The dumpster diving continues, this one is a bit messier and riskier.

Pieris Pharmaceuticals (PIRS) is a clinical stage biotechnology company targeting treatments for respiratory diseases and cancer indications. In late June, the company announced that their partner, AstraZeneca (AZN), in their lead product candidate, elarekibep, discontinued its Phase 2a trial and this week we found out that AstraZeneca also terminated their R&D collaboration agreement with Pieris. Getting a read out on elarekibep's Phase 2a trial was the company's top strategic priority, so much so that they limited investment in their other assets, now without that partnership, the company is left in a difficult position where they are burning cash and can't raise capital in the current environment.

In comes the strategic alternatives announcement where they disclosed a 6/30 cash balance of $54.9MM and a reduction in workforce of 70%. The CEO's (4.8% owner) comments were rather specific:

"We are pursuing strategic options across three main areas following the recent developments that have impacted our ability to independently advance our respiratory programs," commented President and CEO Stephen Yoder. "One track is accelerating partnering discussions of PRS-220 and PRS-400. A second focal area is diligently selecting the best possible development partner and deal structure to re-initiate clinical development of cinrebafusp alfa, our former lead immuno-oncology asset, which has shown 100% ORR in five patients in a HER2+ gastric cancer trial that was discontinued for strategic reasons. Third, we will explore whether our balance sheet, position as a public company, and other assets are of strategic value to a range of third parties.” Mr. Yoder continued, "While the challenges we recently experienced across our respiratory franchise have forced us to make very difficult personnel decisions, I cannot express enough gratitude to our departing colleagues for their dedication, collaborative spirit and integrity."

I appreciate the honesty of "position as a public company" being of strategic value, that points to a reverse merger being high on the list, which isn't ideal.

Pieris has a lot of partnerships, in addition to AstraZeneca, Pieris has current collaboration deals with Genentech (now part of Roche), Seagen, Boston Pharmaceuticals and Servier. These are in addition to the assets mentioned in the above quote. PRS-220 and PRS-400 are wholly owned and controlled, PRS-220 is currently in a Phase 1 trial in Australia and PRS-400 is still pre-clinical. Plus they have cinrebafusp alfa (don't ask me to pronounce that) which previously had a successful Phase 1 study, they were initiating a Phase 2, but stopped to redirect corporate resources to the failed AstraZeneca program. In PIRS's own words in the latest 10-Q, before the strategic alternatives announcement:

In July 2022, we received fast track designation from FDA for cinrebafusp alfa. In August 2022, we announced the decision to cease further enrollment in the two-arm, multicenter, open-label phase 2 study of cinrebafusp alfa as part of a strategic pipeline prioritization to focus our resources. Cinrebafusp alfa has demonstrated clinical benefit in phase 1 studies, including single agent activity in a monotherapy setting, and in the phase 2 study in HER2-expressing gastric cancer, giving the Company confidence in its broader 4-1BB franchise. In April 2023, clinical data showing an unconfirmed 100% objective response rate and promising emerging durability profile was presented at the American Association of Cancer research annual meeting. These data provided encouraging evidence of clinical activity for this program and we are considering a range of transaction to facilitate the continuation of cinrebafusp alfa, including an immuno-oncology focused spinout to traditional partnering transactions.

Between the strategic alternatives press release and the language in the 10-Q, it doesn't appear Pieris is just beginning the process, but rather they've been looking for ways to raise capital all along by selling these three assets (because they needed cash to get to their previous mid-2024 AstraZeneca readout timeline), here there might be quicker asset sale catalyst than others in the broken biotech basket.

But as usual, I have no real thoughts on the science behind any of this, but among the partnerships and the wholly owned programs, there might be some value nuggets above and beyond the cash on the balance sheet.

The partnerships do create some quirky accounting. Pieris has received upfront payments in each of these deals for the licensing rights and some R&D collaboration on future development, they account for the upfront payment by creating a deferred revenue line item for the revenue received but where services haven't been performed (like R&D spend). While this shows up as a liability, as you read through the lengthy description of each partnership, it appears (feel free to push back on this) like their partners can't claw back funds and its not a true debt or liability.

One could probably figure out the margin on this deferred revenue over time by doing some data mining, but with the 70% reduction in workforce, likely over indexed to the R&D team, it doesn't appear the company is too concerned about not being able to recognize this revenue or having it clawed back.

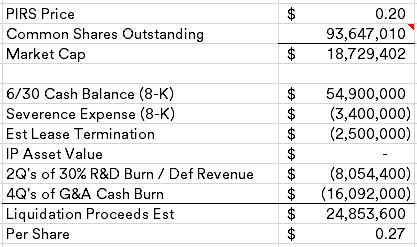

It seems a bit aggressive to me to not only pencil out the deferred revenue but also ignore all other liabilities. I.e. 6m in accounts payable and 10m in accrued expenses. Also, the lease expires in 2032 and included $12m of tenant improvements. I.e. the right-of-use asset is only 3.7m and the rest of the lease is included in PP&E as leasehold improvements. Could be a bit trickier to get out of than usual (?). Dunno. All in all I seem to be a bit more pessimistic than you about this one. Which undoubtedly means that it is going to work out very well!

ReplyDeleteFair point on the lease termination. It's also in Germany, I don't know how in demand medical office space is there but I doubt its the same as Boston or SF.

DeleteOn the other liabilities, we do have an offset in the prepaid expenses, maybe we should knock cash down a net $4-5MM. I get a little comfort from PIRS disclosing the 6/30 cash amount as a good starting point.

This one is a little trickier than the others to handicap. I sized it appropriately small.

While we're on the subject of failing biotechs. I think two much safer names who just announced restructuring plans are ELYM and RKDA.

ReplyDeleteRKDA announcement earlier this morning: https://www.businesswire.com/news/home/20230720998849/en/Arcadia-Biosciences-RKDA-Announces-Strategic-Review

ELYM announcement also this morning: https://ir.eliemtx.com/news-releases/news-release-details/eliem-therapeutics-announces-plans-explore-strategic

Both have a much cleaner balance sheet than PIRS and significantly lower debt.

Also FWIW, RKDA insider ownership has gone up to 23% in the past few months.

DeleteThanks. I did take a look at ELYM this morning and didn't see a huge value gap there, unless I'm missing something about their IP/science.

DeleteHadn't seen RKDA, I'll take a look, but might be too small to post about.

ELYM reminds me of PRDS in a way. Brief history, hasn't had a lot of NOL, very minimal debt. They posted a cash position of $102.6M in the proxy, if you judge by past R&D and G&A there is indeed a narrow gap in value but now that they've halted the Kv7 program (whatever that means), the numbers can look attractive depending on the bestimate. I do agree that it's still hard to put a number on.

DeleteRKDA on the other hand, really small but just 0.2x book. Hmm.

i think WAY more shares oustsnding - like 120m or maybe more. cash went up sequentially likely due to atm

ReplyDeleteCould you share your math? I have low confidence in the share count number. They didn't hit the ATM in Q1, I was trying to square if they did in Q2 or if they received milestone payments. Thanks.

Deletedont think any milestones. take 1q cash accout for normal burn should drop a lot but went up. assume atm.

ReplyDeleteWhere did the sequential gain in cash come from? $54M vs. $39M on the balance sheet....that's either ATM issuing 18M+ shares or a mix of ATM + short-term being liquid + other current assets converting to cash.....lets be conservative and say 8M new shares for $6.4M + $8.6M in short-term investment being 100% liquid and fungible for cash....they still have $16.1M in current liabilities and you are assuming lease termination vs. continuation with the 38 employees even after 70% employee cut....38 employees isn't liquidation mode it's remix for reverse merger turd party...and they are predominantly German with termination agreements for compensation that will run at least a multiple of six figures $300K per employee...and what is this company anyway? Well for one thing it is is a COVID beneficiary with $17M granted from the Bavarian government in Germany...any management reputational risk in taking their cash remainder (call it my estimated $12M vs. your $24M) and giving that cash to US capitalist pigs?

ReplyDeleteThanks for the feedback, this one might not be as interesting as previously thought.

ReplyDeleteThis one appears to have been caught by the day trading crowd, keeps going up 20% a day. I'm selling since this is on no apparent news. Might be leaving some on the table. Sometimes better lucky than good and a benefit of the basket approach to these.

ReplyDeleteI did sell it also.

DeleteThanks!

Pieris owns 54.9 mln USD in cash as of june30, add 2.1 mln USD Just received from Boston Pharma because of PH1 PIRS342 Just started, then 57 mln USD in cash and short term investments. Add 10 mln USD in prepaid expenses and we have 67 mln in current assets,enough to offset 28 mln USD in accrued expenses and lease liabilities. Add 7 mln to payoff both restructuring costs for 70% layoffs and retention services for 30% retained workers until Q2 2024. Add potential 5 mln USD in Investment bank fees plus 10 mln USD in WORST case scenario cash burn until June 2024. 22 mln USD still in net assets and I am excluding other small assets and potential reimburments but... We Need to add Properties plant and equipment worth 15 mln usd plus 4 mln USD in rights of use assets. These 19 mln USD may be recovered at 60% as minimum therefore we have 11mln USD to add to net equity. We are conservative lowering assets and raising liabilities, still 33 mln USD or 34 cents per share in net equity. Add now IP... 3 COMPOUNDS ALREADY PARTNERED with potential milestone and royalty payments up to 2.5 bln USD, plus 4 compounds for sale and partnerships, plus ANTICALIN PLATFORM the most important asset... hundreds of millions imo in CVRs if not more ...or proceeds immediately receivable if assets sold or outlicensed and accrued to net cash position. Add reverse merger due to NASDAQ LISTING and nols CF... Well stock could be worth 2/3USD, os 99 mln and no preferred share, BVF owns more.than 20% institutional investors own 60%...this Is my math...stock has a lot of potential.

ReplyDeleteI generally agree with your analysis, I'm back in for another ride now that it's fallen back to ~$0.31.

Delete$10M future burn is "WORST case" for a company that burned $15M in Q2 alone and will still have 30% of staff on payroll in Q4 and beyond? And if these drugs are worth hundreds of millions in future CVR payments Pieris should have no problem raising more funds themselves, right?

DeleteRead carefully last filing! Total cost for retained employees, 30% not laid off, Will cost around 3.7 mln USD until june30 2024, therefore I have written 7 mln Total restructuring costs for layoffs and retention services. 7 mln not more, and management and Bod members have been granted stock

ReplyDeleteYou tell me if my reading is wrong. I got that they don't get down to 30% employees until Q4. 30% employees won't be 30% of the burn rate, they'll have leases, legal, and other costs that won't decline as much. In Q3 they have $3.4M in severance, and another $3.4M by Q2 2024. Q3 burn has to be somewhere between $15M and 35% of $15M + $3.4M. My guess has been that 2H 2023 burn plus 2024 severance is somewhere between $17M and $21M. Other issues include will they have to repay the $8.5M Bavarian grant, will they have to refund any deferred revenue do, and how much future lease liability can they get out of. To be clear, I'm not saying I don't think it is potentially attractive. All my differences are relatively minor compared to the potential revenues they would generate if they can license their technologies.

DeleteDeferred revenues are not to be refunded, why? Azn handed back the programs and deferred revenues related to PIRS60 and preclinical compounds Will be recorded as revenues. Why to refund Grant to Bavarian Govt if program Is still ongoing and clinical trials results at any moment?

DeleteCash burn Will be minimal because R&D stopped, G&A trimmed and put a cap to expenses until next year. Pirs 220/400 with clinical update soon, PIRS 220/400/343 available for partnerships and sale

ReplyDeleteOnce outlicensed PIRS 220/400/343 and maybe 060, the ANTICALIN PLATFORM too, Company May Be a Rich cash One ready for a Big deal such reverse merger or special distribution to shareholders. Their pipeline has value, pps Is too low imo

ReplyDeleteDo your analysis, lets wait for updates, when and if positive news out 1 usd should be the First target, or 100 mln USD market cap, when cash Is a big chunk of that, glty

ReplyDeletehttps://www.otcmarkets.com/filing/html?id=16906572&guid=Jcg-knvPm24gPih

ReplyDeleteCompany Is assessing the best potential deals, right now if math Is good, stock is trading for estimated net equity as of June 2024, assuming all liabilities paid plus fee to Stifel and some cash burn, not taking into account potential proceeds from asset sale and partnerships. It Is a waiting game

ReplyDeleteSaw a surge in price today - any news?

ReplyDeleteNot that I've seen. I'm still surprisingly drawn to this flaming pile of garbage, has to be some value in the IP, but might not be worth piecing apart.

Deletehttps://www.sec.gov/ix?doc=/Archives/edgar/data/1583648/000143774924009491/pirs20240323_8k.htm

ReplyDeleteBOSTON, MA, March 27, 2024 – Pieris Pharmaceuticals, Inc. (Nasdaq:PIRS) provided a corporate update today announcing a strategy to maximize its ability to capture the potential milestones from its 4-1BB bispecific Mabcalin® (antibody-Anticalin fusion) protein immuno-oncology assets partnered with Pfizer (formerly Seagen), Boston Pharmaceuticals, and Servier. After considering an extensive range of options, the Company's Board of Directors decided to implement this new strategy along with relevant cost-saving measures that are expected to extend the Company’s cash runway into 2027.

I still own this one, want to like this news, it is a similar strategy as what MACK did. But could also be a sign that they received no legit offers or that management had too high of expectations and wants to keep their salaries going. They do have a lot of random assets, was probably hard to do a more traditional busted biotech deal.

Deletehttps://www.pieris.com/investors/news-events/press-releases/detail/707/palvella-therapeutics-and-pieris-pharmaceuticals-announce

ReplyDeleteI know, sad face. I didn't have conviction in holding this one, especially after the announced they were effectively a listed CVR. Thought they gave up on the merger plan.

DeleteYeah, sucks, but I don't think you should've done anything different. It's up a lot because nobody expected a reverse merger, but that's exactly why you didn't want to hold it .. If you start holding any crappy biotech just in case, well, I don't think that would work out great.

DeleteReading back some filings and even with the power of hindsight I don't see clear signs that they were still in the market for a reverse merger. On top of that the balance sheet looked pretty weak.

The merger closed yesterday. I got shares of $PVLA but I didn't receive any CVRs as listed in the merger 8K. Wondering if other participants here were able to receive their CVRs?

ReplyDelete