What a wild week in markets. I'm finding plenty of new ideas, unfortunately don't have enough dry powder to throw at them all. Instead, I'm going to re-highlight PFSweb (PFSW) ($87MM market cap) as a boring business that shouldn't be impacted by bank or market stress trading at an extremely low multiple while also pursuing a sale. PFSW is a third-party logistics company primarily providing online order fulfillment services for 100+ retail brands. In 2021, PFSW

came on my radar when they sold a large business unit and were continuing to pursue strategic alternatives for the remaining 3PL business. M&A markets have slowed since then but they're still guiding to wrap up the process sometime in 2023. To be fair they could end up remaining public and pursuing a go-it-alone strategy but their posture has been a sale. In PFSW's recently

updated investor deck (whole thing is worth a look if you're interested in the idea), they lay out the following options:

#2 scares me a bit as it sounds like what ADES did, but PFSW already distributed most of their cash to shareholders in a special dividend last year, they don't have a huge cash balance burning a hole in their pocket.

Providing 3PL services to the retail industry, you'd expect PFSW to be in the midst of a covid hangover similar to UPS/FDX or Amazon, but the company has continued to grow on top of their covid gains and are similarly guiding to 5-10% revenue growth and 6-8% standalone EBITDA margin in 2023 (on their

recent conference call, 2023 is off to an "very strong start" and later a "phenomenal start"). They also provide their estimate of public company costs of 2% of revenue that could be eliminated by either a strategic acquirer or if the company was taken private. Following the 2021 asset sale and special dividend, PFSW has a clean balance sheet with $30MM in net cash.

The above is using the standalone EBITDA guidance (full corporate overhead), if we use the ex-public company cost guidance it naturally looks even cheaper.

A popular 3PL is GXO, a recent spin of XPO Logistics, GXO is a much larger, more scaled and diversified business, but it trades at 13x 2023 EBITDA guidance levels, well above PFSW that is under 4x EBITDA.

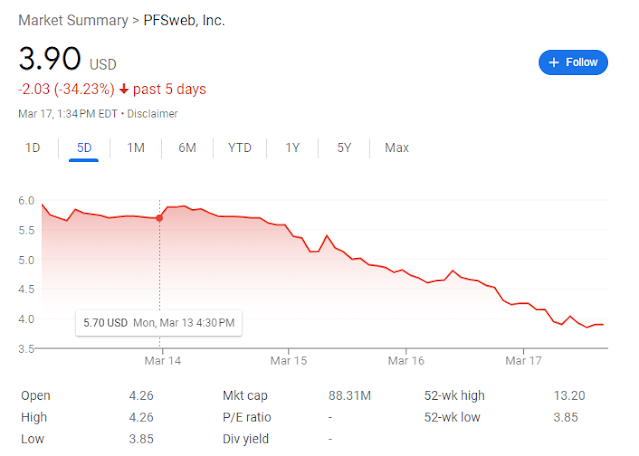

PFSW reported earnings on the 14th, its down about 30% since then despite no negative news coming out of the earnings report or the conference call. My guess is either someone is getting liquidated, this is a relatively illiquid stock, or the revenue guidance is getting picked up by data aggregators as a significant decrease. PFSW had a quirky contract where their GAAP revenue was distorted higher, but that ran off last year, their GAAP revenue will now match their previously reported "service fee revenue".

The sale process has dragged on longer than anticipated, they wanted to dress up the company for sale and by the time the makeover was done, the markets have changed just a bit. There should buyers for this business, dozens of private 3PL providers would make strategic sense and plenty of middle market PE shops that could also be interested.

Disclosure: I own shares of PFSW and calls

Core business did 7.6m / 3m / 5m in adj EBITDA the last 3 years, right? Big jump from that to 15m.. Also, wasn't stock comp ~6m of the 5m in 2022 adj EBITDA, so they were really break-even? And that level of stock comp would still take ~1/3 of economics from the 2023 EBITDA? Still looks cheap, but curious how you think about that?

ReplyDeleteI think both of those are good reasons why its cheap but also would be attractive to a buyer that could eliminate much of the corporate overhead. They took out a lot of costs, so yes it would be a big jump, I think they quote $9MM in annualized costs they've removed, so maybe not that crazy? A little growth, a little operating leverage, seems reasonable to me. But sure, stock based comp does negate a lot of it but if they sold to a strategic that would go away.

DeleteJust more half thought, you're right to point those out, but I don't think either have changed in the last week? But the stock price has significantly. I guess my larger point is PFSW seems to be feeling some indiscriminate selling for one reason or another. I don't think the story has changed but the stock price has.

DeleteSo many new ideas out there it’s tempting to just entirely remake my portfolio. Couple of spins (one potentially) with an already publicly traded subsidiary worth significantly more than the market cap of the parent. Companies like $UNTC technically trade at a yet to be officially announced 24% dividend yield. Numerous liquidations.

ReplyDeleteEven something like $ENZ which just announced a sale of a division for more than its market cap. (Remainco is marginal) is pretty interesting.

Thanks, I agree with the sentiment. Lots out there, maybe one downside of posting ideas publicly is I feel some pressure to see an idea through to a conclusion. It's probably been a net positive, but in times like these sometimes entirely remaking a portfolio might be the right idea.

Delete@Anon, what do you think is the underlying value of $ENZ at this point?

DeleteIf you assume half of liabilities are assumed then it trades at about 80% of liquidation value not assigning a value to the remaining business.

DeleteThe nice thing about having an illiquid portfolio is that you don't have to consider rebuilding it ..

DeleteLOL. nicely said @writser

DeleteMain reason I have stayed away from this is that XPO did their roll up by buying at 5-6x EBITDA. And as another commenter has said, EBITDA has jumped a lot recently. So it is a bit uncertain what EBITDA is in a more normalised economic environment.

ReplyDeleteSo that does not leave a whole lot of upside. I usually try to go for at least 50% clear upside in liquidations.

I struggle a bit with what "normalized" might be for this business. I would have thought they would have seen more of a slowdown already? Feels like the hangover from covid should already have happened, instead they might just grow through it? Famous last words probably.

DeleteAny thoughts on why ~12% of the float is short? What's the bear case here? No deal and corporate overhead erodes much of the value? Just don't see a narrative of asymmetric downside to make that bet, when if a deal is announced you can feel a lot of pain.

ReplyDeleteNot entirely sure what the bear case is at this price, thus my quick post. As others and you point out, this is probably not a sustainable entity long term, maybe the bear case is they haven't found a buyer yet and the M&A market isn't really improving.

DeleteAgree PFSW is quite cheap. The holders list is quite scary - from memory vast majority owned by special sits funds so liquidation scenario is scary. Buyers around here should do well as I believe the selling was someone getting out of the position. Only question is why haven’t they sold yet? It’s been quite some time, should be plenty of buyers for a simple, vanilla biz. Is it a bid/ask issue or some underlying issue? Does mgmt have an incentive to sell quickly (believe they extended the incentive pay and can do that indefinitely?)

ReplyDeleteThey did extend their incentive pay. I do have some sympathy for deals taking longer to materialize than the average investor thinks. It appears they weren't expecting the LiveArea bid when it happened, got an offer they couldn't refuse and scrambled to make the remainco 3PL business into something that would be saleable. Took a year for that to happen, which really isn't all that long in the real world, but unfortunately the M&A markets have taken a turn for the worse during that time.

DeleteIn Q3, they stated "We are also reaffirming our previously stated 2022 financial target for estimated PFS pro forma stand-alone adjusted EBITDA percentage of service fee revenue, which is targeted to range between 8% to 10%." (6-8% without the public company costs). Thus shouldn't have reported EBITDA been in the $16-20mm range less $4mm in public costs (ie 12-16mm)? $200mm revenue * 8 - 10 % margin less $4mm. This is versus a reported $5.5mm in EBITDA and mind you, the guidance was given in mid-November. This may have contributed to the fall in stock price recently. Admittedly, I don't know the business, but I was surprised to see all of the EBITDA for '22 was in Q4 despite revenues being nearly 50/50 between H1 and H2 of '22. A bridge between '22 and '23 EBITDA would be super helpful. I wonder if there are costs taht have since been eliminated dragging down their 9 month numbers in '22?

ReplyDeleteNice move in PFSW over the last couple months, anything worth updating?

ReplyDeleteNot really, seems like the business is performing well, no noticeable post-covid hangover. We just wait until they finish the strategic process and hope for the best.

DeletePretty interesting 8k out today with the main change being to the full vesting of the Performance share award of each tranche’s awards upon a qualifying change in control and the offering of additional stock units upon achievement of certain stretch performance metrics. Wonder if this means the finish line is in sight?

ReplyDeleteThanks, I missed that. Does seem that way, we are nearing Q4 and they've consistently stated that it will be done by year end. Hopefully we don't get disappointed with an odd transaction or where they end up being a buyer and not a seller (the "ADES risk")

DeleteNice call! I need to pay more attention to some of these filings.

DeleteGXO buying PFSW for $7.50:

https://www.sec.gov/Archives/edgar/data/1095315/000109531523000045/exhibit991pressreleasedate.htm

thanks! But I just got lucky there. What do you make of the offer? Do you think a bump in price is in the cards?

DeleteI've already sold, but that might be a good omen. I missed the overbids on both WMC and SCU this year.

Delete