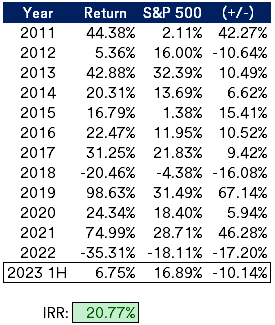

This will be more of a brief check-in rather than a full review. Unfortunately, my recent spell of underperformance has continued into the first half of 2023, my portfolio is up marginally, 6.75% versus 16.89% for the S&P 500. I'm still above my long term goal of 20+% IRR; the show goes on.

The main performance detractors were oversized positions in MBIA (MBI) and Transcontinental Realty Investors (TCI), two speculative M&A candidates that have failed to materialize. Many of my other speculative M&A ideas did announce deals, but well below where I had penciled them out. As a result, I've leaned more on smaller position sizes in the broken biotech basket and other flavors of special situations for new ideas recently.

The one outsized performer was Green Brick Partners (GRBK), homebuilders have exceeded low expectations as single family home inventory has remained tight despite rising interest rates. I've begun to sell down my position, it had become too large and doesn't really fit into a value or special situation bucket any longer.

Closed Positions

- Radius Global Infrastructure (RADI), INDUS Realty Trust (INDT) and Argo Group International (ARGO) all received bids that were a bit disappointing from elevated early 2022 expectations when rumors surfaced that each were for sale. All were interest rate sensitive businesses where the value declined as rates rose faster than initially expected.

- In the broken biotech basket: 1) sold Talaris Therapetuics (TALS) after their recent reverse merger with Tourmaline Bio for a nice gain; 2) sold Oramed Pharmaceuticals (ORMP) for minimal gain after a few readers pointed out their promotional (maybe being kind) management and then saw it first hand; 3) Sold Carisma Therapeutics (CARM, fka Sesen Bio) after the reverse merger, was left with a stub position (received the non-tradable Sesen CVR) that I sold fairly indiscriminately for a small loss.

- The Franchise Group (FRG) story ended rather disappointingly, have a bit of a bitter taste in my mouth, after rumors surfaced early in the year that CEO Brian Kahn was considering taking the company private. FRG then went on to have a terrible Q1 where they breached a covenant in their credit facility, preventing them from continuing their dividend, that was disclosed at the same time as the company agreed to Kahn's $30/share buyout. Since the company is kind of a one-of-one based on Brian Kahn's deal making, with a covenant breach, it was unsurprising that no other bidder came forward during the go-shop period.

- I sold Star Holdings (STHO) shortly after the close of iStar/Safehold transaction after a few readers reached out with some concerns on SAFE. I'll re-evaluate down the road, this is one I'll likely rebuy again at some point in its liquidation journey.

- My thesis in Liberty Broadband Corp (LBRDK) was stale, I originally bought General Communications as a merger arb and held through GCI Liberty into Liberty Broadband. Sold it more because of the opportunity cost, reinvested those proceeds into more current ideas.

- Digital Media Solutions (DMS) ended up rejecting management's buyout offer and instead took on debt to make an acquisition, now it's trading below a dollar. I want to believe the existence of all these busted SPACs will eventually turn into more special situation type opportunities, but these are questionable management teams and it might take a little while longer for management and boards to fully come to their senses.

- Sonida Senior Living (SNDA) disclosed a going concern warning, I mentioned some place else that I oversized this position given the combination of operating leverage and financial leverage, should have treated this more as an option than a core position. Shares have recovered a bit, but they still face a challenging labor environment and a lack of scale.

Thank you for the thoughtful commentary! Noticed you dropped BBXIA. Would be interested to hear your thoughts if you're open to sharing.

ReplyDeleteForgot to include that one in the closed positions. It was kind of another opportunity cost one, I've noticed their verbiage has start to change, talking about the headwinds in the business, similar maybe to FRG, there could be a take under type situation happening. But my original thesis on the spin played out and I didn't have confidence that we'd see a take private soon, but could be wrong.

DeleteI agree. They've sold off almost all the single family homes and not much on MF will be done soon. Also likely they won't make as much on the next batch. They seem focused on investing in industrial / warehouse. Company is massively overcapitalized but they don't seem keen on another buyback either. Something does seem weird there.

DeleteDo you have any thoughts/have you looked at EIGR pharma? SP recently battered, trading well below cash. Has one product generating 12m-ish/year, 3 ph3 assets (although dubious on POS), recently announced strategic review for most of their assets, and a new focus on the GLP1 craze.

ReplyDeleteThis is a new name for me, thanks, appreciate it, I'll take a look.

Deletecurious if you have any updated thoughts on NXDT. that's been a frustrating one. Some positive news on MREO tho with Rubric + insiders buying stock

ReplyDeleteI agree that NXDT has been frustrating. I thought they would make the story simpler faster. I don't understand why they don't follow the same quarterly calls/investor presentations as NXRT and NREF, it's the same team, just a bit puzzling. But I continue to hold it. Outside of Cityplace in Dallas, their main assets are still in attractive segments, self storage and single family rentals. Still think at some point they'll want to spin those off into their own REITs.

DeleteAnything new on PFSW?

ReplyDeleteNo, not since my update in March. Business appears to be performing well, we just wait until their strategic review ends sometime this year.

DeleteIs margin loan primarily used for special situations, or is it a tool commonly employed to leverage one's portfolio in general?

ReplyDeleteIt is a little bit of everything, goose returns a bit, avoid needing to sell (for capital gains) to allocate to new ideas, etc. I don't recommend it for everyone, causes some heartache, but I've used leverage for a while now and can stomach it.

DeleteI bought on margin during the COVID crash and was ~$6.34 away from a margin call near the lows. I punched out of HFRO for what at the time was a huge loss and bought mostly Liberty Broadband (GCI Liberty actually) and Discover financial which I later tripled on. There were rumors that there was a margin call (basically) on broadband at the time not unlike what happened with Liberty TripAdvisors. But I was a bit early. Strangely I’m much richer now despite the fact that broadband is lower than it was during COVID. But the ability to borrow against the broadband stake, which recovered quickly, made a lot of difference. HFRO is the same price it was when I sold it during the crash.

DeleteAre you looking at the Grupo Exito spin off at all or you prefer to focus on the US?

ReplyDeletePrimarily US, but I'll take a look at that one, thanks.

DeleteAnymore news on VCIF and when the tender will occur? And just to double-check, Carlyle is paying the $0.96 in addition to tendering at the current NAV (currently at $10.02)?

ReplyDeleteContinued: For a total current return of $10.98? Just wanted to make sure my calculations were correct.

DeleteIt should happen pretty soon. Shareholders approved it last month. Carlyle is paying $0.96 per share and then tendering for ~25% of the fund at NAV (I'll participate fully). The remaining question is where it trades afterwards, maybe at a moderate discount to NAV that should narrow over time as they implement the new strategy, lever it up, pay a big distribution.

DeleteOk, thanks. Just to triple check, the $0.96 doesn’t come out of the fund NAV - it comes from Carlyle’s balance sheet? I plan on tendering fully as well

DeleteThat's correct. It was essentially an incentive for shareholders to approve the deal.

DeleteCommunication systems CVR paying out. I would guess it’s a minimum of $1.75 (because of the restricted cash component) but could be significantly more than that.

ReplyDeletewhat was the restricted cash component? 1.3m is substantially less than original~5m estimates (from here) for those segments no?

Delete$4.2m in restricted cash held for benefit of CVR holders. Page 10 of 10q from pineapple energy. Add in the value of the assets sold. So it’s perhaps $2.3 to $4. With the lower end being more likely. It’s conceivable the net income would be a lot higher under a new owner so perhaps there’s some upside there.

DeleteOoof on the VCIF NAV write down. 16% discount to stated NAV. Terrible management going to be terrible I guess. I should probably still make money on the investment but sort of a hilarious misperception on my part where it felt like a safe deal. I knew there was a chance of a write down but baffled at the discount being higher than venture loans purchased from bankrupt banks.

ReplyDeleteRates moved up a little, but wouldn't think it would cause that big of a discount. The last few days discussing this idea with others, in my head I was thinking maybe a 5% haircut or something at least in the single digits. Terrible outcome.

DeleteYeah that’s where I was at maybe 5%.

DeleteThis has grounds for a VCIF Shareholdee Class Action Lawsuit

ReplyDeleteShareholder

DeleteHello, And what is the IRR of SP 500 compared to your IRR? And why not focus on who actually earns value, Green Brick Partner?

ReplyDeleteThe S&P 500 is about 12.8% annualized during the same period. Regarding GRBK, I've owned it since 2014, so comparing its return to something I bought recently isn't apples to apples.

DeleteHi MDC, NXDT is really coming down. Not entirely sure why. Good time to buy more, do you think?

ReplyDeleteI'm not buying more, I have a big enough position and I'd rather wait until they show some desire to simplify the structure, tell a better story, etc., I've been disappointed in the relative lack of disclosure. They're basically operating the same way they did as a closed end fund, nothing besides the legal structure has really changed.

DeleteUntil they liquidate their investments and use that as down payment, borrow and buy real estate they won't trade close to book value, isn't it? This is not the best time to liquidate any interest rate sensitive investments or to borrow to buy real estate. We may have to wait for sometime until the interest rates come down, I am thinking.

ReplyDeleteHigh dividend also may be keeping their hands tied a bit.

ReplyDelete