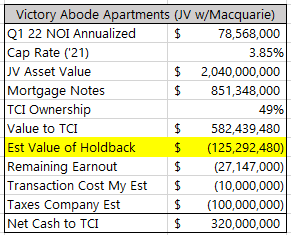

Over the weekend, news came out that Transcontinental Realty Investors (TCI) and their partner, Macquarie, sold the assets inside their Victory Abode Apartments joint venture for a total of $2.04B (which was the original thesis from my December 2021 post for some background). On an annualized Q1 2022 NOI basis the sale was done at a 3.85% cap rate, on a forward basis it is probably a bit above 4% as rents are resetting considerably higher in this sunbelt portfolio. Given the current economic backdrop, that price seems like a great exit for TCI as I was nervous shareholders would be disappointed with no sale or one around the recent $1.4B appraised value (as disclosed on p13 of their recent 10-Q). The sale is a bit complicated in that 53 properties were sold in total with 7 of those properties being sold back to TCI at the same valuation as the rest of the portfolio. After paying off mortgage debt and transaction fees, TCI expects to net $320MM in cash from the sale after $100MM they've earmarked for taxes.

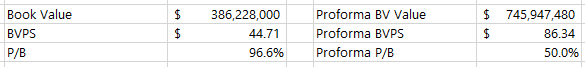

The sale is expected to close within 75 days (~early September), post deal closing TCI will screen extremely cheap on a price to book basis as their equity VAA joint venture is being carried on the books for $50.6MM while they're netting $320MM in cash plus the value of the 7 holdback properties, that delta in my estimation almost doubles the book from $45/share to $86/share. Shares trade for around $43, even after the sale announcement, about 50% of proforma book value.

The sale press release gives limited details, but using the Q1 10-Q and some swag math, we can back into the value of the 7 holdback properties.

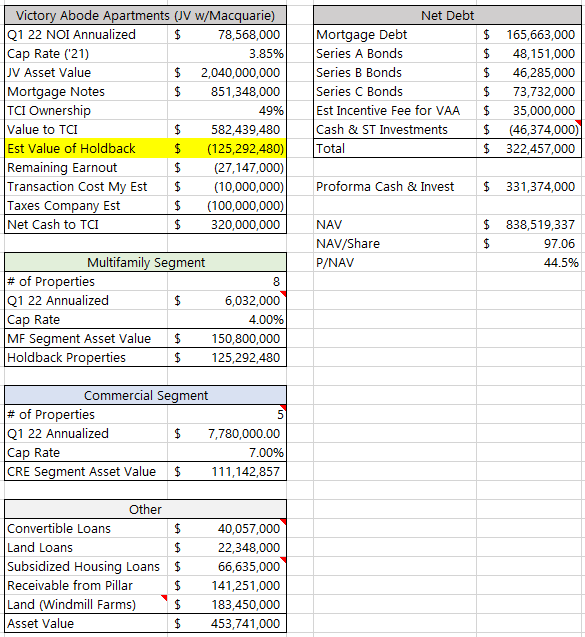

A $2.04B topline price tag, minus the $851MM of mortgage debt, nets $582+MM in value to TCI. Then backing out the remaining earnout owed to Macquarie, some transactional costs and the company's estimate of taxes, the plug to get to $320MM is about $125MM in value for the holdback properties. I'm probably off there, so as always, correct me if I made any major mistakes.Then Pillar, the external manager owned by the controlling shareholders, is due an incentive fee for the capital gains related to the VAA sale, the math is challenging and difficult to model out, but they're due 10% of any capital gains above a 8% annualized hurdle rate. TCI estimates their tax rate at 21%, if the company's estimate of $100MM in taxes is accurate, let's just guess the incentive fee is roughly $35MM for our purposes.

With some simple math, adding the net cash to TCI, estimated value of the holdback properties, subtracting out the incentive fee and the previous carrying value of the JV partnership. I get the below proforma book value.

Once Q3 earnings come out and book value is reported (November time frame if it closes in Q3), maybe some quantitative strategies take notice?

Of course, book value tends to understate the value of real estate companies due to depreciation and historical cost factors. Below I've taken most of TCI's balance sheet and pulled it apart, I'm missing a couple things in their restricted cash and their other assets, there's limit disclosure around those two line items. I've put market multiples on the multifamily and commercial segments, grossed up their land at their Windmill Farms development to approximately equal what the going rate for their acreage has been recently. I get a little under $100/share in NAV, which is probably on the conservative side.

the Company intends to use of most of the cash flow it will receive from the aforesaid in subsection 3 above to make new investments and to expand its multifamily residential property portfolio.

- Yes, this is externally managed, there's a 0.75% management fee on gross assets plus a 10% fee on net income and capital gains. Not super shareholder friendly, but they're really only grifting on the 15% of minority shareholders. I don't see a lot of benefit to them staying public even with the management fee structure, they haven't attempted to grow (they don't even issue shares to themselves, share count has remained steady over the years), there's public company costs that they're bearing (on three different levels, ARL, TCI, IOR), it would seem to make the most sense to take advantage of the big discount in the market by tendering for the remaining float.

- The corporate structure here is really confusing, almost all of TCI's assets are in the Southern Properties Capital entity that was created to issue bonds in Tel Aviv. The commercial properties, the remaining and holdback multi-family properties, all should provide plenty of collateral to back the outstanding Israeli bonds giving them liquidity to do a tender offer.

- ARL and TCI are both entering the Russell 2000 on Friday. ARL traded strangely for a while, trading well above parity with TCI, I switched from ARL to TCI, but it is worth monitoring both of them in the future. I'm guessing most of the index buying has taken place ahead of the reconstitution but given the extremely low float (what a dumb index that would include either of these at their full market cap!) we could see some strange price action.

- One lazy error in my back of the envelope model -- one of the properties in the wholly owned multi-family segment was included in the asset sale, so there's likely a tiny bit of double counting, but shouldn't be too material. There's limited disclosure to parse apart, so I just ignored it.

Disclosure: I own shares of TCI

Damn. Why did I sell half at $44?

ReplyDeleteHm, ha, it's below $44 now, you could always buy it back? Unless I'm missing the joke.

DeleteAny thoughts on the 13D out from the family? I can't really make heads or tails of why the filed it.

ReplyDeleteI'm not 100% sure either, they go out of their way to say it doesn't mean anything. But maybe it allows them to buy 5% more and then do a short form merger? Yeah, I don't know either.

DeleteI go back and forth on wether they could buy out the whole complex (ARL, TCI, IOR) in a single transaction or if there is going to be some tax reason they need to merge the companies together first then do a buyout. I think even with no transaction it should rerate after they report the next quarter. The thing about the 13D that throws me for a loop too is it didn't include all the heirs. Only 3 of 7?

DeleteThanks for the writeups MDC. Any thoughts on the extension here and/or the deal breaking? The 75 day period was up a week ago, I assume since there were no announcements about the deal closing or breaking, the buyers ponied up the extra $10m for an extension. This suggests we may close this week. Perhaps they're having trouble closing the financing? I do own TCI stock...

ReplyDeleteI would have liked to see an 8-K confirming the extension and receipt of the $10MM extra extension, but TCI is pretty minimal in their disclosures so it's not surprising. I'm still going under the assumption that the deal will close, they stated in their 10-Q "the sale is expected to be completed in the third quarter of 2022". Macquarie seems very motivated to close the deal. If for some reason the deal doesn't close, it is not catastrophic in my mind, the stock price barely moved on the news, and while I think we got a good price, there are still plenty of buyers for sunbelt apartments. But yes, let's all cross our fingers that the deal closes this week without a problem.

DeleteThanks MDC. Another great write up. What's to stop the controlling shareholders from buying out minority shareholders at a minimal premium?

ReplyDeleteIt kind of depends what price you're anchored to, the fair private market value is probably somewhere around ~$100 and the current stock price is around ~$40, so there's a lot of room in there for management to steal value from minority shareholders while still offering a reasonable premium to current prices to get the deal done.

DeleteTCI 8K out FYI

ReplyDeleteQ3 results out, nice book value growth to 88.03 per share, so up 116%. However, the price seems to be staying at around 41 per share - seems that quant strategies didn't notice (or don't care), after all. Hopefully, the management doesn't waste that cash.

ReplyDeleteGive it more than a day. Might need to wait until strategies rebalance, indices get reconstituted, etc.

DeletePoint taken. However it ends, thanks for this blog post. I really enjoyed reading your thoughts, clear and logical.

DeleteHmm in hindsight buying ARL was the winning move here.

ReplyDeleteMaybe yes. I owned ARL originally, sold it in early November at $20 to flip to TCI. It is hard to handicap what happens from here, but my thinking is you want to be as close to the assets as possible. TCI owns Southern Properties Capital, and then ARL owns most of TCI. Where in the Russian nesting doll do you want to be? Hard to say.

DeleteARL (owns 78.4% TCI) market cap now $484mm, or 128% of TCI's $378mm market cap. If ARL's $484mm market cap were 78.4% of TCI's, TCI would be trading at $71.49/share (approx. 0.8x Q3'22 book value) which is 64% above today's closing price. Am I missing something? Is there any rationale for holding ARL at current levels instead of TCI?

ReplyDelete