This will be a brief post and not the most exciting idea given the current chaotic market backdrop, but I wanted to throw something out there as it has been a while since hitting publish. I've mostly just been sitting tight, waiting for events to play out and adding to a few current positions during this downturn. I also don't have much experience with insurance companies so be easy on me in the comment section.

Argo Group International (ARGO) is a specialty insurer (~$1.5B market cap) that first popped up on my radar screen in 2019 when it faced a proxy contest from Voce Capital, their largest shareholder (9-10%), which eventually added three representatives to the board. Voce put out an entertaining deck that outlined the now ex-CEO's lavish lifestyle (corporate penthouses, art collection, sailing sponsorships, private jets, etc.) that was essentially being expensed through Argo.

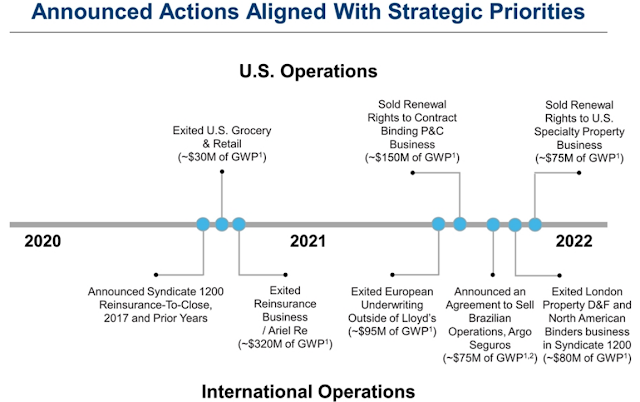

In the ~2 years since Voce refreshed the board and the ex-CEO resigned, Argo has gone about shedding unprofitable or volatile business lines to highlight the strong U.S. focused specialty insurance business.

The crown jewel is their excess and surplus business line that focuses on risks that standard insurance markets are unwilling or unable to underwrite. This the non-commoditized, less regulated corner of the insurance market and thus should be more profitable. The transformation goal has been to uncover and highlight this business:

However, the perceived slow speed of the transition and a surprise reserve adjustment in February brought forward another activist pushing for board representation in Capital Returns Management, an insurance focused hedge fund. Capital Returns has also insisted the company put itself up for a sale and the board agreed last week to run a strategic alternatives process which includes exploring a sale of the company. While, Capital Returns argues the board doesn't have skin in the game (in aggregate they own ~1% of the company), there are three Voce representatives on the board and they've moved the business down Voce's suggested path. My guess is Voce is in agreement that now is a good time to pursue a sale and the board is unlikely to resist a reasonable offer. In short, this may go from semi-hostile to friendly, the verbiage from the recent earnings call seems to imply that as well:Thomas A. Bradley Argo Group International Holdings, Ltd. – Chairman of the Board & Acting CEO

Thank you, Greg, and thank you to everybody for joining us today. Before I jump into our results for the quarter, I'd like to take a moment to discuss our announcement last week. Over the last year, Argo has instituted a number of substantive strategic initiatives, actions that we believe have positioned the company for a clear and consistent long-term path to stable growth and profitability. The Board of Directors and management team, however, do not believe these initiatives are adequately reflected in the company's current market valuation.

After much thoughtful and deliberate discussion and analysis, our Board with the assistance of our advisers has initiated an exploration of potential strategic alternatives. In this review process, our objective is simple: to maximize the value of the company's strategy and its considerable long-term prospects for the benefit of all shareholders. To that end, the Board will consider a wide range of options for the company, including, among other things, a potential sale, merger or other strategic transaction.

Thanks Matt. Kinda like CDOR. If I have this right, estimates are for 15% eps and 5% premium growth next few years. Does that sound right?

ReplyDeleteYeah, maybe if you squint it is a similar situation and sounds about right on the estimates.

DeleteA brief exchange with a friend who knows something about the space says he thinks the reason they trade below BV is due to a need to increase reserves. Since the peers (Bermudan reinsurers') trade at 1.2x he thinks there may not be as much upside possibly (does not know the too well). That said if they are truly a niche provider, then I would think that would provide a premium but I don't know the space well at all

ReplyDeleteThanks, that's good color, appreciate it. As I repeated, I don't look at insurance companies often so I could be way off.

DeleteThe Bermuda reinsurer "issue" isn't really an issue - the main desirable asset in here is the US E&S business. I.e., this is not primarily a Bermuda reinsurer. However, there is a bit of an issue with any whole buyer would have to deal with the bits that they don't want (but this is not that large a company, relatively speaking)

DeleteNote: there is also a third activist/special situations group in the mix here, namely Enstar.

DeleteHopefully, the review process is not undertaken for the purpose of avoiding the shareholder meeting that the Board deferred into the fall?

ReplyDeleteGood point, not the best look.

DeleteYou are going to end up with the same chains that Buffett is stuck wearing if you keep chasing giant cap stocks like this. I predict your time beating the market will soon end, in no more than 50 years. Then you better hope a cult has grown up around your blog that shows up at your home once a year to hear you talk regardless of returns.

ReplyDeleteHa, yeah no where near that popular. And like many others, down on the year, but just continuing to march on as usual.

DeleteYou are so polite, MDC. Keep up the good work; I love your blog.

DeleteIf he can continue posting these kinds of returns for 49 years, I'm sure he'll be fine. Thanks for the idea MDC

DeleteGood write up. Pathetic to stay anonymous when heckling someone. At least MDC is out there doing the work and publishing.

DeleteTheir reserve issues are in a long tail line of business. In other words, an acquirer should (and probably will) haircut that BV. IMO the 1.5x hope on as stated BV is aggressive. That’s the sort of multiple you’d get for a decent franchise without any warts. I would probably consider 1.5x on BV appropriately haircut for these reserve issues to be close to the upper end of the price they can get. I need to look closer, but I think you are ok buying at pixel price - $40.70, but tempered expectations are probably in order.

ReplyDeleteRegardless, I have not looked in any deep detail (on the list).

Thanks, I appreciate the feedback, makes sense.

Delete...and it turns out that me thinking $40.70 was ok was also too optimistic. $30 per share and by Brookfield no less - that's basically bottom of the barrel buyer here.

DeleteYeah, Brookfield putting them out of their misery here. Glad this one is over, terrible pick.

DeleteYou find some very interesting gems. Thank you for the writeup. Well done and interesting as usual.

ReplyDeleteThoughts here?

ReplyDeleteNo new thoughts, stock seems really cheap, although the auction doesn't sound to be going well. Just a tough time to sell right now, everyone looking to sell, no one looking to buy. Might just be bad timing.

DeleteThanks for reply.

DeleteI dig. Do not own. Love busted names where thesis may still be alive. If ...you did not own and met her in a bar tonight would you take her home ...in this condition?

Ha good way to put it. Might be other better options at the bar tonight.

DeleteGracias

ReplyDeleteHey...not as fast as liked...but I think you are gonna be right here. She is trading as process is coming to a head.

ReplyDeleteYeah, signs seem to be pointing that way. Board member resigned and won't be replaced. Hopefully something happens even if it ends up being a loss for me. I still own shares.

DeleteOnly mystery is price. Assume not for cash as that was floated that they will accept paper. Seems to me if getting stock the price could be higher depending on paper buyer.

ReplyDeleteFinally got around to reading that KNSL short thesis, and gosh, it seems pretty compelling at today's P/B of 9.7x, ~40 P/E. Seems you need to make some pretty remarkable assumptions to go long at that price.

ReplyDeleteBeing stupid enough to short, its tempting to put on the KNSL/ARGO pair trade.

oh, whoops, recent share offering should cut that P/B a bit. Don't know if that makes me like the trade less - I'd guess these folks think their stock is expensive.

Deletehttps://seekingalpha.com/news/3924188-arch-capital-enters-auction-for-argo-group-report

ReplyDeleteThanks, Inside P&C really likes to elbow ARGO every chance they get. "Thinly contested process struggles to reach a conclusion" doesn't quite match up with a new entrant.

Deletehttps://seekingalpha.com/pr/19111458-brookfield-reinsurance-to-acquire-argo-in-1_1-billion-transaction

ReplyDeleteAcquired by Brookfield for $30. I sold this morning.