Like just about every other deSPAC, DMS came to the market with inflated expectations, they originally guided to $78MM EBITDA in 2021, but only delivered $58MM. DMS started 2022 with flat guidance of $55-60MM EBITDA, but now only expect $30-35MM due to wage inflation hitting their cost structure (500+ employees), marketing budgets getting slashed and LTV models being adjusted down in their core auto insurance market (Allstate and State Farm are two of their largest customers). Management expects to return to growth in 2023.

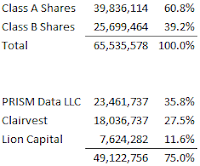

DMS is founder led, the company was started in 2012, the three co-founders are still in the c-suite today and own 35.8% of DMS through their "Prism Data LLC" investment vehicle. In 2016, DMS took on a PE investment from Clairvest, who still owns 27.5% of DMS, and rounding out the top 3 holders is Lion Capital at 11.6% ownership, Lion was the sponsor of the SPAC. In total, these three firms own 75% of DMS, the remaining 25% has very little institutional ownership and is likely held by retail holders who were caught up in the SPAC mania.

On Monday 9/8, via Prism Data, management made a non-binding offer to acquire all of the publicly traded Class A shares for $2.50/share, a 121% premium from where the stock closed the previous Friday. In their letter, they indicate that Clairvest and Lion "are likely to agree to participate" alongside Prism, leaving only 25% of shares needing to be purchased, or about $40MM. The offer is not subject to a financing condition (important in today's market), but DMS does have $26MM cash on its balance sheet and Prism has $50MM in pre-committed financing from B. Riley (RILY) to complete the transaction.

The offer values the minority interest at somewhere around ~10x potentially trough EBITDA, again management expects to return to growth in 2023 (they're the best positioned to know if there is indeed an inflection) so this could be an opportune time for them to take it private again. In August 2021, the company announced they were exploring strategic alternatives, on the last two conference calls, CEO Joe Marinucci (the signatory on the Prism offer letter), has stated they were "hoping to have an update today" regarding strategic alternatives, this offer is likely the end result. Marinucci would know where third parties offers were for the business before offering $2.50 to the board, this is likely the best offer and the independent board members will take it given there are no vocal or significant minority shareholders.

Shares closed today at $1.94/share, a 28% spread to the Prism offer. Yes, there is significant downside given where DMS traded before the offer, but there are no shareholders to put up a fight and likely this is the best offer after the company ran a process. Otherwise, I think the spread is wide because it is a low float former SPAC. I bought a smallish position. Given the number of deSPACs, I anticipate this being a similar fruitful hunting ground as the "broken/busted biotechs", please send me any others that sound or feel like this one.

Disclosure: I own shares of DMS

I like this idea! Will see if anything comes up in it. Makes me wish I'd held onto my Clairvest, which used to be more gaming-focused, if I recall correctly. And makes me think, again, that Riley is perfect for these times, grabbing little ugly opportunistic minnows created by market dislocations. Plus they have their liquidations arm, which is probably going to get busier going forward.

ReplyDeleteGood to hear that the infamous ADL likes the idea. If it now blows up we're all in it together. The next potential busted SPAC merger: Purple: https://www.sec.gov/Archives/edgar/data/1409751/000119312522246696/d404454dex991.htm .

DeleteHaha don't follow the lead of someone who's been catching the falling knife of DHC so thoroughly that it's sliced through my toes.

DeleteWhy didn't they buy shares on the market when they were trading for $1.16?

ReplyDeleteFair, but they were probably running a process so likely blacked out from being able to buy shares personally.

DeleteSomeone wants out of DMS warrants today. Not sure if it means anything. Seem like good risk reward at 20 cents even if much of the volatility is burned off when the deal finally gets around to getting done. I suppose no deal means 10 cents or less though

Delete$SKYH, $PL are potentially interesting busted SPACs. Many of the SPACs that are getting blown out are fairly speculative “Well financed business plans.” But I think these two have potential. No position yet in either but I’m interested.

ReplyDeleteThanks, I'll add them to my watchlist.

DeleteSKYH seems like the definition of a well financed business plan. Anything I'm missing? Was interested based on liking the business model of private air infrastructure and the idea of sifting through SPACS but when I read what they actually do I was disappointed.

Deleteso many questions.

ReplyDelete1). Why didnt they just buyback shares at $1.20?

2). DMS has $6 /sh of debt. Private equity usually buys debt-lite cos and makes them debt-heavy. Here we have the opposite. Why?

3) $2.50? That's quite a premium. Are we sure this isnt another "Taking TSLA private, Funding secured" Elon Musk moment?

They were likely blacked out from being able to buy shares. They do have debt, potentially getting close to a debt covenant. This isn't an LBO in a traditional PE sense, they cashed out during the SPAC transaction and are now reversing it at a much lower price. There's not going to be additional debt put on DMS.

Deletethanks for the idea. Do you know how much the original founders and Clairvest cashed out for through the SPAC, in $ terms?

DeleteClairvest invested $20.5 million in 2016. Some from its balance sheet, some from Fund VI.

DeleteClairvest received $26 million in cash and rolled 20 million shares ($200 million at transaction) in the SPAC transaction. So they were sitting on a 10x investment on paper at the time of the SPAC transaction. Even at the current DMS price, deal performance is fine. 3x MOIC / 20% IRR.

Management received more cash. The total cash proceeds were $240 million based on the investor presentation. Actual number could be a little lower. Subtract the $26 million to Clairvest to get to $210 million. I think most of this went to founders / management.

I think this supports a deal. Founders (Prism) don't have risk a lot relative to cash proceeds in the transaction (they'll still be rich whether this works or not). Clairvest may just take its 25% IRR and run but I don't think that matters given the commitment letter from B. Riley and the net worth of the founders.

Hope you're right on it supporting a deal. Thanks for all your thoughts on this one, its been very helpful.

DeleteSince they are in-control why not restructure in the public markets? Why lever the company up with $1.00 more than the cost of staying public?

ReplyDeleteThey're just being opportunistic, the stock is down a ton, a lot recently, they potentially have a view that 2023 is going to be a bounce back year, they founded the business, know it better than public market investors, etc. Just an opportunistic takeout.

DeleteOn the topic of SPACs... Any thoughts on LSEA? Looks extremely cheap quantitatively and insiders have been making purchases. I've not purchased any of this so far though I've looked at it two or three times...

ReplyDeleteThanks, I remember looking at that one at the time of deSPAC, I'll add it back to my watchlist although I probably have enough housing exposure already.

DeleteOne more idea for the "interesting/untouchable list" is STG. It's a very small, declining-revenue, lightly-traded, volatile Chinese online education company that's down 97% from its high (4 years ago!) and has had its auditor flagged by the PCAOB in the ongoing China-US battle. Under GAAP, it has negative equity. if it were a salamander, it would be neon blue and orange, announcing to the world "I am so poisonous you don't dare take a bite."

DeleteThat said:

The negative equity comes from deferred revenue

They basically, like most of the Chinese educational sphere, went from land-grab to survival mode, cutting expenditures (especially marketing) and seem to be in OK shape

They are focused on graduate/professional stuff, so are not in the same boat as the "cram schools" that fell from grace

They hold conference calls and offer what at initial pass seems like decent disclosure

They recently announced a special dividend and indicated a potential interest in more

They trade at a normalized PE of around 1

I am still trying to get a sense of dilution and how the alleged buyback plays into it, whether the deferred revenue can/will start trending up, what the economics of the new study cohort is, and whether the recent step-change in profitability is sustainable. But I think it's potentially extraordinarily cheap, and there's certainly not much competition in terms of analyzing it.

Keep in mind that I still hold DHC (and SQFTW, though that's held up well in the face of the collapse of the underlying; interesting how option value is the "risk" component in some securities and the "anchor" component in others), so my instincts might be very off!

Oh man I do love these things that put the ick meter to an 11. Thanks!

DeleteI'm not sure that this thing actually has normalized earnings. It looks to me like Gross Cash Billings < (OpEx + Cost of Sales) over the last 10 quarters, and any earnings are either from their asset disposals or the recognition of deferred revenue over the shrinking revenue base. Maybe I've got a bad sample, maybe I'm reading wrong.

DeleteSeems like double counting to say there's real positive equity/book value, and also earnings, but I don't know that you were suggesting that.

I LOVE the setup and want to love this, but I don't know that I can get there.

Yeah, Alex, maybe more accurate to say that I was still trying to normalize them!

DeleteBasically, my ideas was that they were trying to grab "market" "share" (not fixed in size; ephemeral) and wisely scaled back on that recently. So if you're looking at last 10 quarters, that covers when that change took place...if it did.

The question now is what's next: if this is effectively runoff (ongoing declining deferred revenue) it's of no interest because, as you point out, real equity and earning are both going to (/remaining below) zero. In that scenario, I'd be double counting and then multiplying the result by zero!

But if they have established a new baseline--lower revs, lower marketing spend, run for cash--it's interesting. They're still guiding to revenue declines, but I'm interested to see whether deferred revenue decline flattens/stops in coming quarters, along with guidance re: use of cash flow. Seems like the initial stance with the special dividend was they planned more in future if circumstances allow, but have possibly gone back on that in favor of vaguer language.

tl;dr: I want to like the setup too, but I am not in anything like a full position yet.

I feel like I post mostly interesting-but-ridiculous ideas (like Tupperware! Which I do still own) here because they are fun, which is maybe not the best approach. I own a lot more VNET than STG, but what's there to say about that? Lots, I guess, but the thesis boils down to: I think it's likelier than not that the guy who says he wants to take VNET private will.

STG up more than 80% in the last few days on no news and (for the company) high volume. Recent earnings good on a GAAP basis, but they still haven't addressed the shrinking backlog/deferred revenue. After run-up PE is still under 1, but still a non-normalizable figure as they are effectively in slow runoff. I really hate it when low-float Chinese companies shoot up in price, because I always assume there is some nefarious reason for it. Bought a little more at ~4 after earns, and am holding. VNET also exhibiting wildish swings, but less so since it's a larger, better-known company with a currently-defined set of outcomes.

DeleteIB is lending out almost all my shares and is paying me ~30% annualized net. Juicy!

ReplyDeleteWhy would someone short this? Who would short this? I don't see why this deal wouldn't close, but the price action / spread on stock and warrants makes me think I'm missing something. Is it technical? Short the stock and buy warrants?

DeleteAnyone have experience with how warrants are priced and handled? Given how much theta is left, isn't there a chance these are undervalued and will be taken out at a premium to current prices?

ReplyDeleteThe formula for the take-out price is given in the warrant agreement: https://www.bamsec.com/filing/119312520195157/2?cik=1725134&hl=25743:29109&hl_id=vjwcftmwp

Deletewhat are your thoughts on $FRG franchise group here? has sold off so much recently but I havn't seen any news

ReplyDeleteI believe the market is just concerned about their core low-income consumer in the American Freight, Buddies, and Babcock segments. Inflation hurts this socioeconomic group the most. RCII also cut guidance today.

DeleteWhat do you guys think of the JVA deal? I've followed this little coffee play forever (have not traded it in years though). Looks like reverse merge type deal. Not bad if one can believe any numbers they give

ReplyDeleteThanks for the idea! What do you think of the risk that this setup gives management the optionality to decide when and if they want to consummate the acquisition depending business and macro conditions. If their outlook inverts, not much they have to do to pull the plug on the acquisition. When do you think this will close?

ReplyDelete@MDC As someone relatively new to the arb space, please forgive some ignorance and know that your response will not constitute buying/selling advice, all investors are responsible for their own decisions.

ReplyDeleteI'd love to understand from you how normal this timeframe has been for DMS. It's been nearly two months since the initial Prism letter, and thus far there's been no response from management or additional filings. Is this timeframe normal? In your experience does a longer time frame indicate more risk or could it potentially reduce risk (e.g. would the company have announced a definitive no earlier if they weren't considering/actively negotiating/etc?)

Thanks so much in advance for your thoughts!

Pretty normal. They need to create a special committee of independent board members to evaluate the offer, hire advisors/legal, negotiate with management, etc. Maybe a 2-5 month process. But yes, this one is relatively risky because it is hard to know where it would trade on a true break. This is a small position for me, I basically diversify over time on arbs, have 0-2 at any given time, but over the long haul expect to do reasonably well on them.

DeleteHelpful, and appreciate the tidy reply. Agreed that arb strategies require sufficient diversification. Thanks!

DeleteThe company has been on a downward trend for the past few years. They are not doing well in the market and their stocks have been dropping. I think that they should focus on building up their brand and customer service instead of trying to sell off assets.

ReplyDeleteMedia advertisement

The current leverage covenant is 5:1 and it moves down to 4.5:1 at the end of this quarter. So they are definitely blowing through covenants. I assume the banking group would be in favor the the proposed deal from Prism? At the very least it would remove public co. G&A costs. Also probably like that the equity commitment from sponsors is increased and less liquid. Would they use the fact that the company is in technical default to negotiate in favor of the proposed deal?

ReplyDeleteWhat is your view of normalized levered FCF (ex-SBC) in the event of a deal break? $20 million? The EBITDA calc is a joke. Interest costs will keep going up so that eats in to the ~$20 million they have generated on an LTM basis. Not an incredibly attractive valuation on an EV basis, but obviously a great price on the equity if they can get some breathing room from their lenders.

I agree with you, this is a not a good business. But why would the BoD of say no to the transaction? There are no real shareholders here, it's a good premium, if the management team is still interested, who is harmed here?

DeleteI agree with you on all of those points. Just wondering if lenders provide another reason why this would close. I think the likely outcome is a deal based on what you shared and a little bit of my own research. On trying to determine normalized FCF: I'm trying to point out that on an EV basis you probably don't get killed long-term if they can actually generate $20mm of LFCF and $40mm of ULFCF. There's probably not a ton of downside from current levels on a LONG TERM basis. This assumes lenders act rationally. Short-term, i realize the price could crater in the event of a broken deal.

ReplyDeleteIf the deal doesn't get approved, the company is immediately in technical default. Interest costs are variable and will worsen the near-term outlook. BK certainly a non-zero possibility. If I'm a board member, I'm not rejecting an offer at a significant premium when a plausible outcome could be bankruptcy.

ReplyDeleteSorry for spamming this thread. Anyone still following? The market clearly thinks this isn't happening? Maybe it's because the "market" is a bunch of retail investors and the selling is all technical on a stock with a tiny float?

ReplyDeleteI'm still holding, but yeah, conviction is slowly degrading, not sure why it is taking so long.

DeleteTheir nearly 300m term loan looks quite onerous under current LIBOR. I agree with you that @jakclally that not accepting the buyout would be close to a death knell for the co. I don't see the incentive for the board to not accept the offer unless Prism has gotten cold feet and/or is negotiating the bid down?

DeleteI guess they could be re-cutting offer price. But why go through the hassle and risk a lawsuit? So you go down to $2 a share and save $8 million vs. the $40 million you were originally willing to commit? The board has no incentive to reject the offer. However, price action combined with the comment about paying out 30% annualized on borrowed shares makes me think I'm missing something.

ReplyDeleteThe Board knows that this is the only consortium that will inject significant equity into the business. The business now needs that equity. Non-insiders aren't going to put up a real term sheet for a digital business in technical default heading into a big cut in corporate marketing spend. Prism / Clairvest know that the board knows that.

Only other thing I could think of is that Prism / Mgmt. are negotiating a MIP with Clairvest / B Riley equity consortium? They want to make this worth their while if they are going to go through hell for the next few years keeping this business afloat. They would have a lot of leverage. They are the only group that will put in equity and they are also the only group that can / will manage this business unless you want to bring in an A&M type.

I'm spending way too much time trying to think about what other people are thinking about, but that's my two cents. Just going to keep holding my nose here.

I agree with your analysis. I don't see another way out.

ReplyDeleteBut, with this now pushing into 80% spread territory -- it seems like somebody knows something. Hard to maintain conviction when there's only one way out.

I don't have much to add but I don't think 3 months and 1 week (and counting) is too long for this. Original offer was preliminary and while I think any deal issues could be pretty much dealt with in a few hours (I mean, they've all been covered in the comments here!), some people work more slowly than others. After all, the original strat-alt process took almost 13 months before resulting in this nonbinding offer. I guess I'm saying my initial sense of the odds of this happening (not a slam-dunk, but pretty good) hasn't changed much, because there hasn't been any new information (to my mind, the duration since deal offer isn't a data point YET; ask me again in February...).

ReplyDeleteVery helpful perspective, thank you @ADL. In your experience what percentage of time do you see excessive price action without public news indicating concern? I've seen, at times, price behavior that seems to indicate that 'people knew things' even though the information was not yet public, and had some fears that's what this price action is showing. But, I only have limited experience in markets so I could be overweighting anecdotal data.

Delete@anonymous: see below.

Deletetl;dr: I know nothing.

ReplyDeleteLonger amble: A high-volume dump on no news is the best indicator of someone knowing something, though there are plenty of false positives in that too as holders flush for whatever reason. But still--unless it's, say, a Chinese company that normally trades 10k share a day that suddenly traded 20 million and quadruples in price (which is almost certainly manipulation, nothing more)--that's a decent sign of something good (or bad) coming.

In any case, we haven't seen that here; there was a frenzy after "deal" announcement (~60mm shares traded in those few days), continued activity for a few weeks as arbs/speculators darted in and out (~7mm shares in those 2+ weeks) and then not much (2ish million since the first week of October).

This company has somewhat concentrated ownership, which means regulatory burden on anyone big selling, so that seems unlikely as well, though reporting delays and the possibility of other subterfuge doesn't make this heuristic 100% either.

My guess, looking at that pattern, is that small buyers took a punt in anticipation of near-term deal announcement (much of the initial volume being them selling to each other), and as time passed and tax-selling season began, this was a prime candidate for loss-taking.

So I don't find much information, to the positive or the negative, in the way this has traded. Ditto in the length between initial announcement and now, though I do think there's a LITTLE information there, because if everything were dotted and crossed and the board consideration were entirely pro forma, it probably would have been wrapped up by now. But that's sort of minor in my mind until a little more time has elapsed.

Please keep in mind the tl;dr above! I really don't have a great sense for these things.

Very helpful, thank you. I'm one of the small buyers, but I have plenty of other things to sell if I want a tax benefit. Will keep being optimistic.

DeleteThanks to both of you, appreciate the discussion here.

Delete@ADL - I need to make a blogger account, but I'm the 'anonymous' from above. Want to thank you deeply for your graciousness in spelling that out. Looking to vol as a heuristic (though not a guarantee) is a valuable insight. Much appreciated!

DeleteSome observations

ReplyDelete~$161mm spent on 11 acquisitions functionally almost completely net debt financed given the history of dividend recaps

They say that the Apple privacy changes help them but not sure have shown evidence of that, direct to consumer businesses like Naked Wines getting their business model maybe broken through less effective cost of customer acquisition spend probably shrink the overall adtech pie

Good visibility on insurance advertisers coming back seems key to surviving the debt load, combined ratios in auto are looking healthier for most states now

Not clear Lion Capital/Clairvest would consent to a take-under of only other minority holders right when ability to equity capital raise is probably getting important given the leverage covenant

Lenders probably unexcited to have adj EBITDA go up by saving on financial controls spending

Maybe the ~50% annualized borrow cost can be explained by people hedging against the warrants looking for a cash settlement at a high vol in a cash buyout, I'm surprised only a small portion of my owned shares are getting lent out currently

Thank you. Can they even do an equity capital raise at these prices without having Lion/Clarivest/Prism participate? Do you just try to get enough retail participants? Can you even do an equity raise at current prices when you (maybe still) have a $2.50 offer on the table? My thought was that an equity raise at current prices without majority shareholders is not viable. Would appreciate your thoughts.

DeleteLenders may not get excited about adj. EBITDA going up by saving on financial controls spending. However, controlling shareholders putting up more equity would have to be appealing to lenders. What's the alternative? Banks take the keys and management walks? I would think founders are key to the relationship with auto insurers and other big customers.

I agree that this is an average business at best with a below-average near-term outlook. However, I can't see any reason why lenders, minority shareholders, Lion, Clairvest, and the Board would not go for the proposed deal. I CAN see why Prism would want to back out or re-cut. Even if the $2.50/share deal goes through, I would bet that equity investors will be on the hook for several "cures" over the next few quarters that require even more equity.

Good to know that most of your shares are not being lent out at that price. Thank you for the color.

My best guess is still one of three things. 1)ADL is right - all parties are moving slowly and there is a chance this goes through (for ADL's peace of mind - I'm not counting on it). 2) Prism is getting cold feet / recutting. 3) Clairvest and Lion won’t participate and / or the B Riley equity commitment is waning, meaning founders would have to put up significantly more equity.

Anyone know what's going on? +20% today. No press release or filing.

ReplyDeleteNo idea. If I'm reading correctly, 5x avg daily volume on a fairly low float stock? Can drive some sharp movements. I see a very slight uptick in twitter mentions for $DMS, but not enough to indicate a retail rush. With that being said, ~400k in vol on a $1 stock is a small enough amt to not read too deeply into it imo.

ReplyDeleteI shall remain patient until a filing is posted.

https://www.sec.gov/Archives/edgar/data/1725134/000162828023000498/a1q2023-8xkxjanuary2023xre.htm

ReplyDelete8-K out, they took down most of their revolver for a possible acquisition. Still talking with Prism, but no sense of how those discussions are going. Slightly strange that they'd be pursuing an acquisition, worried that it would qualify as the end of their strategic alternatives process if they consummate that deal.

Yeah, that's enough for me to bail tomorrow, almost certainly. Incentives more difficult to suss if there are two alternatives on the table. Stock up AH. Maybe it'll go up a lot further, but going from binary to something else is not for me.

Deletehttps://www.businesswire.com/news/home/20230306005476/en/

ReplyDeletePrism withdrew their offer on Friday, strategic review concluded with DMS remaining an independent company. Market sniffed this one out a while ago, but disappointing result.