ALJ Regional Holdings (ALJJ) is likely a familiar name to many readers (and thanks to those that pointed it out to me), it was an NOL shell that Jess Ravish (former Drexel, Jefferies and TCW executive) used as a holding company to buy and sell several various unrelated businesses over the last 10-15 years to soak up the tax assets. The vast majority of the NOLs expire in 2022. It has functioned as Ravich's mini-PE fund, he owns ~47% of the stock (management owns 56% as a group). As of 9/30/21, ALJ had two operating businesses: 1) Faneuil, a business processing outsource provider and; 2) Phoenix Color, a specialty book printer that manufactures education materials, heavily illustrated books, etc.

Likely due to the upcoming NOL expiration, ALJ has made two significant asset sales in the last two months:

- On 12/21/21, ALJ sold a large piece of the Faneuil business to TTEC Holdings (publicly traded as TTEC) for $140MM cash ($15MM of which will be escrowed) and a $25MM-earn out. The remaining pieces of Faneuil are expected to generate normalized revenue of $80-$90MM. The sale is expected to close in Q1, and TTEC gets a 3-year option to buy the remaining business. The transaction is structured as an asset sale, so ALJ will receive all the economics of the business performance up until the closing date.

- On 2/4/22, ALJ sold the entire Phoenix Color business to Lakeside Book Company (subsidiary of LSC Communications, the disaster spin from RRD) for $135MM cash. The sale is expected to close in Q2.

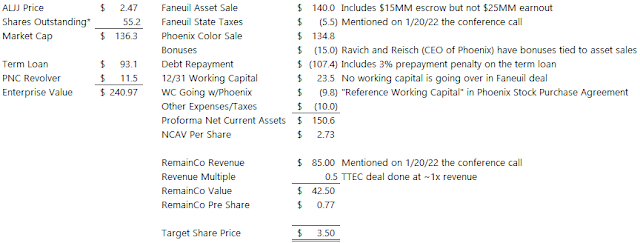

Following the closing of both of these transactions, I estimate ALJ will have roughly $150MM in net current asset value plus the remaining business at Faneuil, versus a current market cap (including the conversion of converts and warrants) of $136MM:

The main reason the stock is cheap is Jess Ravich, the market doesn't trust him, one good example is he participated in a financing round during covid and got convertible debt at a $0.54 conversion price that PIKed for a year (further diluting minority shareholders) before it was amended. Another is he's also been facing legal trouble over the last few years regarding his time at TCW. Now that the NOLs are burned off and/or expiring, maybe he no longer wants to deal with public shareholders and uses the cash proceeds to take out the minority shareholders. There is precedent, he did a large cash tender back in 2012 following the sale of a business, the Alpha Vulture blog covered it well back then.Disclosure: I own shares of ALJJ

Spoke with CFO, he said the bonus/commish is closer to 7.5% of sale price, so ~10 cents a share cash. Havent looked into employment agreement, just parroting him

ReplyDeleteThanks for that color, yeah it is tricky to calculate because its a percentage of the gain and I didn't dig into what their cost basis would be on each business, capex over time, etc.

DeleteCost Basis on Phoenix is 90m in 2015, https://www.prnewswire.com/news-releases/alj-regional-holdings-announces-acquisition-of-phoenix-color-and-other-financing-transactions-300111954.html

ReplyDeleteand Faneuil is 53m in 2013, https://www.prnewswire.com/news-releases/alj-regional-holdings-inc-announces-acquisition-of-faneuil-inc-228357851.html

Luda! Luda! Luda!

ReplyDeletehttps://www.sec.gov/Archives/edgar/data/1438731/000156459022014465/aljj-ex992_29.htm

ReplyDeleteBoth transactions closed, above is the proforma financials, fairly close to what I have in the post, now we wait to see what Ravish does next.

I could not understand from the filling how much is the new remaining operating is making ‘ loosing thoughts?

ReplyDeleteProformas have to be taken with a grain of salt, but I would guess the remainco is roughly breakeven going forward.

DeleteMDC, Any change in your thoughts on the value. Are you still expecting close to $3.5?

ReplyDeleteExpecting might be too strong of a word, just a target price. But yes, I don't think anything has materially changed since the post, in the latest earnings press release they did slip in "possible strategic alternatives" for ALJJ.

DeleteGoing dark here is maybe not the coolest... perhaps the strategic alternative is shaking out the minority shareholders at prices below liquidation value.

ReplyDeletePretty much.

Deletehttps://www.prnewswire.com/news-releases/alj-regional-holdings-inc-acquires-ranews-companies-completes-repurchases-and-certain-investments-301637230.html

ReplyDeleteI sold on this new yesterday. Ravish is now going full speed ahead treating ALJJ like his own PA/family office. Not my thesis, I got this one wrong (one of many this year), I'm out.

Here comes a tender! 10M shares between 1.84-2.00. I don’t like Mr Ravich very much, but this is definitely accretive to book value and technically counts as returning capital.

ReplyDeleteWell below fair value, curious how many people take him up on the offer. He's intentionally transferring value to him, company is dark now, some people might sell just for that reason, knowing there could be very limited liquidity on the other side.

DeleteOh yes, this is basically robbery. That said, I went ahead and bought some at 1.88 to tender at 2. Either I get a fill, or who knows what happens.

DeleteEach situation is different, therefore this observation I am making shouldn't be taken too seriously, but Emmis made a tender offer in Nov '21 to buy back 2 million shares at a price of $2.6. Little over a million shares were tendered by shareholders. This June they had another tender offer this time Dutch reverse with price between $2.75 and $3.75, they received only a bit over 100K shares tendered even though the stock basically can not be traded. Similarly those that didn't tender last year for BBXIA are getting a much better deal this year $8 vs $10. So may be not tendering may not be a bad idea. It is risky though playing with Mr. Ravish. By the way Buffett is called Buffett, Musk is called Musk, why call Ravish, Mr. Ravish. As a joke calling him Mr. Wolf, I can understand.

ReplyDeleteThanks for your thoughts. I'm still in BBXIA, also considering that tender similarly, but likely won't tender.

Delete