Planned Liquidation and Dissolution

Due to the planned discontinuation of CYT-0851 development, and the previously announced discontinuation of Cyteir’s discovery pipeline, the Company’s Board of Directors intends to approve a Plan of Liquidation and Dissolution (“Plan of Dissolution”) that would, subject to shareholder approval, include the distribution of remaining cash to shareholders following an orderly wind down of the Company’s operations, including the proceeds, if any, from the sale of its assets. Prior to winding down operations, the Company intends to complete regulatory and patient obligations from the ongoing clinical trial. The Company will engage independent advisors, who are experienced in the dissolution and liquidation of companies, to assist in the Company’s dissolution and liquidation. The Company also intends to call a special meeting of its shareholders in the second half of 2023 to seek approval of the Plan of Dissolution and will file proxy materials relating to the special meeting with the Securities and Exchange Commission (the “SEC”). If the Company’s shareholders approve the Plan of Dissolution, the Company would then file a certificate of dissolution, delist its shares of common stock from The Nasdaq Global Select Market, satisfy or resolve its remaining liabilities, obligations and costs associated with the dissolution and liquidation, make reasonable provisions for unknown claims and liabilities, attempt to convert all of its remaining assets into cash or cash equivalents, including through a potential sale of CYT-0851, and return remaining cash to its shareholders. The Company will provide an estimate of any such amount that may be distributed to shareholders in the proxy materials to be filed with the SEC. However, the amount of cash actually distributable to shareholders may vary substantially from any estimate provided by the Company based on a number of factors.

Friday, June 30, 2023

Cyteir Therapeutics: Liquidation Announced

Cyteir Therapeutics (CYT) ($92MM market cap) is another broken biotech, unlike others, this one is forgoing a reverse merger and announced today they were simply liquidating:

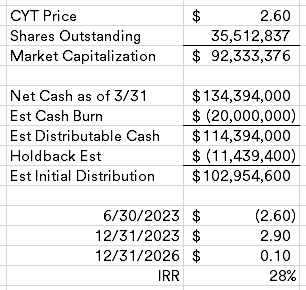

The company isn't going to put out an estimate until they file their proxy, but let's attempt to make a conservative guess on how much they could distribute to shareholders. Cyteir did layoff approximately 70% of their employees in January and incurred severance payments in Q1, so their expense run rate is probably significantly lower in Q2 and beyond given this announcement. I have no clue how to value CYT-0851, but it doesn't sound like a total zero, there might be some additional value here.

Here's my quick, likely wrong, swag at a liquidation scenario:

I'm estimating $20MM of cash burn, which might be too high, especially during a period where money market funds are returning 5%, helping to offset some G&A. I'm assuming a year end initial distribution of 90% of the cash, and then just 30% of the holdback amount in 3 years when the liquidating trust winds down.

Disclosure: I own shares of CYT

Labels:

Broken Biotech,

Cyteir

Subscribe to:

Post Comments (Atom)

I think your estimate is probably pretty accurate. Mine is a bit higher and I am targeting first payment by end of October, but I'm still honing my liquidation estimate skills and my estimates are always too optimistic so smart money should take yours.

ReplyDeleteWhat do you think about the potential acceleration of outstanding stock awards of 6.7m shares under the 2021 Equity Incentive Plan in the event of liquidation, which is part of the definition for Covered Transaction?

ReplyDelete@anonymous If I'm looking at what you're referring to, I believe the 6.7m shares are available for future grant under the 2021 Equity Incentive Plan but not actually granted so won't be accelerated and should be irrelevant (pg. 11 of last 10Q). However, per the chart on pg.12 of 10Q, there are 4.2m options outstanding which were not included in the diluted share count of 35.5m shares (would have been anti-dilutive since company lost money). However, the average exercise price of these option is $4.68 so most of them are unlikely to be exercised (even if vesting is accelerated) given the current stock price. The most recent grant of ~1m shares had an exercise price of $1.69 so those may be exercised but won't be that dilutive since the cash from exercise will be in the liquidation proceeds (we're talking about $1m of total value leakage at current share price so <1%). Someone correct me if there's a mistake in there...

ReplyDeleteIn pg 154 of S-1, the section headed effect of certain transactions indicated that acceleration of award is possible in liquidation

ReplyDeleteYeah, but they haven't been awarded / granted yet. They have just been approved for potential future issuance.

DeleteFrom the proxy filed today:

ReplyDeletebased on the information currently available to us and if our stockholders approve the Dissolution, we estimate that the aggregate amount of cash that will be available for distribution to our stockholders in the Dissolution will be in the range between approximately $106 million and $121 million and the total amount distributed to stockholders will be in the range between approximately $2.92 and $3.31 per share of common stock.

This will hopefully workout well!

Thanks, yes, some of them work out almost as planned!

DeleteAlso the unanticipated claims reserve of only $500k is a pleasant confidence boost although they can claw back more later if needed.

Delete"We currently estimate that we will establish a reserve for unanticipated claims of approximately $500,000, which will be used to satisfy contingent and unknown liabilities as they become due."

It’s also worth noting that the IP might be of some value as well. Not certain as of now but they are looking to sell the MCT inhibitor program.

DeleteDid the vote go through yesterday?

ReplyDeletehttps://www.sec.gov/ix?doc=/Archives/edgar/data/1662244/000095017023064788/cyt-20231116.htm

DeletePassed by a mile.

Has anyone spoken with the company recently? Any ideas on timing of a first distribution?

ReplyDeleteSorry - I haven't. Just waiting patiently.

DeleteDelisting notice out today, figure getting close to the end here. Surprised how long this has taken.

ReplyDeleteI hope so too, but the delisting notice may have more to do with not wanting to file the 10-K by the March deadline than with the liquidation progress.

DeleteDelisted to OTC and now gone from OTC a day later. Dont think Ive seen that before. Let us hope it means something.

DeleteThey did mention this in their filings, where the transfer books would be closed and no trading market would develop: https://www.sec.gov/Archives/edgar/data/1662244/000095017024028044/cyt-ex99_1.htm

DeleteYes saw that , just weird that it developed for one day and then cxled, just can never recall that.

DeleteCertificate of Dissolution filed. Payment range updated to $3.10 - $3.16 per share.

ReplyDeletehttps://sec.gov/ix?doc=/Archives/edgar/data/0001662244/000095017024034247/cyt-20240320.htm

Any idea how the IP plays out here? Is there potential for more upside there?

DeleteFeels like they've been winding down for a while, if there were asset sales they would have been done by now...but could be wrong

DeleteEven though the outcome was as hoped, the extended delay in cash distribution has completely diminished the IRR here.

ReplyDelete"Regarding your inquiry on the CYTT position, DTC is showing an effective date of 04/12/2024 as well as an exchange such, positions will be allocated into CUSIP 232ESC012 at a

ReplyDeleterate of 1:1 for potential future distributions. DTC also shows a 3.16 cash amount aligning with that 04/12/2024 date."

Just paid out the $3.16 , with an escrow ticker as well. Think that number is around $.015 or so per share max so not much if anything left. Glad to move on.

ReplyDelete