makes logical sense at least. But everyone should consider their own tax situation here.

DeleteThanks for the idea and the insight to both of you!

Delete1) Curious why you care about the qualification. Is it because you will get withholding on the dividend but not on the return of capital?

2) When will this stop trading? Will you still be able to sell this for something more than 0 after the $11 dividend?

Yeah, in case of a dividend taxes would be withheld for me at the source, which I would rather have not. But again, I'm not a US resident and I know nothing about the tax implications for anybody else.

DeleteI don't know when it will stop trading. That is unknown so far. I guess it will delist shortly after the distribution but will subsequently still trade on the OTC or expert market. But that's just speculation from my side.

I am writing this in the hope that no one else is in the situation I am in and as a warning to those who may be subjected to withholding tax. Make sure you check with IBKR or whichever broker you use whether your 11.0 or 1.0 USD distribution had been subjected to U.S.'s 30% withholding tax. Do not simply assume that your broker had done it right!

DeleteIBKR had deducted the 30% withholding tax from my RBCN distribution. I have argued with them for months to no avail.

I have asked on the other hand that RBCN provide the form 8937 to me and other shareholders as evidence that the distribution was a return OF capital and is not subject to withholding tax. RBCN has replied to me that they have not been able to find in the company record a copy of the form (i.e. RBCN may be liable for failure-to-file).

If anyone else is in the situation I am in or has a similar problem, please leave a comment below or DM me at @c94044111 on x.com (i.e. twitter.com). See what we can do. Thanks!

Same here unfortunately (IB too). Taxes were withheld both over the initial large distribution and the subsequent 1.10 distribution. I agree that this is probably a problem at the side of RBCN. Given the balance sheet, both distributions should be a return of capital instead. I'm wondering if this is somehow intentional because this classification is better for Janel.

DeleteStrange situation. I'll start bothering some insiders more incessantly.

Do people at other brokers have the same problem? Or is it classified correctly there?

A caution to any Canadians considering this play for a non-taxable account like an RRSP. There are horrific taxes for holding onto a stock that delists like Rubicon is planning. It would be 50% of the fair market value. If you do own it, be sure to sell or swap it out the RRSP ahead of the delisting.

ReplyDeleteI struggle to understand how can $19/share in NOLs be valued at $9/share. At current tax regime these might provide c. $19 * 21% = $4/share in saved corporate income taxes. And that's before discounting to present day. So why would JANL paying $9/share for these?

ReplyDeleteThe $19/share is already doing the 21% tax rate math, the NOL is $189MM of federal and $181MM of state.

DeleteMDC, How familiar are you with IRS Section 382 (Corp NOL's). Did some research in the past but never could come to a firm conclusion. I'm not certain Janel can reach the 80% ownership interest for tax consolidation in one 3 year look back period. Based on Janel tendering for 45% currently, they couldn't again tender for the remaining 35% without Sec 382 coming into play and limiting the useable amount of NOL's.

ReplyDelete"In very general terms, an "ownership change" for Sec. 382 purposes takes place if the percentage of stock of the corporation owned by one or more 5% shareholders increases by more than 50 percentage points over the lowest percentage of stock owned by these shareholders during a three-year testing period (Secs. 382(g) and (i))."

https://www.journalofaccountancy.com/issues/2021/feb/tax-benefits-of-a-corporation.html

Maybe I'm looking at it wrong, but this leads me to believe that a transaction of this type would take two 3 year look back periods at minimum. I know you have some old investments in NOL's related to Icahn so maybe you could clear this up for me?

You very may well be right, hopefully someone smarter than me can confirm/refute.

DeleteNot an expert but I thought this Troutman law firm presentation did a nice overview of the mechanics of how the 50% ownership change is tested (https://www.troutman.com/images/content/2/4/v2/247931/AhlersA-101719-110027930-1.pdf). It makes sense to me this is why they put a minimum tender amount of 35% on the first tender so that after 3y + 1 day they can do another tender for 45% and get to that 80% threshold. One thing I have trouble with is their motivation to buy the last 20% stake seems much lower and by taking it dark they create a dynamic where they are negotiating against pretty motivated sellers, if there is 45% tendered first step the current 5% holders will have another 12.4% they've committed to holding for the 3y period so it's only really about half the remaining other float they'll need to buy (assuming no stock issuance shenanigans).

DeleteGuessing this is why Paragon had the line in their filing about poor future value? I'm backing into only a ~5% IRR in a taxable account against a 15.95 price when trying to probability adjust different scenarios (some mix of $0, $5 and $9 payoffs and paying some capital gains in the tender step). No position so far.

Janel already owns 29%, so won't they own 74% after the offer concludes

ReplyDeleteUnless I've made an embarrassing mistake, I don't believe they own any, rather their 13D is stating they'll own at least that much because they've entered into a voting agreement with the major shareholders who agreed to tender their shares.

DeleteJanel doesn't own any stock currently.

Delete"Beneficial ownership of shares of common stock of Rubicon Technology, Inc., par value $0.001 per share (“Shares”), is being reported hereunder solely because the reporting persons may be deemed to have beneficial ownership of such Shares as a result of the relationships described under Item 2 and Item 3 and the matters described in Item 3, Item 4 and Item 5 of this Schedule 13D. Neither the filing of this Schedule 13D nor any of its contents shall be deemed to constitute an admission by any of the reporting persons that it is the beneficial owner of any Shares referred to herein for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, or for any other purpose, and such beneficial ownership is expressly disclaimed."

https://www.sec.gov/Archives/edgar/data/1133062/000114036122024908/brhc10039175_sc13d.htm

Why don’t these buyouts ever happen to the junk I own?

ReplyDeletewhen does the tender actually start?

ReplyDeleteIt is active now.

DeleteHow active will management be after the shares are delisted? Will they be able to reject a JANL take under in 3 years at a below-fair-value price? I assume JANL at 45% voting will have a lot of sway, but not full authority to tender at a low price? The implied price of the stub right now is only $0.60. I'm just trying to understand why it would trade so low if JANL won't be able to exercise a true take under at just 45%

ReplyDeleteI apologize, totally missed your comment. I don't think management will be very active at all, but there are real shareholders here (the 4 funds who signed onto the tender) who likely won't be able to exit their positions after the company goes dark because it'll be too illiquid. I think that lessens the chance that JANL completely low balls us in 3 years.

Deletehttps://www.sec.gov/Archives/edgar/data/1410172/000121390022047069/ea164222ex99-1_rubicontech.htm

ReplyDeleteSpecial dividend declared, going to be paid at the end of August. Should be interesting to watch how it trades immediately afterwards with the company going dark, there might be some forced selling prior to that which could make it an interesting time to add.

In addition to forced selling, there is also a small chance that buyers would hesitate to buy after (record_date-2) as they may be unsure of receiving $11. Given it trades due bills there shouldn't be any issue. If the stocks trades at 11 or below, it's like getting free money to buy then.

ReplyDeleteYep, agree, good point

Deletegot 50.3333% of shares paid @ $20

ReplyDeleteHere is a tangential question. How does one get access to the expert market? And how do I log in so my comments are no longer anonymous?

ReplyDeleteThe RBCN stub is down quite a bit since Rubicon announced a delisting a few days ago. I'd argue that a delisting (and the CEO leaving) was actually to be expected - and desirable. They just need to keep costs as low as possible for 3 years and then Janel can tender again.

ReplyDeleteJanel now owns 45%. The market value of the outside stake is less than $2m. If Janel wants to consolidate $60m+ in NOL's three years down the line without too much of a hassle I'd say there is a lot of room for an offer significantly above the current market price.

Of course you can get screwed or Janel can go bust, but still, Rubicon seems cheapish here to me (obviously not something to go 'all in' on). I've been buying more.

Thanks for the reminder. I bought back a little, to the comment below's point, about enough that I can forget about it for three years.

DeleteI'm going to try and forget I own it and wait for the tender, three years will be here before you know it! Fits in the bucket of tax loss selling candidate with large special dividend. Some wild moves this month.

ReplyDeleteJanel latest Q

ReplyDeletehttps://app.quotemedia.com/data/downloadFiling?webmasterId=90423&ref=117215297&type=HTML&symbol=JANL&companyName=Janel+Corp&formType=10-Q&formDescription=General+form+for+quarterly+reports+under+Section+13+or+15%28d%29&dateFiled=2023-02-03&CK=1133062

If they keep going like this Janel may have it's own capability to generate NOLs. Might not need RBCN's.

ReplyDelete20% of the shares outstanding may well be left for dead after Janel acquires 80%. Maybe we together as shareholders should over the next two years or so try to form a understanding of at what price and on what conditions would we be willing to sell our shares? E.g. should we ask Janel to buy every remaining share? And what's the appropriate price?

ReplyDeleteGrateful for comments.

Why would they leave the shares for dead. If Janel is profitable then they would like to advantage of the NOLs by buying remaing shares right? Of course that is if Janel is profitable. Am I missing something? Other issue is if they try to low ball, but hopefully the larger shareholders won't let that happen.

DeleteI am not sure, but can Janel slow walk the last 20%? I do not know. I hope you are right. I am a shareholder too. Regardless, I think we together as shareholders should try to form a consensus of at what price and on what conditions would we be willing to sell our shares. $9 for every remaining share - in one go? Would that be the appropriate base line?

DeleteHave you seen the new bylaws in the latest 8-K? At least the next step has to be approved by a majority of the independent shareholders. Looks pretty reasonable.

DeleteAnyone worried about Janel not being profitable couple of years from now and losing interest in NOLs that RBCN brings to the table?

DeleteYes, that's the primary risk.

Deletea significant dividend from rubicon just hit my account. thanks for a great idea!

ReplyDeleteMine too. It was worth the wait!

DeleteStreet clocks add a touch of elegance and historical charm to urban landscapes. Prices can vary widely based on design, materials, and craftsmanship. Antique and custom-made Street clock prices tend to be pricier, while more modern, mass-produced options are generally affordable. Investing in a quality street clock not only enhances aesthetics but also serves as a timeless landmark in any community

ReplyDeleteHas anyone done recent work here? What could the stub be worth?

ReplyDeleteI think the same base case is in tact; I've studied Janel for roughly 10 years. They produce a lot of cash (relatively speaking) and have levers to pull to increase profits - I don't see them backing off acquiring the rest of the company. There is additional incentive to pay a higher price - my understand of the tax guidance is that they can only utilitze a certain amount of the NOL based on the total amount they pay for the shares; in other words, there's a limit to the amount they can use; the more they spend, the more they can use. My low end estimate is 7.90.

ReplyDeleteAnon, I've followed Janel for a long time. Please feel free to reach out if you'd like to swap notes: burnersignup@gmail.com

Delete