Now onto something that is a little more in my historical wheelhouse.

Radius Global Infrastructure (RADI) is a holding company that owns 94% of the operating company APWireless (but I'll just refer to the company as Radius/RADI going forward). Radius is a wireless tower ground lease company (the legal structure can vary by country, but in each case works similar to a ground lease) that purchases rent streams mostly from mom and pops, individuals or smaller investors who own the underlying real estate. Historically, before tower REITs really took off, the wireless carriers would build their own towers and lease the land/rooftop from individuals or building owners. Today, tower companies mostly develop and own the land under their new structures, but there's a large fragmented global market of leases for Radius to rollup.

Radius checks a few other boxes for me:

- RADI is not a REIT and doesn't pay a dividend, although the business model would lend itself well to both, thus limiting its investor pool today. This would be a great YieldCo (see SAFE).

- RADI doesn't really develop new towers, but they have a global originations team that scours the market to create new leases, as a result their SG&A looks high for their current asset base (it doesn't screen particularly well), but their SG&A could arguably be separated and thought of as growth capex (HHC or INDT are semi-similar, but RADI's distinction is probably cleaner). Their origination platform would likely be valuable to someone with access to lots of capital, for example, an alternative manager like DigitalBridge (DBRG).

- Bloomberg recently reported that Radius was exploring strategic options including a sale. RADI has some financial leverage and given the stability of their lease streams could trade privately for a low cap rate juicing any returns to equity holders.

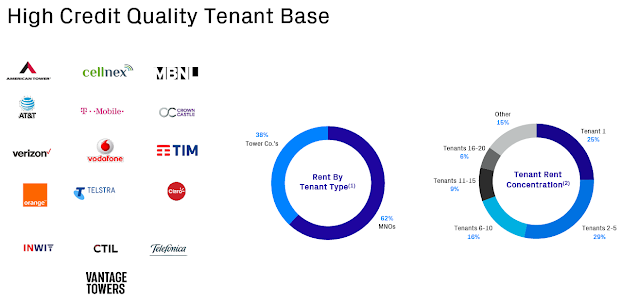

Radius has all the major tower companies and wireless companies as tenants, wireless infrastructure is an essential service that is only increasing in importance. As a ground lessor, Radius is senior to the tower companies which are great businesses and have historically traded at high multiples.

In the current environment, everyone is concerned about inflation, Radius has inflation indexed escalators in 78% of their portfolio against a largely fixed rate debt capital structure, further increasing the attractiveness of their lease streams.

For a back of envelope valuation, I'm simply going to take the annualized in-place rents minus some minimal operating expenses to create an NOI for the as-is portfolio. This portfolio should have minimal expenses other than a lockbox to cash the rent checks as there is no maintenance capex (these are structured as triple net leases). Note the RADI share price below is my cost basis, things are moving around so much this week, don't know what the price will be when I hit publish.

The other challenging thing for RADI is all the dilutive securities. There's also an incentive fee that is rebranded as the Series A Founder Preferred Stock dividend, I've left that out for now but may try to workout how much it would dilute any takeover offer, although I think there's enough room for error here either way. As usual, I've probably made a few mistakes, please feel free to correct me in the comments. But above is roughly the math if the acquirer buys Radius and fires everyone, sits back and collects the inflation-linked levered cash flows.

The piece I struggle valuing is the origination platform, but I have a feeling someone like DBRG (just as an example, any private equity manager really) would be very interested in it as they could deploy a ton of capital over time and generate pretty reliable returns. RADI has guided to originating $400MM of new leases in 2022 at an average cap rate of 6.5% inclusive of origination SG&A and other acquisition costs. Even using the current market implied cap rate of 5.1% above, the origination platform would create ~$110MM in additional value this year by putting the 5.1% public market valuation on the lease streams they originated for 6.5%. RADI's management thinks they have a long runway for origination growth as they've just scratched the surface (low-mid single digit penetration) of this fragmented market. Any value prescribed to the origination platform would be above and beyond my simple math in the Excel screenshot.

Interestingly, during the Q1 DBRG conference call, DBRG CEO Marc Ganzi said the below with regards to the digital infrastructure M&A environment (transcript from bamsec):

We do see public multiples retreating in some of these different data center businesses or fiber businesses or ground lease businesses. There's been a pretty sizable contraction and the window is beginning to open where we see opportunity. And I think by being once again by being ultimately a good steward of the balance sheet and being prudent in how we deployed that balance sheet last year, we've taken our shots where we have good ball control, and we've taken our shots that are candidly going to be accretive

And there's reason to take Ganzi's comments quite literally as DigitalBridge made a splashy deal this week in one of the three categories he called out by purchasing data center provider Switch (SWCH) for $11B.

I've bought some RADI common this week and also supplemented my position with some Aug $15 call options. Similar to other ideas over the years, I like call options here, there's no reason to really think that RADI's business is deteriorating alongside the overall market, their leases are inflation linked and structurally very senior in an infrastructure like underlying asset. There's financial leverage, low cap rates and an origination platform that could be valuable to someone, all of which could lead to a big takeout premium if they strike a deal.

Disclosure: I own shares of RADI (plus DBRG, HHC, INDT) and call options on RADI

Think diluted shares are 109 when using treasury method. Great write up though. I peg the yield co at $19/shr and the origination platform at $3-5/ shr

ReplyDeleteAh okay thanks, makes sense, if I can pry, how'd you come up with $3-5/share for the origination platform?

DeleteIt’s kind of finger in the air math but roughly:

Delete$400m deployment per year

At a 7.5% cap that should trade at ~4% in private markets = roughly $314m of value creation per year

They spend $60m a year to originate so $250m a year in net value / 109m shares

Then put some multiple on that. You can probably argue 2-3x is reasonable which gets you north of $5/shr

I'm good with finger in the air math, thanks.

DeleteNice idea. Been following this company since the SPAC, surprised they want to sell so quickly.

ReplyDeleteHave you looked at Uniti Group? Somewhat similar situation.

I haven't in a while, at least since the legal stuff around them and Windstream, but thanks for the idea, I'll add it to my list.

DeleteThanks for the idea, I'm very interested, there was a pretty candid interview the CEO gave earlier this week at the JPM conference.

DeleteThanks for the writeup! Why do you think the cap rate of 5.1% is too high? Do you have any previous comps to refer to?

ReplyDeleteThanks, I sort of intentionally left out comps, there aren't perfect ones. But I would probably blend SAFE, the tower REITs, the debt of the tower REITs and wireless carriers all together in some fashion. Or just in an absolute sense, 5.1% seems too high to me for senior secured inflation adjusted cash flows on digital infrastructure assets.

DeleteMy gut says so too. The company went public through a SPAC in Oct 2020 and is now considering leaving the public markets? How credible do you think the rumors are? If it falls through this stock doesn't screen well. Thanks!

DeleteI think the rumor that they're gauging interest is likely true, whether it results in a transaction, who knows.

DeleteIntriguing idea, as is usually the case with your posts. However, depending on the contractual terms, my immediate reaction is that the "ground lease" structure may add significant risk. The underlying towers are infrastructure assets probably deserving of a low cap rate. But, correct me if I'm wrong, but RADI doesn't own the towers, they just lease them from the owners and then sublease them on to tower companies or MNOs. Ground leased building generally take price haircuts when compared to fee-owned buildings (except in frothy markets and also except in the case of super-long ground leases with favorable economics). I'd want to know more about the terms of the "ground leases" and the terms of the "subleases" before geting too excited.

ReplyDeleteMaybe someone more knowledgeable on RADI's lease structures can comment.

DeleteMy concern around their leases was more the number and nature of them, they don't have a master lease with one of the tower companies or MNOs, these are individual leases that could be cancelled without much disruption to their operations (I could be wrong), but apparently they don't get cancelled often. The company reports a 1% churn rate. So while the business model might resemble SAFE in someway, I don't think it deserves the same cap rate because a tower isn't an a Class A apartment complex.

Thanks for the reply. My problem is with the business model. My background is in commercial real estate and I've always had an aversion to ground lease deals. So to me it's not whether or not towers should have a similar cap rate to Class A apartments, but whether (1) a hypothetical pure play Class A apartment SAFE should have the same cap rate as EQR and (2) whether RADI should trade at the same cap rate as AMT. For me it's no, not even close. Thanks again for the post.

DeleteAppreciate the pushback, gives me something to noodle on.

DeleteI did a little digging into SAFE, since I wasn't super familiar (I've usually avoided Sugerman vehicles). Although their disclosures aren't super clear, it appears that SAFE generally acquires a fee interest in land, either (1) following up by originating a ground lease with a developer who constructs improvements (multifamily residential, office, etc.) on the land or (2) already subject to an existing ground lease with an operator of the improvements (apartment building, office building, etc.). I like this business model. Valuation is difficult because it's idiosyncratic but if the business is structured properly there is good downside protection combined with long term upside optionality. That, however, is not RADI's model. If RADI followed SAFE's model, they would be the owners of the buildings on which the towers were located and they would lease them to, e.g., AMT (that would be the "ground lease") who in turn would lease them to, e.g., VZ. But RADI is instead in the middle, leasing from the underlying property owner and then leasing on to VZ (or, in some cases, AMT). In other words, SAFE is the landlord under the ground lease while RADI is the tenant. So my concerns regarding RADI remain - I don't like the "tenant under a ground lease" business model. Apologies for the ramble, but you helped me clarify my thinking.

DeleteSo the reason they have low churn is the legacy or "Piggyback " type of design you have in a cellular network. It's a bit of a house of cards . Over the years the carriers have added antennas to towers to improve and expand coverage. It's engineered based on previous work. They can't just pull the plug on a tower in their network without creating wider problems.

ReplyDeleteThat's good right? Ha, got thrown off by the house of cards piece.

DeleteJust had a look back at my February list mentioned here. Despite some stinkers there, up about 11% on an equal-weight basis (or 4% excluding the BDSI buyout) vs. approx -5% for SPY over that period. Not earth-shattering, but I'll take it.

DeleteOne quick hit on a name that's probably not actionable, but you never know...

ACMC, a tiny provider of mortgages to churches, is being bought out after many years of failing to thrive. This afternoon's 8-K has details, but the broad strokes are that the buyer is making whole the note buyers who funded the operation, with about $2.50/share left over to be distributed to shareholders. Target date for completion is end of June; drop-dead date end of December.

I assume there is a fairly high degree of confidence if they are naming a target date only a month out. The equity value above is about half of stated book, and twice the last trade price. They last paid a (small, increasingly so over the years) dividend a year ago, and I imagine holders, whoever they are (apart from me, a token amount), will be glad for the liquidity.

My $2.50 assumes de minimis costs for windup and liquidation, which may or may not be realistic. This is a very thinly traded Pink Sheets stock (though fully SEC reporting) and any hiccup with expenses or timing would likely deplete the residual value.

I think the likeliest path is that this will open around $2 on Tuesday, making it not terribly attractive, but there is a chance that there's some to be found at the last ask (maybe I shouldn't have mentioned this at all until I saw if there was a fill!).

DeleteAlso--obviously--my estimates might be off. If, say, two million dollars are held back for contingencies and expenses with a stated holding period of a year or two, and/or closing is put off to Q4 (introducing further uncertainty), the prospective return drops to an unpalatable level.

Fun walk down memory lane, I looked at this one maybe 8-10 years ago. Any current thoughts on ADMA? I spent some time on that one after you mentioned it, still hovering my "interesting if some of my other ideas play out" list.

DeleteI bought some during the GFC and held it for a year or two, and was amazed to see it was still around in 2020 when I bought again. Funny little company.

DeleteNothing too much to say on ADMA, though I'm keeping track of it too. I liked it very much up to $1.30 (my last buy), and obviously it's very cheap on 2024/5 guidance, but even with their seemingly good execution of late I just don't have the comfort level yet that'd be necessary to make it a medium-large position vs a smallish one.

The growth, the expiration-extension inventory writeup, the strategic alternatives, the potentially accelerated timeline to profitability, the presence of Perceptive (well, that USED to be a good thing until 2021, and it's a rounding error for them anyway)...it all makes for a great story, but if there's any hiccup they could be a liquidity-challenged cash-consuming microcap in a possibly-unfriendly market, in which case I'm not smart enough to handicap their odds. Hope to have more confidence as the year progresses.

Same story with SQFTW, a bizarre warrant with downside protection. I really want to like the management there (Cliff's Notes: subscale REIT, priced at ~60% of envelope-math NAV, mgmt seems shareholder-focused and very--too?--creative) enough to make it a large position, but am not there yet.

Maybe 5% cap rate is not as low in a rising interest rate environment?

ReplyDeletehttps://www.nar.realtor/blogs/economists-outlook/commercial-cap-rates-likely-to-keep-compressing-in-2022-despite-higher-interest-rates

https://www.cbre.com/insights/books/us-real-estate-market-outlook-2022/capital-markets#:~:text=Cap%20rates%20to%20hold%20steady&text=The%20all%2Dproperty%20average%20cap,250%20bps%20in%20H2%202022.

Thanks, I struggle a bit with how to rethink about cap rates in the current environment. Some things like long term NNN leases should definitely be hit by higher interest rates, but things like multi-family where rents are increasing faster than inflation or rates moving up, that's less clear to me that their cap rates should move up significantly. Here with RADI, their rents are going to go up 20% in a year like multi-family, but they are largely inflation hedged.

Delete*rents aren't going to go up 20%

DeleteI think it's more about risk premium, as cbre and nar point, cap rate is a function of T-yield plus spread so in a rising interest rate environment spreads should compress in order to keep cap rates stable (which is hardly achievable). 5% cap rate may look good now but no so in the 70s

DeleteHere is a good piece from Cornerstone about cap rates in historical perspective: https://www.google.com/url?sa=t&source=web&rct=j&url=https://www.adventuresincre.com/wp-content/uploads/2017/09/Cap-rates-and-RE-Cycles.pdf&ved=2ahUKEwjxzYGFspP4AhW9BxAIHddLBVAQFnoECAQQAQ&usg=AOvVaw0WbVZgC_Zkz5Y65VnWRbje

https://www.lightreading.com/digital-infrastructure/insatiable-digitalbridge-kicking-tires-on-radius---report/d/d-id/777974

ReplyDeleteApparently DBRG is in talks with RADI.

DBRG is buying GD Towers at ~3.9% cap rate. You are totally right with your cap rates)

ReplyDeleteI just hope they want RADI as well and it wasn't an either/or situation where they burned their dry powder on GD Towers.

DeleteBloomberg reporting that EQT is in talks to acquire RADI. I still hold the stock, but I'll likely lose money here after my calls expired worthless in August.

ReplyDeleteLooks like RADI buyout rumors are circling again per Bloomberg. Unsure what the downside is here. Currently (still) trades at ~5% cap rate by my numbers.

ReplyDeleteNot sure if you're still in this but there are acquisition rumors between 26North and Digital Bridge https://www.gurufocus.com/news/2867724/26north-partners-nears-acquisition-of-digitalbridge-dbrg-dbrg-stock-news

ReplyDeleteThanks, I gave up on DBRG, but it did get pretty cheap there, not surprised someone is interested in buying them.

Delete