Homology Medicines (FIXX) (~$70MM market cap) is a clinical stage genetics biotech whose lead program (HMI-103) is meant to treat phenylketonuria ("PKU"), a rare disease that inflicts approximately 50,000 people worldwide. In July, despite some early positive data, the company determined to pursue strategic alternatives as FIXX wouldn't be able to raise enough capital in the current environment necessary to continue with clinical trials. Alongside the strategic alternatives announcement, the company paused development and reduced its workforce by 87% which resulted in $6.8MM in one-time severance charges.

Outside of approximately $108MM in cash (netting out current liabilities), FIXX has a potentially valuable 20% ownership stake in Oxford Biomedia Solutions (an adeno-associated virus vector manufacturing company), a joint venture that was formed in March 2022 with Oxford Biomedia Plc (OXB in London). As part of the joint venture, FIXX can put their stake in the JV to OXB anytime following the three-year anniversary (~March 2025):

Pursuant to the Amended and Restated Limited Liability Company Agreement of OXB Solutions (the "OXB Solutions Operating Agreement") which was executed in connection with the Closing, at any time following the three-year anniversary of the Closing, (i) OXB will have an option to cause Homology to sell and transfer to OXB, and (ii) Homology will have an option to cause OXB to purchase from Homology, in each case all of Homology's equity ownership interest in OXB Solutions at a price equal to 5.5 times the revenue for the immediately preceding 12-month period (together, the "Options"), subject to a maximum amount of $74.1 million.

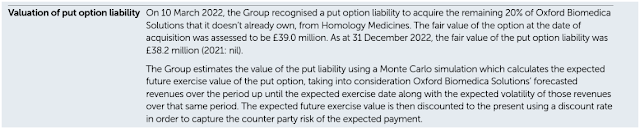

Poking around OXB's annual report, they have the below disclosure:

Using the current exchange rate, that's approximately $47MM in value to FIXX. Now OXB isn't a large cap phrama with an unlimited balance sheet, so there is some counterparty risk that OXB will ultimately be able to make good on this put. In my back of the envelope NAV, I'm going to mark this at a 50% discount to be conservative.Unlike GRPH, the operating lease liability at FIXX is mostly an accounting entry as the company's office space is being subleased to Oxford Biomedia Solutions, but doesn't qualify for deconsolidation on FIXX's balance sheet. I'm going to remove that liability, feel free to make your own assumption there. Additionally, even though HMI-103 is very early stage, it wasn't discontinued due to a clinical failure and might have some value despite me marking at zero since I can't judge the science.

It is hard to handicap the path forward, maybe OXB buys them out, they could do a pseudo capital raise with FIXX's cash balance while eliminating the JV put option liability. Or FIXX could pursue the usual paths of a reverse-merger, buyout or liquidation.

Disclosure: I own shares of FIXX

I get $2.02 in cash per share if the put option is fully valued?

ReplyDeleteThat's correct, but I don't know if its reasonable to assume FIXX gets full value in a sale or in some negotiated early exercise with OXB. Probably best to include some discount.

DeleteIsn't the full value better for shareholders? And available with a CVR? How about the science here? How do you value that?

DeleteOf course it would be better for shareholders, just not sure how likely that would be? Could be solved with a CVR, depending on what path they take for strategic alternatives. If a reverse merger candidate is just interested in the cash and public listing, a CVR could solve for the JV's value.

DeleteNo clue on the science here, that's why I marked it at zero but left it open. Could be worth something, but I'm just a retail guy with no science background.

Yeah but how would you value it if were going to do the work on valuing the science?

DeleteThe option probably can be assumed by the the acquiring company depending on how deal is structured. I guess it would depend on if they want to continue using facilities for drug programs. I doubt this will drag on much longer with early next year or sooner close to any deal and that should limit cash burn. Firing all the employees tells me there was interest in company but that does not mean its good for shareholders. I think science alone worth $50 million, OXB deal worth $25 as I do see lease as a liability. $3 seems doable

DeleteWhy don't you think firing employees and interest in company is good for shareholders?

DeleteLease is NOT a liability it's 100% pass through check the filings, however there's $13M additional spend owed to OXB in 2024 as part of original asset sale which is the floor on the option value $13M x 5.5 x .2 = $14.3M option value worst case scenario ...... Clark's gross $32M in forward burn is conservative enough to account for the additional spend + severance, so realistically forward G&A is max $5M on the 12 remaining employees (including their severance) + $13M OXB spend + $8M in clinical obligations = $26M vs. $32M......science value is an open question without more clarifying data very hard to price properly could be zero could be $100M+

DeleteDecember or January next year conclusion....probable that informal approach initiated process, Albert isn't a CEO or entrepreneur type but an honest scientist and is looking to setup his next seat....hopefully Tessera if we get shares in reverse merger or buyout if we don't....

DeleteThank you for clarifying lease obligations. My understanding is they brought on 4 new clients as of late last year so hitting max rev threshold appears solid. I assume the company laying off most employees in midst of solid data extremely bullish for shareholders as they could muddle through.

ReplyDeleteTheir gene editing science appears to be most popular approach to Gene therapy so hopefully pipe has some decent value.

From OXB's interim report:

ReplyDelete"The put option liability to acquire the remaining 20% of Oxford Biomedica Solutions that the Group doesn’t already own has decreased from £38.2 million at 31 December 2022 to £20.3 million at the end of June 2023 due to a decrease in the value at which the option is expected to be exercised."

Put option liability on financials is vague and nebulous at best. I think $25-$35 million for this asset is reasonable but seems similar to valuing the science in my view.

DeleteThat's fair, but much of the revenue of Oxford Biosciences Solutions comes from FIXX if I'm not mistaken, so now that they're pausing development, the revenue is going to drop and the put option price is fairly formulaic at 5.5 TTM revenues. Or do I have that wrong?

DeleteYes Fixx is pausing development and think I read they were paying $25 million annually to OXB solutions. With that said OXB solutions says they many more clients now without saying how much cash that will mean annually. I bet its more than $15 million. I would think OXB would like to own entire partnership and I still think best case is $35 million for fixx.

DeleteInteresting as an OXB shareholder (have the scars to prove it!) The recent OXB results indicated that they expect no more work from Fixx in Solutions. They have also recently made significant redundancies in Solutions although are now indicating that they plan to produce AAV in Oxford (rather than just Boston) and potentially add LV into Boston. This suggests that there might have been concessions or variations to the original agreement from March 22 (not obligating Fixx revenue commitment and allowing more operational freedom to OXB)

ReplyDeleteOXB recently announced their 2024 contracted revenues. These are almost 40% higher than for 2023 (even allowing for loss of FIXX work). Not clear how much relates to Bedford but clear that Lenti capability being moved there so not just AAV (although implication that AAV will also be in Oxford going forward with an 'everything everywhere' model).

DeleteOXB isn't paying anything for this FIXX revenue commitment doesn't count to valuation and AVV's are going away like Lenti went away ala Tessera Therapeutics LNPs, FIXX has to pay salaries and severance at over $24M before shutting down.....PKU data worthless....this is nothing but cash and should trade at a 25-35% discount to cash call it 0.75 per share....thanks for the bids you make me short more

ReplyDeleteThanks for the pushback.

DeleteSo I finally took a look at this. The issues I have are the lease and the equity option. The recent filing breaks down R&D spending pretty well, so with severance I'm giving burn a range of $21M -$40M. The problem with the lease being treated as pass-through is that FIXX is still a co-signer, given that OXB is losing FIXX as a client it doesn't need all the space so getting off that lease should take some sort of buyout. Secondly OXB was already struggling from losing COVID revenues, now with FIXX gone not sure it wants to spend precious cash buying out equity that its not obligated to buy for two years. And without a solid turnaround not sure what Solutions equity is worth, put already declined to $25M on OXB's balance sheet before FIXX canceled their programs. Now it should be worth significantly less and there likely there needs to be a big discount to get OXB to free up any cash to buy out the option/minority position now. Though there is a small risk there is not enough cash to do in 2025 the smart play on FIXX's part is probably to negotiate out of the lease cosignature as cheap as possible, and hold the equity to 2025 betting that OXB can replace some of the lost revenues.

ReplyDeleteReverse merger, 8k is out

ReplyDeleteYep, as usual, no opinion on the science of the reverse merger target, but I do like they're putting all the legacy assets including the Oxford Biomedia Solutions JV in a CVR.

DeleteThink the drop yesterday in anticipation of this announcement? Seems a bit sus

DeleteEh, I don't think so, their 10-Q was released and the cash burn was a bit higher than, at least I, anticipated.

Deletemakes sense thanks

DeleteI bought a little more today. The deal is assigning $1.38/share in value for FIXX, pre-CVR. Market it valuing it at less than half that this morning. Shareholder turnover should happen and I still think the CVR could have some positive value.

Deletehave you had any luck speaking to CEO? the deal seems really bad for FIXX shareholders....we're essentially contributing more than half the expected net cash ($60mm) yet only receiving 25% of PF entity. the deal valuation isn't really relevant here for us since it won't trade anywhere close to that until there's some positive datapoint from their trials / studies in the future.

Deleteassuming the deal goes through, it will and should trade at a discount to net cash since they will be definitively be using it and likelihood of success of their pipeline is unclear esp since HZNP / AMGN didn't seem overly optimistic of the prospects of one of the drugs from my quick search on background of the Q32 assets.

would you vote in favor of the deal?

I haven't tried to reach out to management. Probably wouldn't vote for it, I always prefer the liquidation route but know that's rare, hopefully an activist steps forward and pushes for a better deal. I'm probably more bullish on the CVR than most.

DeleteIt's weird that the PIPE investors will be buying shares at Q32s price at closing, $1.38/share when they can buy it in market now for less than half that price. What are odds Q32 can't get the PIPE done? Can they start open market purchasing to keep price close to deal valuation? Or does this blow up the deal?

DeleteI agree on the CVR, at current carrying value the Oxford Bio shares are worth 29 cents a share. Obviously not actually worth that at the moment, but they have two years for Oxford to rebuild its value before the put can be exercised.

BTW: my worst case liquidation estimate was $1.09. I obviously am not voting for this deal, will be interesting to see if activists see the $30M+ in value being market is offering and take a run at accumulating and running a campaign to kill the deal and liquidate.

Delete@mdc - thank you for all of your content. Just curious how do you get 1.38? I'm getting .47 (25% of 115m) pre-cvr.. Thanks!

ReplyDelete$317MM is the pro forma equity value with the PIPE, 25% of that is just under $80MM, with 57.8 million shares.

DeleteThe deal is awful. The resulting company will trade at a significant discount to net cash ($110m) and fixx get 25% in exchange for their $60m. Just dreadful by management and I'd imagine they have some kind of ulterior motive.

ReplyDeleteCVR is something of a saving grace but uncertain and market won't price much value there for now.

The hope for redemption here is that an activist comes in and blocks the deal. Management have limited support in terms of voting power. It wouldn't take much to block the deal imo

Then we could proceed with a liquidation and see a much higher capital return.

Watch out for Tang Capital, BML, Cable Car or others to report a stake. Shareholders are screwed otherwise if the deal goes through.

Its unlikely there are any ulterior motives. Biotech execs want to change the world, and when its a choice between cashing out their $1 options in a $1.50 liquidation or roll the dice on a new drug that will help people and turn into a $10 stock they are going to take the gamble every time.

DeleteYep agree.

DeleteProxy issued today, and frustratingly contains no liquidation calculation that they should have done before agreeing to the Q32 merger. The reason why is very clear, they'll have at least $60M in net cash at closing ($1.04/share), so that's the minimum liquidation value. Add on any asset sales, the value of the Oxford Biomedica investment, subtract $2.4M breakup fee and the liquidation is likely to pay out more than $1.20/share, and maybe more than $1.50/share. They don't want that disclosed before the vote. So my question is, how would one distribute a letter to FIXX shareholders through EDGAR to point out how much more immediately lucrative liquidation is?

ReplyDeleteI haven't looked at the proxy yet, but maybe I'll write an updated post.

DeleteI think these are the instructions for SEC letters:

https://www.sec.gov/page/edgar-how-do-i-submit-correspondence-corresp

Looking back at my notes, I did look at the initial proxy a few weeks back, came to similar conclusions as you did. Market really hates this one for some reason, they are ascribing quite a bit of IP value to Q32.

DeleteAny thoughts on the strength today? I have looked but can't find any new filings and not seen a letter?

DeleteNone from me, a bit surprising, but these do tend to recover from the initial reverse merger sell off as the shareholder base churns into those that want to own the NewCo. My plan is to still hold through the merger (not sure how I intend to vote) to get the CVR and let the shareholder base continue to churn, maybe get a good piece of data, then move on.

DeleteI'd recommend everyone vote, and vote against the merger even if it's almost certain to pass. Doesn't hurt if it passes, but would suck if it passed by a fraction of 1% after not voting or voting with management.

DeleteThanks both. My plan was also based on the CVR. I did wonder if 'Q32' supporters may start buying here to gain more exposure at a material discount to the funding round

DeleteI don't think this one is certain to pass. BML and Newtyn seem unlikely to roll the dice on Q32. Ditto Temasek and Pfizer, that's 20% already. I've already voted againt.

ReplyDeleteI know someone with 2% who has voted against. They considered not voting at all wondering if it would be easier to defeat by not reaching a quorum, but decided it was safer just to vote.

DeleteAlso this would have been a great situation to invoke appraisal rights when their own prospectus demonstrates that liquidation value is over $1.36 a share. Unfortunately Delaware doesn't allow them.

DeleteUnfortunately, looks like everything passed at the meeting

DeleteDeal is closing 3/22:

ReplyDeleteBEDFORD, Mass., March 18, 2024 (GLOBE NEWSWIRE) -- Homology Medicines, Inc. (FIXX) today announced that it declared a distribution to its common stockholders of record as of the close of business on March 21, 2024 of the right to receive one contingent value right (CVR) for each outstanding share of Homology common stock held by such stockholder as of such record date. The payment date for such distribution is expected to be March 27, 2024 (three business days after the expected closing of the merger on March 22, 2024). Each CVR represents the non-transferable contractual right to receive certain contingent payments upon the occurrence of certain events within agreed time periods as provided in the merger agreement and agreement governing the CVRs.

Will be interesting to see what value is ascribed to the CVR. Suspect that there might be quite a two way trade as CVR holders exit and Q32 investors mop up loose stock

DeleteHmm, I received the QTTB trades but not the CVRs yet. What are your thoughts on the stub post-merger?

DeleteQTTB shares*

DeleteI was holding for the CVRs as I have a view there. I've also not been credited with those yet

DeleteI sold today, ended up making a decent profit at the end of the day (plus the CVRs). Investors freaking out after the reverse merger turned into a little opportunity.

ReplyDeleteIf I understand correctly, OXB have paid $30m for another 10% of the JV ahead of the put option that can be enforced in March next year.

DeleteI've also sold. Thanks for the write up. I got involved at around $0.60 and topped up when it nudged lower.

ReplyDeleteFinally had the CVRs credited. OXB have announced some contract momentum so I'm hoping a chunk of that work gets booked to Bedford. No idea whether the legacy assets will get a bid, but general market environment seems to have picked up noticeably form when the deal was announced.

Received $0.04/share in the CVR today

ReplyDelete