Last June, Regional Health Properties (struggling skilled nursing real estate company) proposed an exchange offer where the company's Series A preferred stock holders (RHE-A) would receive 0.5 shares of common stock (RHE) for each share of preferred stock. At the time of my post, RHE was trading at $12/share, today it trades sub-$5 as all speculative trading sardines have generally come down substantially over the past several months. Last Friday after hours, with no corresponding press release this time, Regional Health snuck in a new exchange proposal whereby Series A preferred stock holders could exchange their shares for new Series B preferred stock. The Series A preferred stock trades for $4.50/share.

The proposed Series B preferred stock has some interesting terms that I haven't seen before:

- First to nudge Series A holders to exchange, if the proposal passes (need 2/3rds) then anyone who rejects the exchange or is just too lazy to exchange gets pretty severely penalized. The Series B becomes senior to the Series A, the liquidation value of Series A goes from $25 to $5 and all the accumulated but unpaid dividends get erased.

- The headline dividend rate is 12.5%, but it will not be payable or start accruing until the fourth anniversary of the issuance/exchange date.

- The liquidation preference starts at $10 and increases back up to $25 at the fourth anniversary. If all Series A holders exchange, the liquidation preference will initially drop to $28.1MM, there's $55MM of debt ahead of the preferred stock, last June I estimated the value of their owned real estate at $87MM (9.5% cap rate), so that might cover the preferred stock at a $10 liquidation preference.

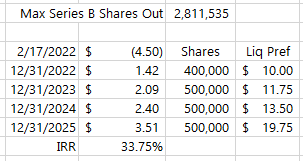

- Instead of the typical 6 quarters of missed dividends penalty to nominate a preferred stock board member, since the Series B won't be paying a dividend for the first four years, the Series B terms call for a "cumulative redemption" where Regional Health has to repurchase or redeem a certain amount of preferred each calendar year. It starts with 400,000 shares in 2022, then 900,000 shares by year end 2023 (again, cumulative, so an additional 500k shares in 2023), then 1,400,000 shares by year end 2024, and then finally 1,900,000 shares by year end 2025. If they fail to do so, then the preferred shares will have director nomination rights.

- Additionally, if Regional Health doesn't redeem or repurchase 1,000,000 with 18 months, Series B holders get common shares in a pro-rata fashion to make up the difference. Interestingly for both this penalty and the cumulative redemption penalty, the threshold is a specific Series B share amount, so if only 2/3rds of the shares are exchanged, each of these milestones becomes a greater percentage of the Series B.

- They then throw in a little game theory to encourage Series B holders to participate in early repurchases or redemptions, once there are less than 200,000 Series B preferred shares outstanding, the liquidation preference drops back down to $5 (for reference, there are 2,811,535 Series A preferred shares currently outstanding).

- Like the last exchange offer, this offer requires both the preferred (2/3rds) and common shareholders (majority) to approve. The common vote might be hard to obtain, they didn't get many shareholders to vote in the last annual shareholder meeting, these shares are likely mostly in retail hands.

Disclosure: I own shares of RHE-A

This is a much better deal for the Preferreds than the June proposal, particularly the cash flow component (cumulative redemption provisions). And it could become quite lucrative if a large amount of preferred shareholders don't exchange. Remaining Series A won't accrue or receive any future dividends either

ReplyDeleteAside from getting the requisite votes, RHE's ability to grow from here and actually redeem the Series B is the biggest challenge. But I would think the Preferreds react positively to this proposal in the near-term

Good lord that's complex. I think I need a drink, and its only 11:30! Did Bill Ackman design these preferreds? :) How are they able to "erase" cumulative dividends on the remaining A's? Aren't they accumulated preferred dividends a contractual obligation?

ReplyDelete...same thing for the change in liquidation preference. Not sure how they are able to change the rules in the middle of the game.

DeleteNever mind - I see it requires a vote.

DeleteHa yeah laughed at the Bill Ackman comment, would be a structured he'd come up with.

DeleteThis seems like a pretty good deal for both Pref and Common...

ReplyDeleteNew offer was evidently negotiated directly with Frischer and other larger pref holders, which I think bodes well for getting it approved. Given insiders own 37% of common, hopefully that vote should be relatively easy to get. Their going to have to dust off the cobwebs with some of these older pref shareholders and hopefully get them notified and on board.

ReplyDeleteThe Series A should be well in the money at today's prices and it sounds like the larger holders aren't going to let common off the hook without realizing a good bit more value than where it trades today. So downside on this feels good and makes this one of the better risk/rewards out there right now in my opinion.

Built a pretty meaningful position this week. Hope they can get this across the finish line soon. Also wonder if they are planning on putting out an actual press release. Would suspect not if they are trying to buy on open market too, but could create some movement in the share price in short order if they did.

GLTA!

Thanks, I agree, good deal for both sides.

DeleteWhich brokerages allow one to purchase RHE-A? IBKR?

ReplyDeleteI'm a dinosaur and use Vanguard, pref symbols sometimes differ by the platform, for me it is RHE PRA.

DeleteWhats is that in column B of your table there (goes from -4.50 to 3.51)? I'm not following your NAV math. I see the mandatory share repo and your calc for liq pref/sh, but whats the other column?

ReplyDeleteThat's the per preferred share cash flow, again its really just a sketch out of the cash flows, but it was trading for $4.50 at the time and assuming pro-rata tenders for the liquidation preference, that's what it would come out to.

DeleteHas anyone's broker received terms for the exchange and/or have you been able to tender your shares? TDA and Schwab are both saying they see absolutely nothing related to this exchange or proxy.

ReplyDeleteSame for my broker (Vanguard).

DeleteDon't they need to get shareholder approval through vote first before soliciting preferreds to exchange?

ReplyDeleteAh good point.

DeleteNo, it's happening in conjunction. The tender period is 2/28-3/28, and the meeting to vote is on 3/28.

DeletePer filing:

Regional Health Properties, Inc., a Georgia corporation (the “Company,” “our,” “we” or “us”), invites you to attend a special meeting (the “Special Meeting”) of the holders of our 10.875% Series A Cumulative Redeemable Preferred Shares (the “Series A Preferred Stock”) and holders of common stock of the Company, no par value (the “Common Stock”), to be held on Monday, March 28, 2022 at 10:00 a.m., Eastern Time, at Sonesta Gwinnett Place Atlanta, located at 1775 Pleasant Hill Road, Duluth, Georgia. The Special Meeting is being held in connection with the Company’s offer to exchange (the “Exchange Offer”) any and all outstanding shares of the Series A Preferred Stock for newly issued shares of the Company’s 12.5% Series B Cumulative Redeemable Preferred Shares (the “Series B Preferred Stock”

and:

In exchange for each share of Series A Preferred Stock properly tendered (and not validly withdrawn) prior to 11:59 p.m., New York City time, on March 28, 2022 (such time and date, as the same may be extended, the “Expiration Date”) and accepted by us, participating holders of Series A Preferred Stock will receive one share of Series B Preferred Stock

Also, FWIW, I finally got notice of tender terms being rec'd by broker. Mailing was just delayed by exchange agent.

Thanks for the clarification, I don't see it yet at my broker, but yes, everyone be sure to vote yes to the exchange otherwise you'll see material value destruction.

DeleteMDC, Any new thoughts on ADES, JCS and INDT?

ReplyDeleteADES - I bought a little more today, results seemed reasonable, they did get an accelerated payment of $10.3MM from Cabot on the change of control in February. I tend to error the side of "things take longer in the real world than investors expect" on the strategic alternatives process. There are probably only a handful of strategic buyers, management might also want to show that they've turned the corner operationally to maximize the sale price.

DeleteJCS - I'm out of it, but following it still. I don't think they're going to get the necessary votes to complete the Pineapple deal. One of the required proposals requires 2/3rds of all holders (non-votes are a no), Gabelli reaffirmed 15% no yesterday, this stock is probably held in a lot of retail brokerage accounts that won't vote, math becomes pretty hard without Gabelli. If the deal fails, not sure what their path forward is after that.

INDT - No new thoughts, just contently holding.

MDC - saw your reply over on ADES writeup, but then saw this comment, figured I'd respond here.. I thought I read in the Cabot recent 10k they plan to accelerate payment in q2 of this year. Has it already been paid? I could also look more closely through ADES filing, but tend toward the lazy side, and don't remember seeing it at first glance.

DeleteAnd yeah, I am learning the longer than expected lesson here: last time it dipped into mid/upper $5 range I bought too many June $7.5 calls; my hopes for them are beginning to fade.

Finally, your last line about potential management strategy is something that's grown on me, too. In the end, I don't disagree, from management or shareholder point of view (other than that of my poor call options!): why sell at a low point in the buiz, especially if you see better times on the not-too-distant horizon?

pg 27 of the ADES 10-K:

DeleteOn February 25, 2022, we received $10.6 million in cash from Cabot (the "Cabot Payment") as a result of a change in control provision in the Supply Agreement (the "Change in Control"), which occurred as a result of the sale of Cabot by its parent, Cabot Corporation.

Agreed on the management strategy, I think its also worth noting that the timing has to be right for the buyer too, given that there are likely limited strategic buyers for something like this, could just be a getting the timing right for both sides issue.

JCS may get it done. They are definitely desperate. I already voted but in the last couple days they contacted me directly (not through broker) by mail and by text. So if they work very hard over the next couple days it's possible!. Hopefully. I only have a couple thousand shares left but would like to see it get done. Not sure what Gabelli is thinking (they do say the deal is not tax efficient for them but not sure how destruction of capital is better)

DeleteI agree with you, I don't see Gabelli's view here other than taxes (I think the CVR is a taxable event at the time of the merger, but you might not get the cash until following tax years although they've recent said there will be a distribution this year), the time to oppose this deal and make a public stink about it was before they started selling assets. I'm still following it, hope it does get approved.

DeleteI got my TO instructions and Proxy from Fidelity today. Will be putting in my yes vote and tendering today.

ReplyDeleteDid not receive a proxy for my RHE common shares but did receive an offer to exchange RHE.PRA to PRB. Doesn't the common need to vote on it?

ReplyDeleteI believe record date for vote was Feb 23 so if your shares settled after COB on Feb 23 you wouldn't have a vote. Doesn't affect ability to tender though.

ReplyDeleteActually, I did receive the proxy for the common shares (that were purchased before record date) as well. Just didn't notice the email that went to a different account that I don't use much.

ReplyDeleteGet those votes in!

ReplyDeleteSM was this morning at 10:00AM ET. Any idea on the results? I have a feeling there will be an adjournment.

ReplyDeleteGood call on the adjournment. With the new May 2 deadline, do you know if the record date also changes? Considering buying more A but don't want to be unable to tender and stuck in the (newly diminished) Series A shares.

DeleteThe Special Meeting will be reconvened on Monday, May 2, 2022 at 10:00 a.m., Eastern Time, at Sonesta Gwinnett Place Atlanta, located at 1775 Pleasant Hill Road, Duluth, Georgia. The record date for determination of the holders of Series A Preferred Stock and the holders of Common Stock entitled to notice of, and to vote at, the reconvened Special Meeting remains the close of business on February 24, 2022.

DeleteThe record date remains the same

You should be able to participate in the exchange up until the deadline, you just won't be able to participate in the vote. So there shouldn't be much risk in get stuck with crammed down 'A's as long as you buy and tender before your broker's new deadline.

DeleteThat's helpful to know, thanks.

Deletehttps://app.quotemedia.com/data/downloadFiling?webmasterId=102213&ref=116579019&type=PDF&symbol=RHE&companyName=Regional+Health+Properties+Inc.&formType=8-K&formDescription=Current+report+pursuant+to+Section+13+or+15%28d%29&dateFiled=2022-03-28&CK=1004724

ReplyDeleteTerrible timing to fire CFO. He may still be with the company but has been removed from the job it looks like.

Why terrible timing?

ReplyDeleteI agree, not sure it is terrible timing, probably completely unrelated to the exchange offer, I try not to read too much into these things, having corporate experience seems to help.

DeleteCompany has 1.73 million common shares. Since Feb 23rd about 1.3 million shares have traded hands. In worst case scenario if that only about .43 million shares will be eligible to vote. Of course some of that trading will be by folks that bought after Feb 22nd. So let's say instead of .43 mil, about a million shares are still in the hands of those that bought before record date. How will the company muster enough proxy votes. I am assuming that those that sold are not likely to respond even if the company tries to contact them trying to encourage them to vote. Does anyone know what happens to the limbo shares?

ReplyDeleteAlso is there a SEC regulation that prevents the company from resetting the record date to say March 20th or some such to reduce limbo status of the shares and increase shareholder participation?

ReplyDeleteYeah it is interesting that they didn't reset the record date for the vote. I would think they must be prohibited from doing that as it would seem smart to amend the date based on the fact that quite a few common and preferred shares have traded since Feb 24. See the last sentence from the below excerpt from the offer. Looks like they were kind of locked in to that date, even with an adjournment.

Delete"The proxy statement/prospectus describing the matters to be considered at the Special Meeting to which you will be entitled to vote is attached to this notice, and all capitalized terms used but not defined in this notice have the meaning ascribed to them in the proxy statement/prospectus. The Board of Directors has fixed the close of business on February 24, 2022 as the Record Date for determination of holders of Series A Preferred Stock and holders of Common Stock entitled to notice of, and to vote at, the Special Meeting and any postponement or adjournment thereof."

When I spoke to them a couple days ago they seemed more worried about being able to garner the common votes than preferred, to your point about how many of those have traded hands recently. I'm kind of surprised that instead of going through this whole process, they didn't just start doing small $10/share tender offers. I'm guessing they want to be able to buy on the open market since prices are so low, which this amendment would provide for, but who knows.

No news about the vote. Anyone know?

ReplyDeleteMeeting adjourned to solicit more votes, new date is May 31. I wonder how far away they are...

DeleteThey were willing to mention how many preferred shares voted to convert but were unwilling to mention how many common shares voted for the proposal. May be they felt disclosing that number will discourage additional votes coming forward to vote for the proposal. Also don't know how they can deal with large number of shares that are not eligible to vote because of being bought after the record date for vote. It may make more sense to figure out a way to change the record date. Can they do it with a new proxy? Now that it is clear that preferred will go with the deal and new shareholders that will buy would be buying knowing what is going to happen, they should have better chance of an approval with a new record date. Just thinking out loud.

ReplyDeleteMight be the route they have to take, I'm guessing it is more about expenses, RHE is obviously tiny, every dollar they spend here matters, so maybe they're hoping the proxy agent is able to get those last few votes.

DeleteThey have 180 days from the initial record date to get the votes needed before having to reset it. I suspect they will to continue adjourning until they get the common votes needed or until they have to cross the bridge of a new record date. Hopefully they can pull it off without having to reset everything, but I guess we'll see. It also sucks because it's giving As more time to tender which adds more to the pot and dilutes returns of the original tenderers.

ReplyDeleteObv a little late to the game here, but hopefully better late than never. Now that I finally got my hands on the prospectus and was able to give it a read through, I have to say, I’m real surprised to read all the love in the comments above for this exchange offer. In my view, this deal is a real stinker – a turd.

ReplyDeleteFirst of all, there is a clear intention here to cram down any unsuspecting Pref’d A holders, which really makes me further question the worldview of the author(s) of this proposal. Grandpa caught the Rona, leaving Grandma a little short on time to be keeping up with the blow-by-blow over at Clark Street Value, so we just cram them down? I mean, I get distressed investing is a full-contact sport, kill or be killed, but – in this case, it doesn’t have to be this way. Morrison’s trying everything to save the equity, but it’s hopelessly underwater. With any moral compunction, he should start tendering common with one or more modified Dutch auctions for these preferred, and just take the dilution; he needs to swallow the pill, and then we can all move on. But he isn’t doing that, he’s wasting time and money making these laughable exchange offers; I’m kind of concerned about what he might come up with next? For instance, the exchange offer is contingent on Series A charter amendments, BUT the Series A charter amendments are NOT contingent on the exchange offer. So, if the vote on the amendments passes, all the A’s get crammed down … but there is a whole laundry list of reasons that management allows itself to abort the exchange offer. I’m not saying what he might find in his dirty laundry basket, but the A’s will be crammed down if the vote passes. For those of you hoping this deal passes the vote, I’d be careful what you wish for.

Sorry that’s a lot of preamble that just sets the context – haven’t even gotten to what I hate about the meat of this deal. OK, here it is: it’s completely one-sided. Laughably so. There is no “give to get” here. As a reminder, given the current dividend default, the A-holders already have director nomination rights. Management proposes to buyback the B’s under the proposed cumulative redemption schedule … and if they fall short, we get (wait for it) director nomination rights? LOLWUT? Umm, how about if you fall short, we zero the common equity? If you don’t like that, then like I said, let’s cut to the quick here and find the market clearing price for the preferred’s in terms of the common through a modified Dutch auction.

Now, MDC is completely correct that you don’t want to be left holding the bag here with the Series A’s in the case that the exchange occurs. So for me, the play is to tender the A’s in the exchange offer, but vote AGAINST this horrible deal in hopes you guys come to your senses.

Yes, I read Jedi Frischer’s letter. But I also read the prospectus. I don’t get it, the Force was not with him on this one.

Just my opinion, not investment advice, do your own due diligence. 4b67fc185aa7a7b3164a32a78fef72b4

It is a well thought out opinion, thanks, yeah the company is in a tough spot. Morrison's incentive package is in common stock, so some of your criticism isn't surprising from that lens.

DeleteLooks like the exchange offer has been terminated because they couldn't get enough votes from the commons: https://www.businesswire.com/news/home/20220725005736/en/Regional-Health-Properties-Inc.-Announces-Special-Meeting-Results-and-Termination-of-Exchange-Offer

ReplyDeleteThat’s unfortunate, I did like this exchange offer, but like most everything else in 2022, not quite working as planned. We’ll see what they come up with next.

DeleteNo quarterlies. No press releases about future plans. CEO calling everyone before vote. Now his attitude is "So long, suckers." Hopeless management. Poorly signaled, poorly executed tender offer. Hope they are not running the business as badly.

ReplyDeleteI participated in the unsuccessfull exchange offer. Wanted to get rid of my shares now for tax purposes. My broker tells me, that the shares are still blocked, I can't sell. Anyone else has similar issues?

ReplyDeleteI'm still holding it, but I don't see any issue selling it. Likely an issue with your broker.

DeleteVery painful ride. I seriously worried if bankruptcy is a possibility.

ReplyDeleteIndeed. I don't know if bankruptcy is a real possibility, not sure if that's the path pref shareholders want to take as it would be expensive, but there might not be another option if the common shareholders are zombies and won't consent to any restructuring outside of court.

DeleteFailure of last shareholder vote for the preferred exchange, I believe is in a big part due to record date being too close to the announcement. Everyone who was not interested in the exchange or opposed to it, just walked by selling shares. Those that bought the shares were not eligible to vote as most of the volume happened after the record date.

ReplyDeleteNow a days there isn't much volume of common. However looking at similar thinly traded stocks that had tender offers recently, noticed that huge number of shares were tendered. What this seem to imply is that, it is not that the shareholders are asleep but they don't feel like they can get a proper quote in such thinly traded market but are happy to get out at any reasonable price that can absorb volume.

As a suffering RHE-PA holder, I am wondering if as a group we made a tender offer to common holders to purchase say around $3 or so, if it would be possible to get hold of enough shares to retry some kind of exchange. If residual value is $25 mil, Around $3 for common, common gets little over 20% and the rest to preferreds. Any thoughts? Appreciate feed back from RHE-PA holders or others. Not sure how expensive it is to run a tender offer though.