Quince Therapeutics (QNCX) ($55MM market cap) is a broken biotech that is trading well below cash and is facing activist pressure from two parties looking to either acquire the company for cash or put the company into liquidation. In the first half of 2022, Quince (known as Cortexyme at the time) bought Novosteo in a reverse merger, then in this past January, the company sold their old drug portfolio back to the previous management of Cortexyme who now run privately held Lighthouse Pharmaceuticals for a 7.5% equity stake in Lighthouse (plus a CVR of up to $150MM based on meeting certain milestones). Alongside the asset sale, Quince also announced a 47% reduction in force and that they would be pursuing an out-licensing strategy for their remaining drug candidate, NOV004, which is designed to accelerate bone fracture healing. The go-forward strategy now is:

On January 30, 2023, the Company provided an update on its development pipeline and business outlook for 2023. The Company intends to prioritize capital resources toward the expansion of its development pipeline through opportunistic in-licensing and acquisition of clinical-stage assets targeting debilitating and rare diseases. The Company plans to out-license its bone-targeting drug platform and precision bone growth molecule NOV004 designed for accelerated fracture repair in patients with bone fractures and osteogenesis imperfecta.

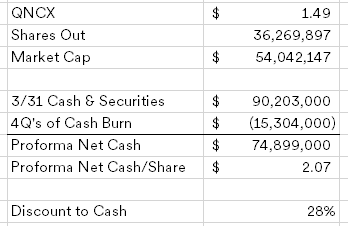

This acquisition strategy appears to be dubious given their track record, the current market mood towards reverse mergers and/or speculative biotech companies. Biotechs in this position should show some humility, liquidate and let the shareholders decide where to redeploy that capital, not management. My super simple back of the envelope math for these broken biotechs is as follows:

This situation has caught the attention of two investors:

- Kevin Tang owns just under 10% of the shares and based on other similar situations, one can assume he's asked if management would be open to an offer to buy QNCX for some discount of cash plus a CVR for any proceeds the pipeline brings in a sale;

- Echo Lake Capital submitted a non-binding proposal to buy QNCX for $1.60/share, which was formally rejected by the company, who then adopted a poison pill. Echo Lake followed up this week with another letter criticizing management.

While management hasn't given up here like I would prefer to see, they have cut costs and this is basically a cash shell at this point with no business, not to dissimilar to other ideas in the broken biotech basket. If Tang or Echo Lake manage to force management's hand, a strategic alternatives or liquidation announcement could be a catalyst to move the stock higher.

Disclosure: I own shares of QNCX

Tang Capital launched a takeover offer for JNCE and AVIR so I wouldn't be surprised if they tried to buy QNCX too.

ReplyDeleteIf you read the MGTA S-4, Tang made an offer there too. Seems like he's following a similar strategy with these busted biotechs, offering a discount to cash.

DeleteKevin Tang is dangerous and has lost his shirt on some of his prior investments so I have little confidence in him. Echo Lake also is a worry since they have tried to do deals before but not sure where the funds come from. Both are a little dubious, but not to say they couldn't force things

ReplyDeleteI agree on Tang, I got burned a bit on his offer for APVO. I'm not sure Echo Lake really wants to buy the company, but rather put it in play and/or force a liquidation.

DeleteWho wouldn't want to buy a company when they are buying it below cash??? Its easy money.

ReplyDeleteAlso, its not hard to raise funds to buy qncx if you are buying it below cash.

This stock could be a huge short squeeze. Why are people short a stock trading below cash that is facing a hostile takeover?

ReplyDeleteGiven insiders own 21% (https://ir.quincetx.com/static-files/a5143477-3060-476d-8b83-8c069cbca3e2) why do you think they are trying to follow a path that is likely to lead to further value destruction?

ReplyDeleteI don't think it is an intentional destruction of value. I'd like to believe a lot of these people who run biotech companies are partially missioned based, they want to discover new drugs/therapies, so they just keep trying to put more and more shots on goal and don't fully consider the financial implications.

DeleteThe 21% insiders don't necessarily have the same motives. Tang capital wants to get the highest stock price, nothing more. The chairman, who comes from a very wealthy family, may have different motives.

ReplyDeletePoison pill and staggered board - It's not going to be easy for activist to pressure management into capitulating and liquidating/selling the company. In addition, management are compensated millions of $ a year while owning few shares. Looks like a long road to me...

ReplyDeleteLSXMK potentially other liberty entities fairly interesting given the split off and reclassification. If the live nation and Sirius xm portions trade at a 15% discount it’s probably a 30%+ return in a couple of months.

ReplyDeletehttps://www.accesswire.com/767388/Echo-Lake-Capital-Increase-Offer-to-Acquire-Quince-Therapeutics-Inc

ReplyDeleteEcho Lake bumping up their offer to $1.80/share + CVR.

Echo lake also said they might increase their bid

ReplyDeletehttps://www.businesswire.com/news/home/20230724507851/en/

ReplyDeleteQuince being the acquirer and not the acquired. Don't have an 8-K yet, but the press release doesn't mention needing shareholder approval.

These broken biotechs are turning out to be more risky than I had modeled. This was low on my scale of estimated reverse merger risk.

DeleteTheir stated strategy was to in-license. Important to treat this as a basket. I'm curious to see Echo Lake's response.

DeleteYes, I realize that but put more weight on Echo Lake, Tang, etc.

DeleteYep. I'm going to hold for a bit. The market seems to be over-reacting negatively to some of these deals (see NLTX last week), after a little bit of shareholder rotation, sometimes they come back somewhat. Still might hear from Echo Lake or Tang again too.

DeleteI'm still holding too. And here is some good news, MSN picked it as a short squeeze candidate. Come on wallstreetbets!

Deletehttps://www.msn.com/en-us/money/topstocks/9-short-squeeze-stocks-that-could-take-off-in-august/ar-AA1eHv0L

Ha, hmm.. interesting, doesn't seem like a very meme-able stock, but sure, I'd take it if it happens.

Deleteare you still playing it?

ReplyDeleteI've sold, it recovered a bit in the days/weeks following the initial drop. That's when I exited for a smallish loss.

Delete